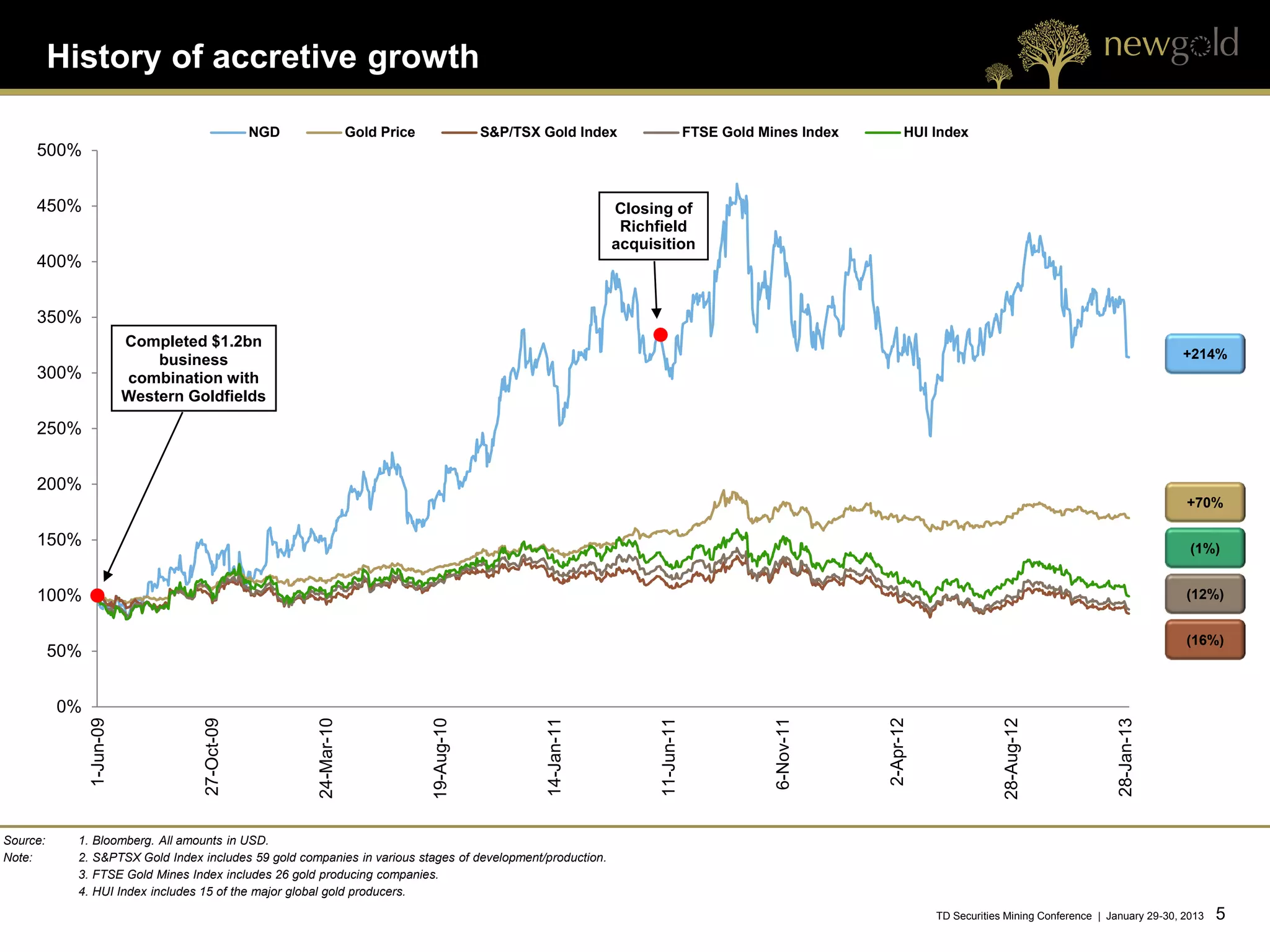

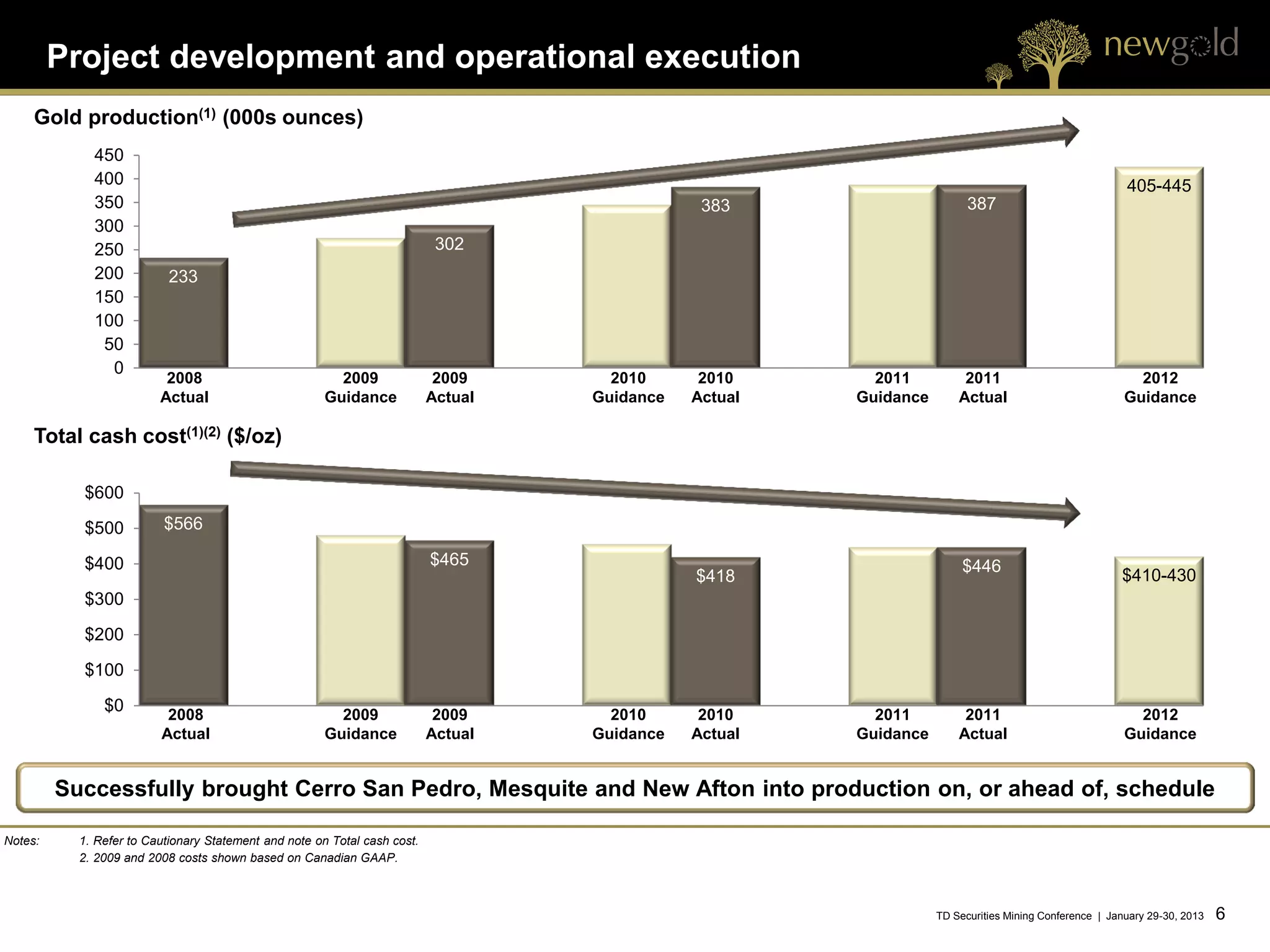

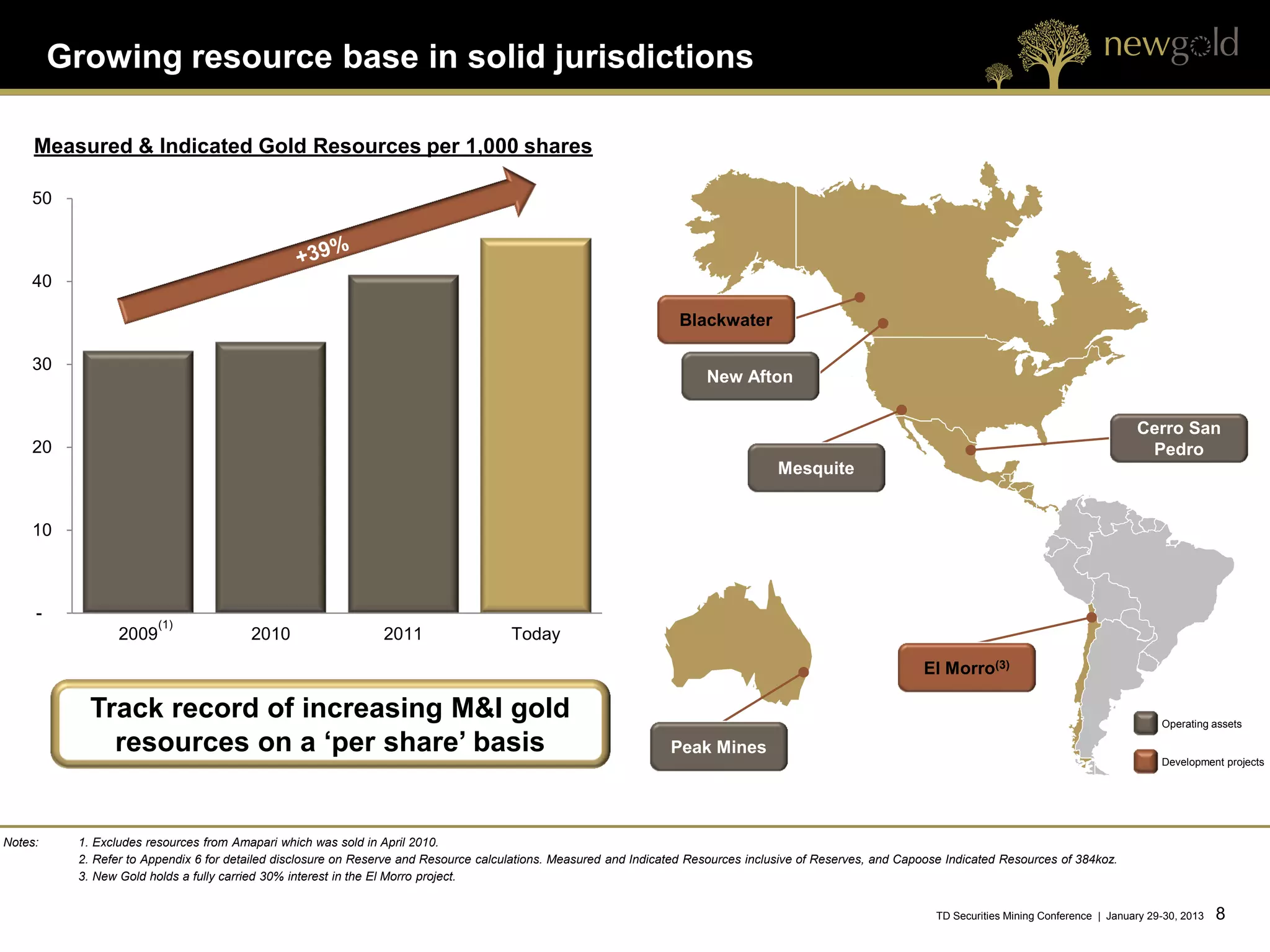

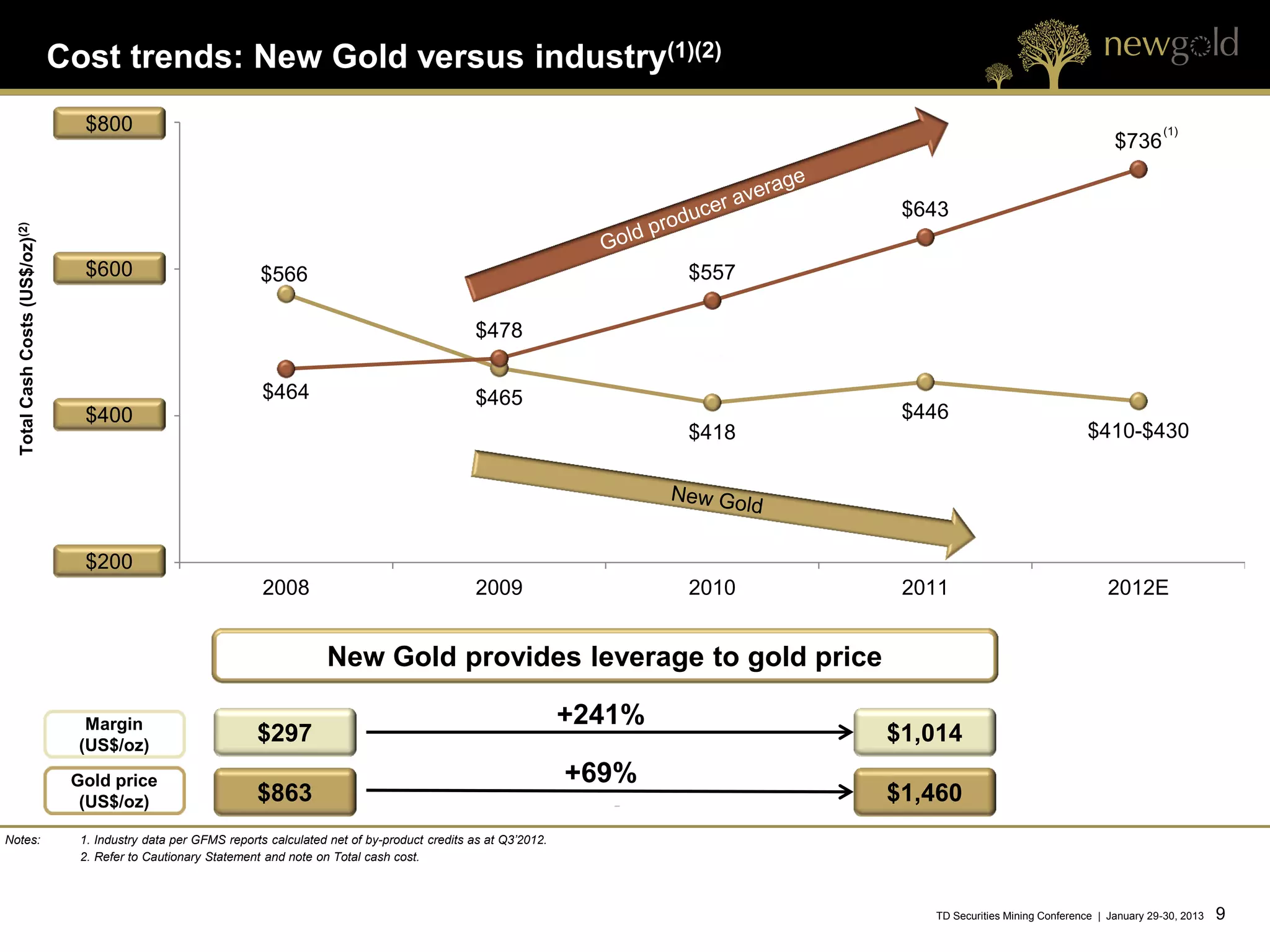

