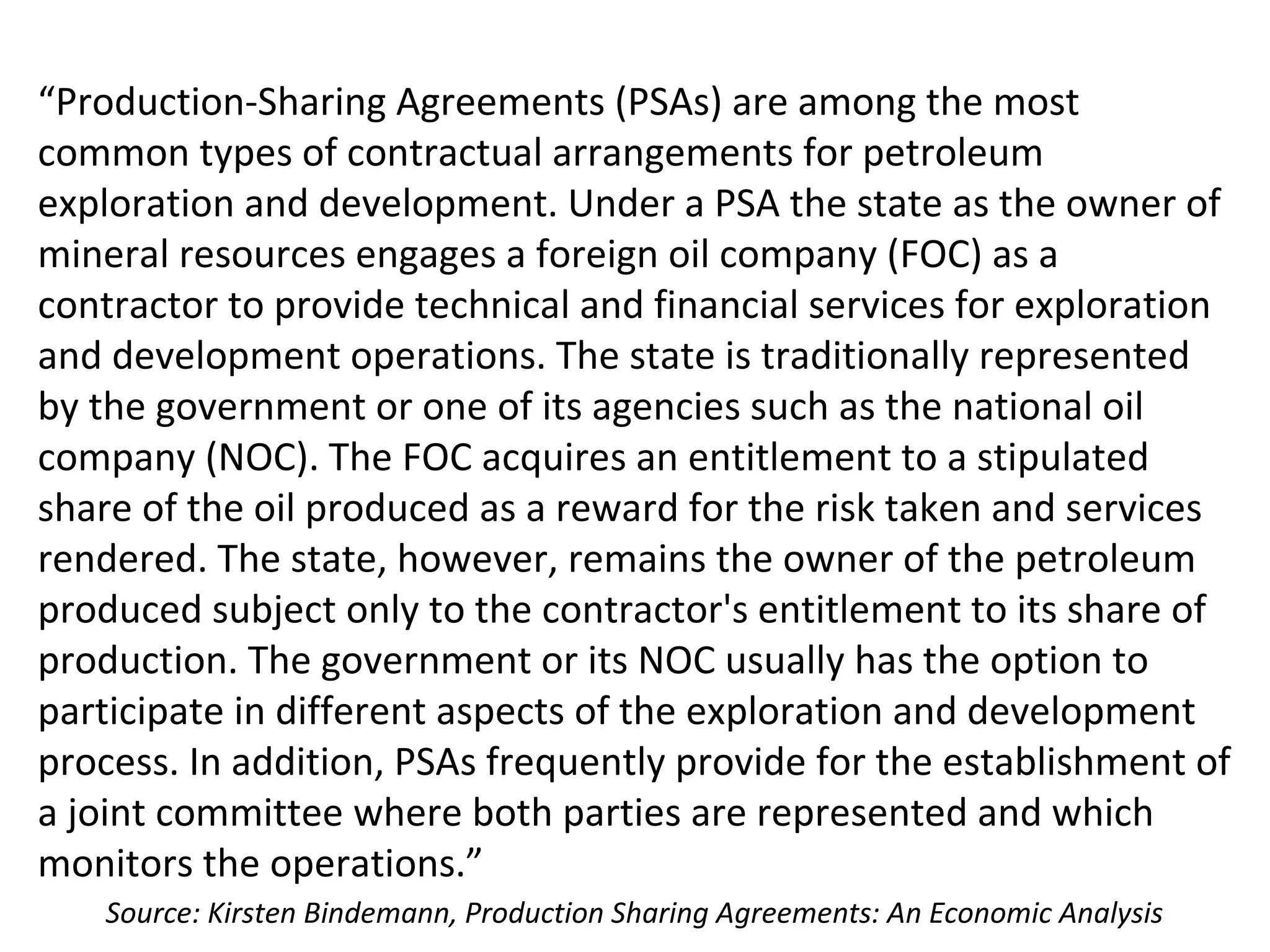

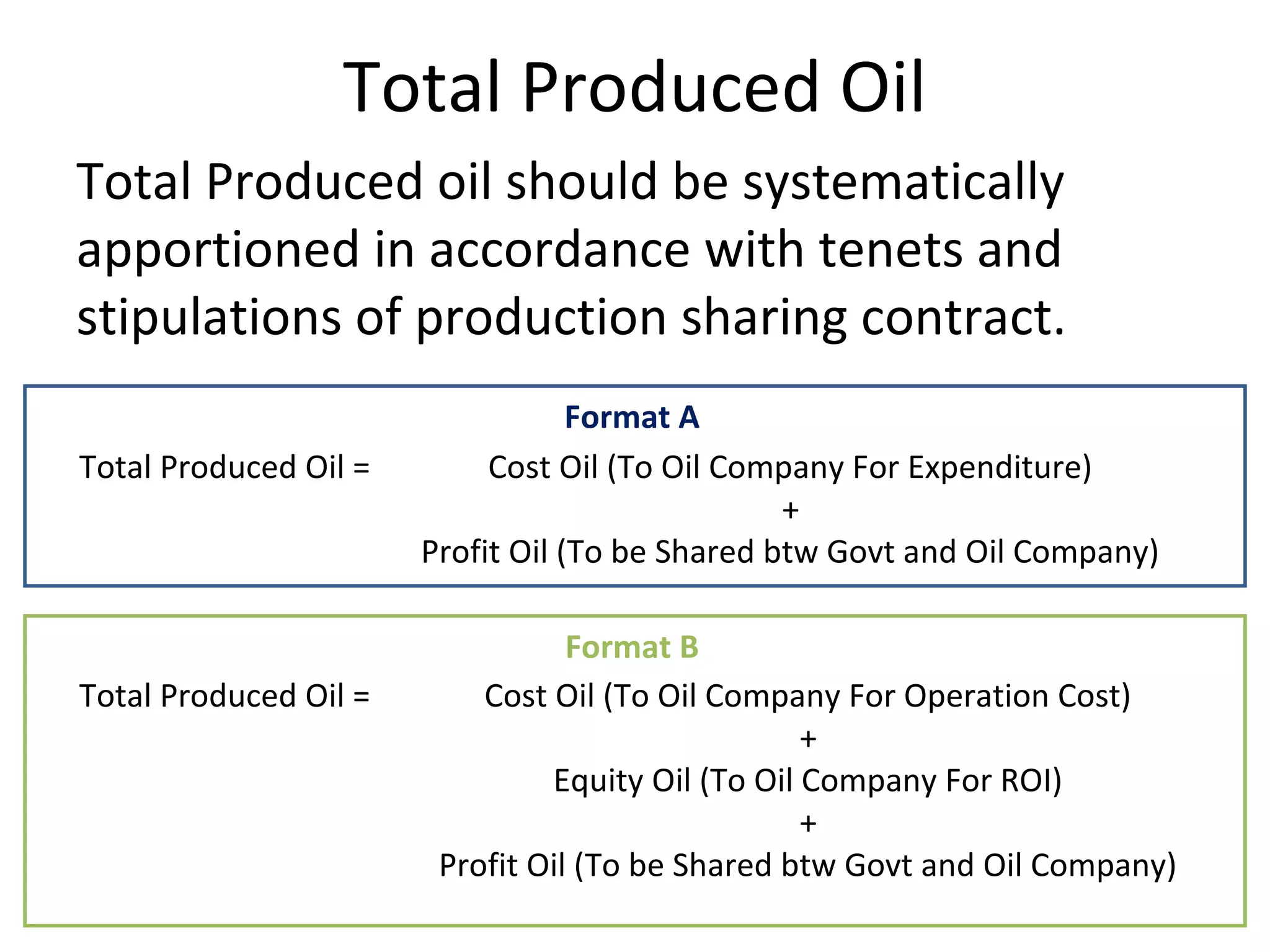

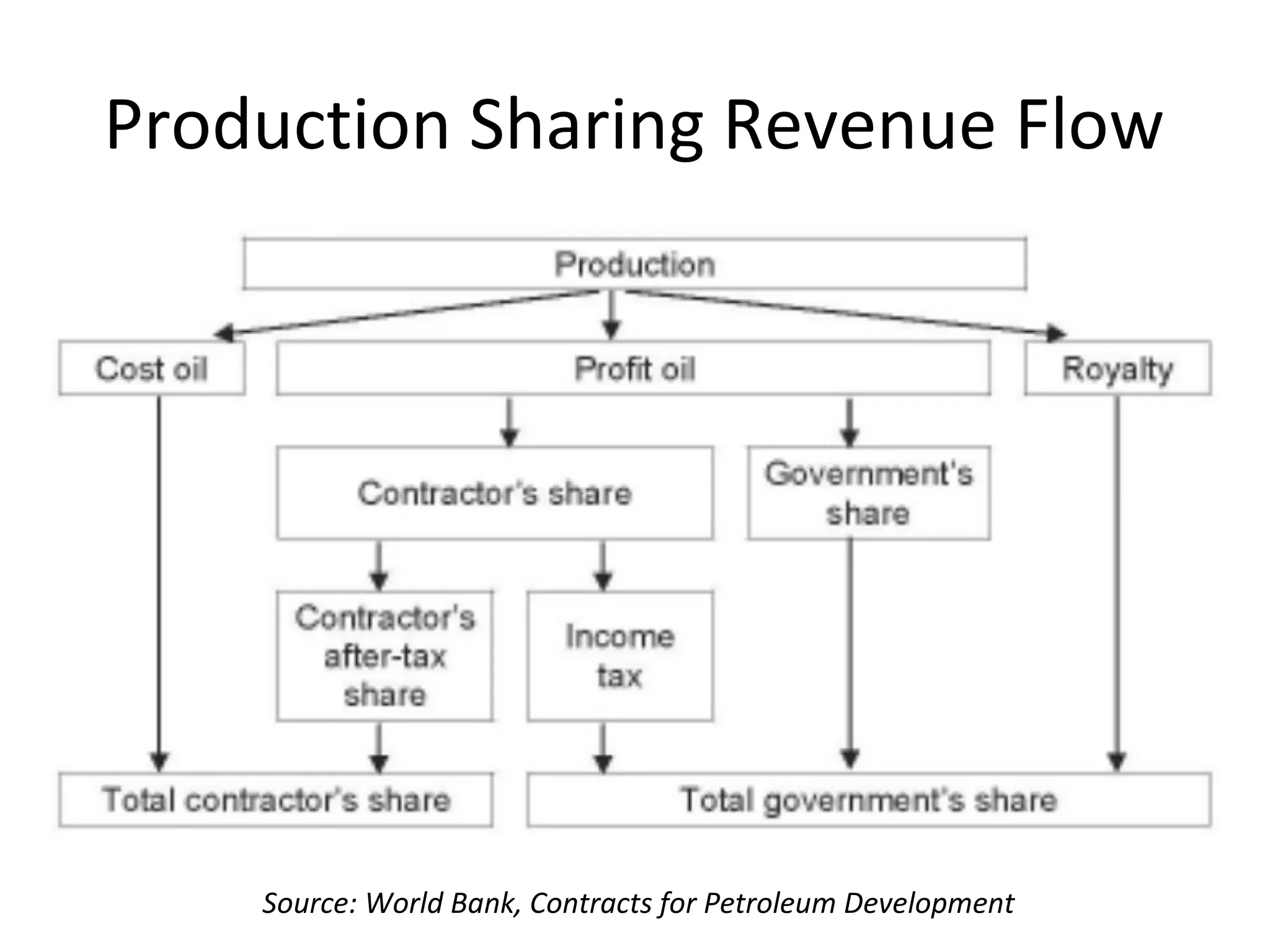

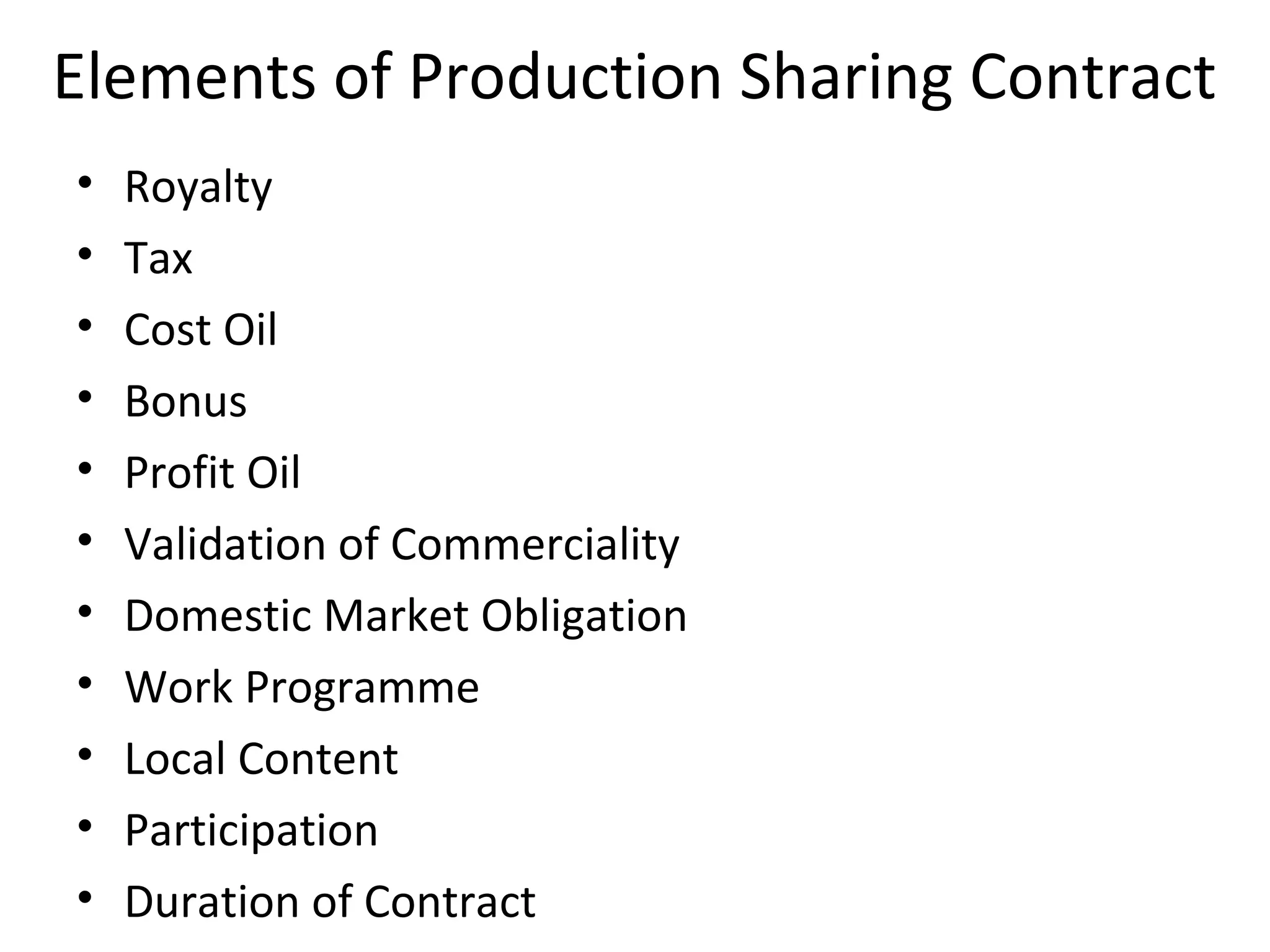

