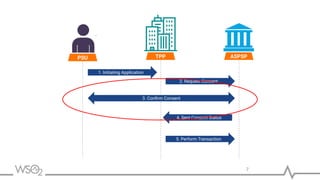

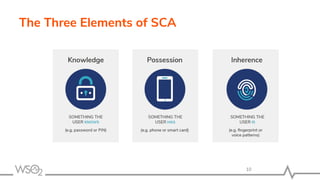

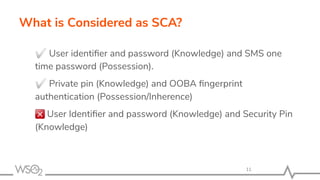

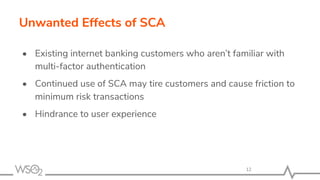

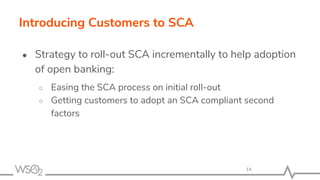

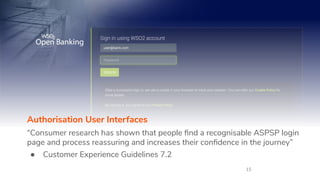

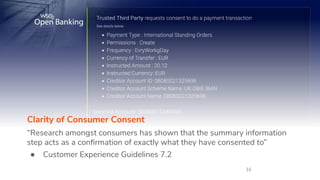

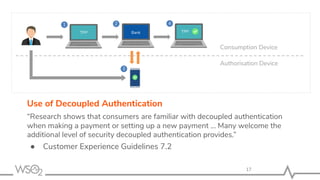

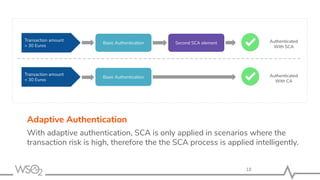

This webinar discusses getting ready for Strong Customer Authentication (SCA) requirements under PSD2. SCA requires authentication using two or more elements to help prevent fraud. The document outlines the motivation for SCA, defines its three elements, and discusses its potential negative impact on user experience. It suggests introducing SCA incrementally to help adoption and providing frictionless experiences. WSO2 Open Banking is highlighted as enabling effective SCA through customization flexibility, authentication freedom, and adaptive authentication capabilities.