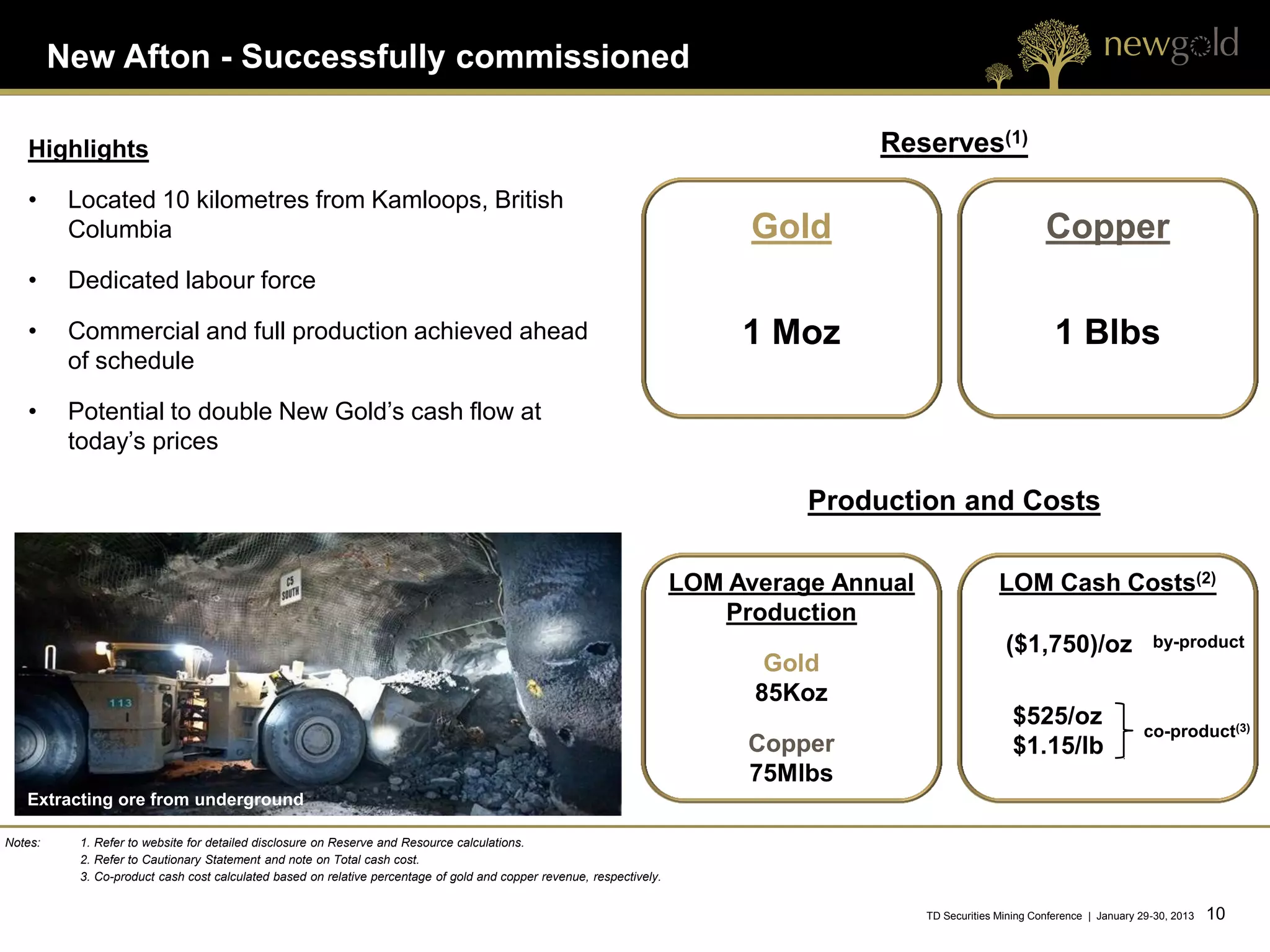

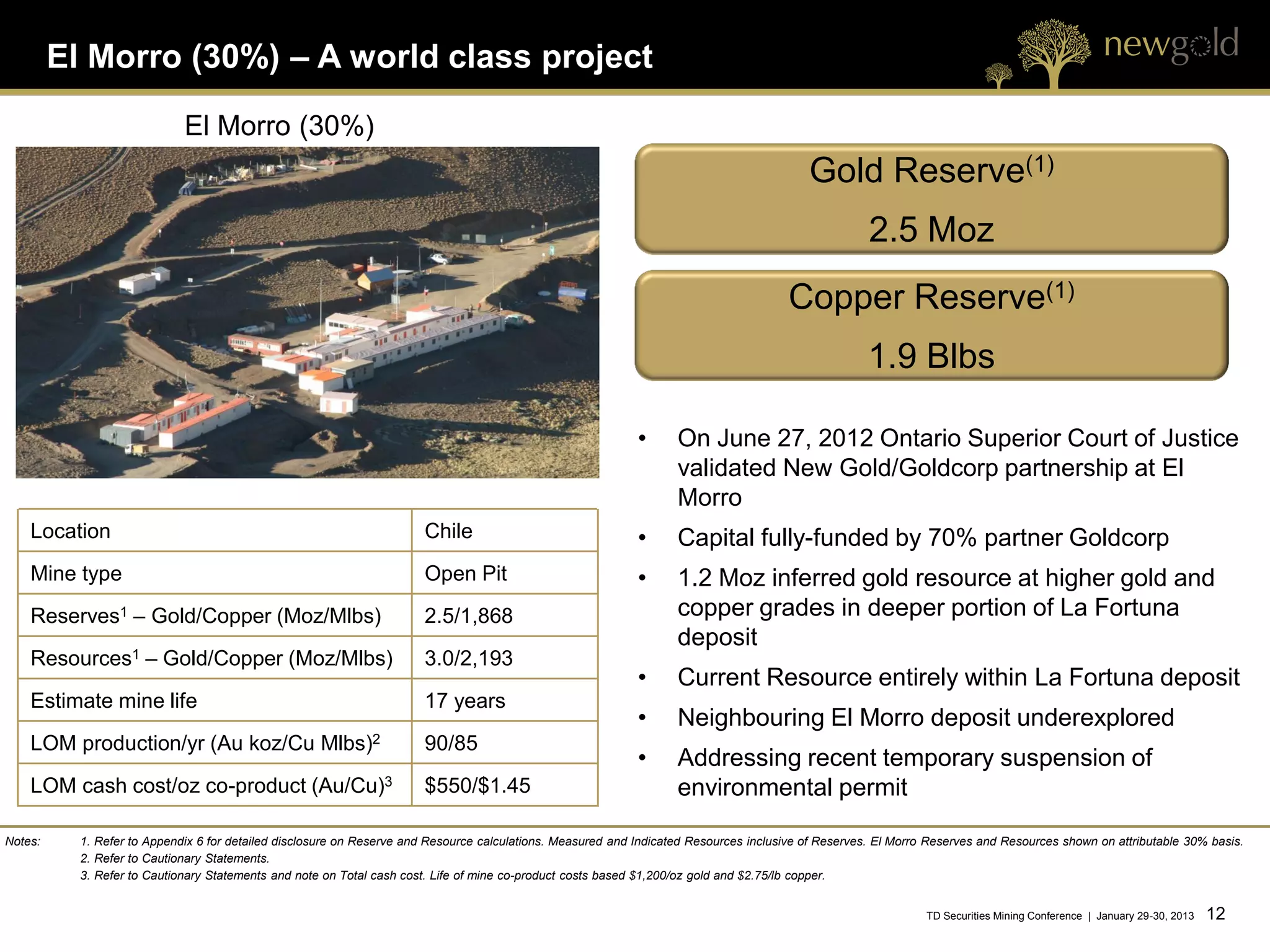

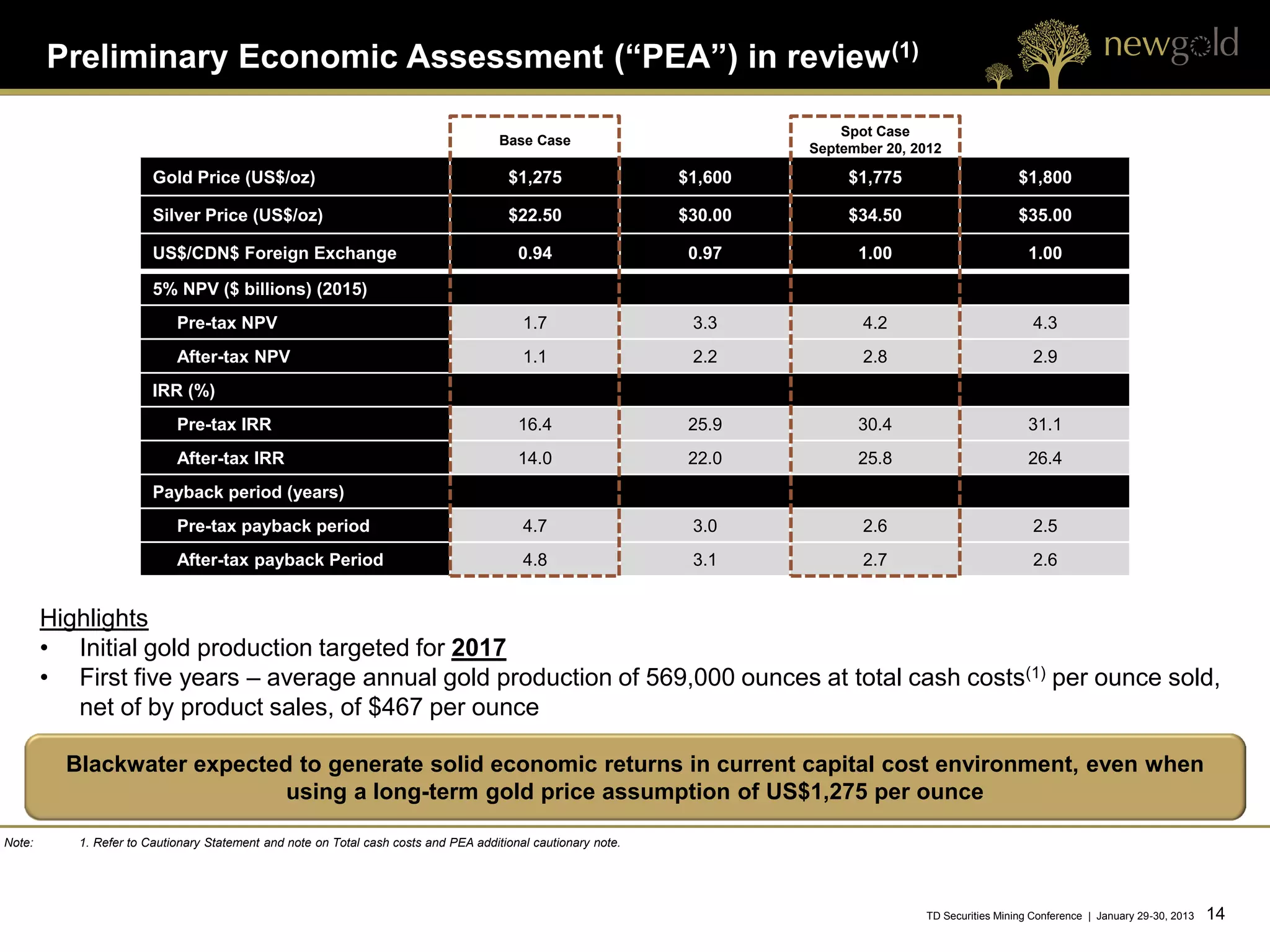

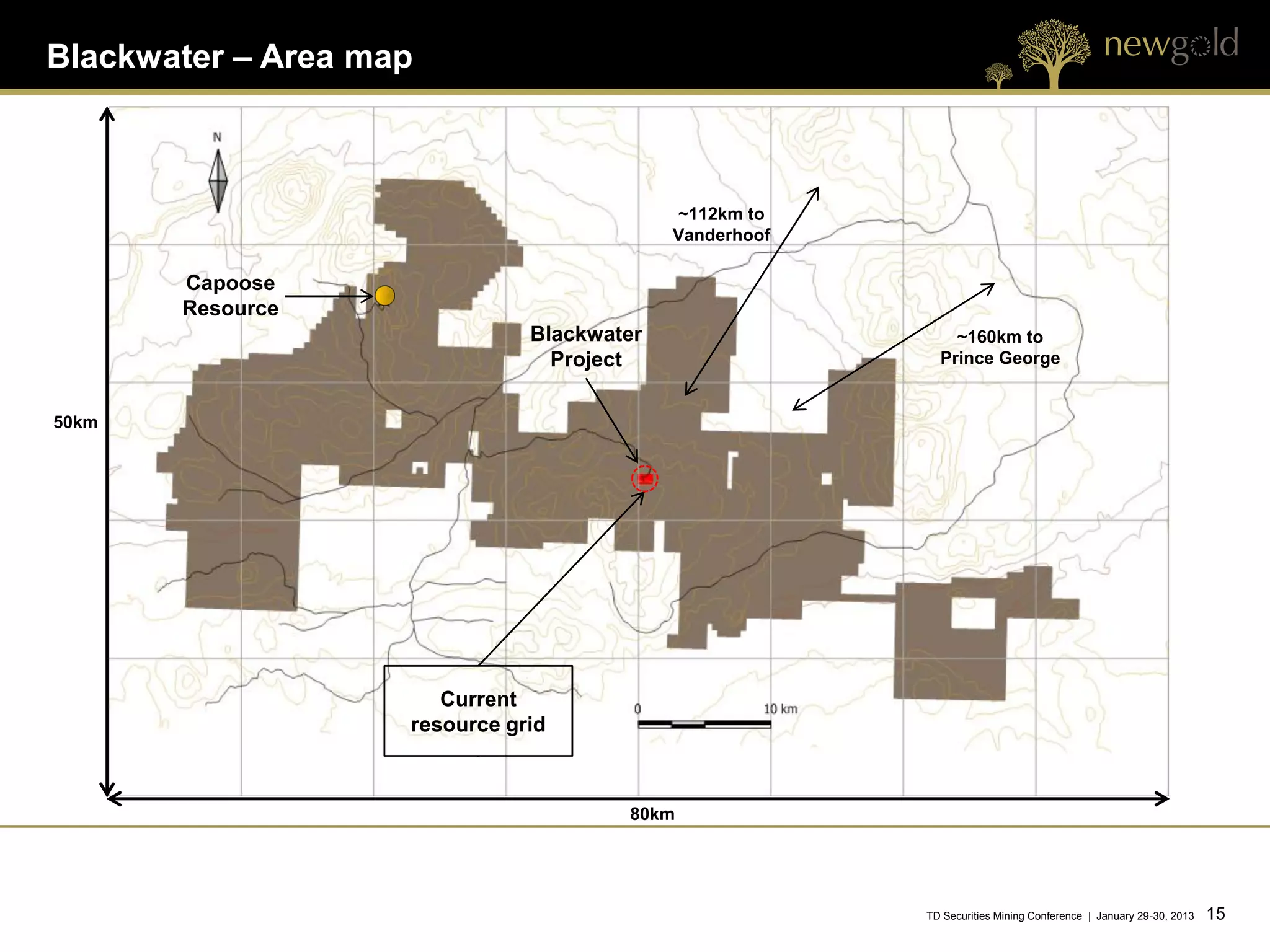