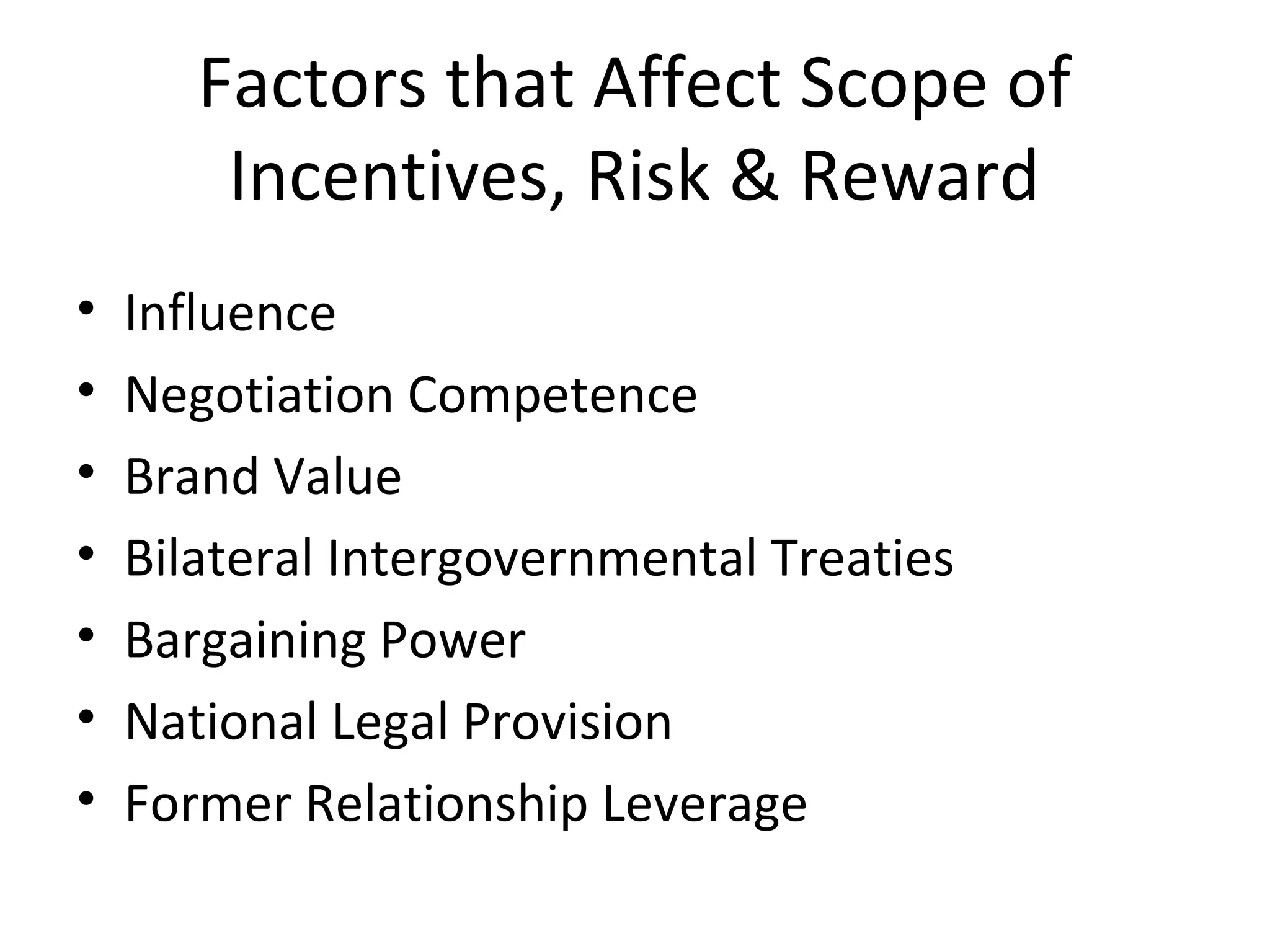

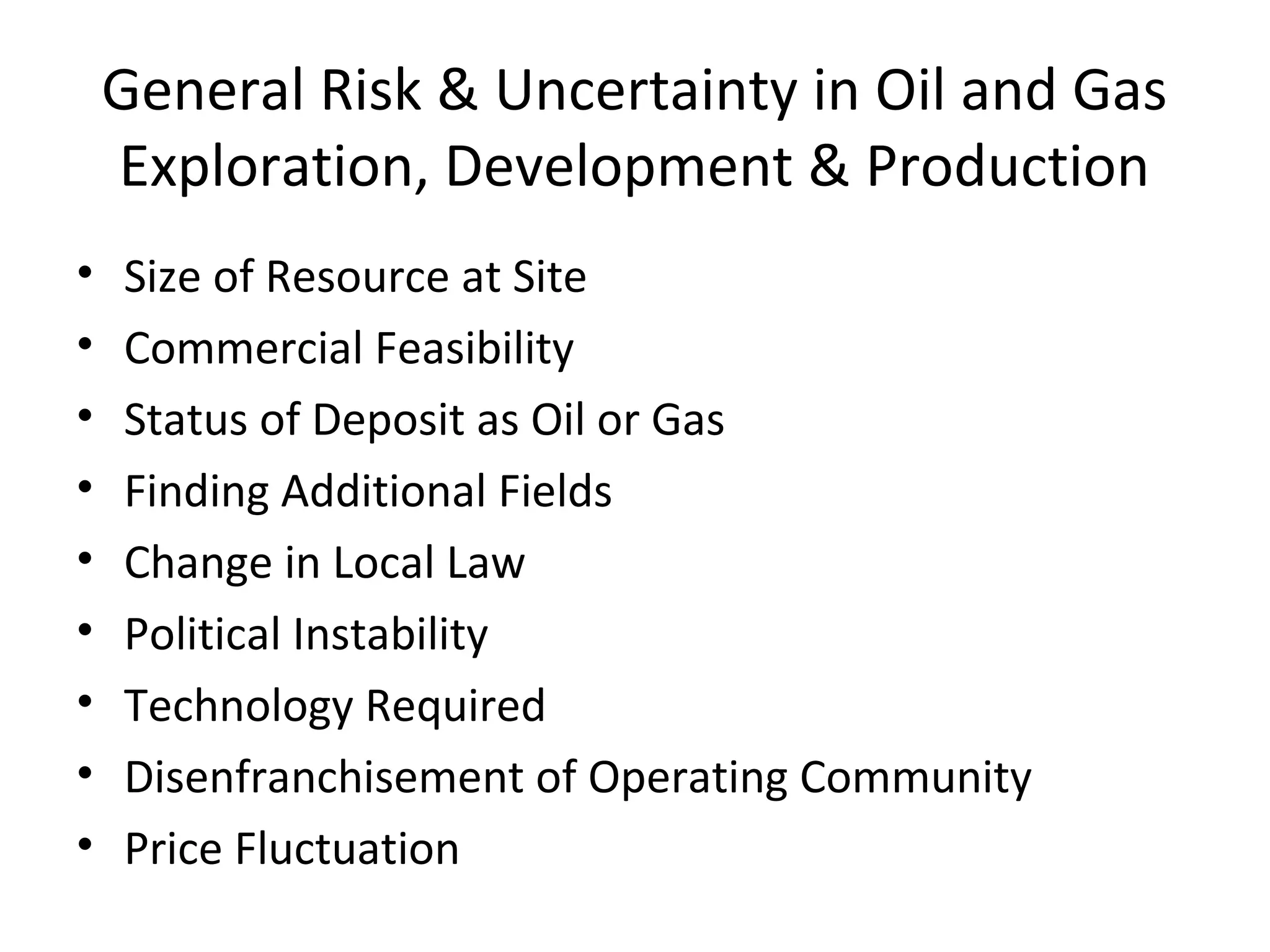

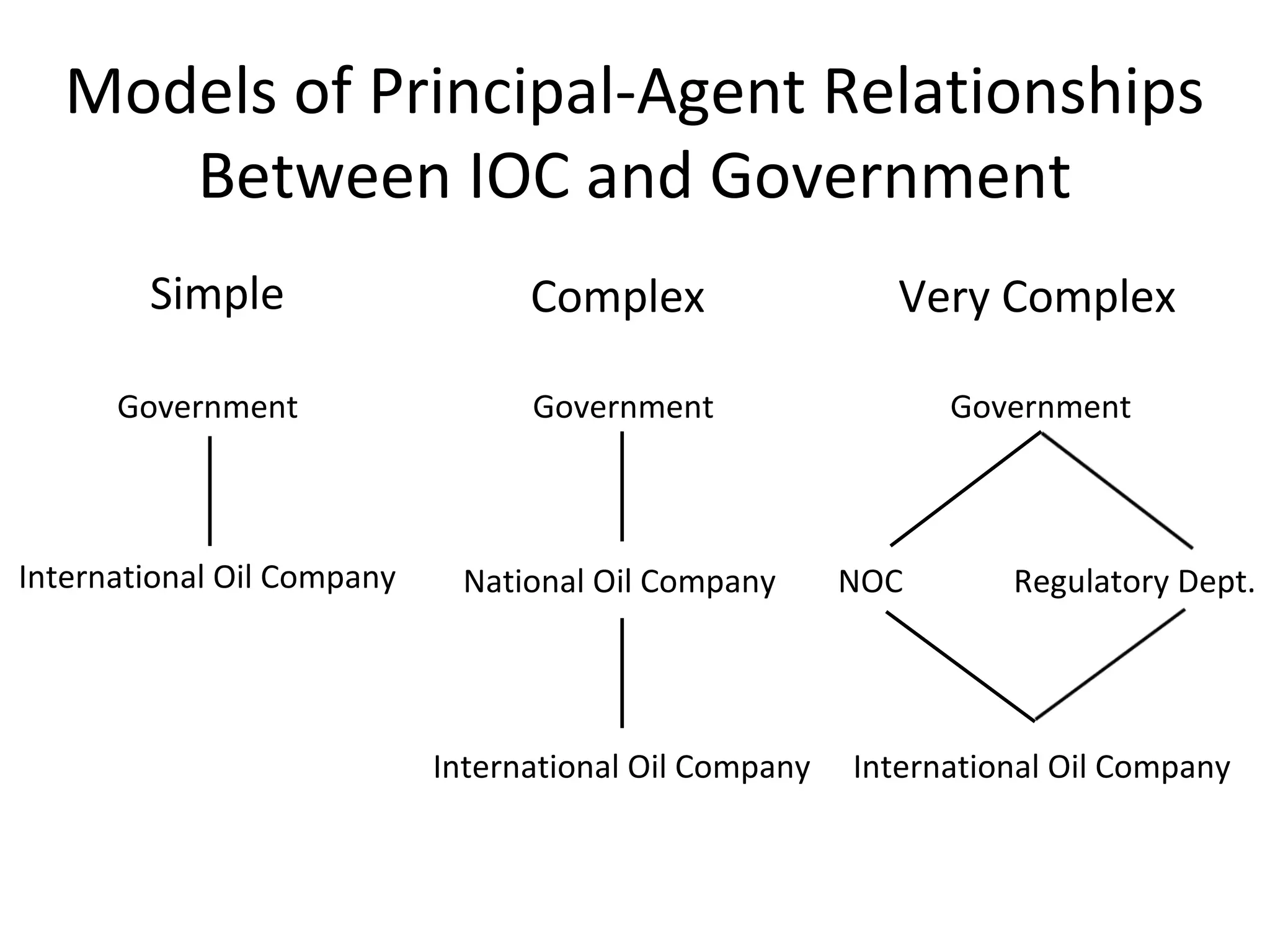

