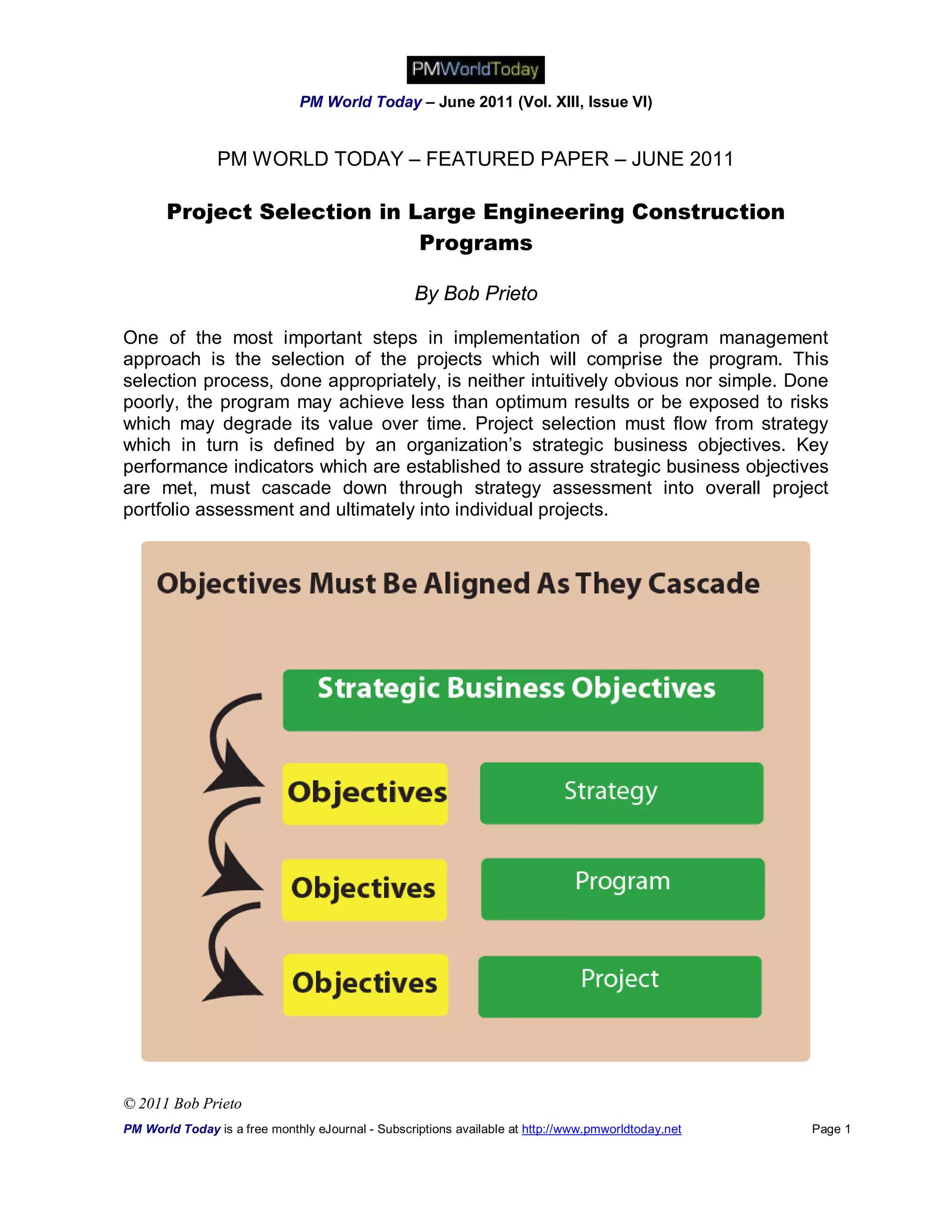

The document discusses the critical importance of project selection in large engineering and construction programs, emphasizing that it must be aligned with an organization's strategic business objectives and involve careful evaluation of various factors, including interdependencies and resource constraints. It warns against biases in the project selection process and recommends a methodology that includes objective performance metrics and the elimination of heuristic biases. Successful project portfolios are characterized by their alignment with strategic goals, resilience to uncertainties, and a structured decision-making process that addresses risk and project interdependencies.