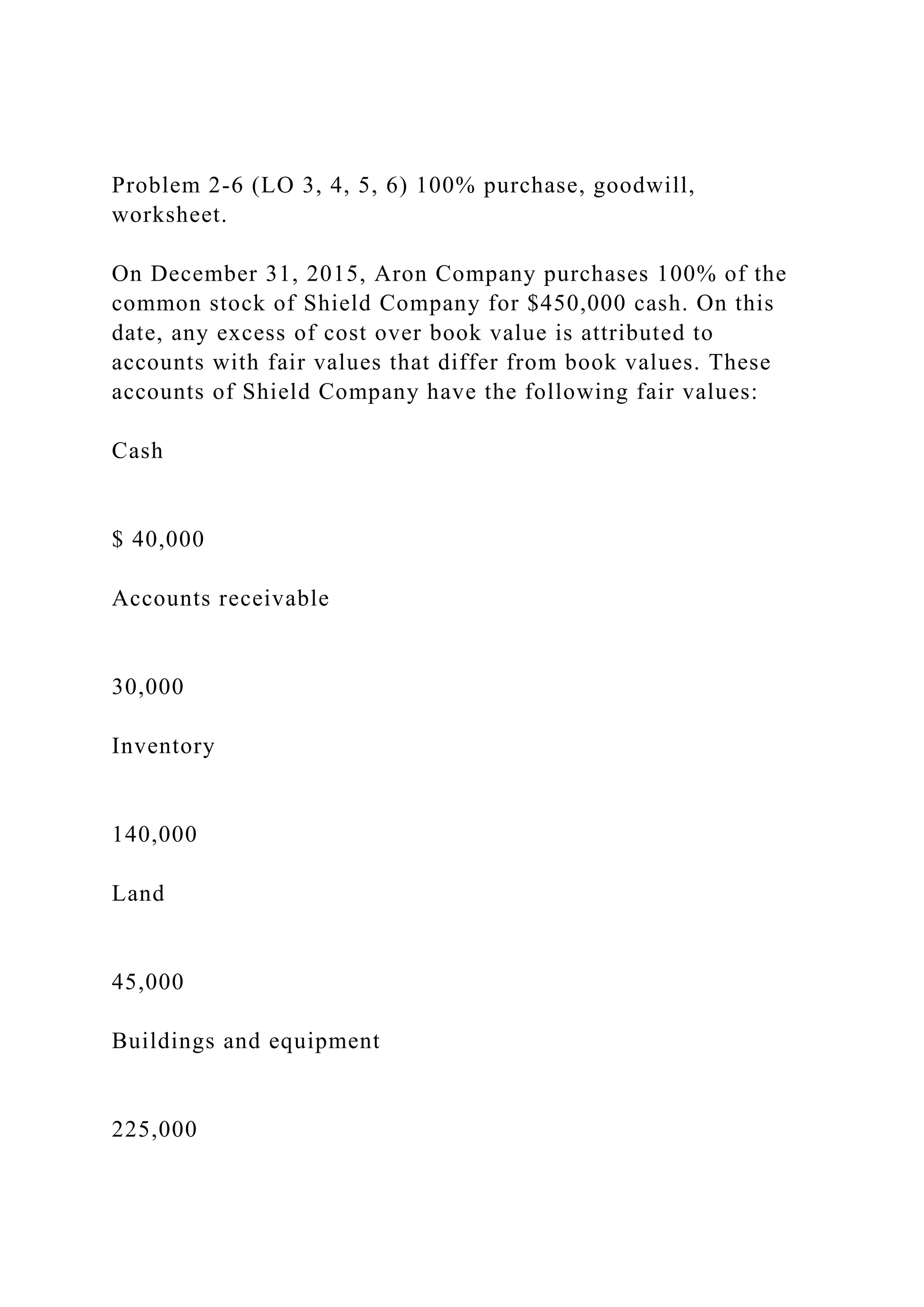

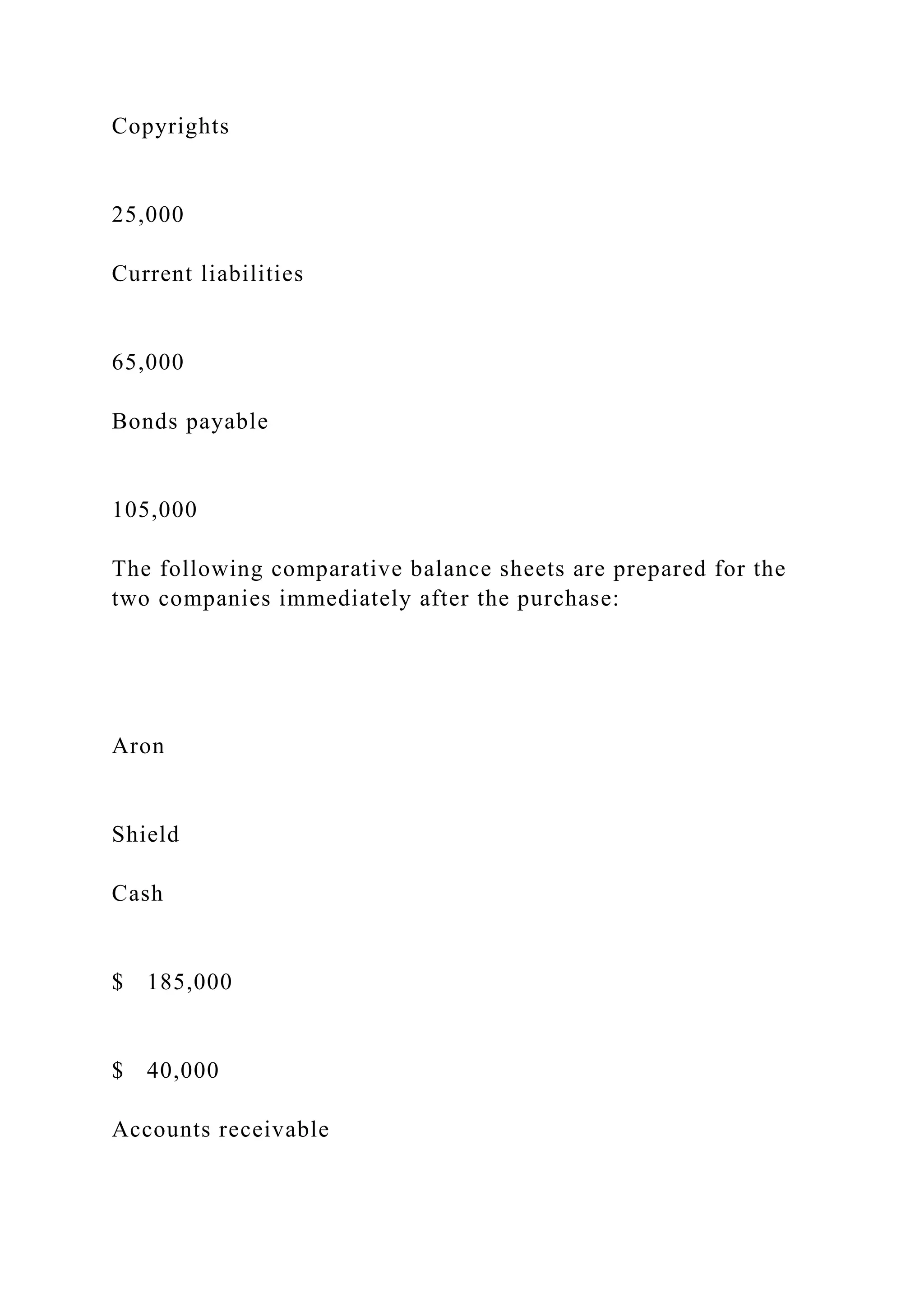

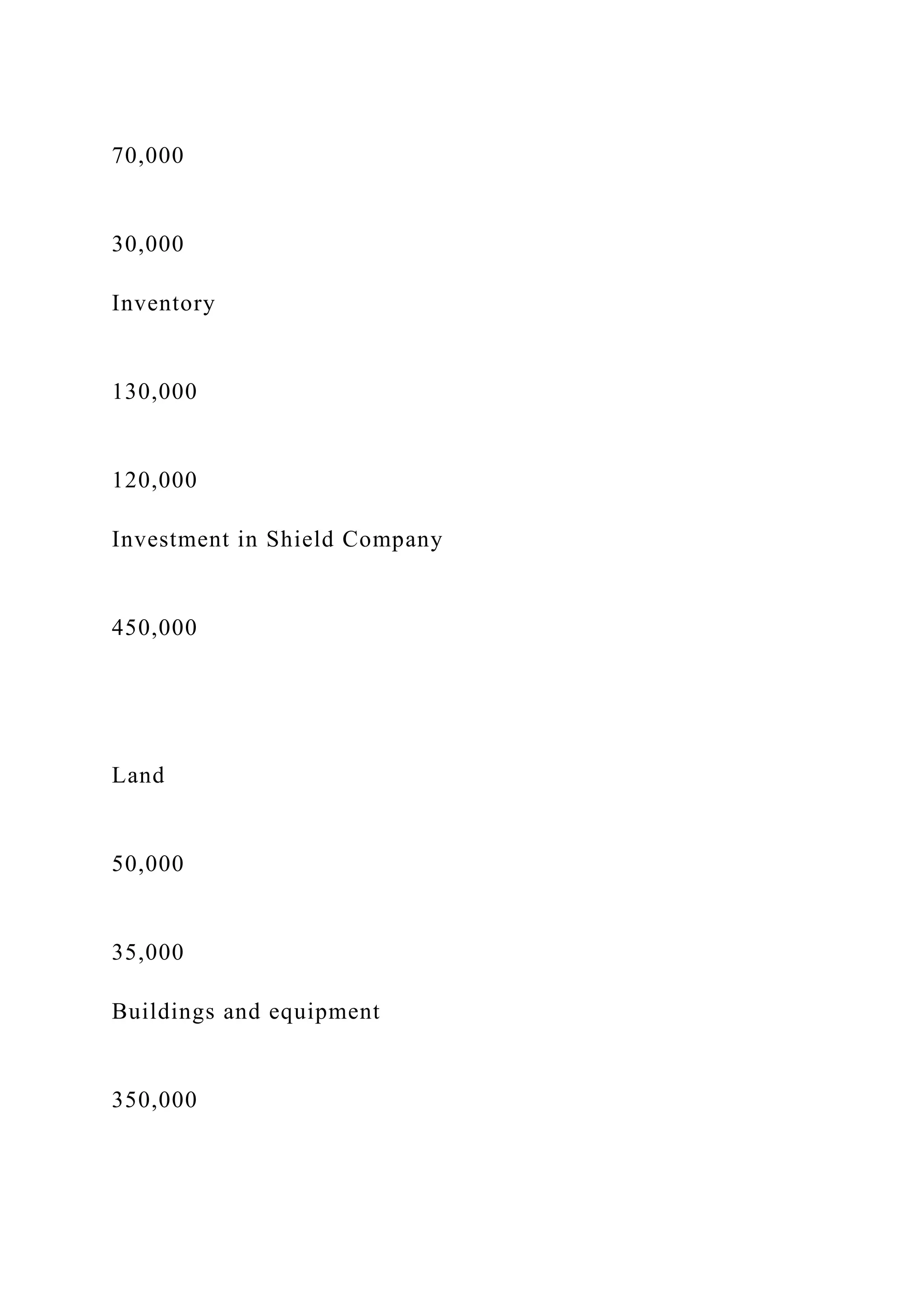

