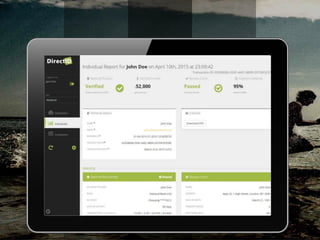

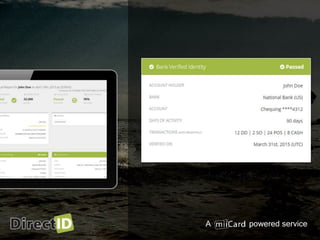

The document discusses a powered service related to PSD2 that offers banks as a trusted source for identity verification, enhancing the process of customer authentication. It highlights the advantages of early adoption, including risk management, improved compliance, and real-time financial data access, while demonstrating the benefits seen by lenders in reducing losses and increasing applicant bases. The collaboration between Miicard and Deloitte aims to further leverage analytics for deeper insights into financial transaction data.