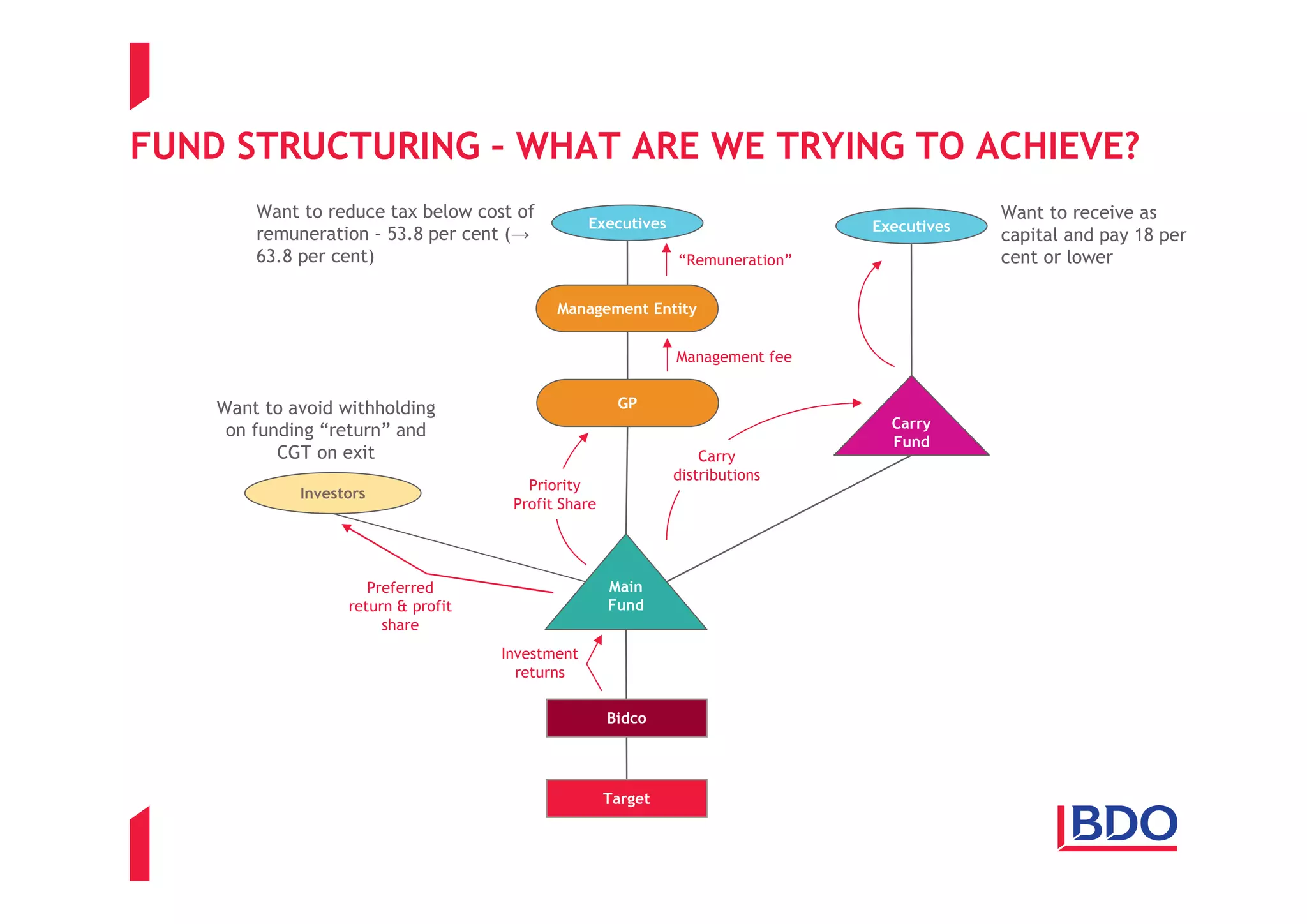

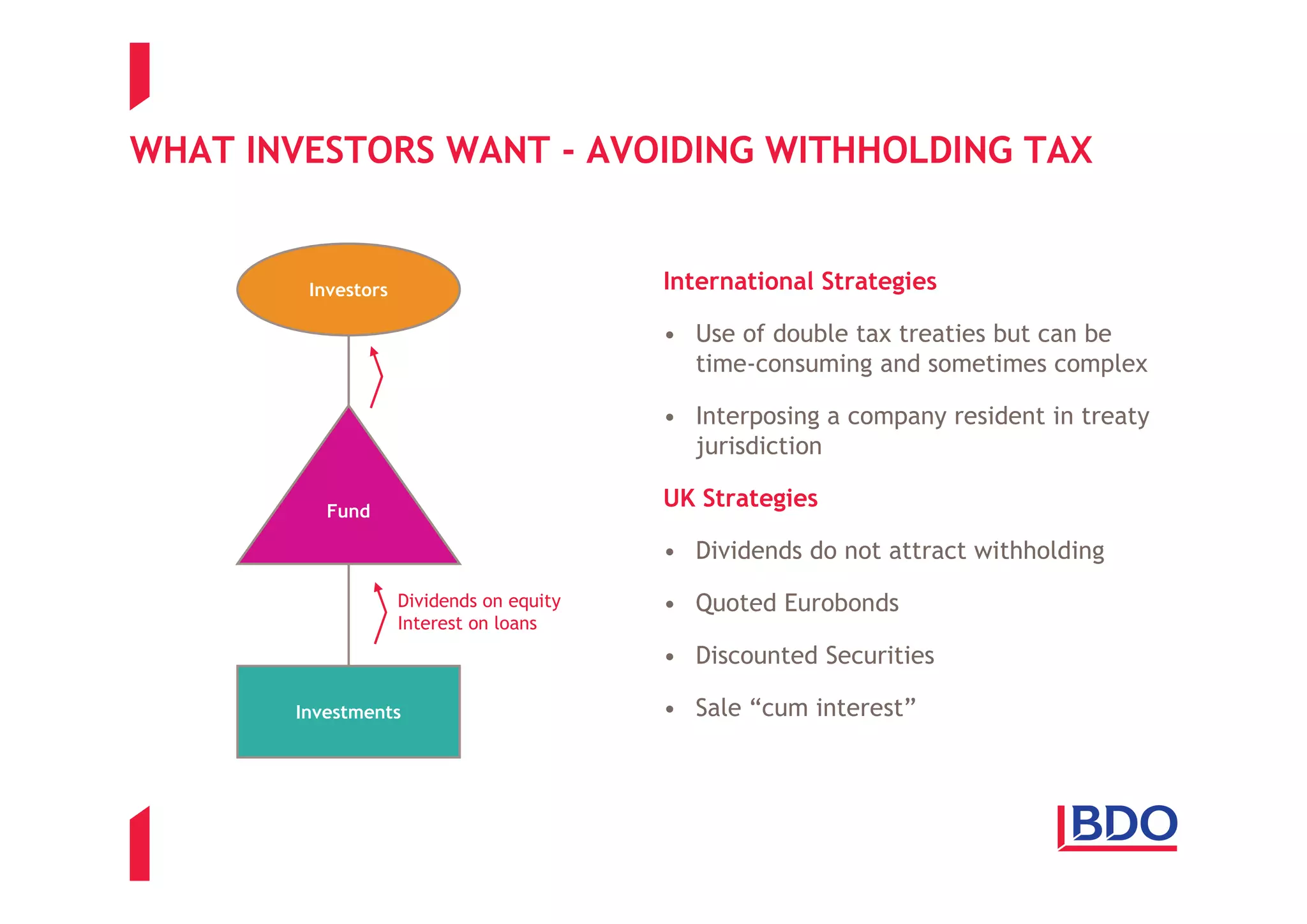

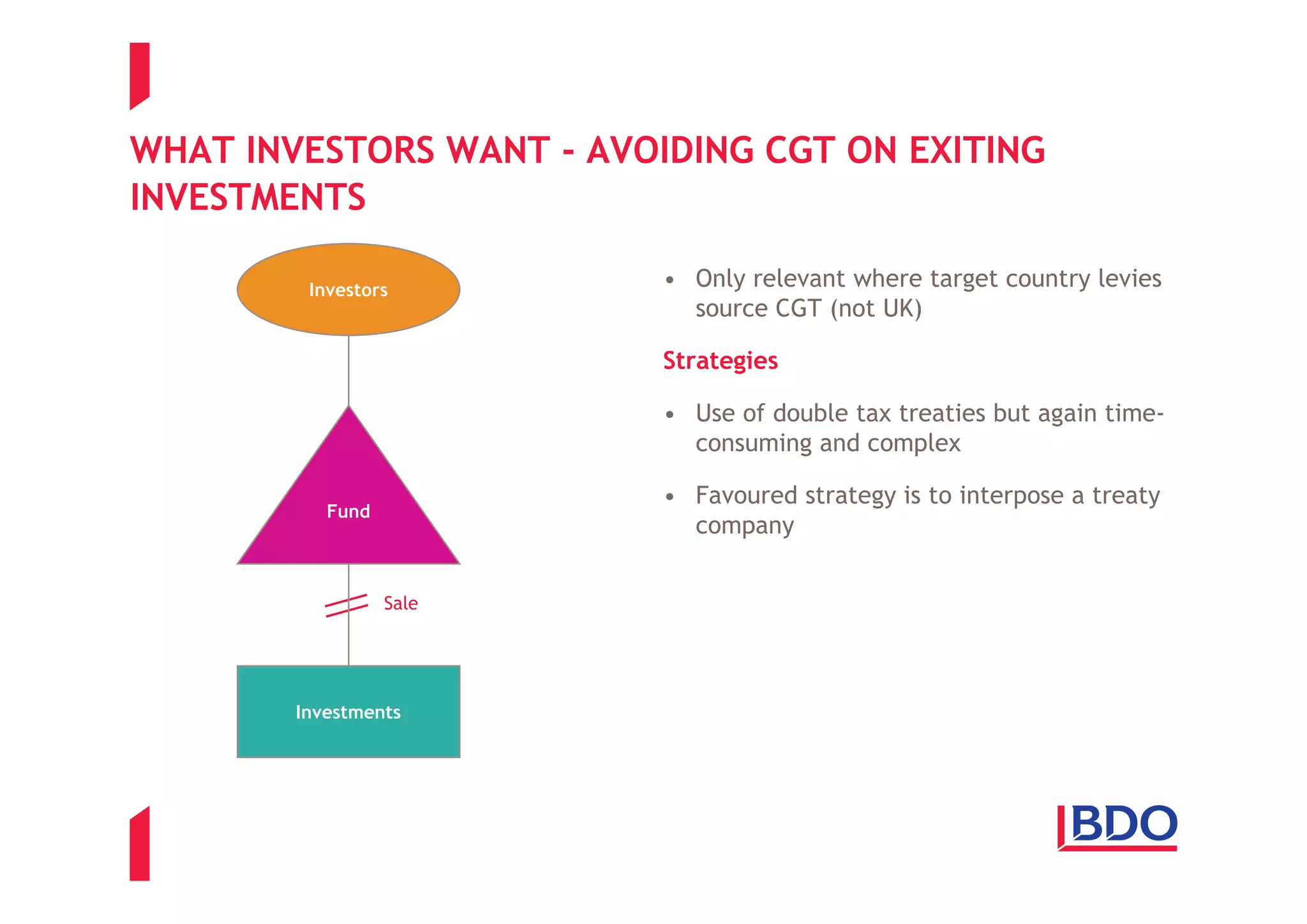