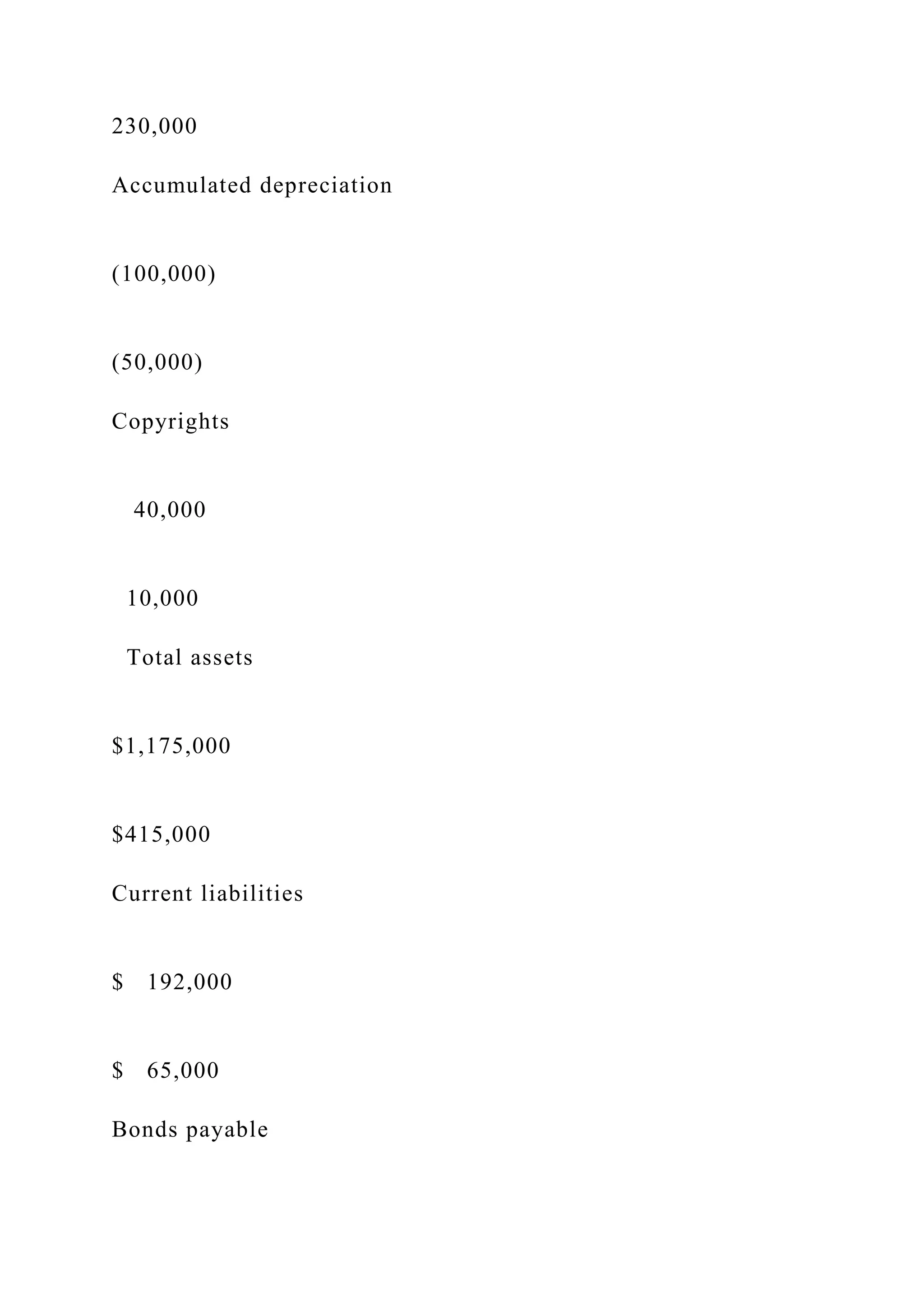

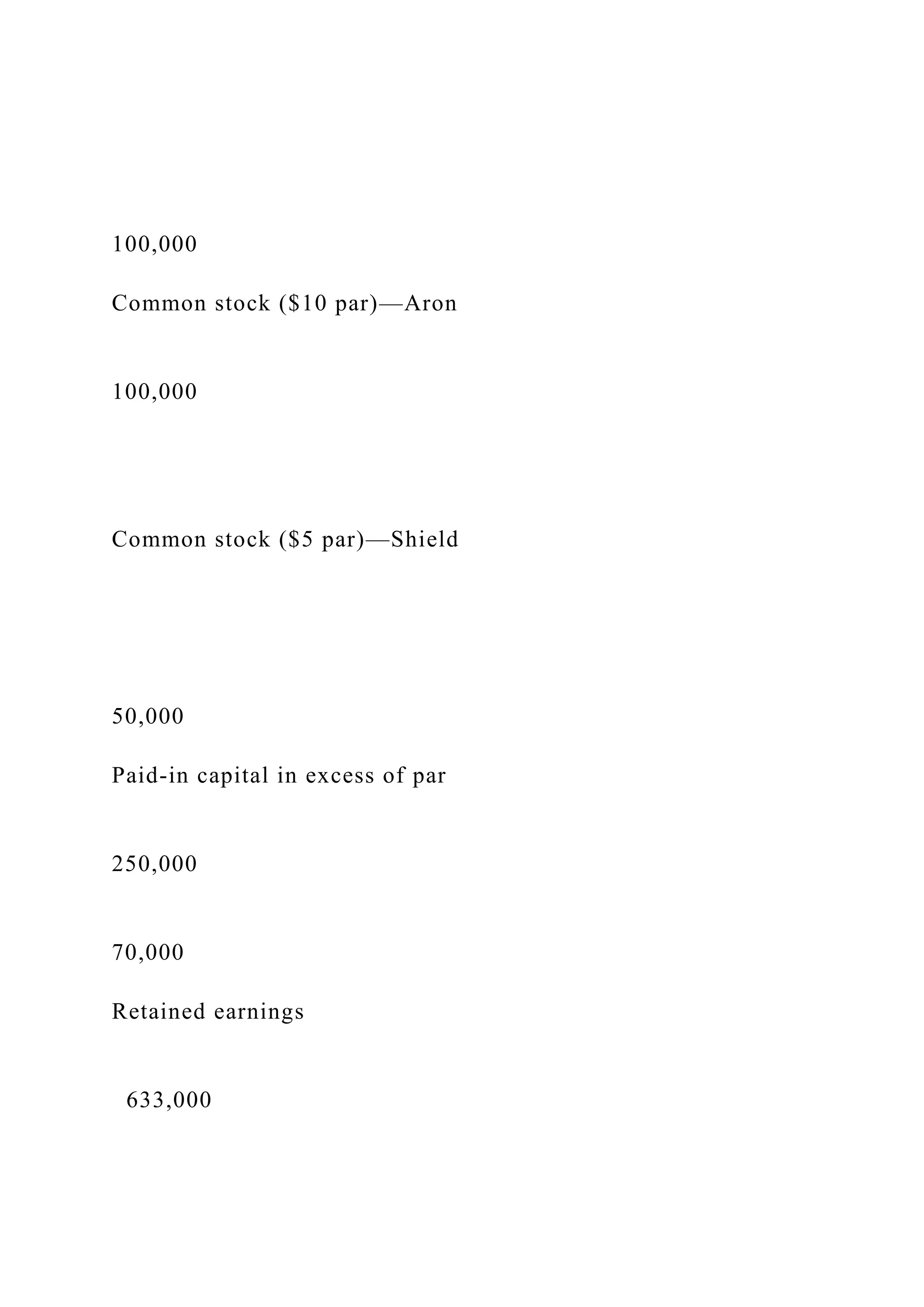

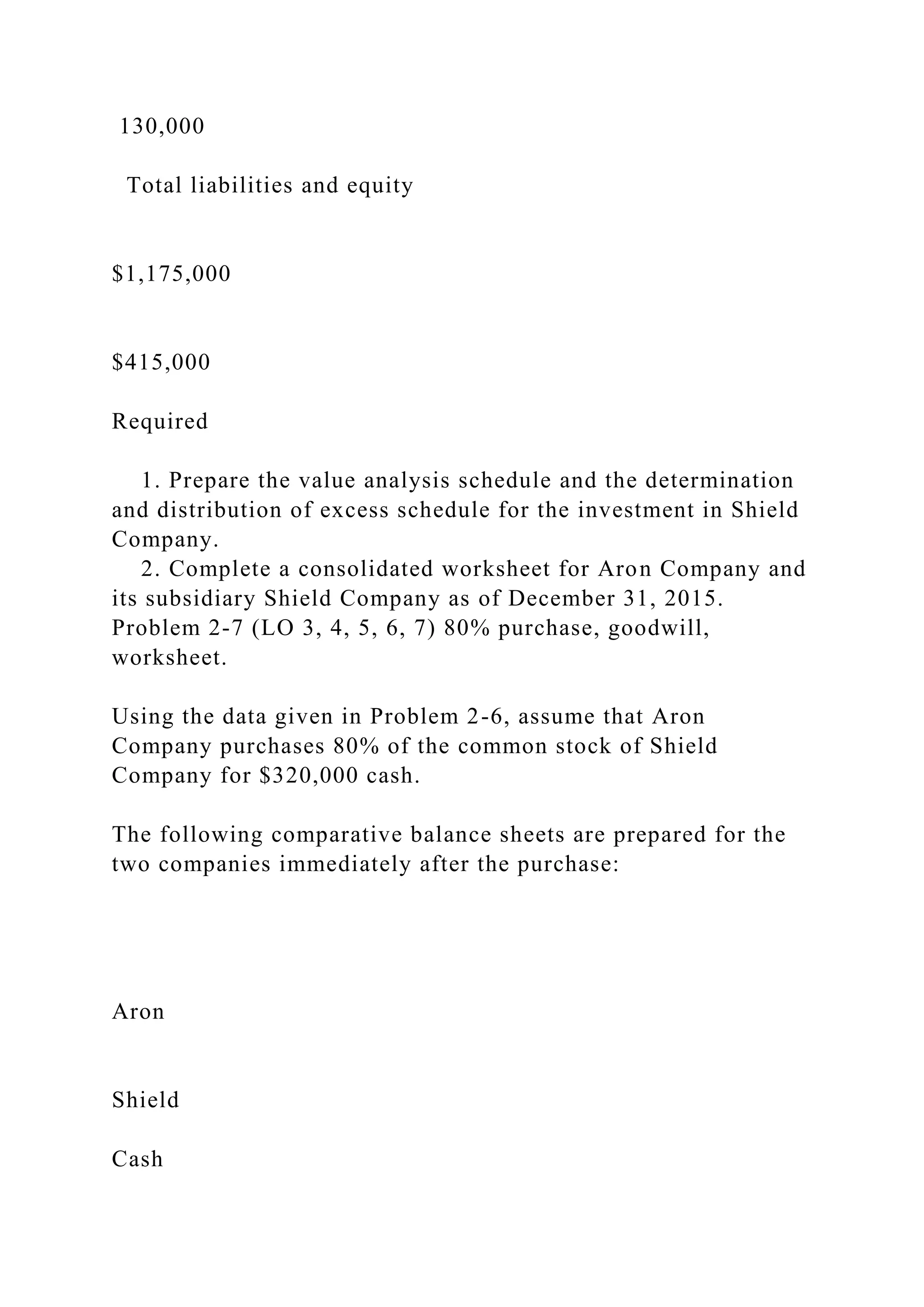

