The document is a research project report on working capital management at Pullmac Cranes India Pvt. Ltd., detailing the study's objectives, methodologies, findings, and suggestions over a five-year financial analysis period from 2011 to 2016. It emphasizes the importance of effective working capital management for ensuring the company's operational efficiency and liquidity. The report concludes that the company has effectively managed its working capital, with recommendations for maintaining this positive trend.

![WORKING CAPITAL MANAGEMENTOF PULLMAC CRANES INDIA PVTLTD,

GHAZIABAD, UP, INDIA

12

registered a growth rate of 6.0 per cent as against2.8 per cent during2001- 02.As per the use-based classification,

production of basic foods,capital goods,intermediate goods and consumer goods exhibited higher increaseduring

2002-03 as compared to 2001-02.

MANUFACTURING INDUSTRY STRUCTURE

Highlyfragmentedandwidelydispersed.

WesternIndiaaccountsfor 45-50% of total IndianManufacturing Industry.

FOREIGN TRADE

India exports approximately 7500 commodities to about 190 countries,and imports around 6000 commodities

from 140 countries.[9] Indiaexported US$318.2 billion and imported $462.9 billion worth of commodities in 2014.

Summary tableof recent India Foreign Trade

Year Export Import Trade Deficit

1999 36.3 50.2 -13.9

2000 43.1 60.8 -17.7

2001 42.5 54.5 -12.0

2002 44.5 53.8 -9.3

2003 48.3 61.6 -13.3

2004 57.24 74.15 -16.91](https://image.slidesharecdn.com/projectmba-170223071407/85/Project-mba-12-320.jpg)

![WORKING CAPITAL MANAGEMENTOF PULLMAC CRANES INDIA PVTLTD,

GHAZIABAD, UP, INDIA

13

2005 69.18 89.33 -20.15

2006 76.23 113.1 -36.87

2007 112.0 187.9 -75.9

2008 176.4 305.5 -129.1

2009 168.2 274.3 -106.1

2010 201.1 327.0 -125.9

2011 299.4 461.4 -162.0

2012 298.4 500.4 -202.0

2013 313.2 467.5 -154.3

2014 318.2 462.9 -144.7

2015[14] 310.3 447.9 -137.6

The top 10 commodity exports in 2014 were as follows:

Rank Commodity HS Code Value (US$ billion) Share (%)](https://image.slidesharecdn.com/projectmba-170223071407/85/Project-mba-13-320.jpg)

![WORKING CAPITAL MANAGEMENTOF PULLMAC CRANES INDIA PVTLTD,

GHAZIABAD, UP, INDIA

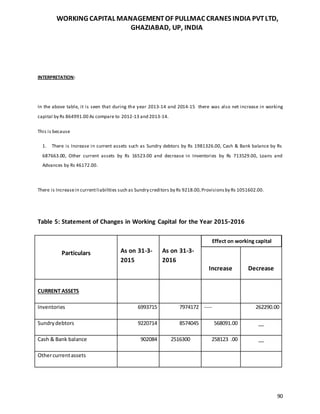

21

CAPITAL STRUCTURE OF PULLMAC CRANES INDIA PRIVATE LIMITED

SHARE CAPITAL:-

1. Authorized capital Rs 1000000

100000 equity shares of Rs. 10 each.

Subscribed/ paid-up sharecapital Rs. 1000000

100000equity shares of Rs .10 each.

Name of the company PULLMAC CRANES INDIA PRIVATE LIMITED

Year of establishment 1993.

Chairman

SHAKEEL AHMED SIDDIQUE

JAVED SIDDIQUE

IMRAN SIDDIQUE

Type of company Private Limited.

Area of operation

PULLMAC CRANES INDIA PRIVATE LIMITED.

B-65, HIG DUPLEX, SANJAY NAGAR, SECTOR-23 GHAZIABAD

UP 201001 IN

Nature of Business Manufacturing, Cranes Machine

Export places

Dandeli, Harihar, Goa, Hyderbad, Hubli, Dharwad,

Banglore, Nagpur, Belgaum.

No. of departments 6 [Six] Departments.

Number of employees 232

Number of working days 6 days in a week.

Production capacity 4 Cranes per month

Storage Capacity 50 cranes](https://image.slidesharecdn.com/projectmba-170223071407/85/Project-mba-21-320.jpg)

![WORKING CAPITAL MANAGEMENTOF PULLMAC CRANES INDIA PVTLTD,

GHAZIABAD, UP, INDIA

31

DESIGN DEPARTMENT

Design management is a business disciplinethatuses project management, design, strategy, and supply

chain techniques to control acreativeprocess,supporta cultureof creativity,and build a structureand

organization for design.The objective of design management is to develop and maintain an efficientbusiness

environment in which an organization can achieveits strategic and [[mission statement|mission goalsthrough

design. Design management is a comprehensive activity atall levels of business (operational to strategic),from the

discovery phaseto the execution phase."Simply put, design management is the business sideof design.Design

management encompasses the ongoing processes,business decisions,and strategies thatenableinnovation and

create effectively-designed products,services,communications,environments, and brands that enhance our

quality of lifeand provide organizational success."[1] Thedisciplineof design management overlaps with marketing

management, operations management, and strategic management

PRODUCTION AND ASSEMBLING DEPARTMENT

The Production department is one of the important department in the company. It is the department that

produces the product on which the company is established.Special careis taken in this department on production.