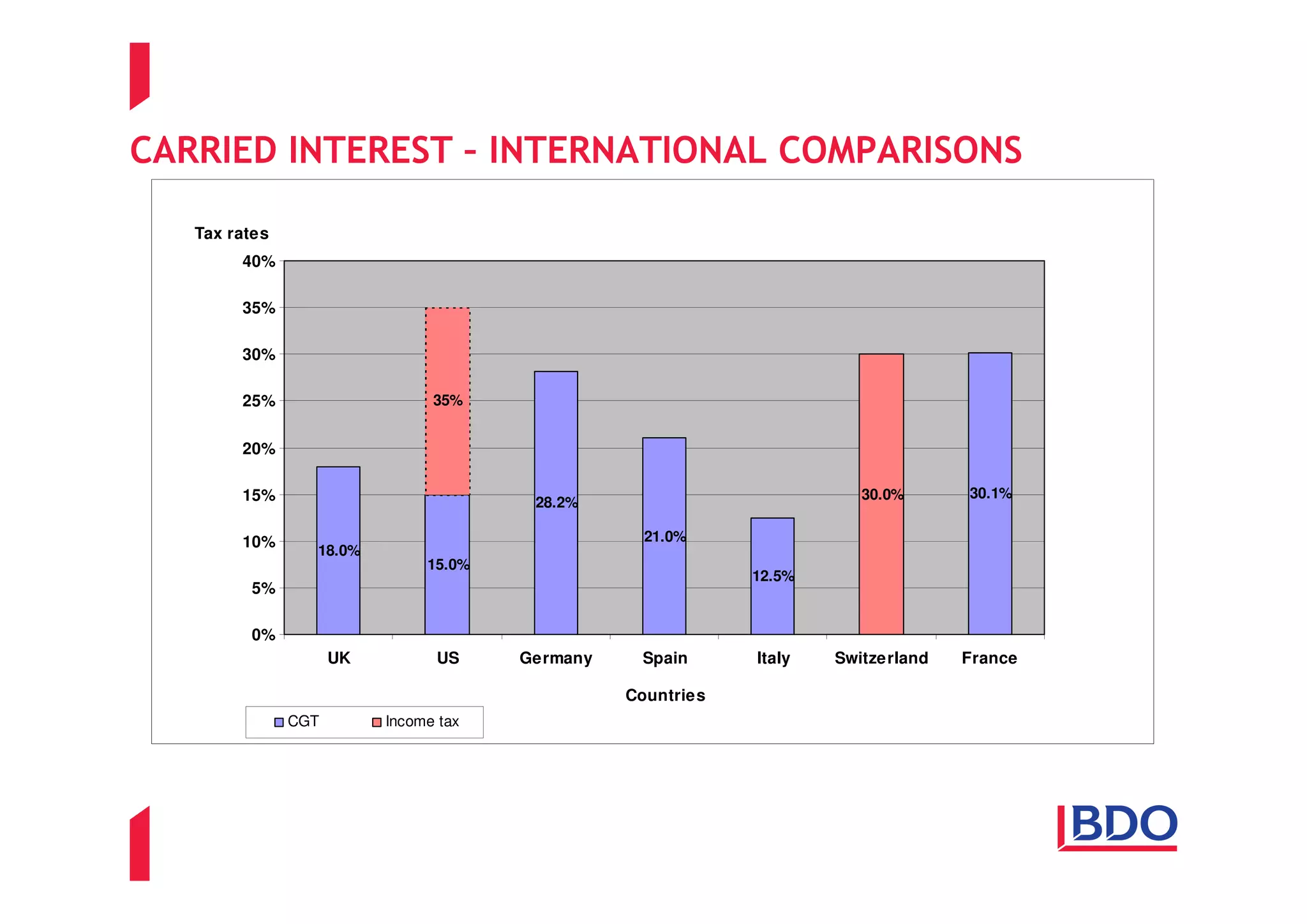

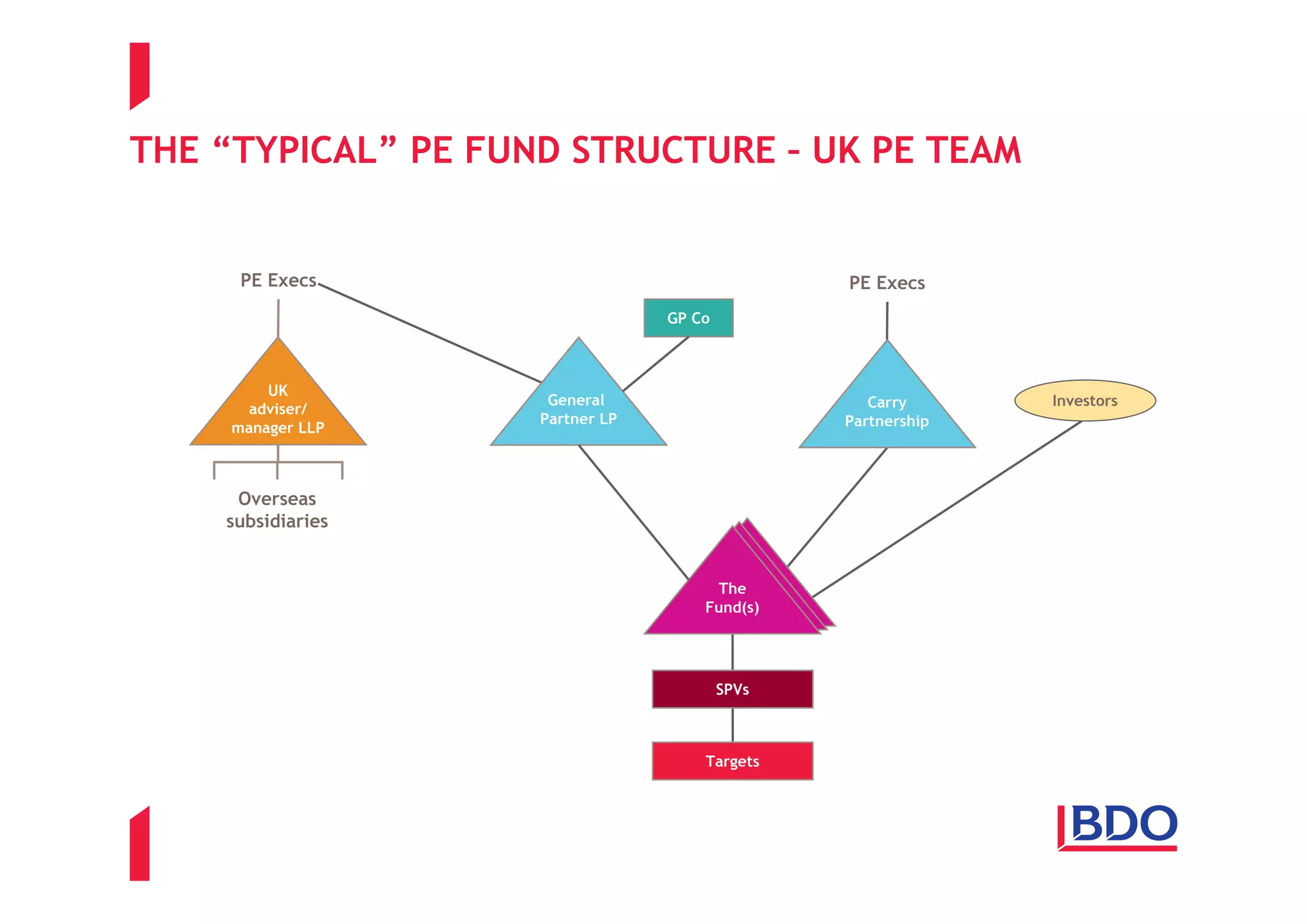