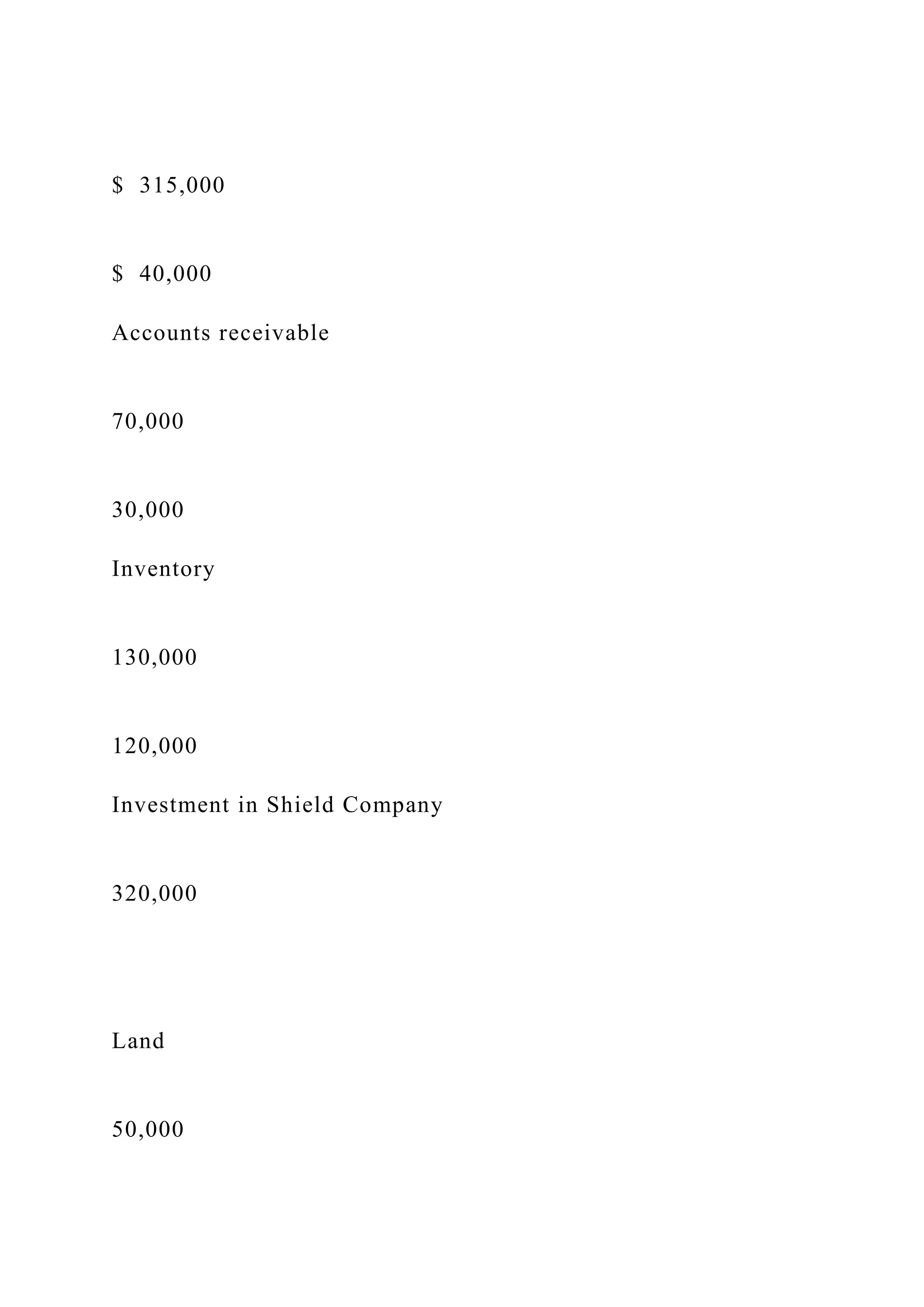

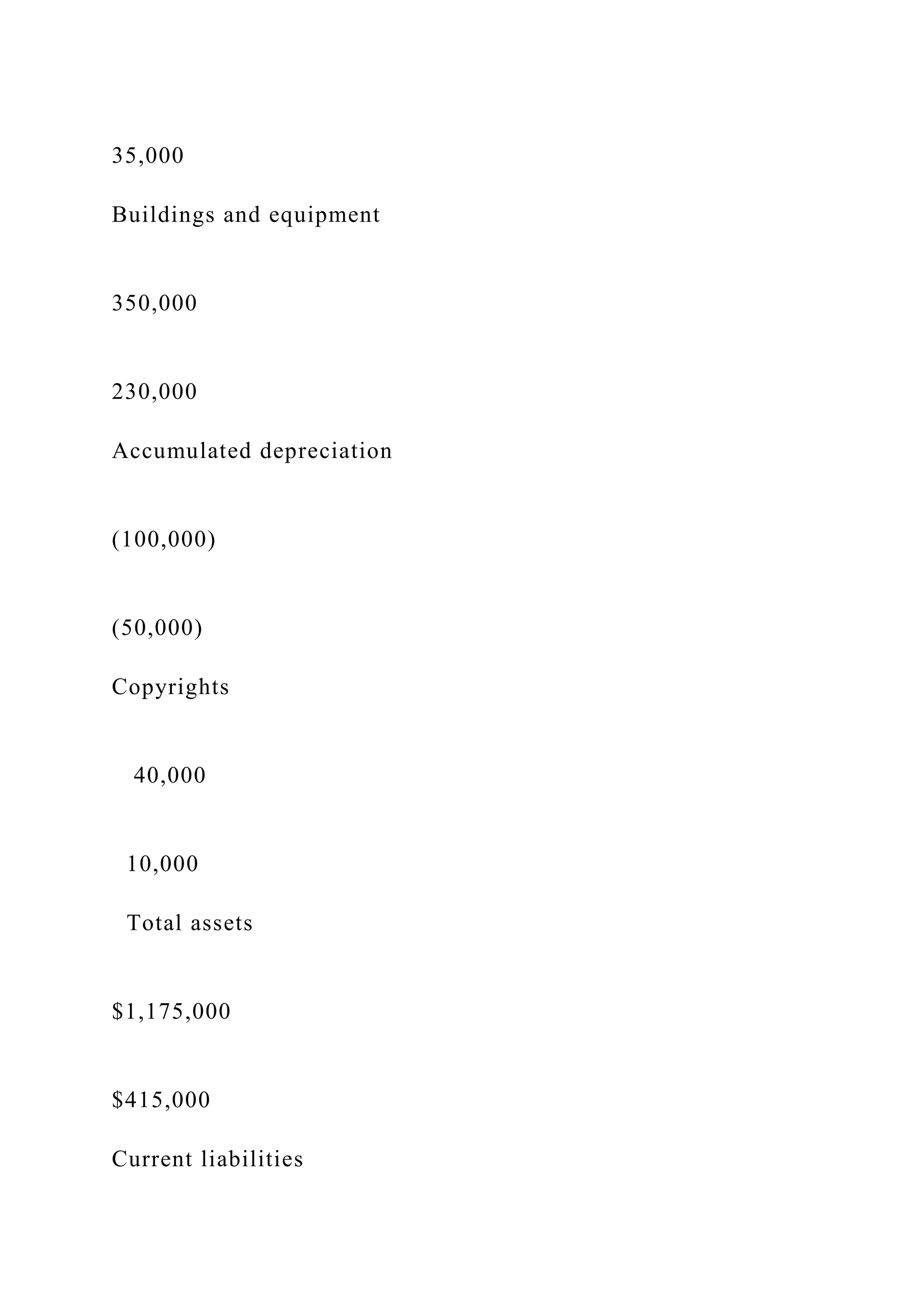

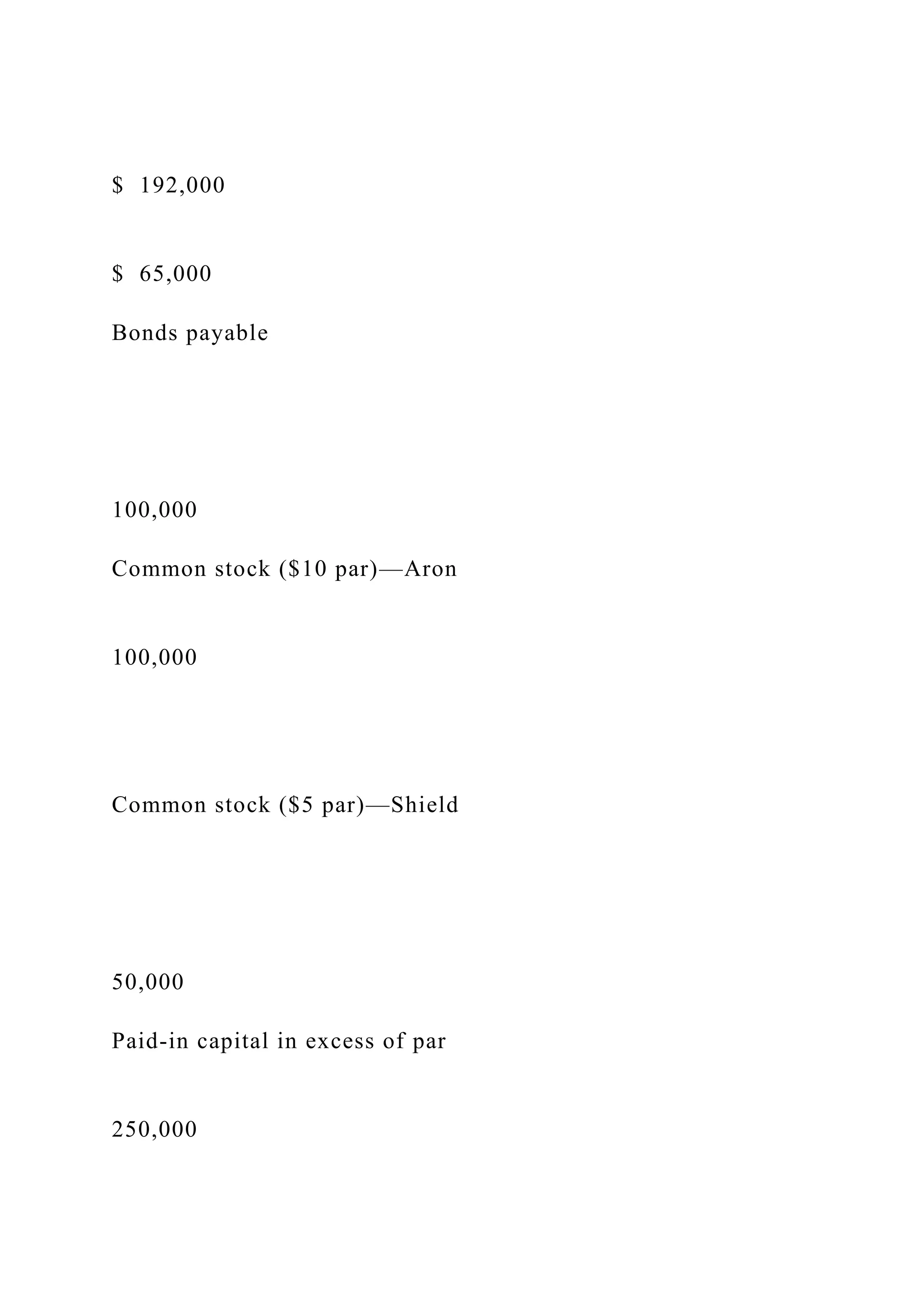