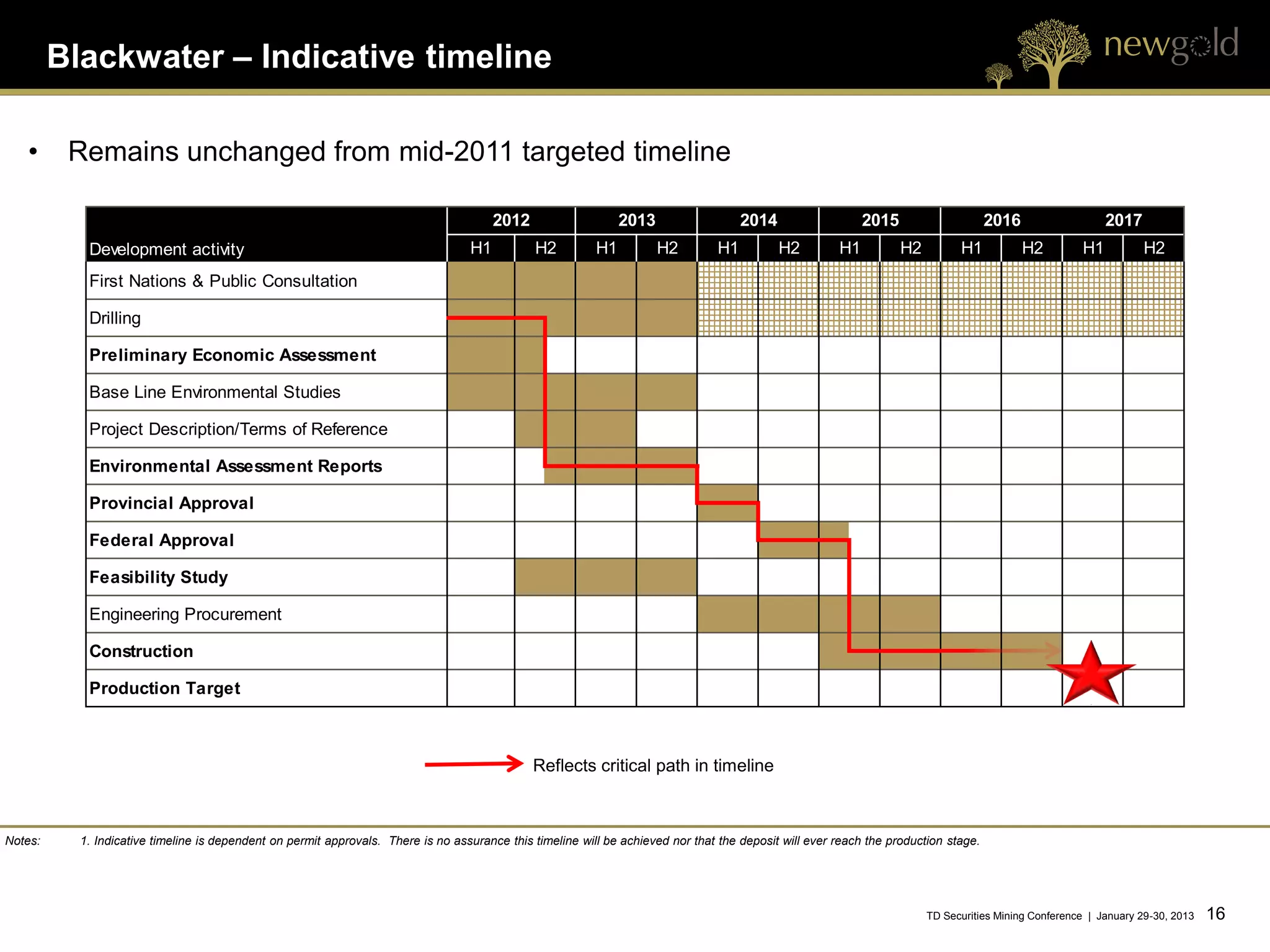

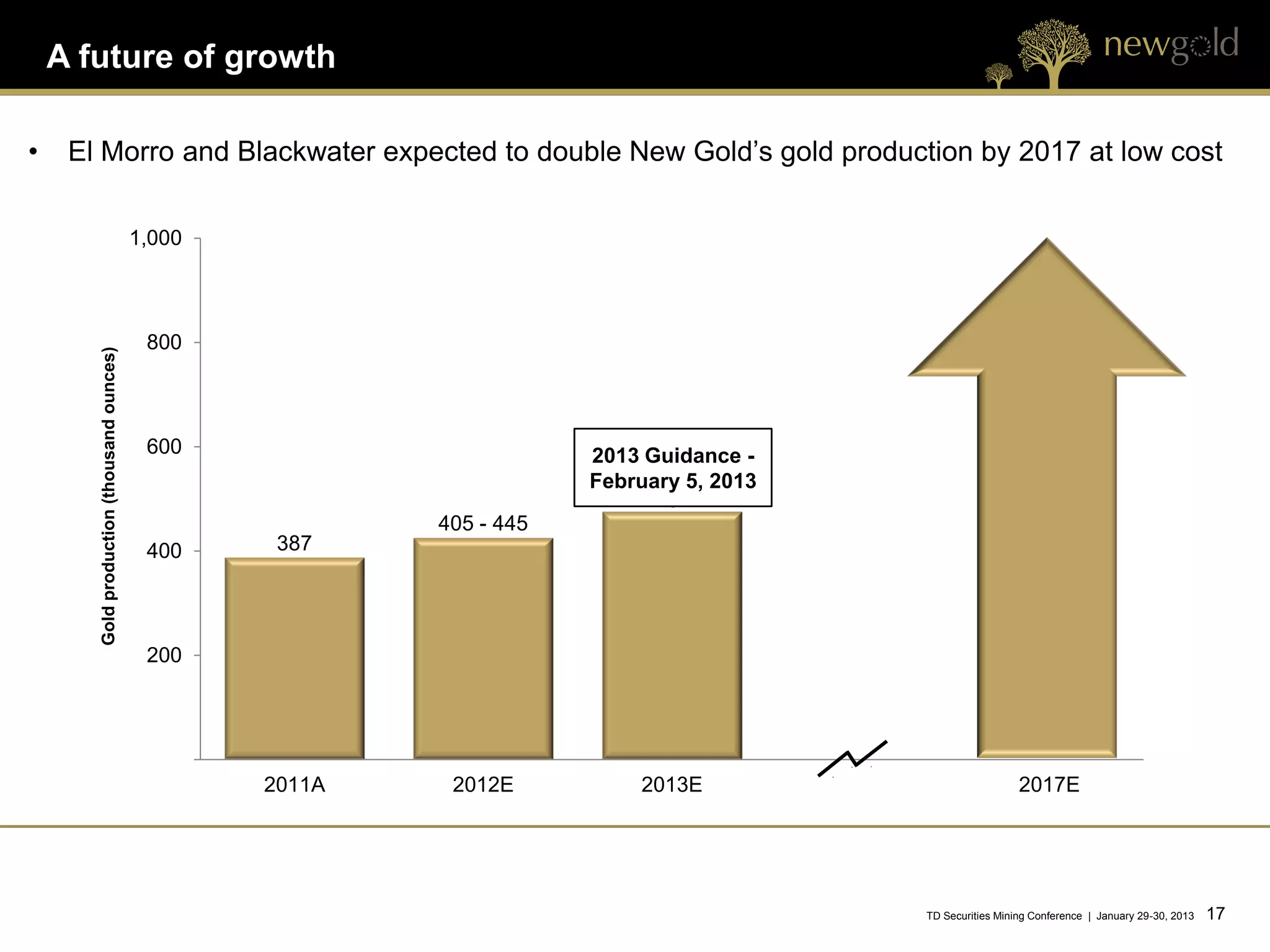

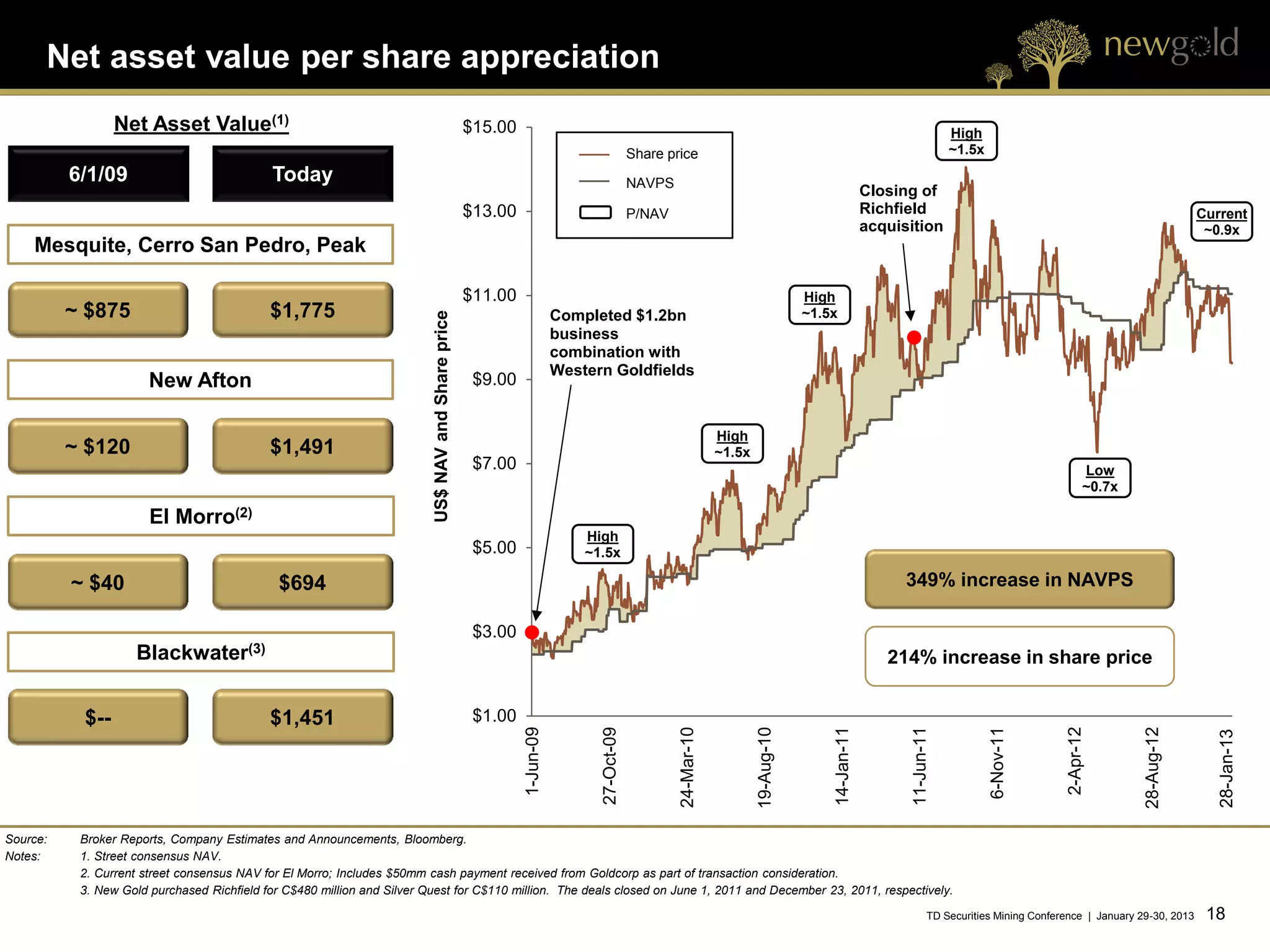

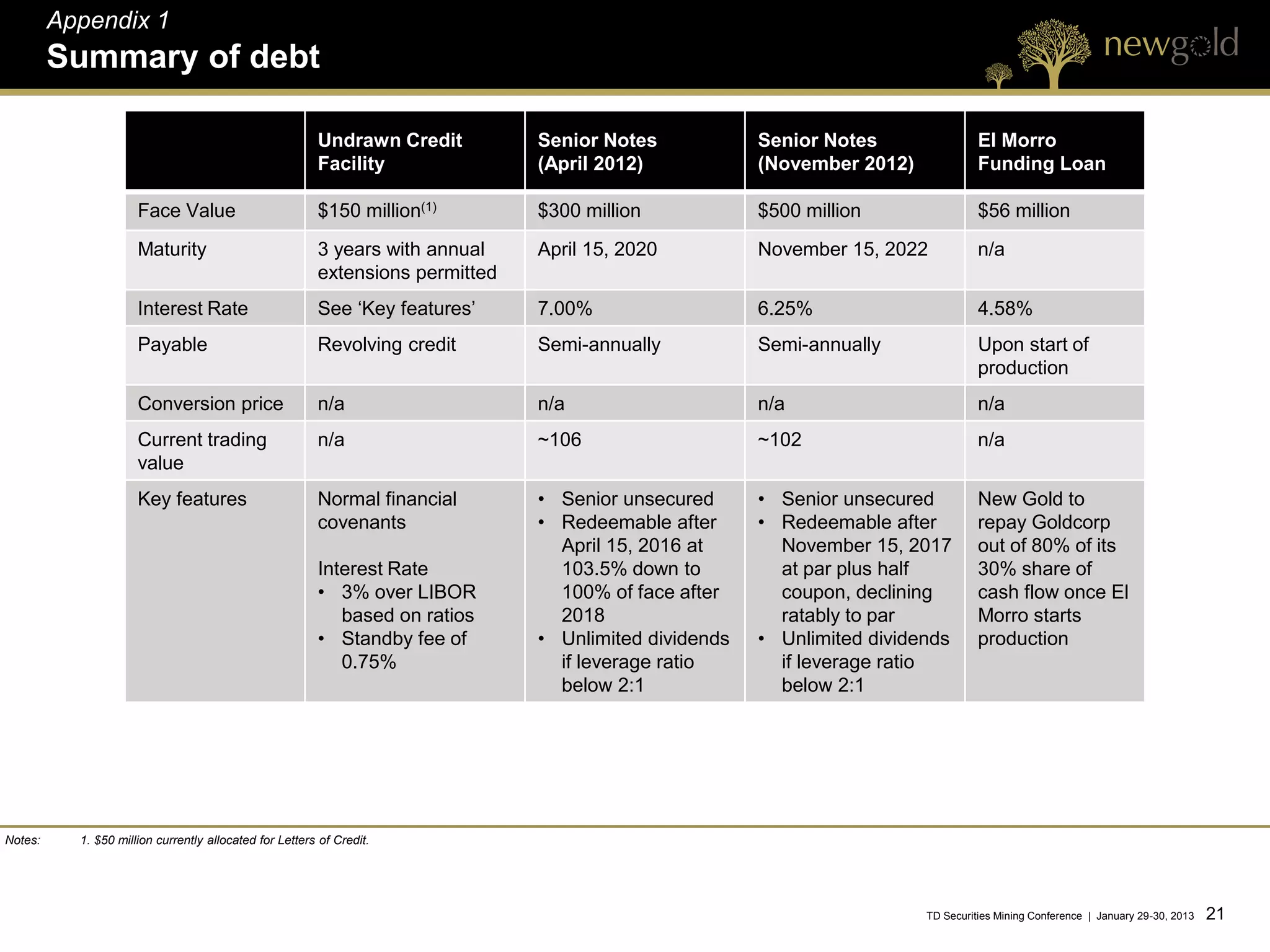