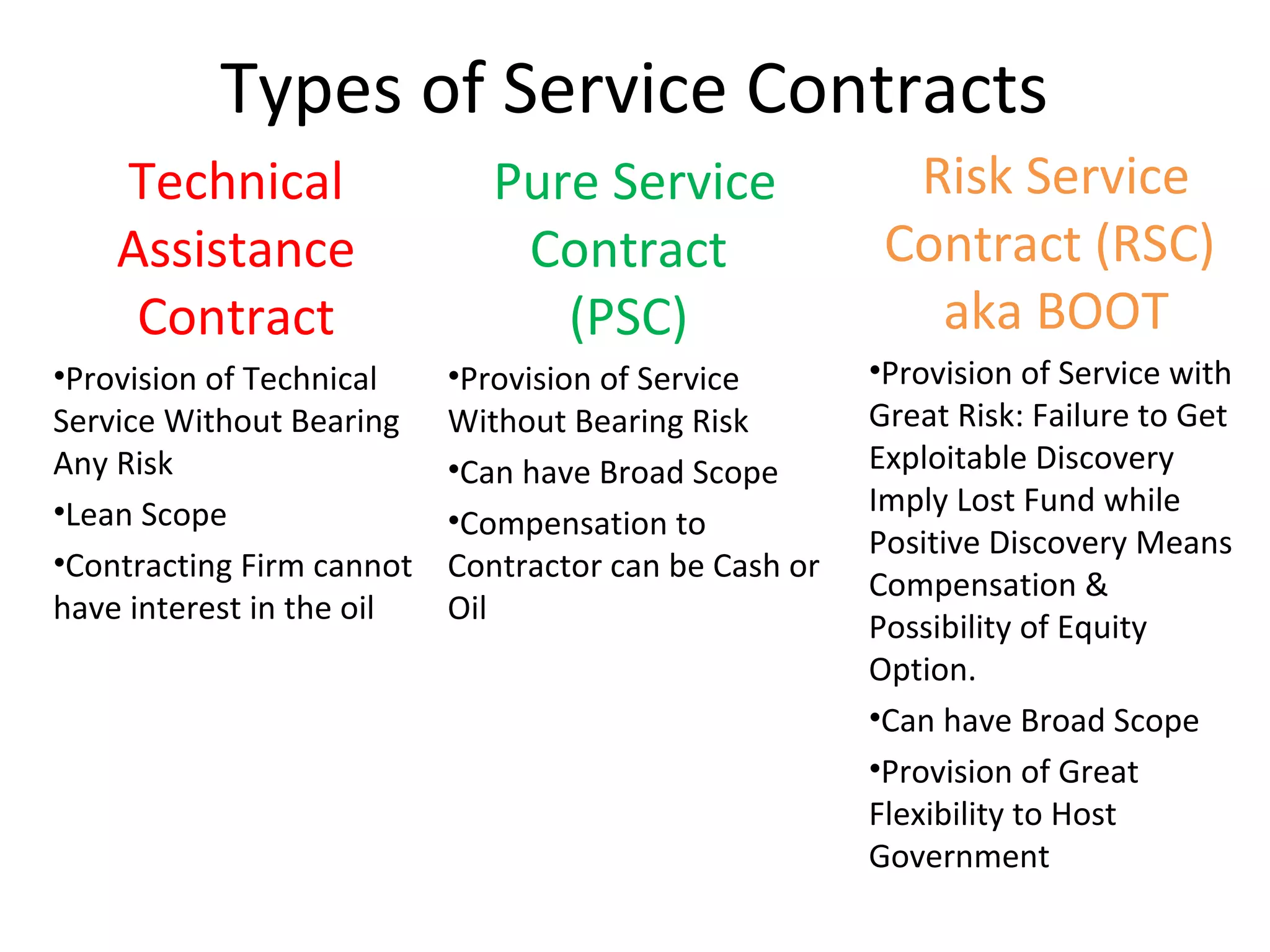

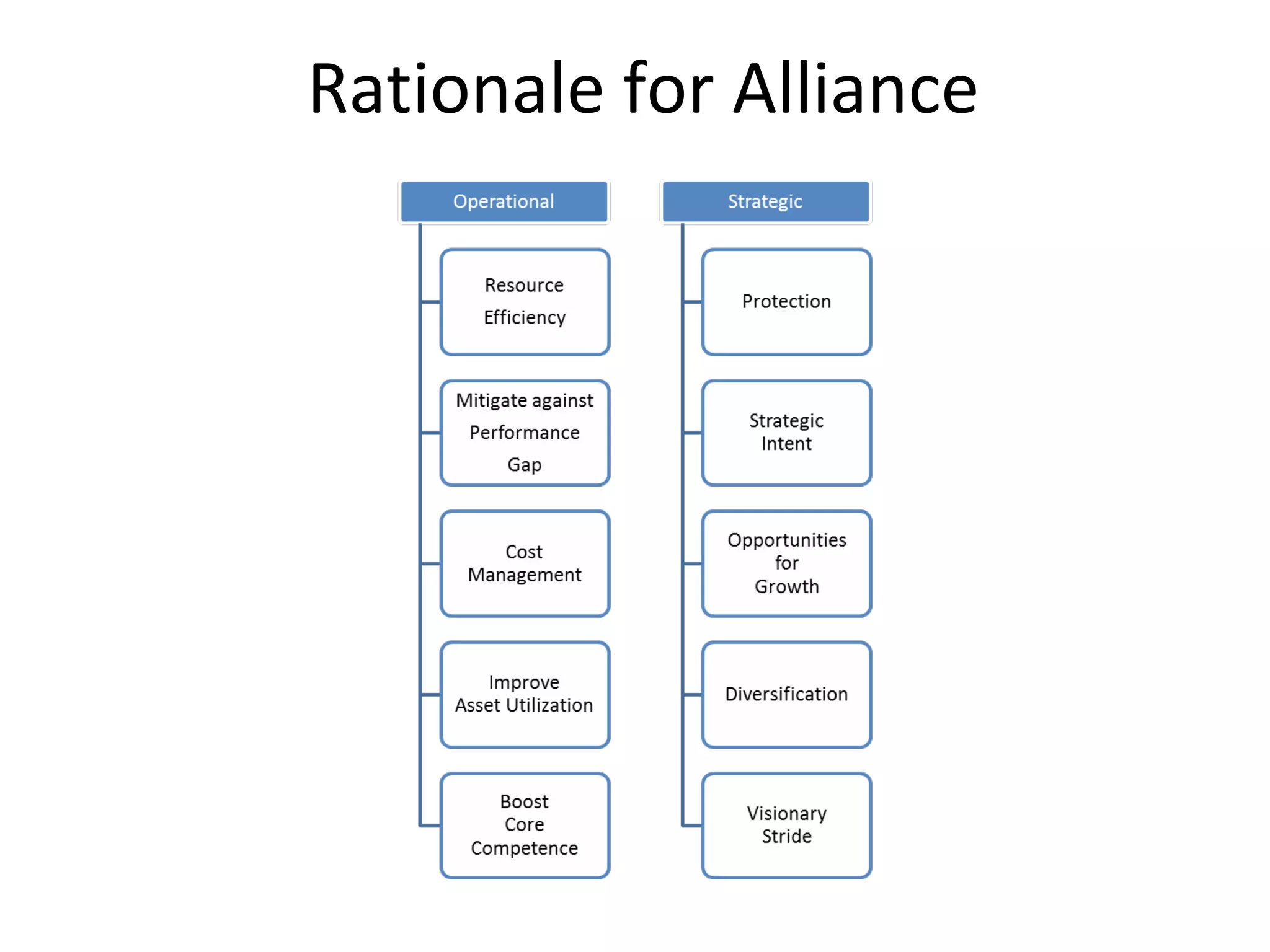

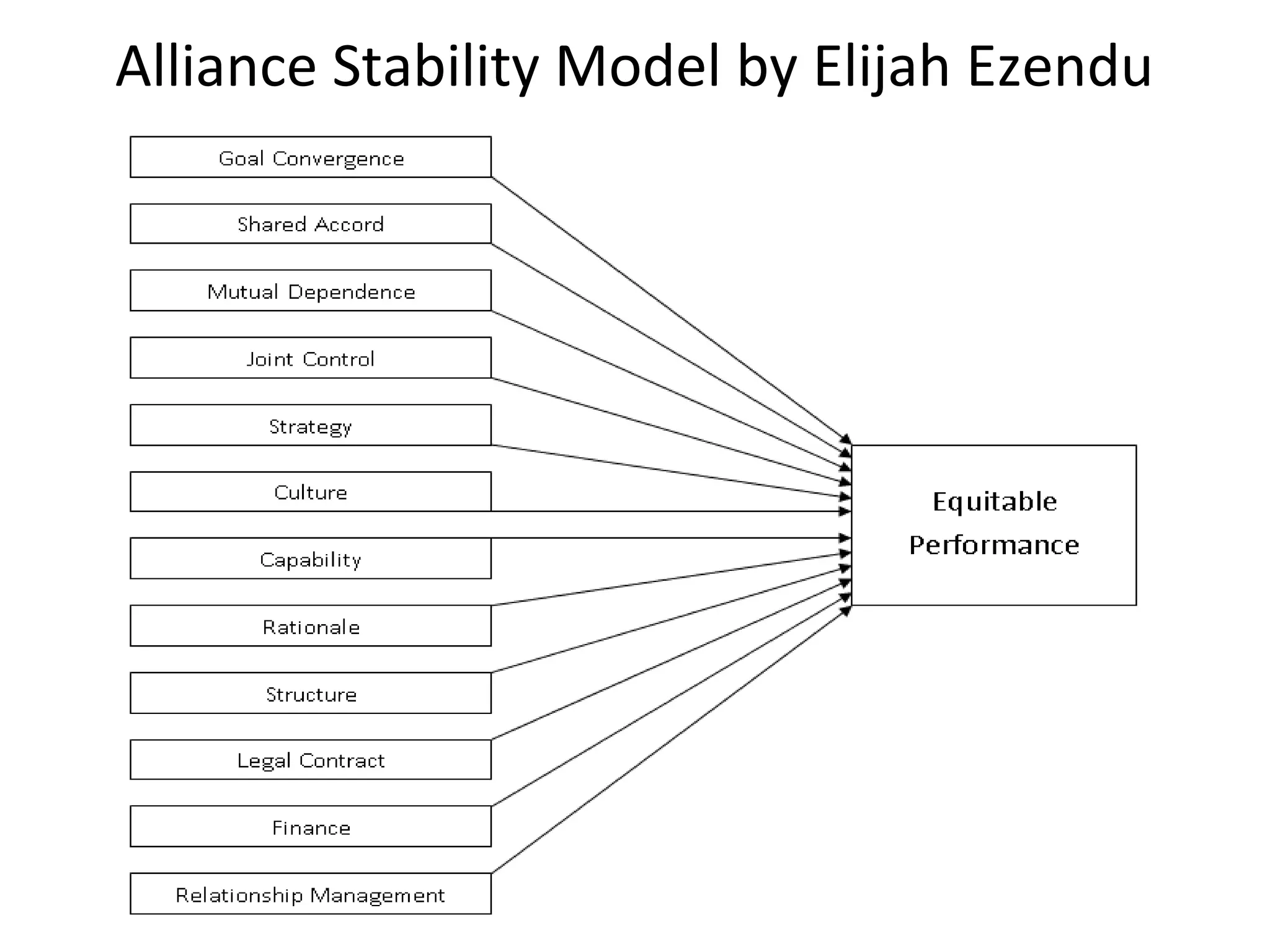

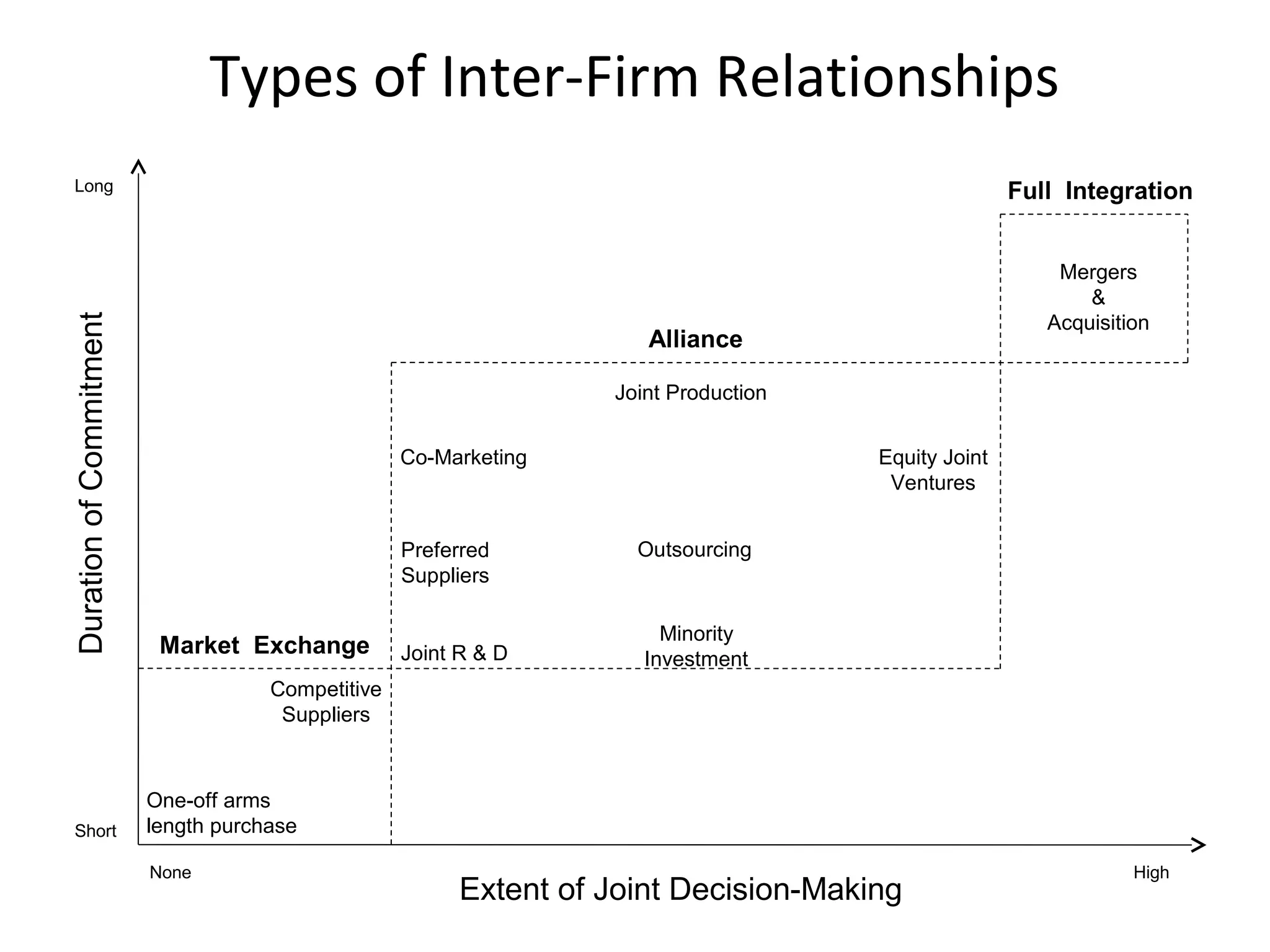