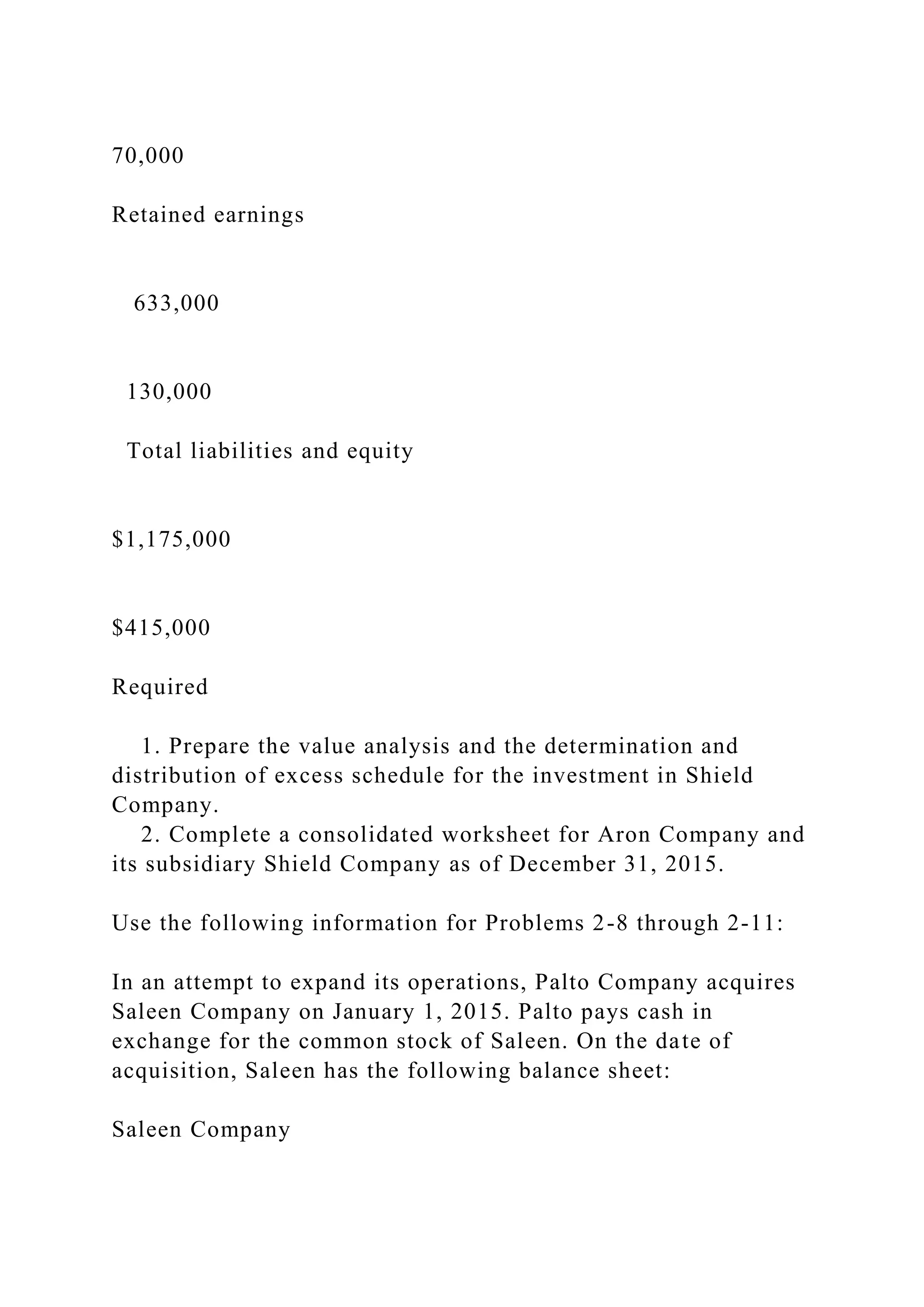

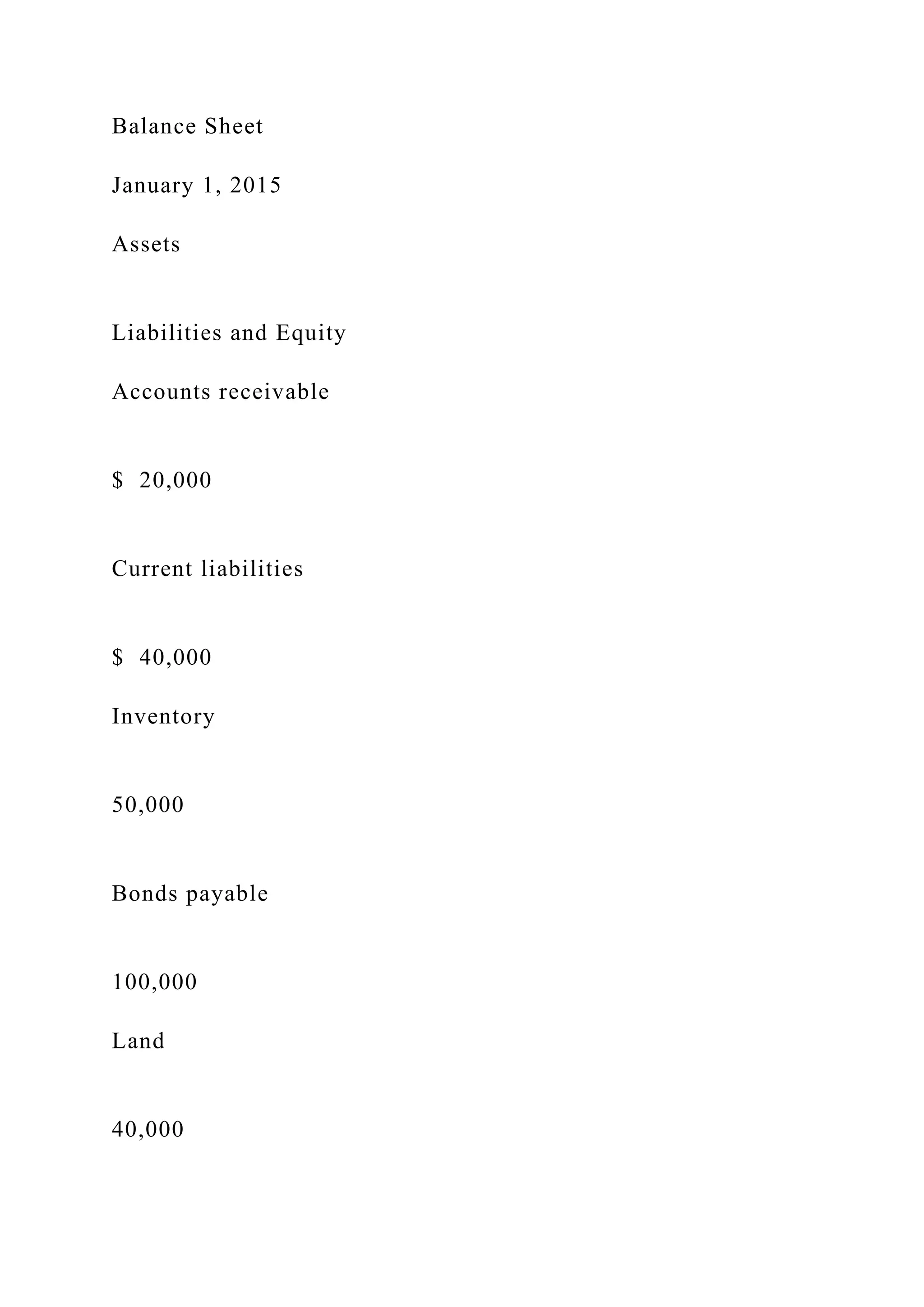

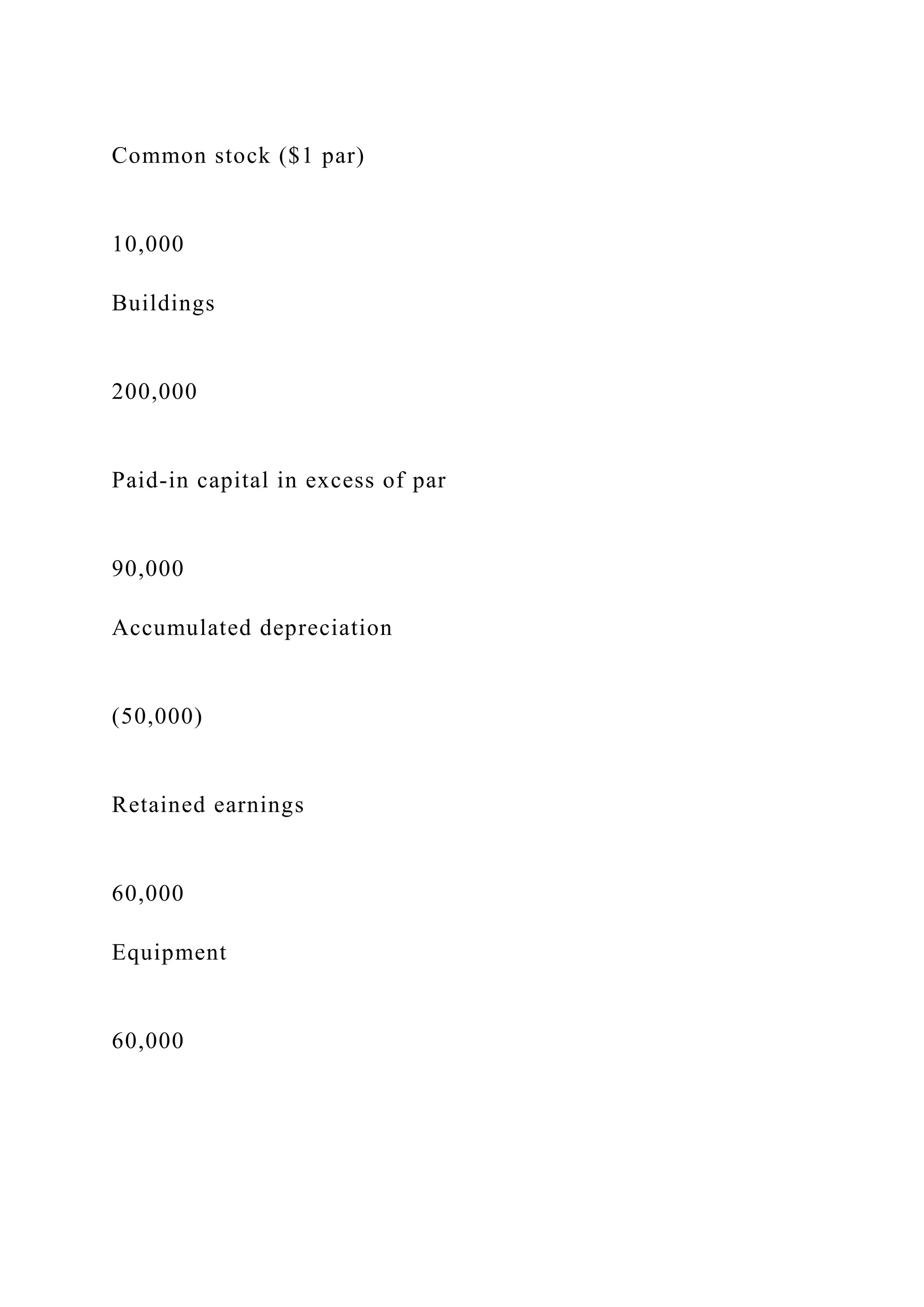

The document details transactions involving Aron Company and its acquisition of Shield Company, highlighting a 100% and an 80% purchase scenario, with specific valuations for assets and liabilities. It requires the preparation of value analysis schedules and consolidated worksheets as of December 31, 2015, emphasizing goodwill and excess cost analysis. Additionally, the document discusses broader accounting concepts related to cash flows, goodwill valuation, and the transition from master files to databases.