Listof critical rawmaterials presently in the production of Alum.

PRODUCTS PRODUCED:

The company is engaged in the production of three types of Cranes

a. Vehicle Mounted Crane.

b. Tower Crane.

c. Rough Terrain Crane.](https://image.slidesharecdn.com/projectmba-170223071407/85/Project-mba-31-320.jpg)

![WORKING CAPITAL MANAGEMENTOF PULLMAC CRANES INDIA PVTLTD,

GHAZIABAD, UP, INDIA

52

Pull Mac Crane is a production firm, there for working capital required is more in period of production as

compared to other period.

2. Production Policies:

The production policies also determine the Working capital requirement. Through the production

schedulei.e. the plan for production,production process etc.

The Pull Mac Cranehas small production process.

3. Credit Policy:

The credit policy relatingto sales and affects the working capital.

The credit policy influencethe requirement of working capital in two ways:

1. Through creditterms granted by the firm to its customers/buyers.

2. Credit terms availableto the firm from its creditors.

The credit terms granted to customers have a bearingon the Magnitude of Workingcapital by determining the

level of book debts. The creditsales results ishigher book debts (re available) higher book debt means more

Workingcapital.

On the other hand, if liberal credit terms are available from the suppliers of goods [Trade creditors], the need for

working capital is less. The working capital requirements of business are, thus, affected by the terms of purchase

and sale,and the role given to creditby a company in its dealings with Creditors and Debtors.

In pull mace crane company raw materials are purchased with a credit or cash and finished goods are sold on cash

basis and also creditbasis.

Changes in Technology:

Technology used in manufacturing process is mainly determined need of working capital. Modernize

technology needs lowworking capital,where as old and traditional technology needs greater working capital.](https://image.slidesharecdn.com/projectmba-170223071407/85/Project-mba-52-320.jpg)

![WORKING CAPITAL MANAGEMENTOF PULLMAC CRANES INDIA PVTLTD,

GHAZIABAD, UP, INDIA

66

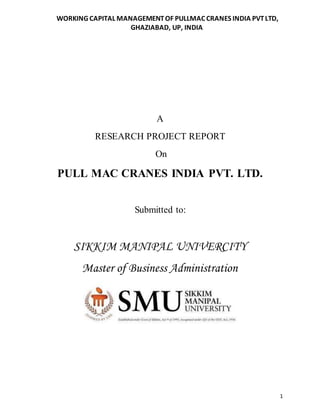

A] NET WORKING CAPITAL

An analysisof the net workingcapital will bevery help full for knowing the operational efficiency of the

company. The followingtableprovides the data relatingto the net working capital of PULL MAC CRANE.

NET WORKING CAPITAL = CURRENT ASSETS-CURRENT LIABILITIS

Years Current Asset Current Liabilities NWC

2011-12 4563099.00 2041543.00 2521556.00

2012-13 9599646.00 3887765.00 5711881.00

2013-14 9077617.00 2829079.00 6248538.00

2014-15 11003428.00 3889899.00 7113529.00

2015-16 11946666.00 4165659.00 7781007.00](https://image.slidesharecdn.com/projectmba-170223071407/85/Project-mba-66-320.jpg)

![WORKING CAPITAL MANAGEMENTOF PULLMAC CRANES INDIA PVTLTD,

GHAZIABAD, UP, INDIA

67

INTERPRETATION:-

The above chart shows that during the year 2011-12 the company has 2521556.00 N.W.C. In the year 2012-13

huge increase in the N.W.C is 5711881.00 and in the year 2013-14 the company has 6248538.00 N.W.C in the year

2014-15 the company has 7113529.00 N.W.C the N.W.C of the company is increasing compared to the previous

years, in the year 2015-16 the company has 7781007.00 N.W.C this means the company in a positive position &

N.W.C has improved vary fast as compared to the previous years which show liquidity Position of the Pull Mac

Cranes Pvt Ltd has always more& sufficientworkingcapital availableto pay off its current liabilities.

B] RATIO ANALYSIS

INTRODUCTION:

Ratio Analysis is a powerful tool of financial analysis. Alexander Hall first presented it in 1991 in Federal

Reserve Bulletin. Ratio Analysis is a process of comparison of one figure against other, which makes a ratio and the

appraisal of the ratios of the ratios to make proper analysis about the strengths and weakness of the firm’s

operations. The term ratio refers to the numerical or quantitative relationship between two accounting figures.

Ratio analysis of financial statements stands for the process of determining and presenting the relationship of

items and group of items in the statements.

Note: I have used the ratio analysis in this project in order to substantiate the managing of working capital. For

this,I used some of the ratios to get the required output.

Various working capital ratios used by me are as follows:

1. LIQUIDITY RATIOS:

Liquidity refers to the ability of a firm to meet its current obligations as and when these become

due. The short-term obligations aremet by realizingamounts from current, floatingor circulatingassets.

Following arethe ratios which can help to assess the ability of a firm to meet its currentliabilities.

1. Current ratio

2. Acid Test Ratio / Quick Ratio / Liquidity Ratio](https://image.slidesharecdn.com/projectmba-170223071407/85/Project-mba-67-320.jpg)