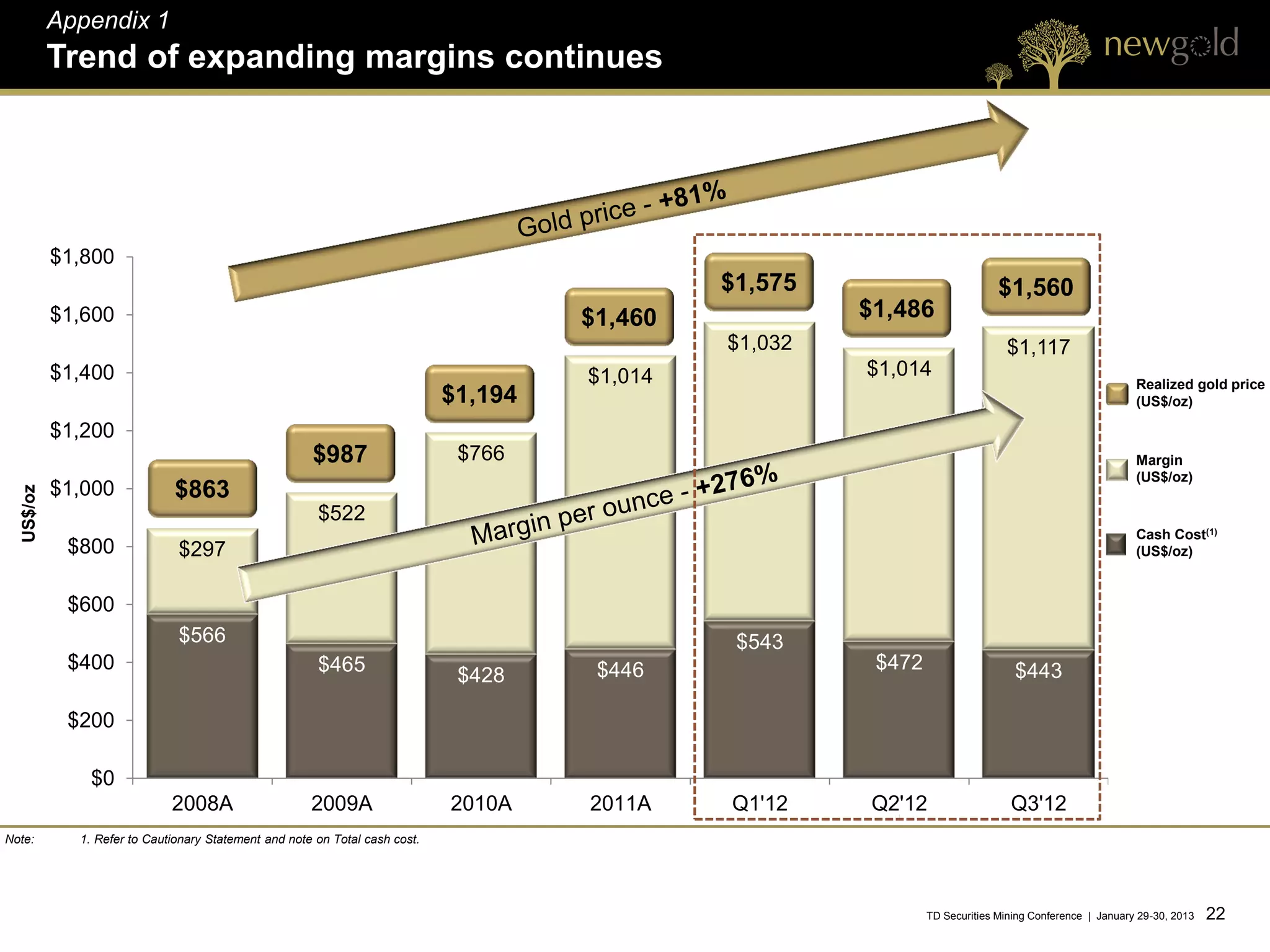

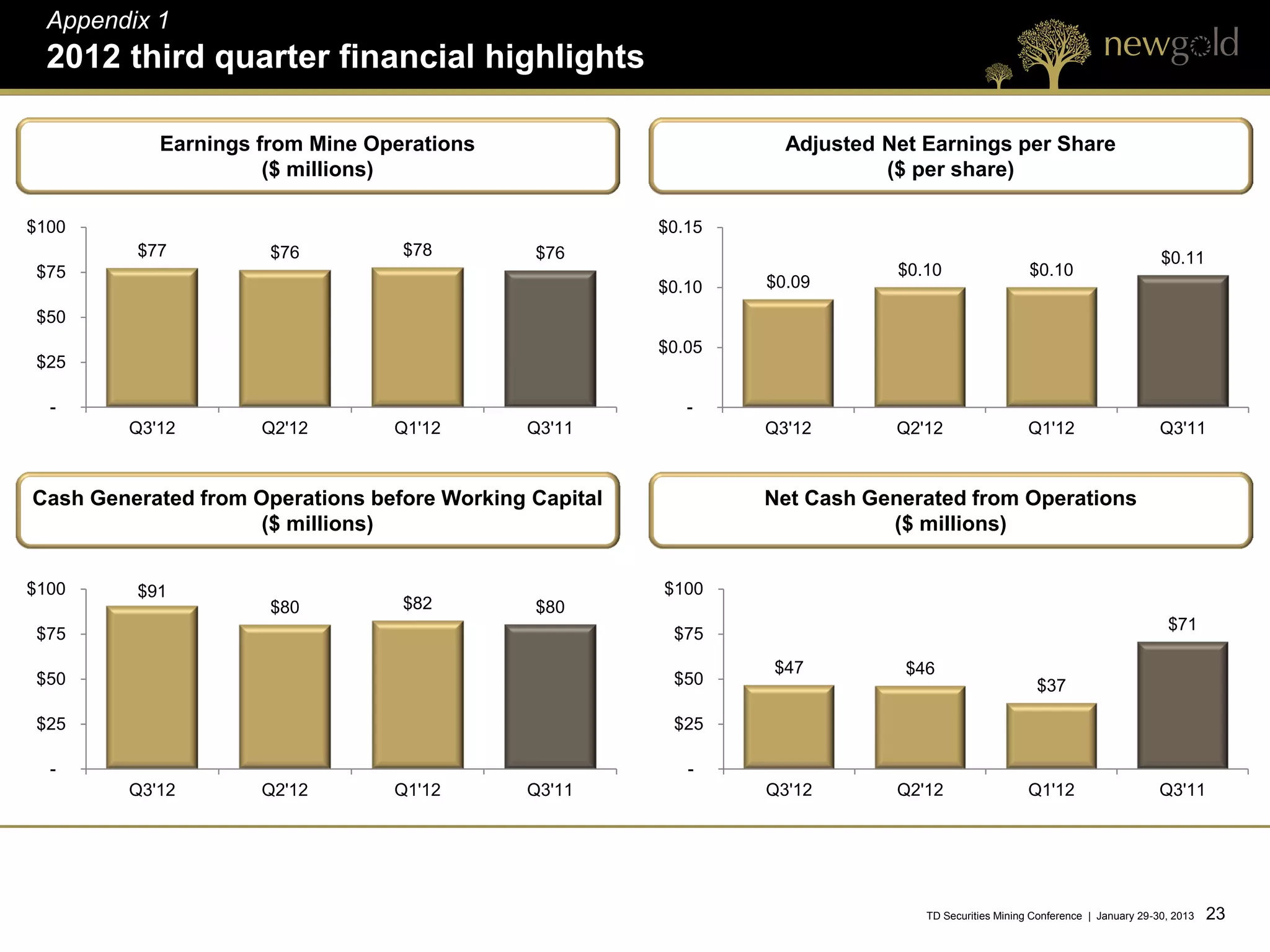

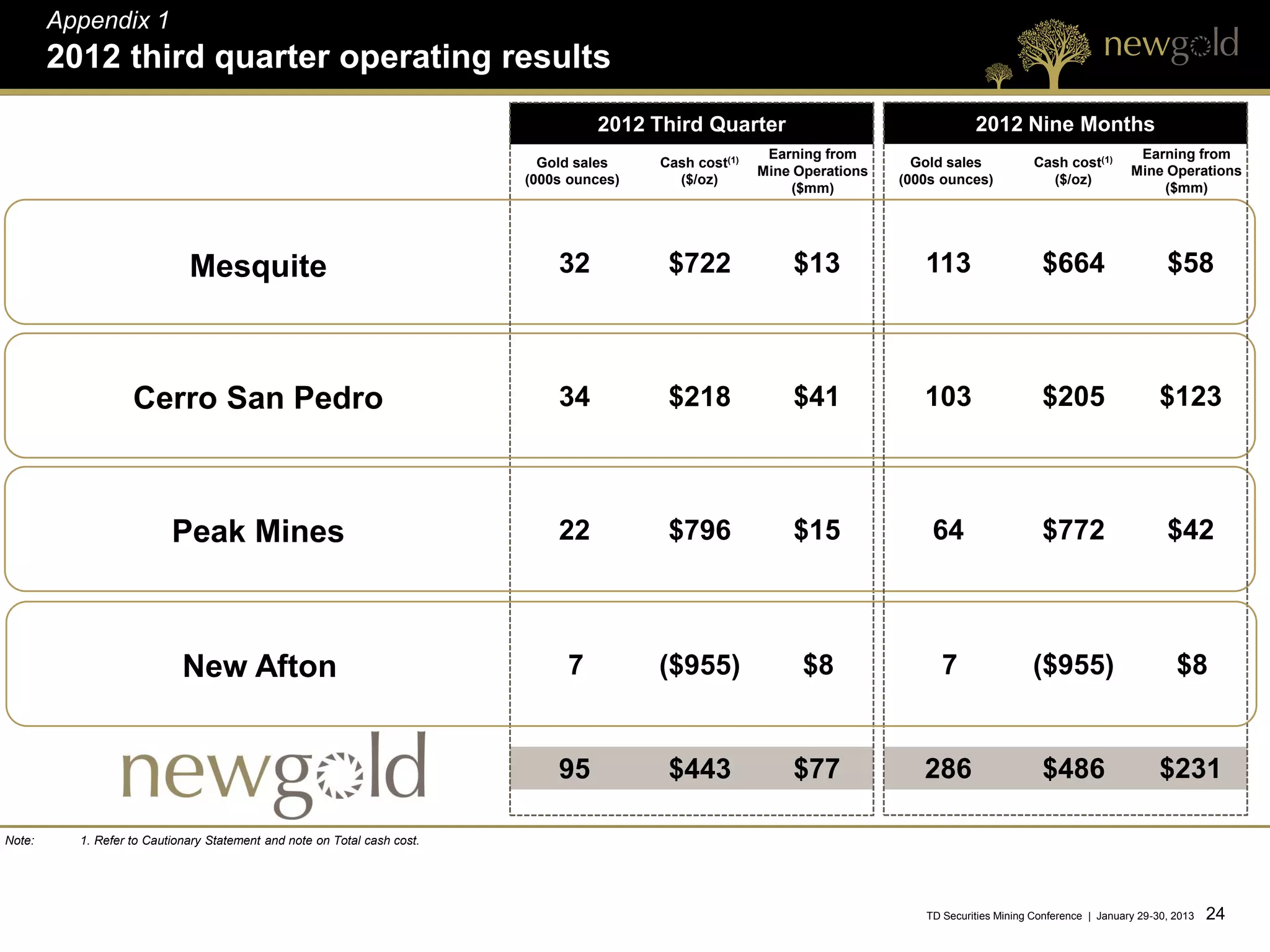

