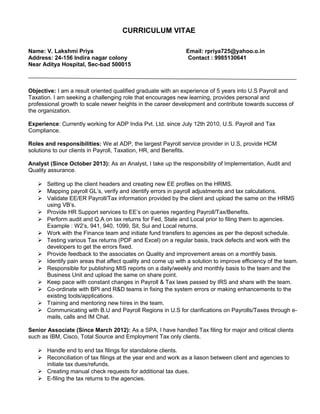

V. Lakshmi Priya is seeking a challenging role that leverages her 5 years of experience in U.S. payroll and taxation. She currently works as an analyst for ADP India Pvt. Ltd, where she is responsible for tasks like client implementation, quality assurance, and maintaining compliance with changing U.S. tax laws. Previously she held roles as a senior associate and associate at ADP, handling tasks like tax filings, reconciliations, and client billing. She has a B.Com degree and certifications in payroll fundamentals. Her strengths include strong domain knowledge of U.S. and Indian payroll and tax systems as well as skills in communication, problem solving, and teamwork.