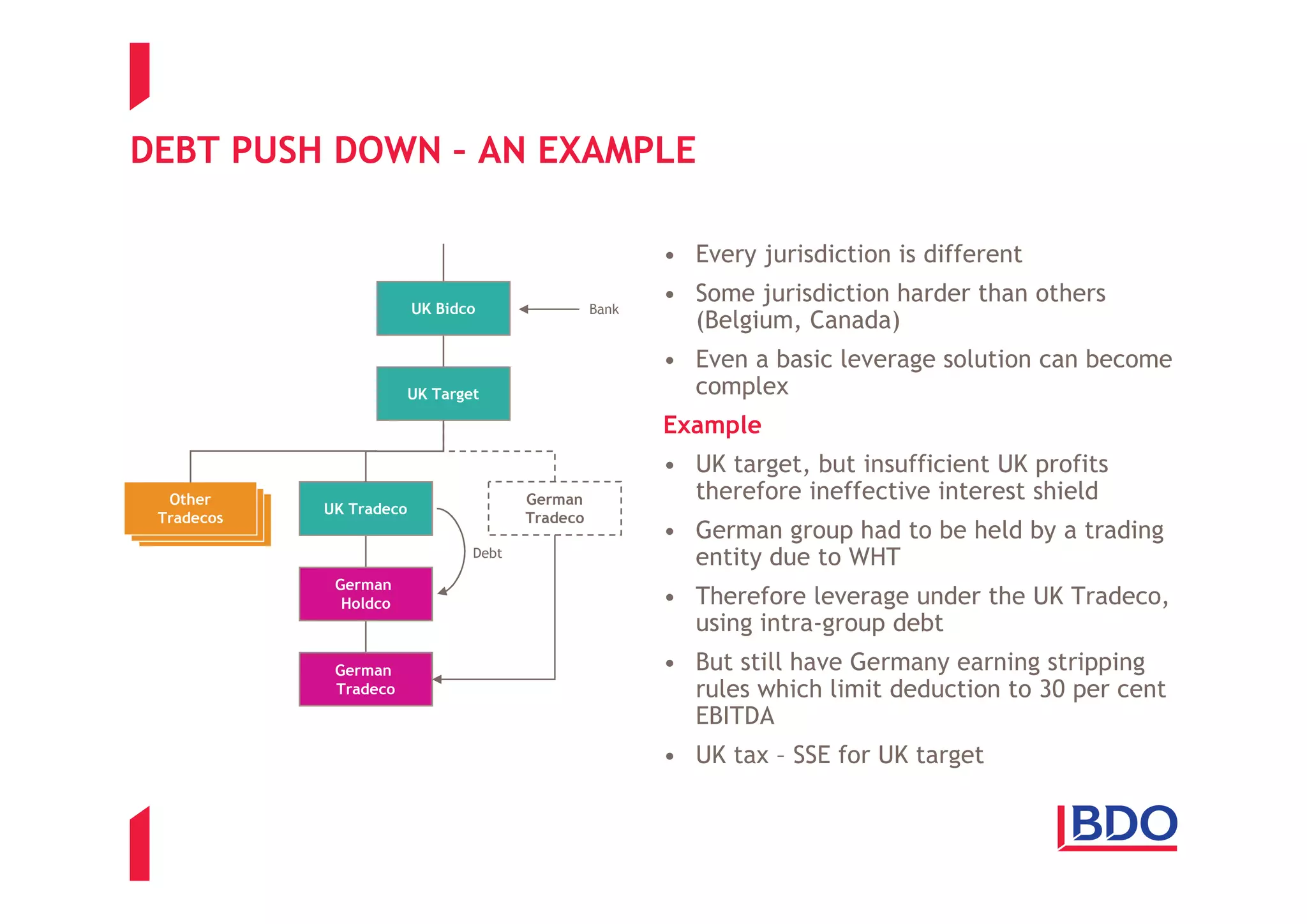

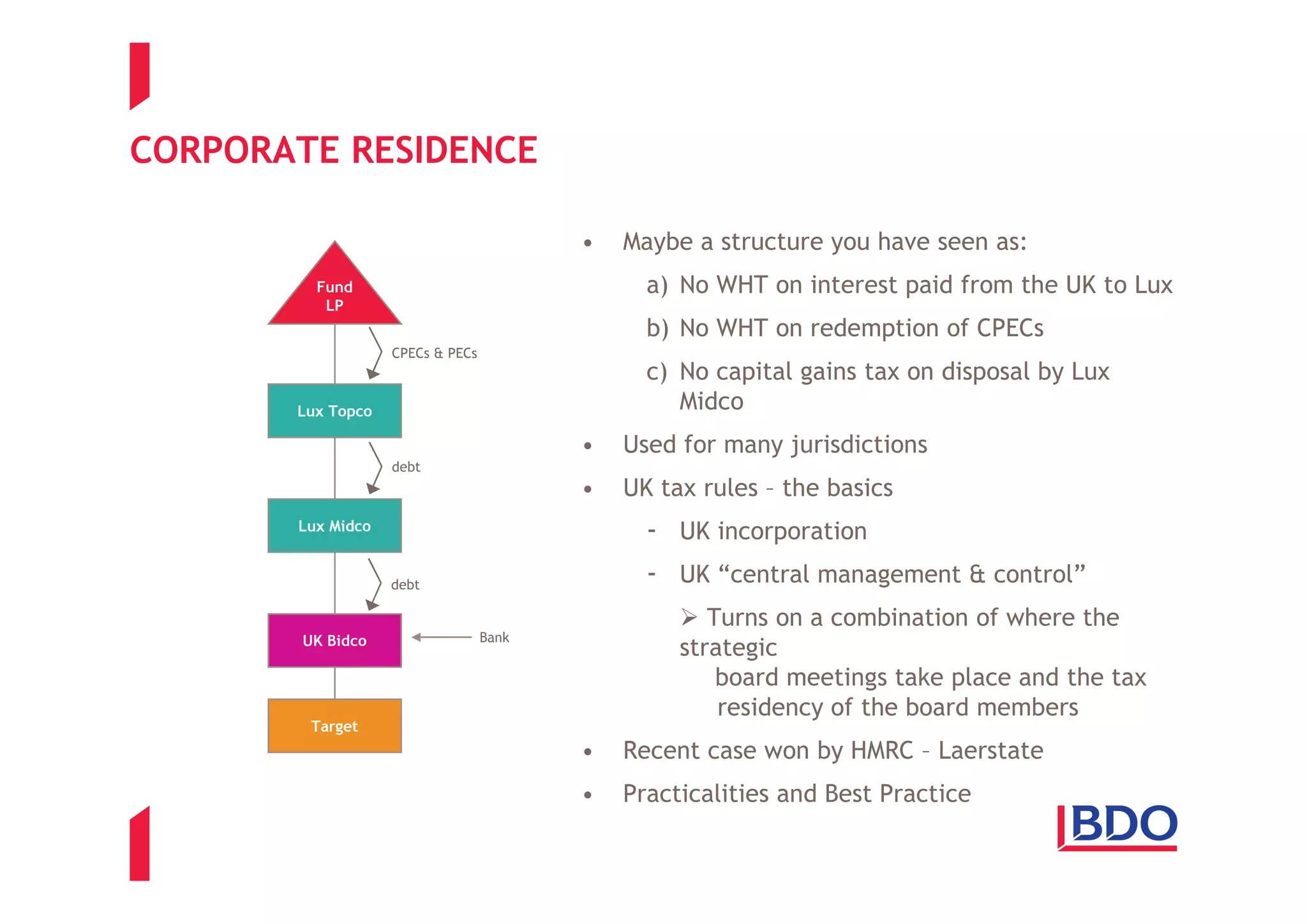

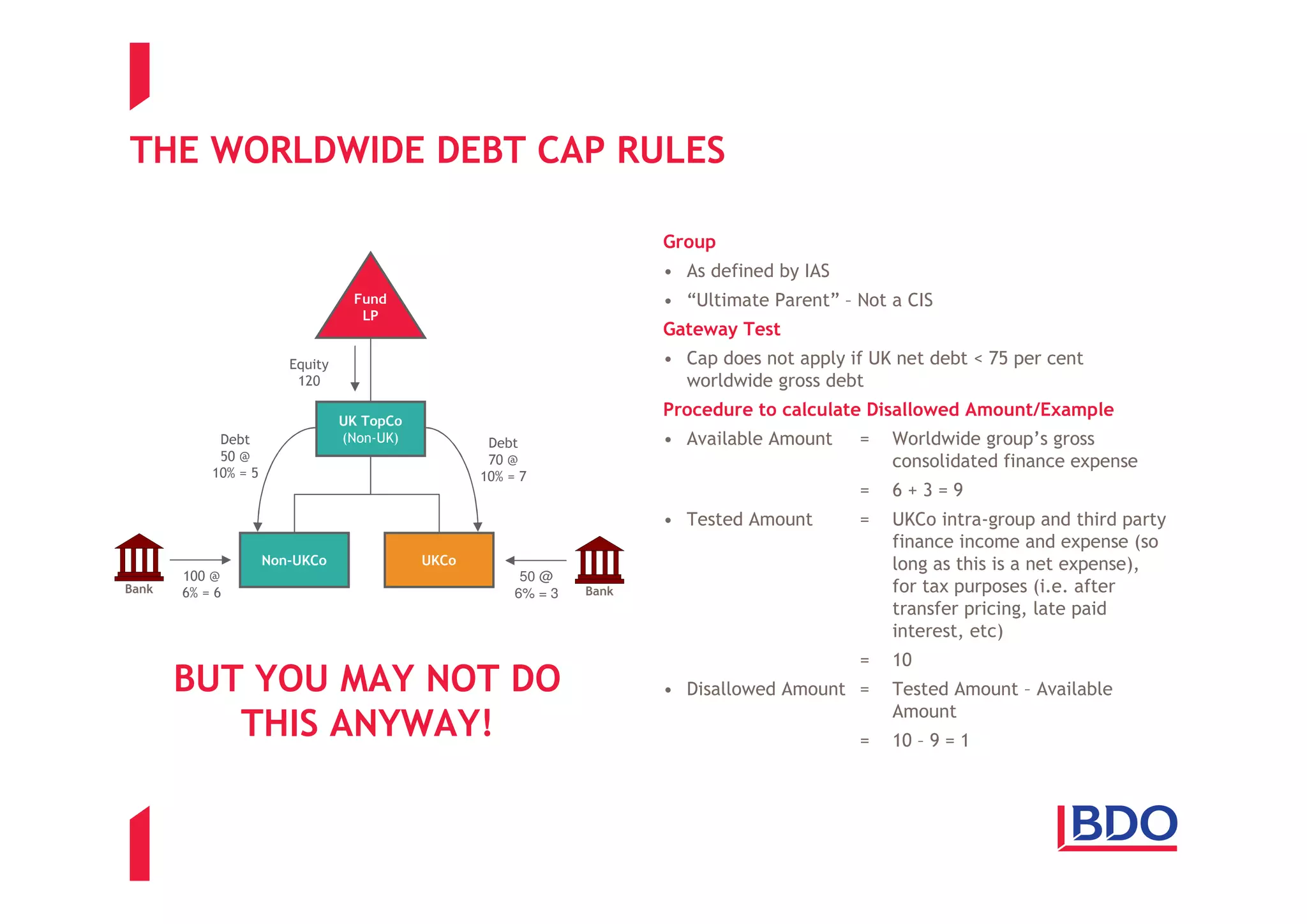

