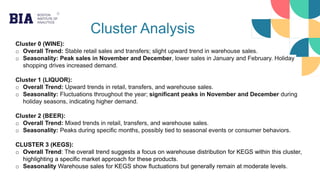

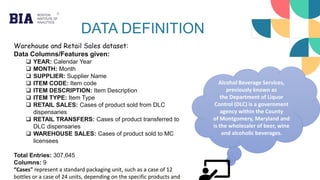

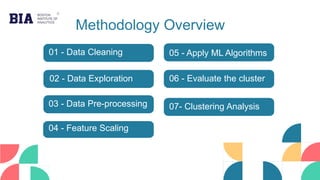

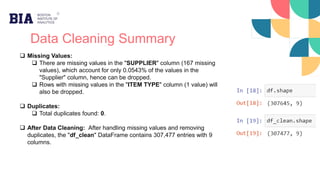

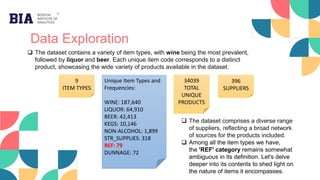

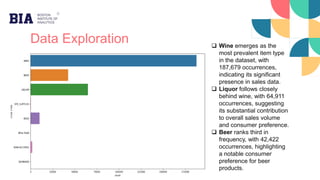

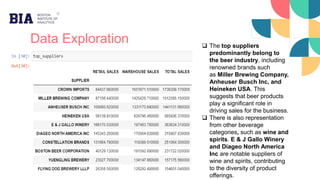

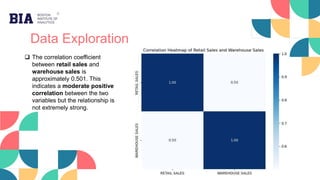

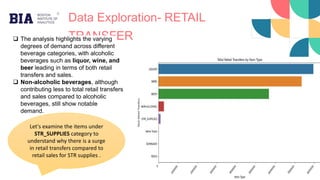

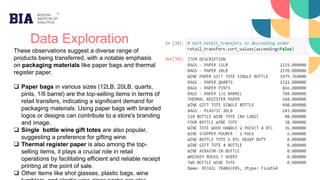

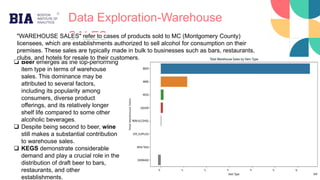

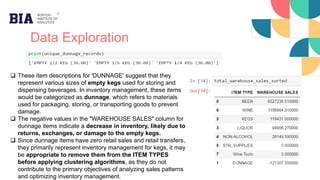

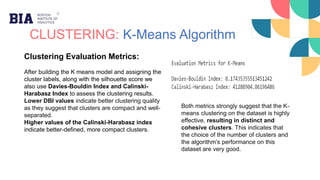

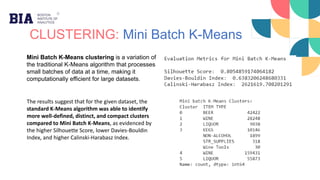

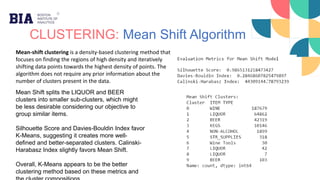

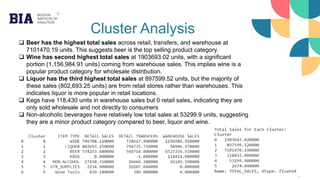

The document presents a product cluster analysis aimed at optimizing inventory management in the retail and wholesale distribution sector, specifically by grouping similar products based on sales patterns. Key findings include high demand for beer and wine products, significant seasonal sales fluctuations, and a focus on tailored promotional strategies for different product clusters. The analysis employs k-means clustering and identifies six distinct clusters, providing actionable insights for inventory optimization and marketing strategies.

![Cluster Analysis

Clusters where the total sales are among the

top 25%, include cluster 0 [WINE] and cluster

2 [BEER] indicating high demand.

This insight is valuable for inventory

management, marketing strategies, and product

planning, as businesses can focus on stocking

and promoting beer and wine products to

capitalize on their popularity among consumers.

Let’s analyze seasonal decomposition plots for

RETAIL SALES, RETAIL TRANSFERS, and

WAREHOUSE SALES to understand seasonal

effects and overall trends in each cluster. These

insights will help us grasp the nuances driving our

sales patterns, aiding better decision-making and

strategy.](https://image.slidesharecdn.com/capstoneprojectproductclusteranalysisakshitharai-240626121102-65966915/85/Product-Cluster-Analysis-Unveiling-Hidden-Customer-Preferences-28-320.jpg)