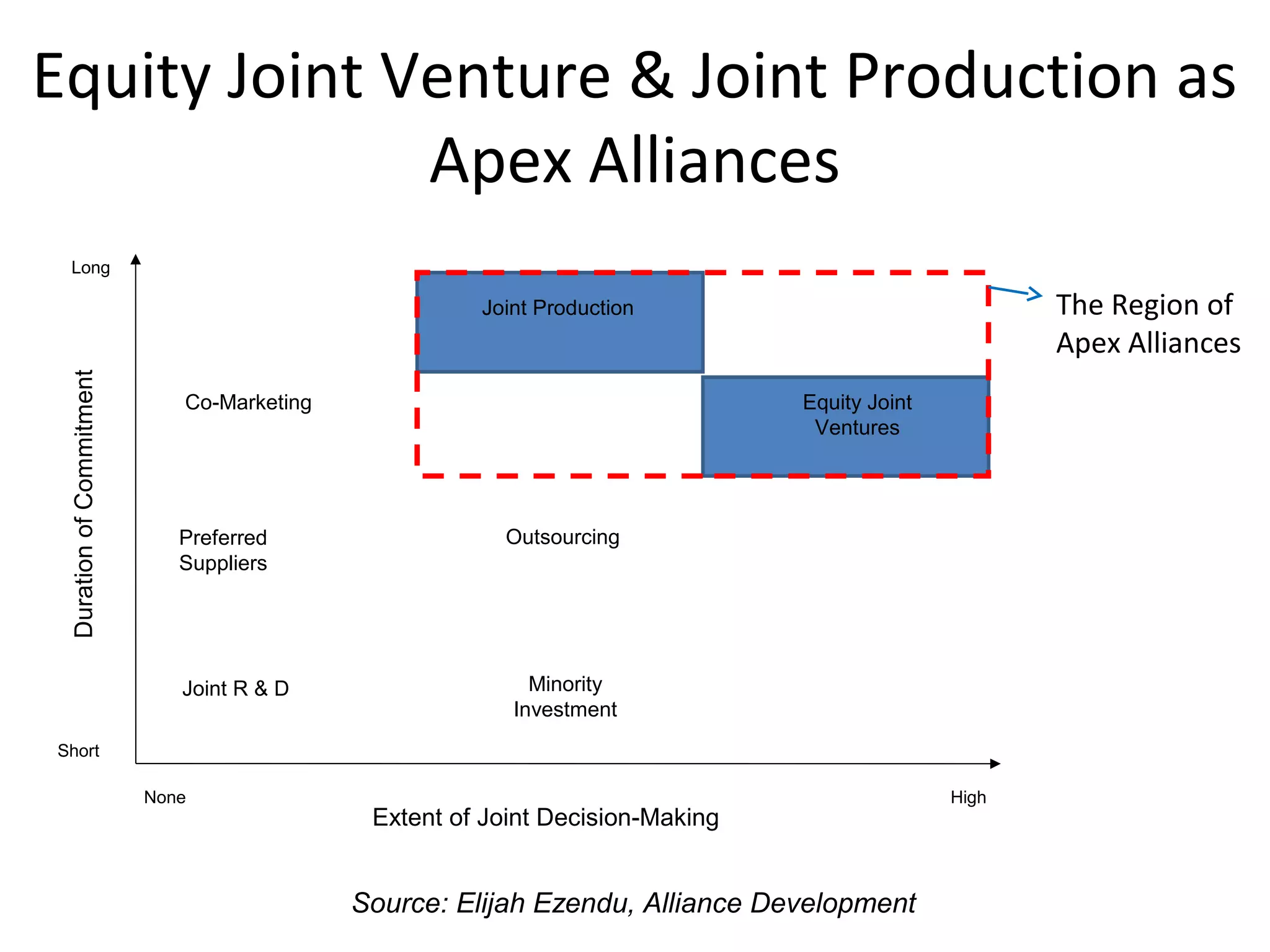

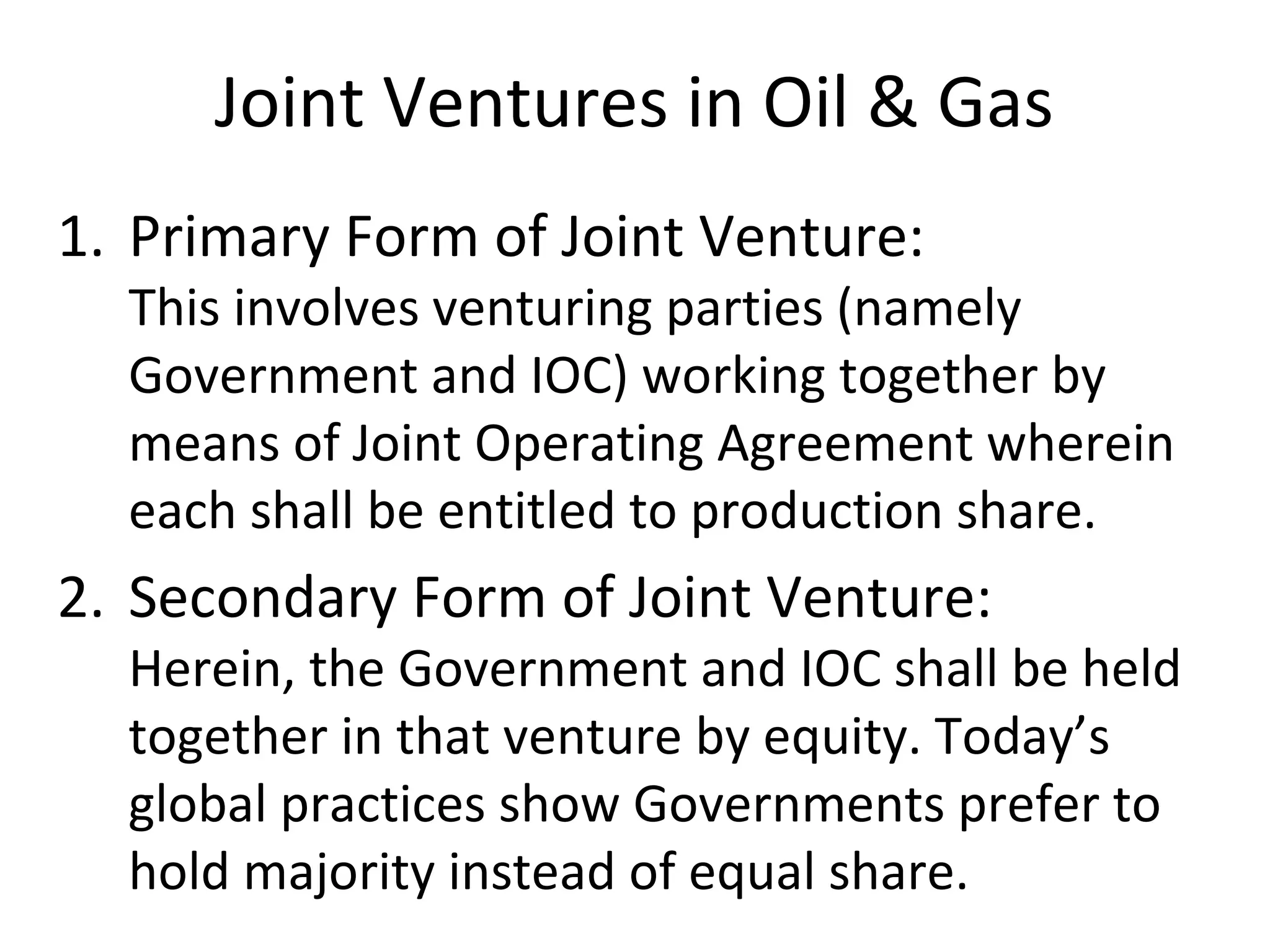

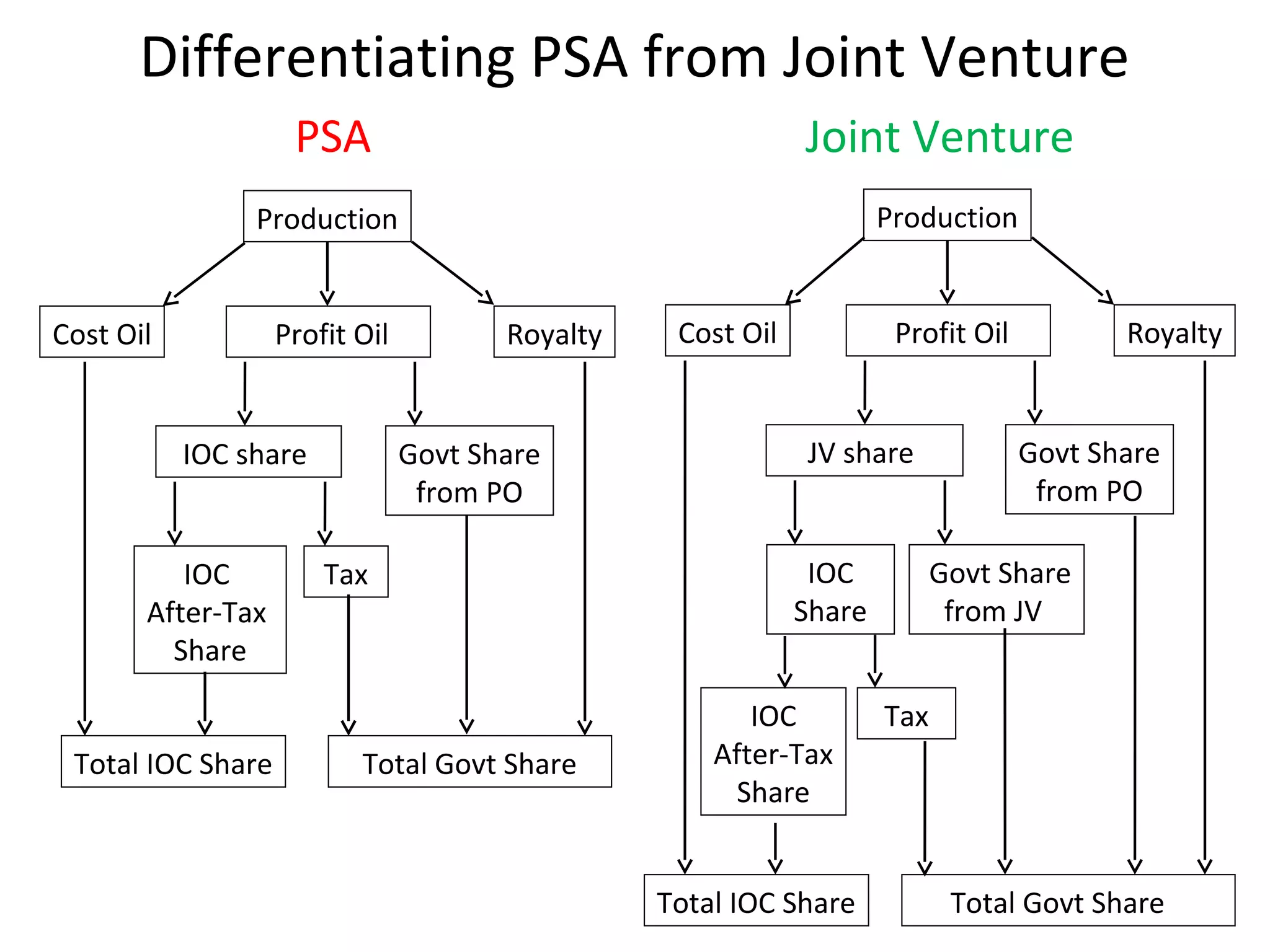

The document discusses different types of agreements for oil production and exploration between oil companies and governments. It describes production sharing agreements where the oil company bears costs of exploration and production in exchange for a share of output. It also discusses joint ventures where governments and oil companies jointly operate projects and share outputs. Service contracts are mentioned where the government maintains greater control and the oil company is compensated for services. The pros and cons of these different models are compared from the perspectives of both the host government and international oil companies.