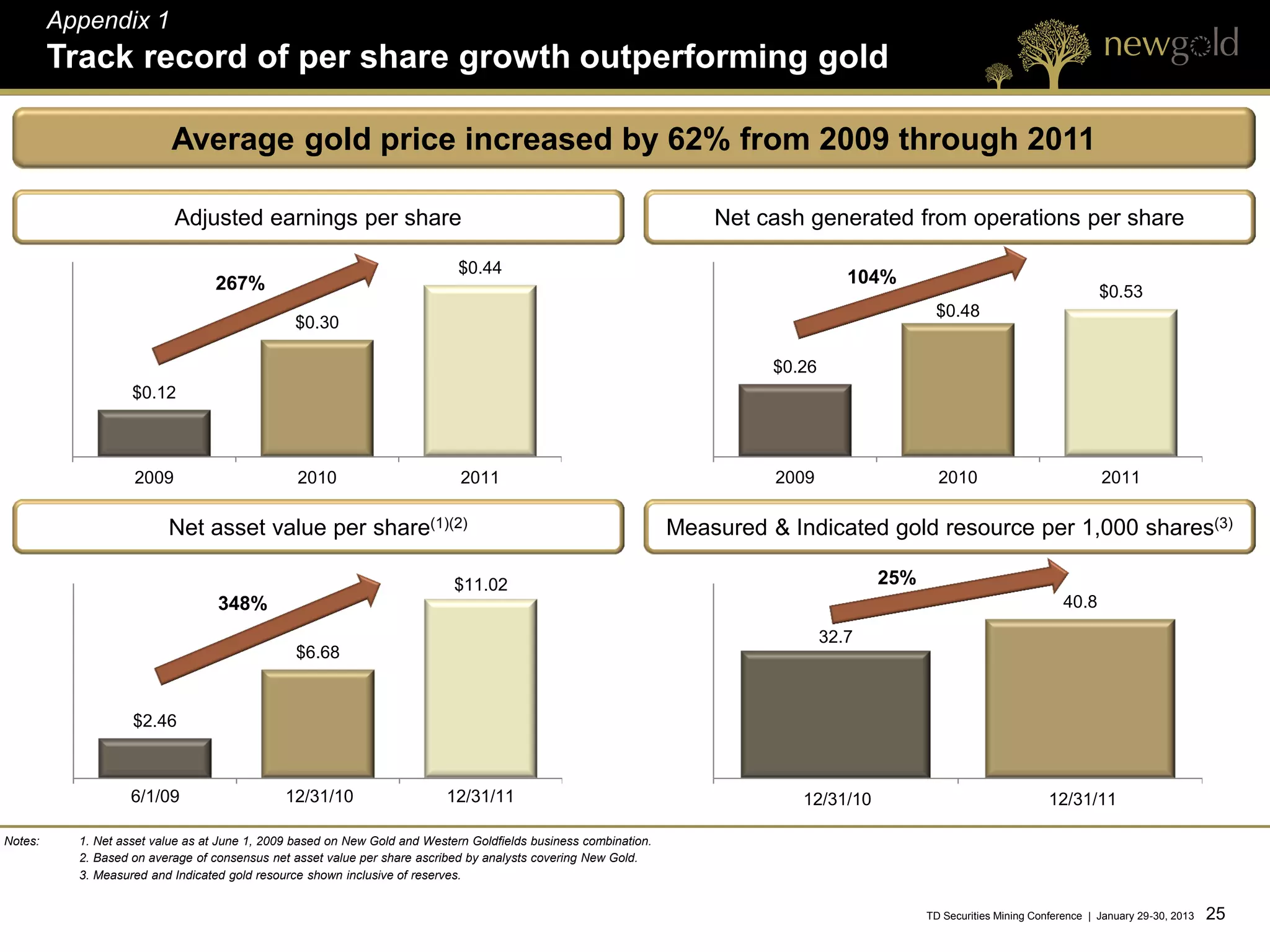

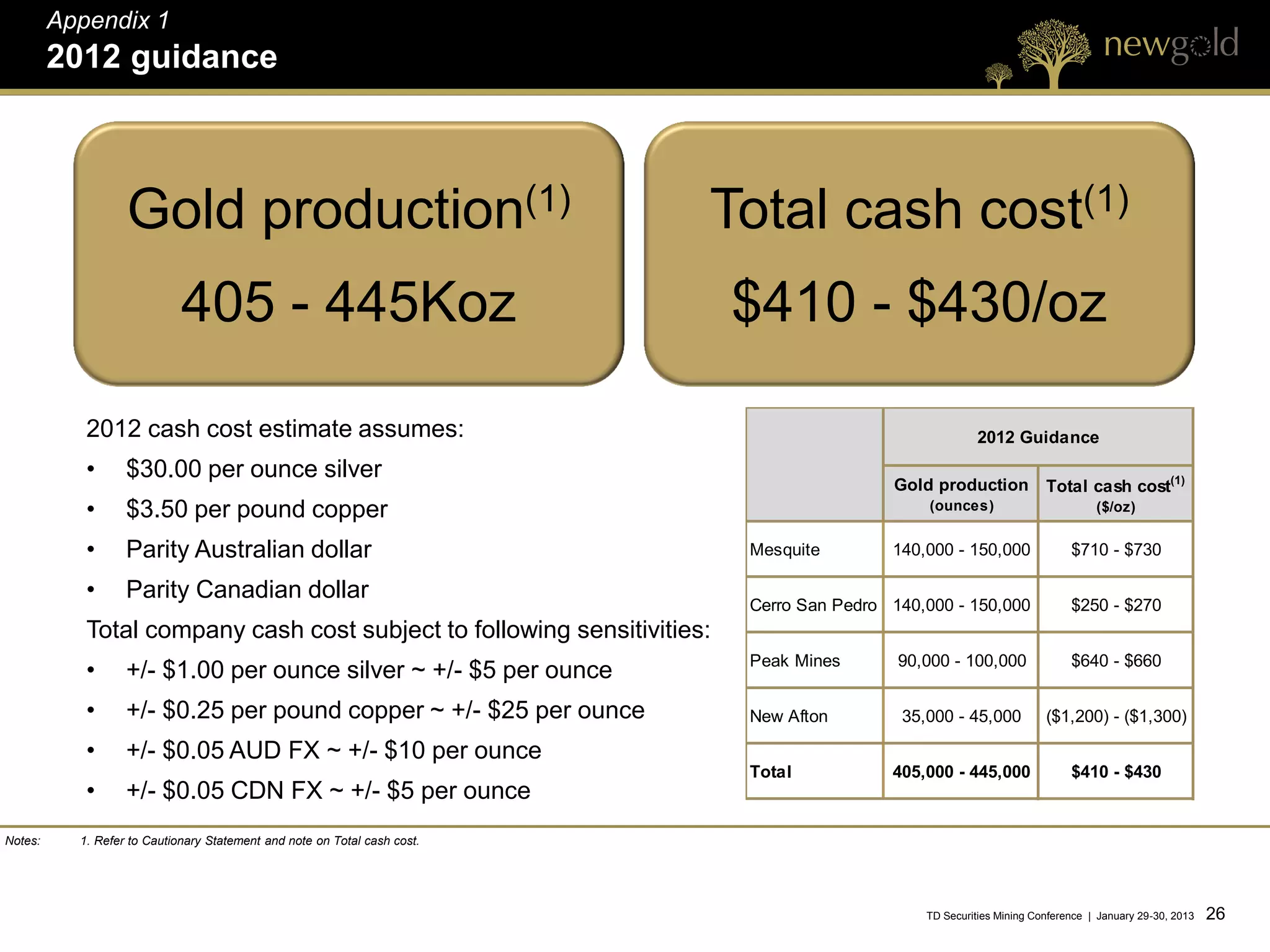

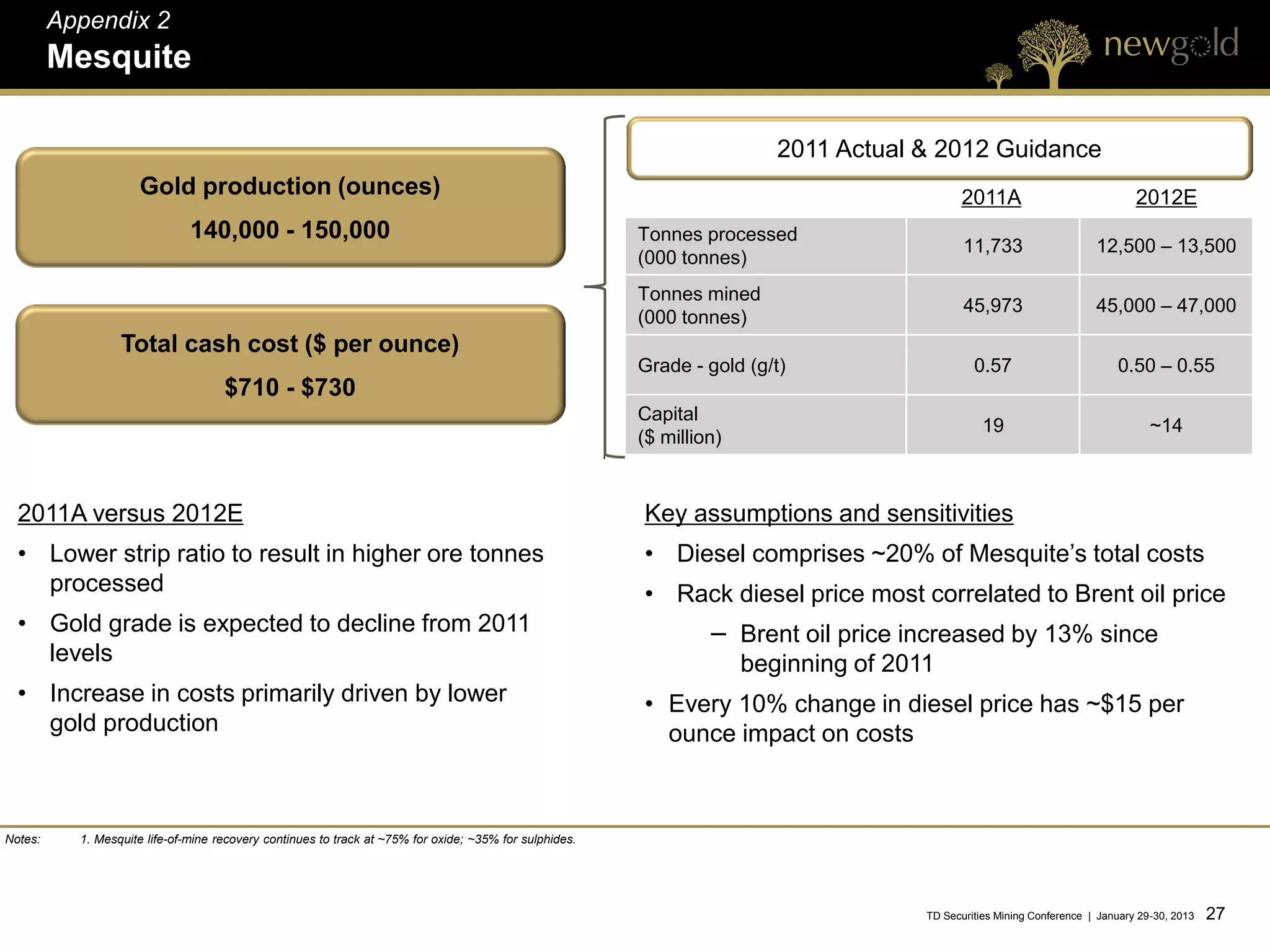

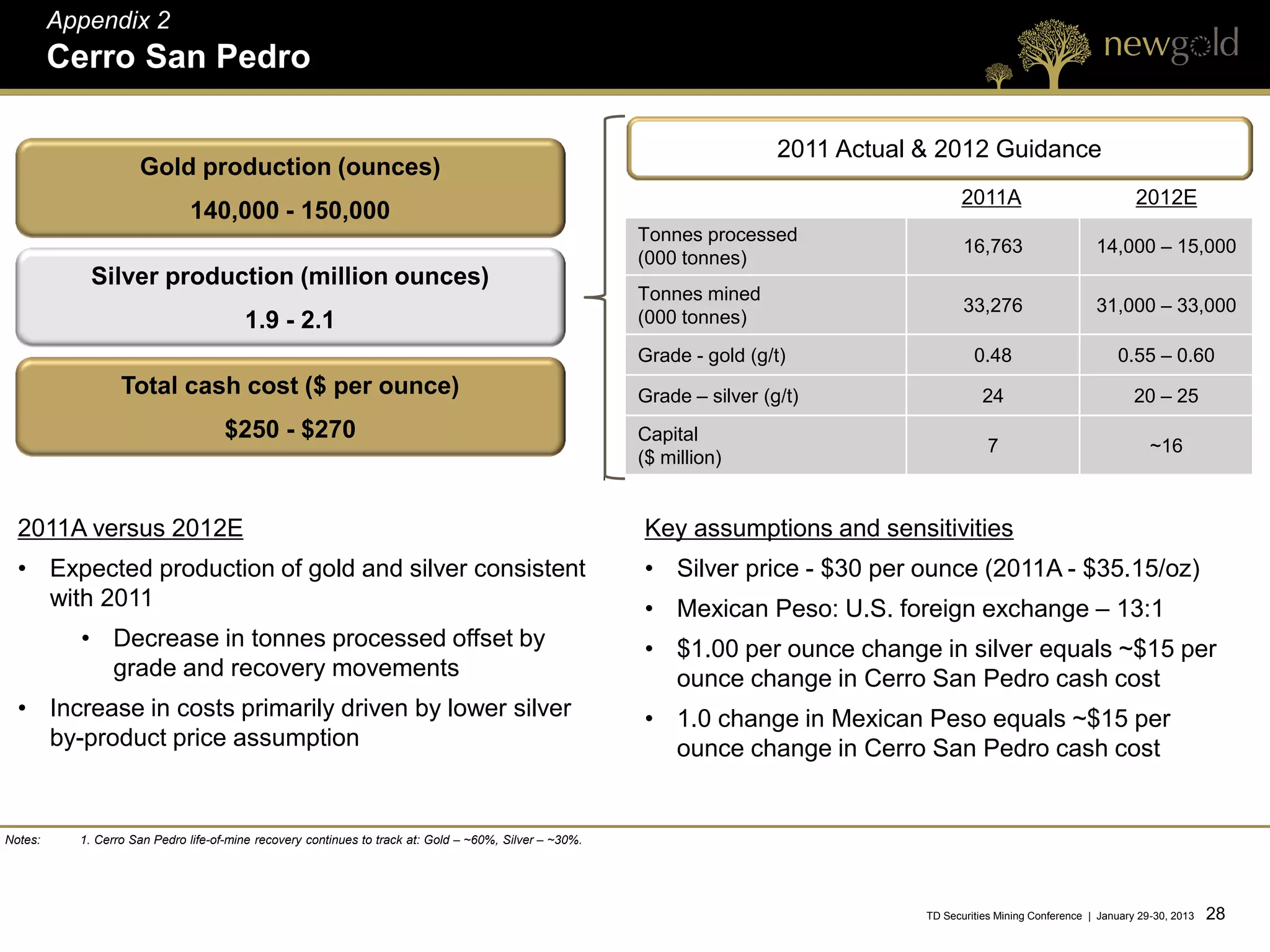

