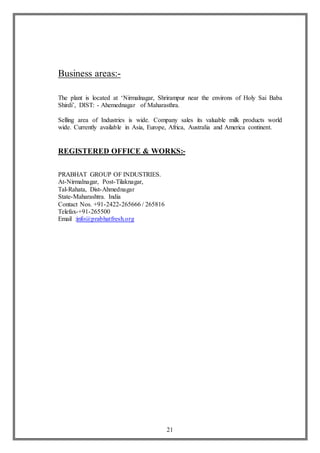

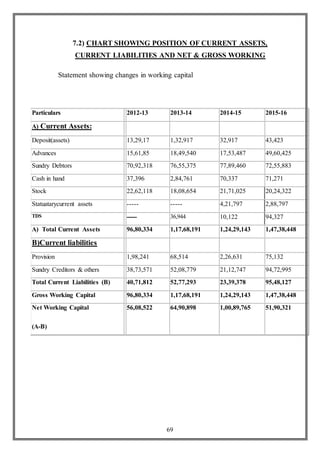

The company Prabhat Milk & Agro Industries Pvt. Ltd is a leading dairy company established in 1998 in Ahmednagar, Maharashtra. It procures milk and agricultural produce from thousands of farmers. Prabhat processes and distributes dairy and fruit products domestically and internationally. The company has a strong focus on quality and sustainability in its operations. It aims to grow its business while providing support to farmers and employees.