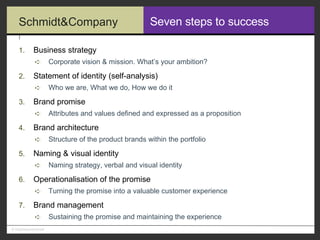

This document discusses branding strategies for luxury hotel chains. It begins by profiling some of the largest luxury hotel brands such as Hilton, Marriott, and Four Seasons. It then examines mid-tier luxury brands and smaller independent groups. The document notes the extremely competitive nature of the luxury hotel market and stresses the importance of differentiation. It provides examples of boutique "couture" hotels that have succeeded through distinctive designs. The rest of the document outlines strategies for driving earnings, attracting customers, justifying investments, and expanding opportunities through strong branding. It proposes a seven-step process for developing a branding strategy and program.

![Mega brands (luxury) 1 InterContinental Group InterContinental Hotels & Resorts (140 hotels; 75 countries) Hotel Indigo – Atlanta Marriott International JW Marriott (24 hotels; N./S. America, SE Asia, Middle East) Ritz-Carlton (57 hotels [35 city; 22 resorts] - worldwide) Hilton Hotels Corp/ Hilton Group Hilton (500 hotels, of which some true 5-star) Conrad Hotels (19 hotels - JV between both Hiltons; 5 under dev.) Starwood St. Regis (11 hotels; 5 under development) The Luxury Collection (40 hotels) Hyatt Hotels & Resorts Grand Hyatt (26 hotels worldwide) Park Hyatt (24 hotels worldwide; 7 under development)](https://image.slidesharecdn.com/project-plaza-part53084/85/Project-Plaza-Part5-2-320.jpg)

![Mega brands (luxury) 2 Le Méridien Hotels and Resorts Le Méridien/ Le Royal Méridien (130 hotels; 56 countries [35 city; 45 resorts] Fairmont Hotels and Resorts 47 hotels [23 city; 24 resorts], mainly N. America Kempinski Hotels & Resorts 40 hotels & resorts (17 countries in Europe) 30 under development (Global) Shangri-La 39 Shangri-La hotels [30 city; 9 resorts], mainly Asia and Middle East Four Seasons 63 hotels in 28 countries [42 city; 21 resorts] 28 hotels under development Source of ranking information: Hotels’ Corporate 300, July 2004. Based on number of rooms.](https://image.slidesharecdn.com/project-plaza-part53084/85/Project-Plaza-Part5-3-320.jpg)

![Mid tier luxury brands 1 Mandarin Oriental – monolithic with location descriptors 21 hotels (14 countries: 9 SE Asia; 6 N. America; 4 Europe) Raffles Hotels & Resorts – monolithic and co-branded 12 luxury hotels Loews Hotels – monolithic and endorsed 17 luxury hotels (N. America) Taj Hotels, Resorts & Palaces – monolithic with sub-brands 9 Luxury Taj hotels (India); 13 international hotels Kimpton Group – monolithic (Monaco) and branded 7 Hotel Monacos (US) 24 other 4.5-star hotels Dusit Thani Hotels – monolithic 10 Dusit hotels; SE Asia [5 city; 5 resorts]](https://image.slidesharecdn.com/project-plaza-part53084/85/Project-Plaza-Part5-4-320.jpg)

![Mid tier luxury brands 2 Oberoi Group – monolithic 20 Oberoi hotels; (India: 11) Rosewood Hotels & Resorts – strongly-endorsed hotel brands 12 individually-named hotels, endorsed ‘A Rosewood Hotel/Resort’ Global [7 city; 5 resorts]; 4 under development Regent International Hotels – monolithic 7 Regent hotels; (Asia: 4; Europe: 2; N. America: 1) 6 under development (China, Boston and Florida) Orient Express – medium-endorsed hotel brands 34 hotels; (Europe: 10; Americas: 12; Africa, AsiaPac: 12) Rocco Forte Hotels – lightly-endorsed hotel brands 13 hotels. Munich opening soon. Wyndham Luxury Resorts – strongly-endorsed hotel brands 7 resorts (All USA)](https://image.slidesharecdn.com/project-plaza-part53084/85/Project-Plaza-Part5-5-320.jpg)