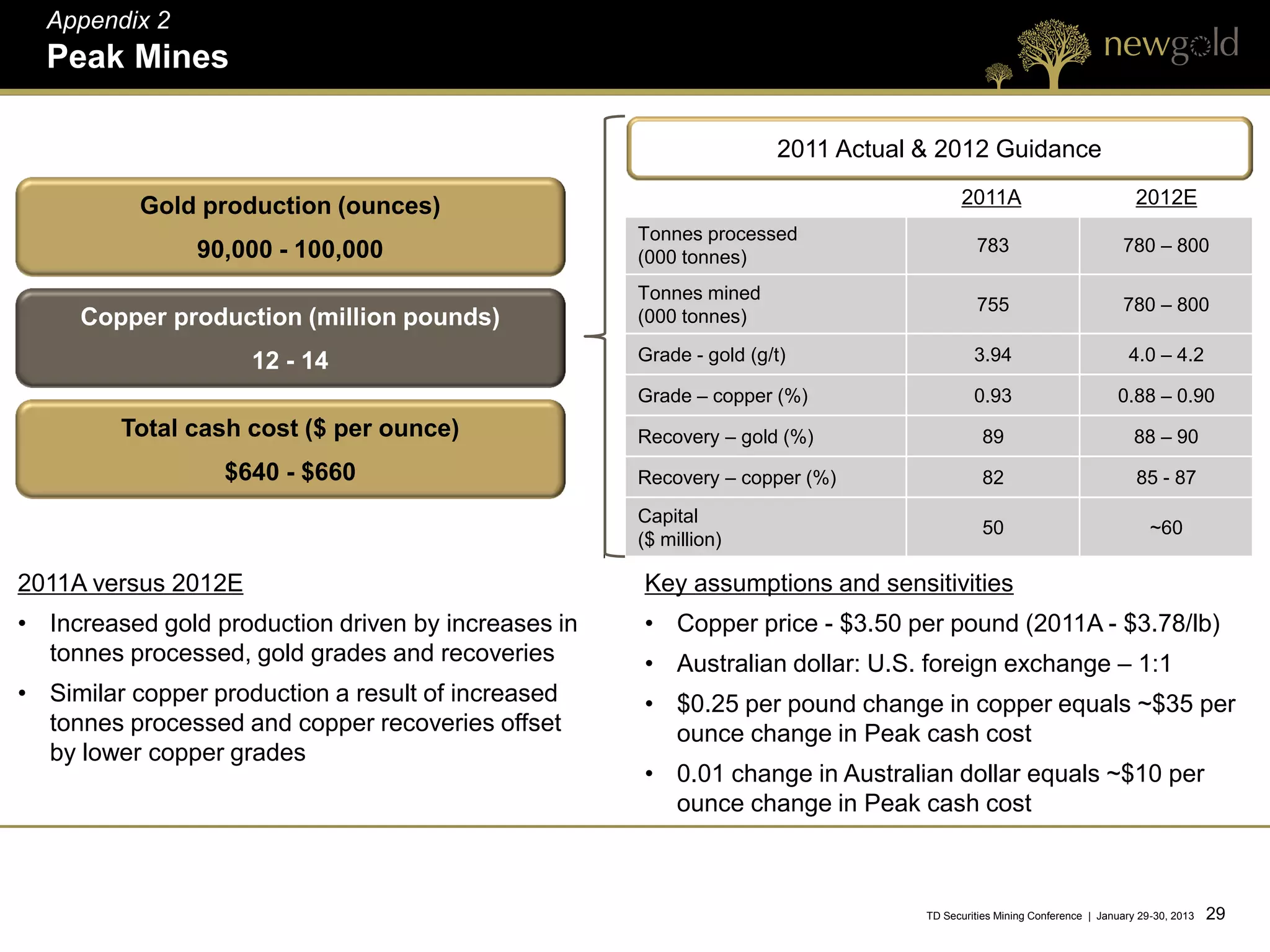

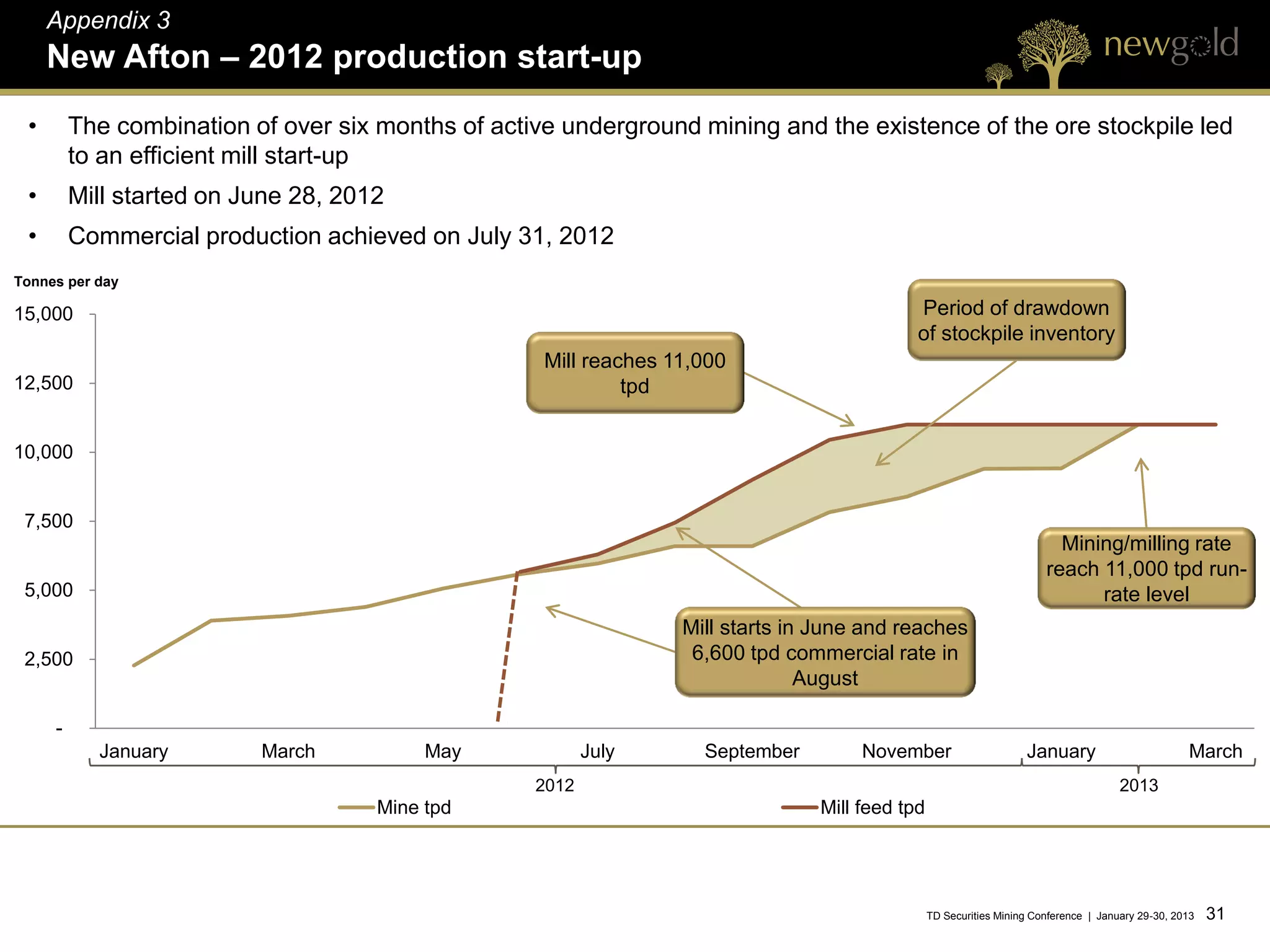

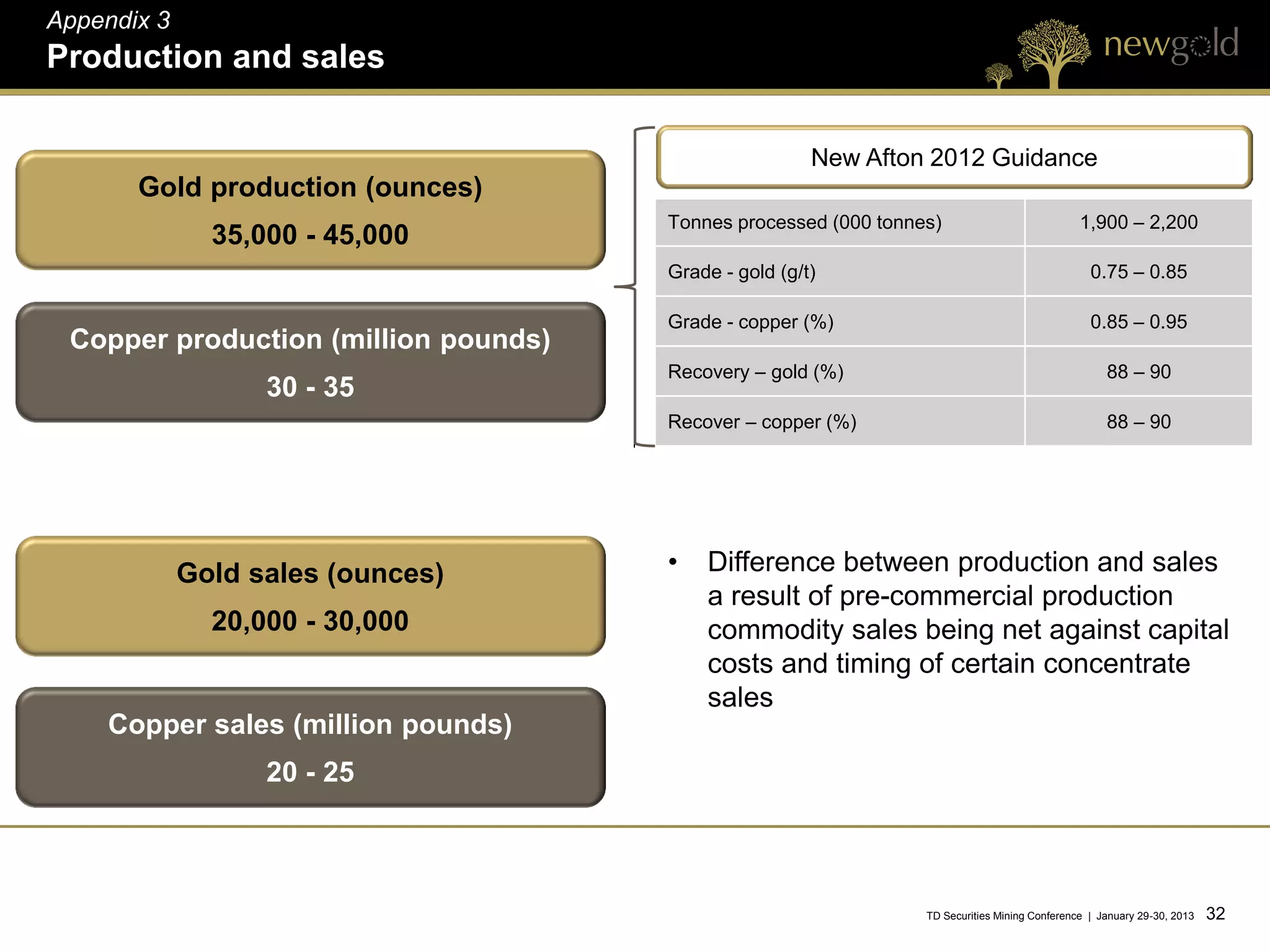

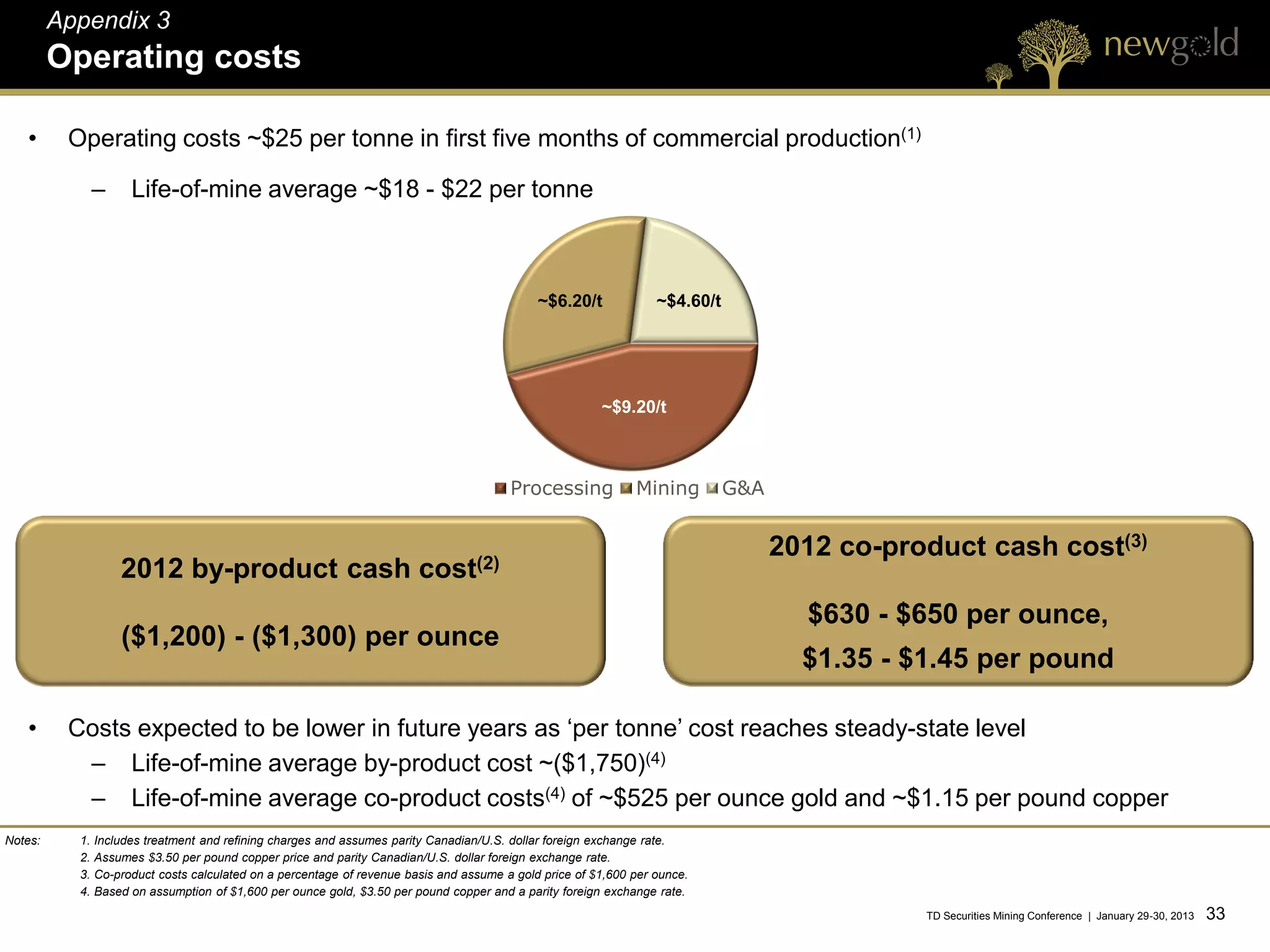