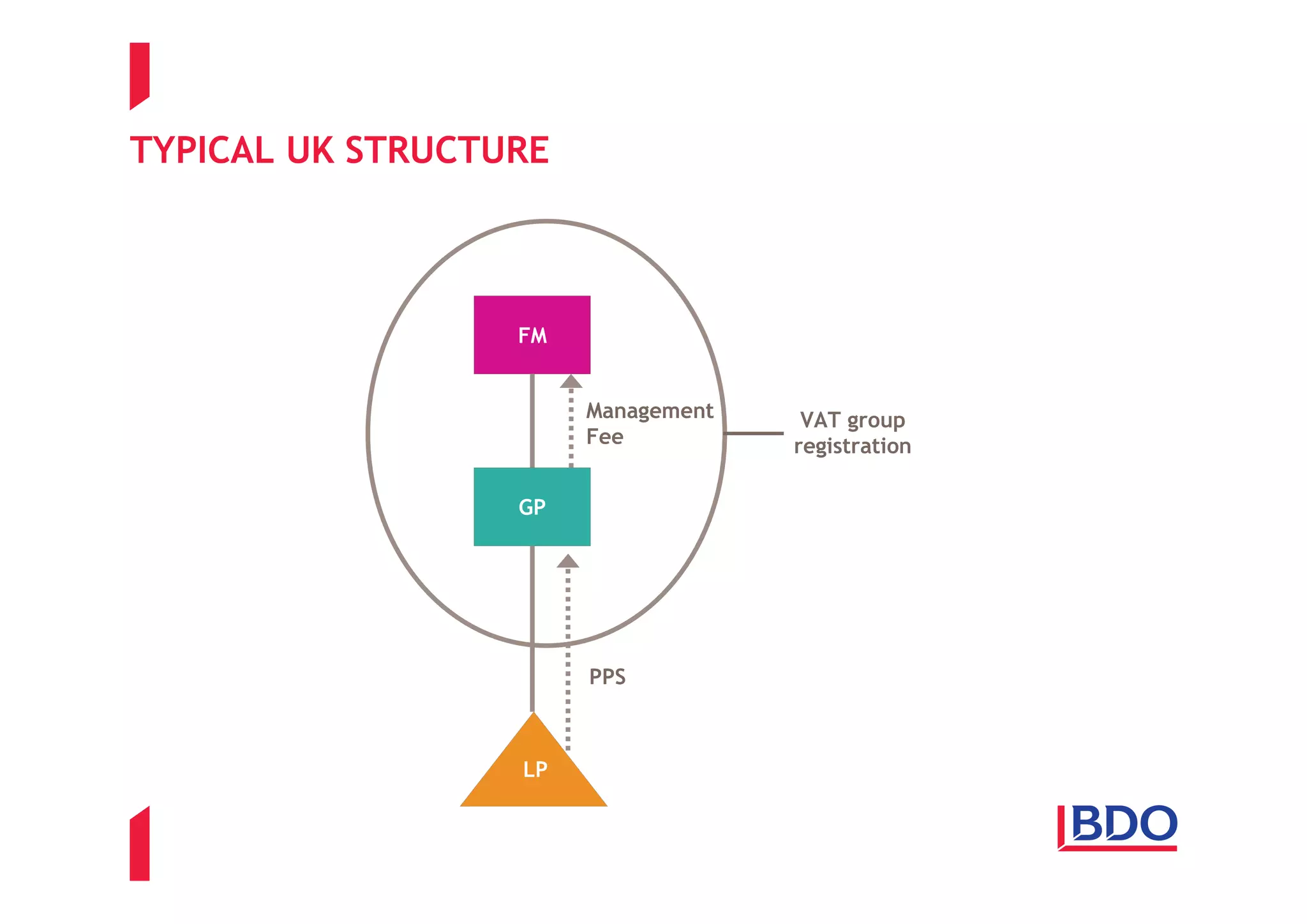

The document discusses private equity tax planning strategies for 2010, focusing on fund structuring techniques that aim to minimize taxes on income and capital gains for executives and investors. It highlights various tax avoidance strategies, including the use of double tax treaties and offshore structuring, and outlines the implications of changes in tax rates and regulations. Additionally, the document touches upon challenges faced in managing VAT and implications of recent legal rulings regarding tax recoverability on service fees.