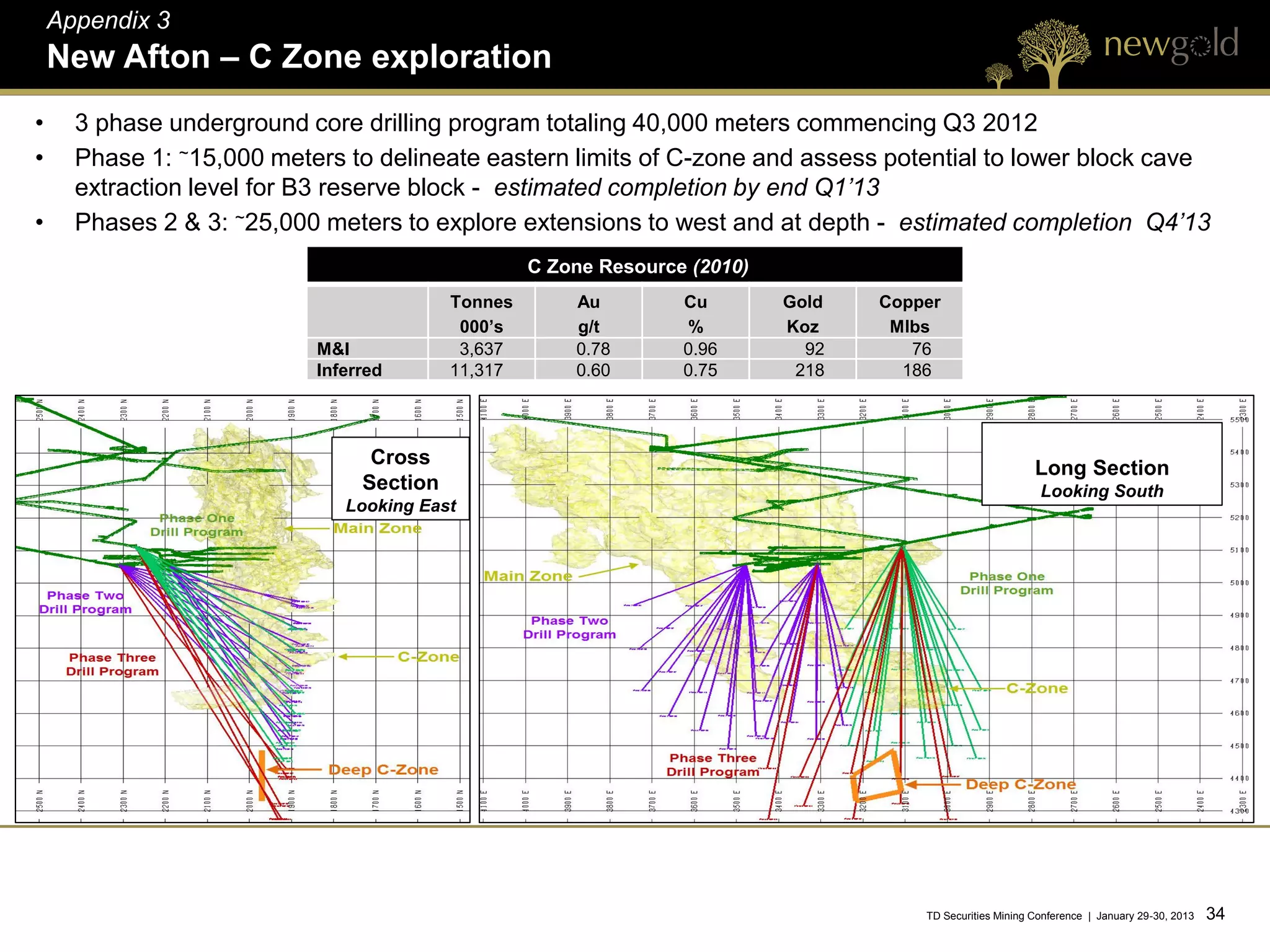

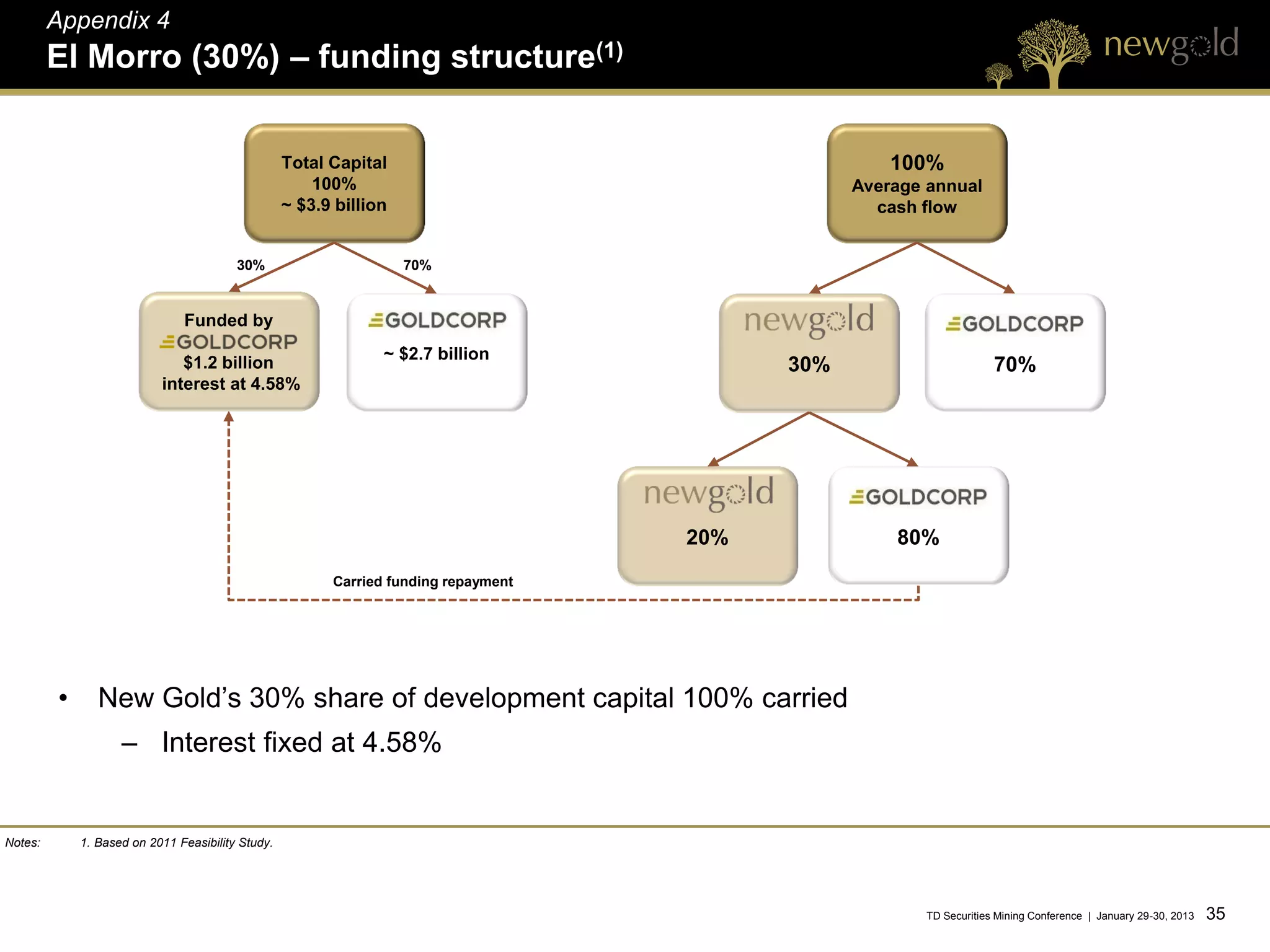

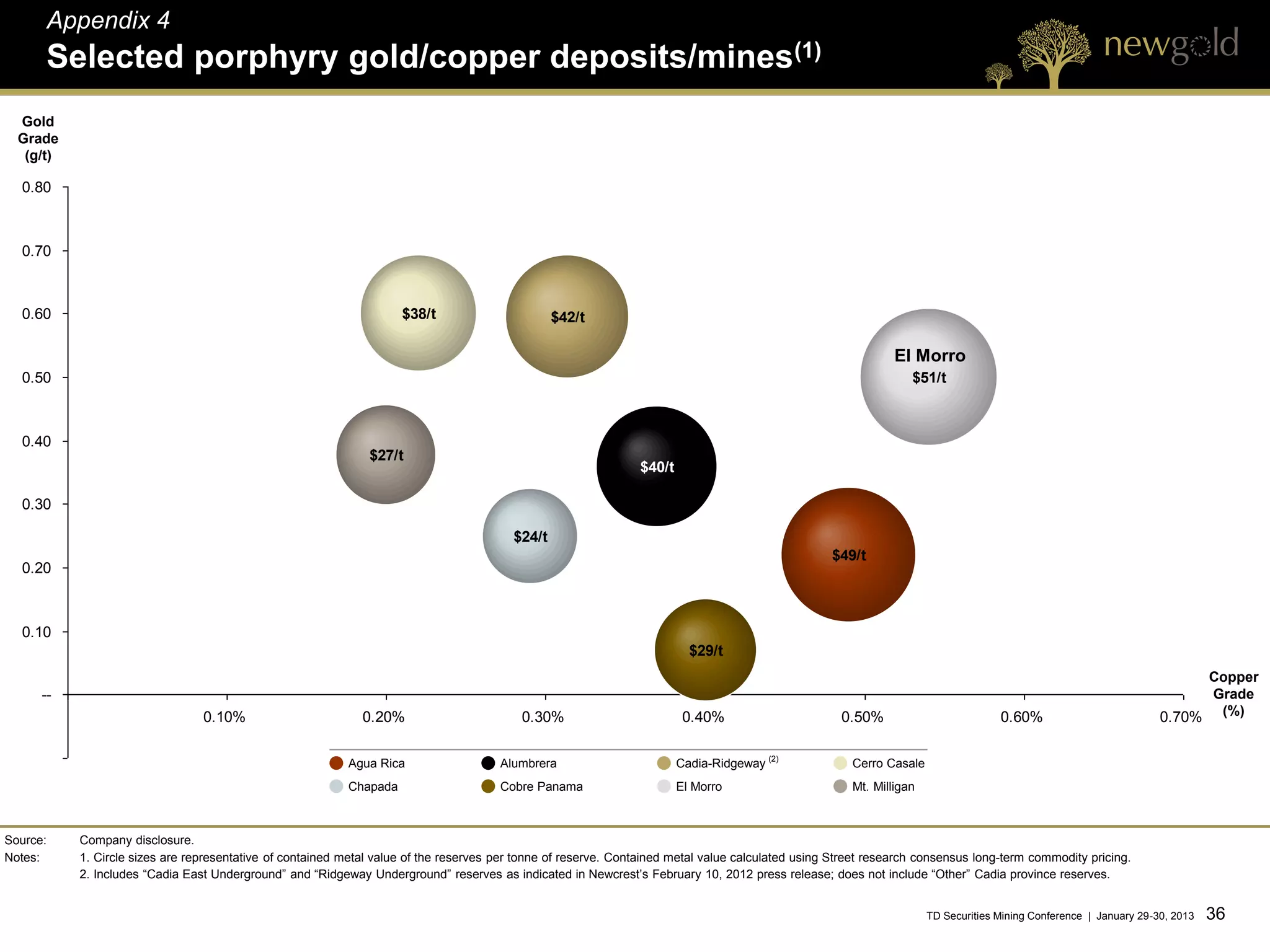

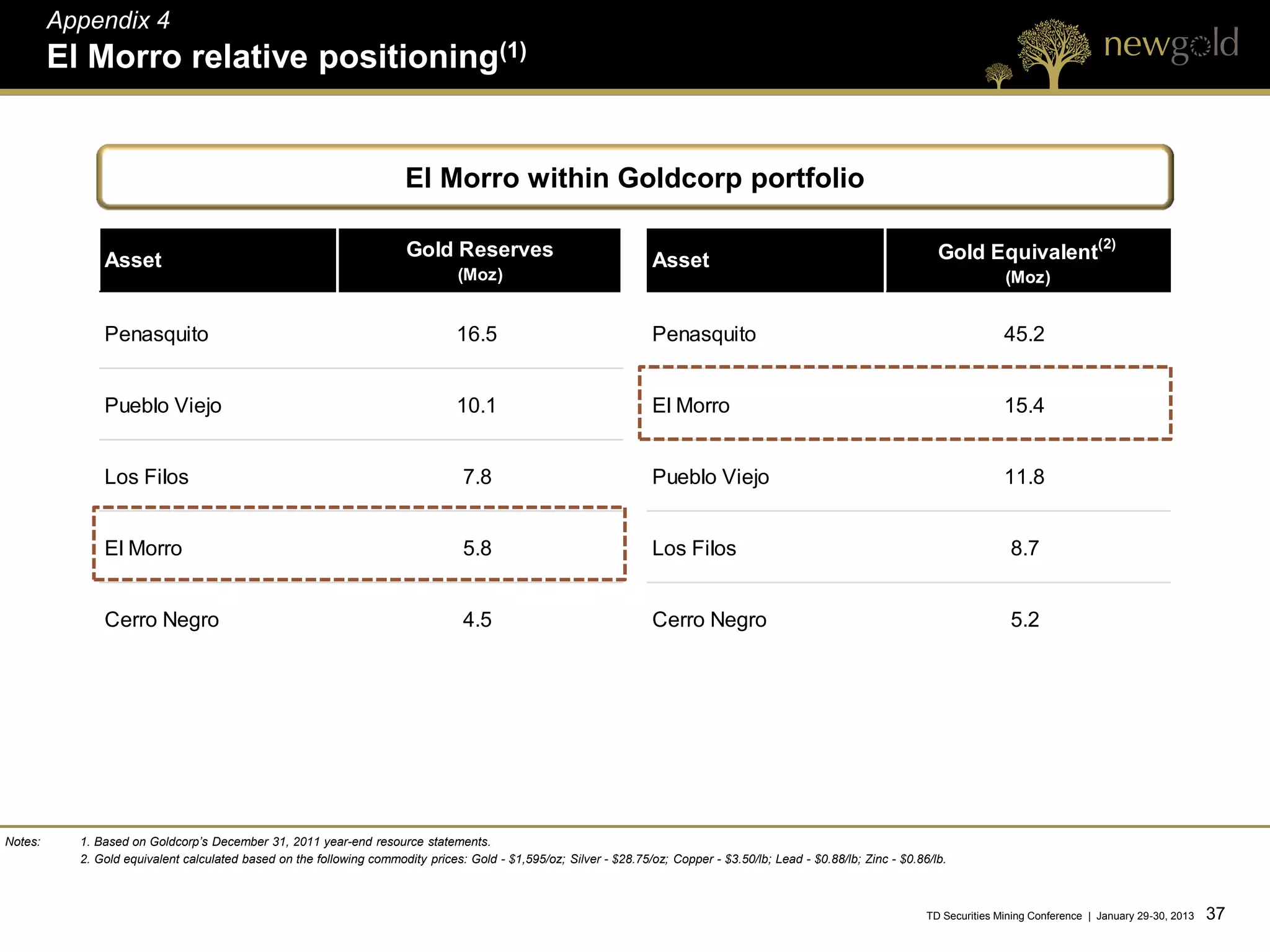

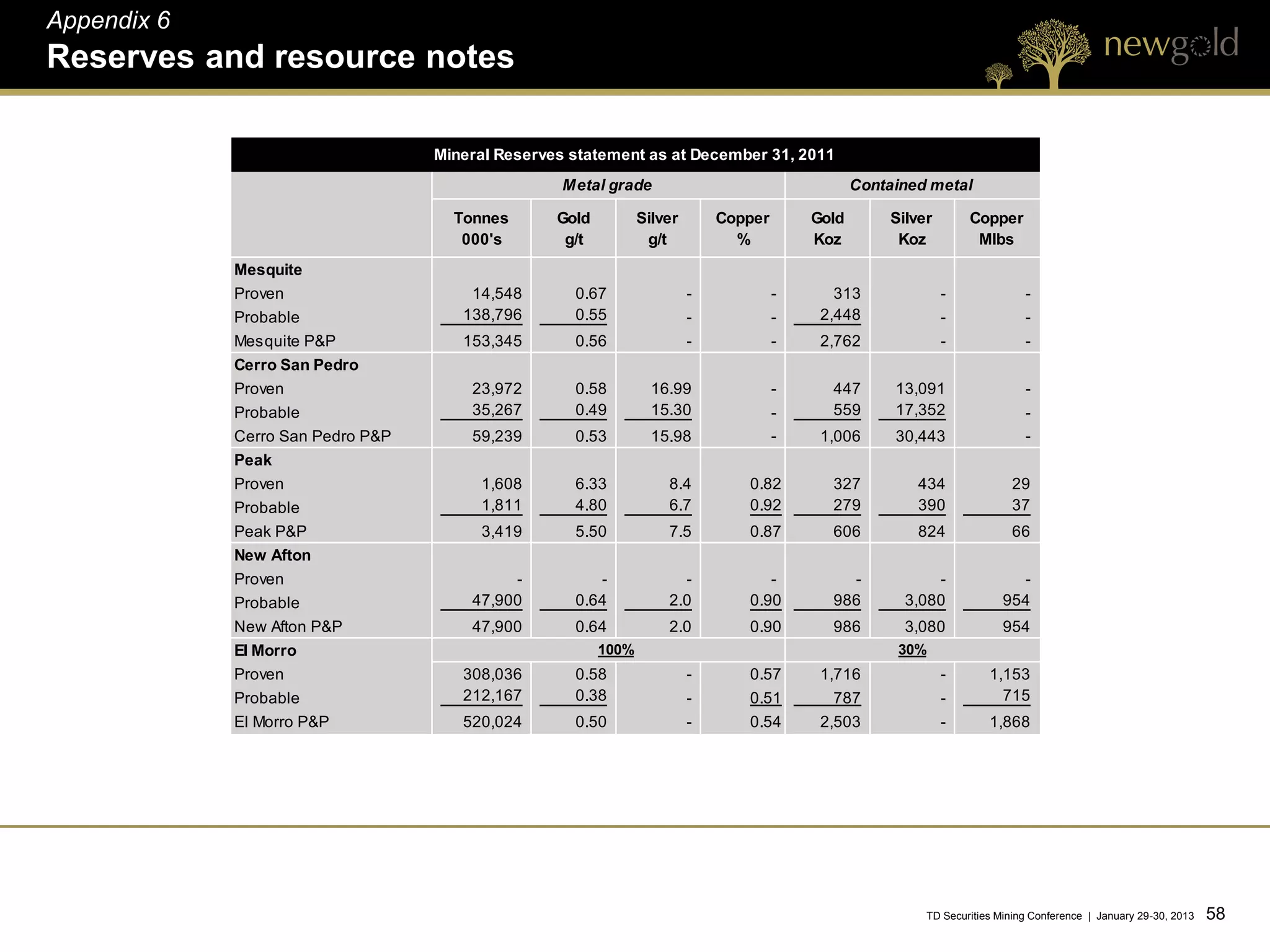

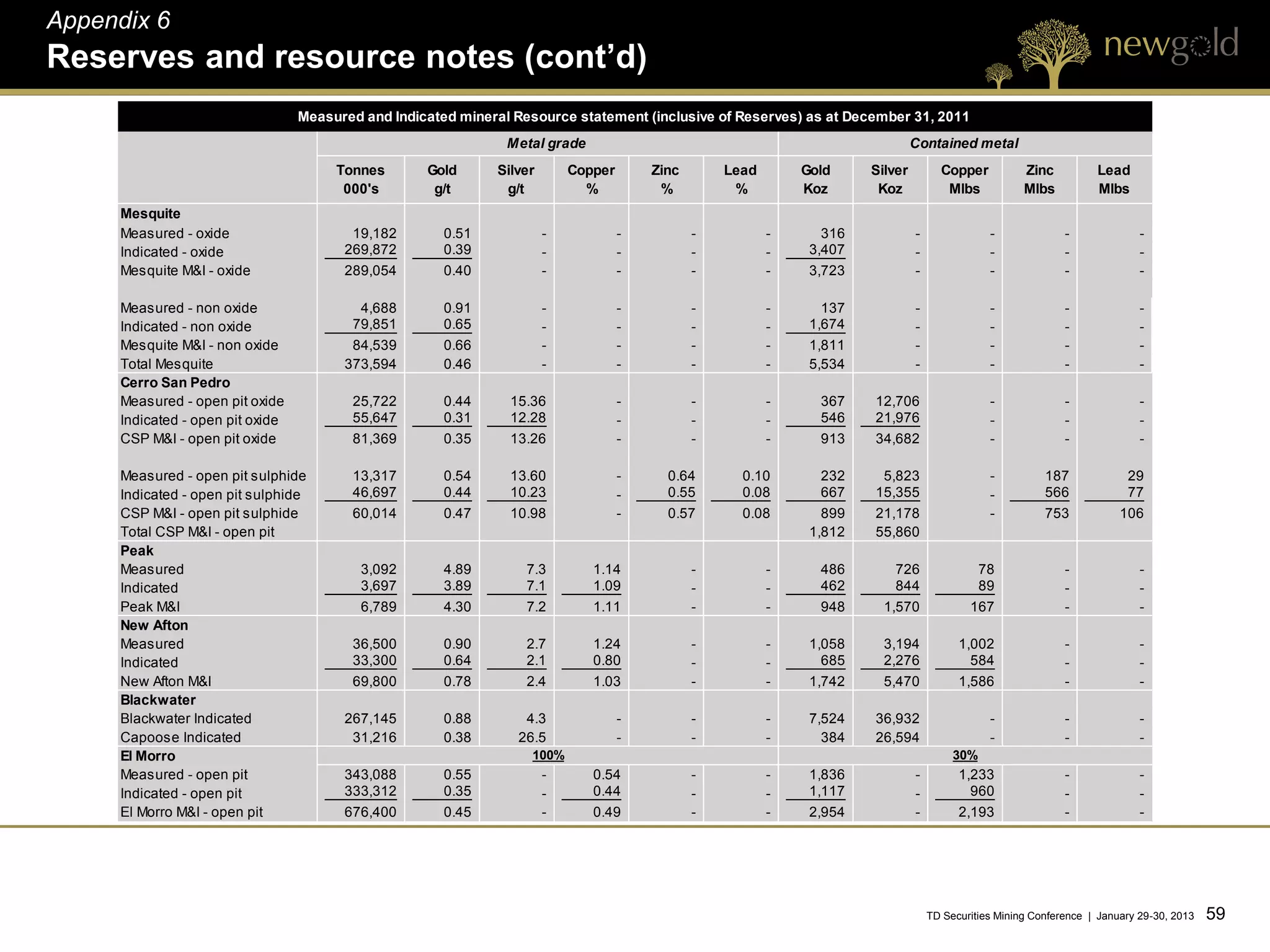

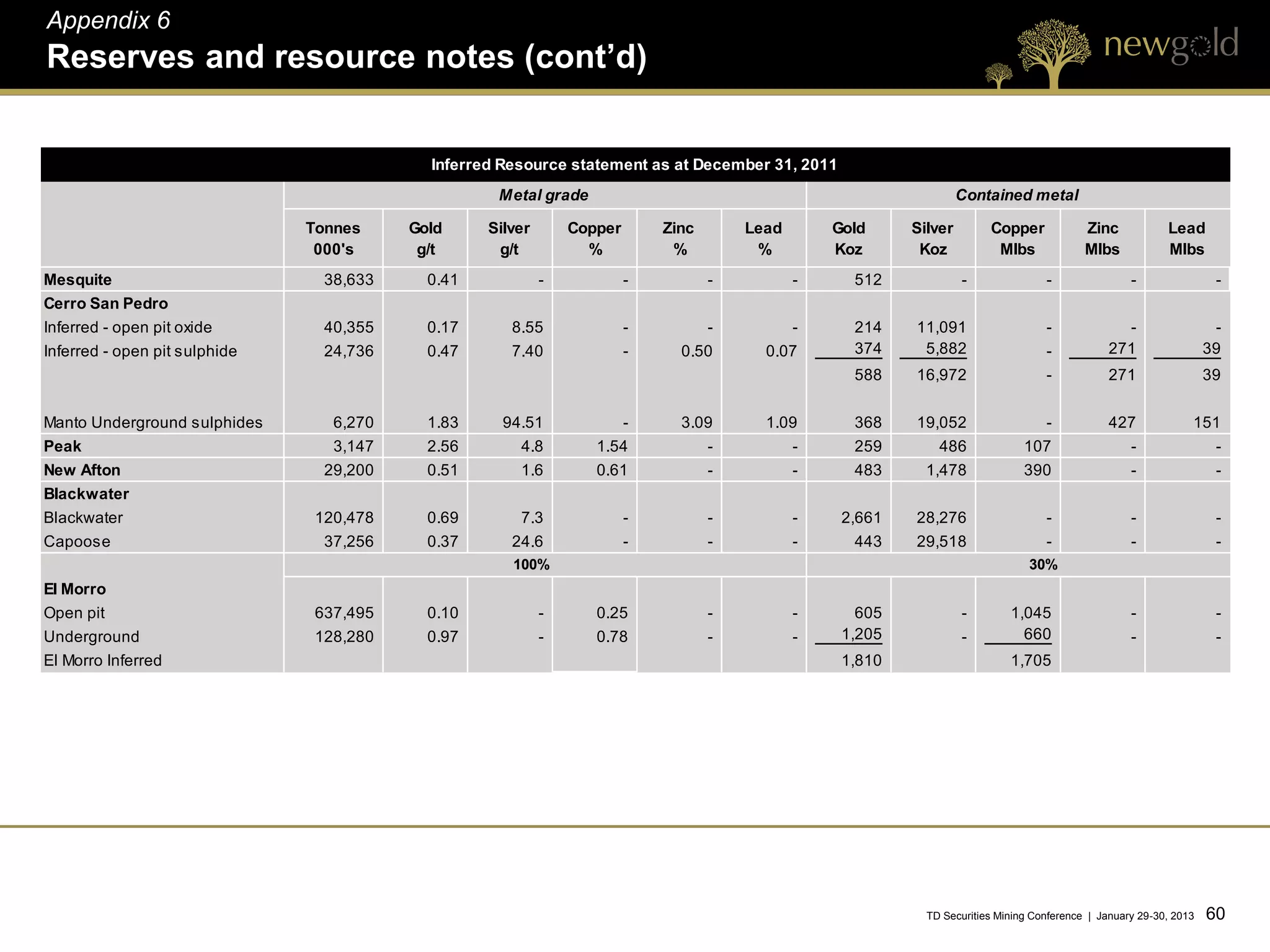

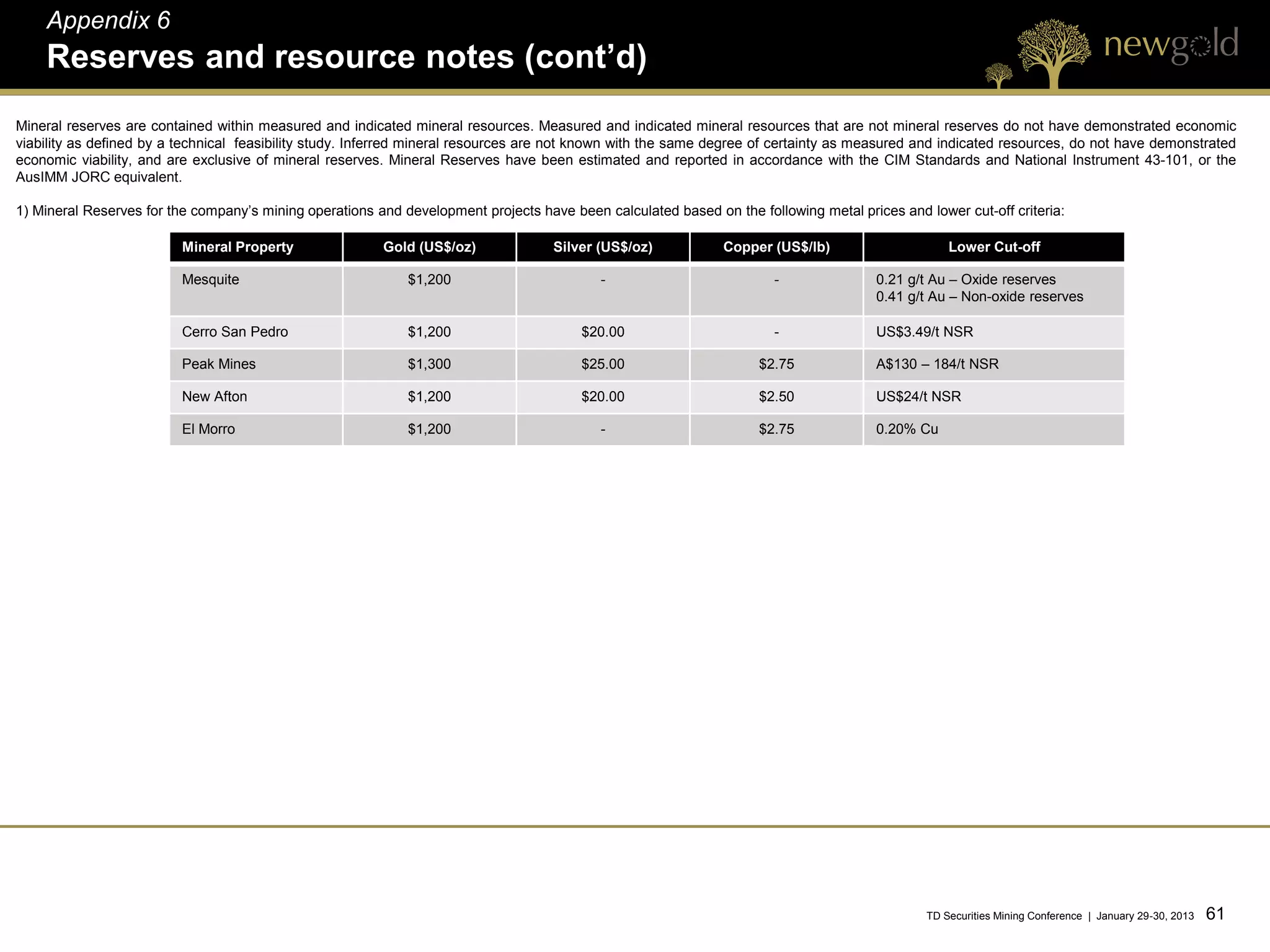

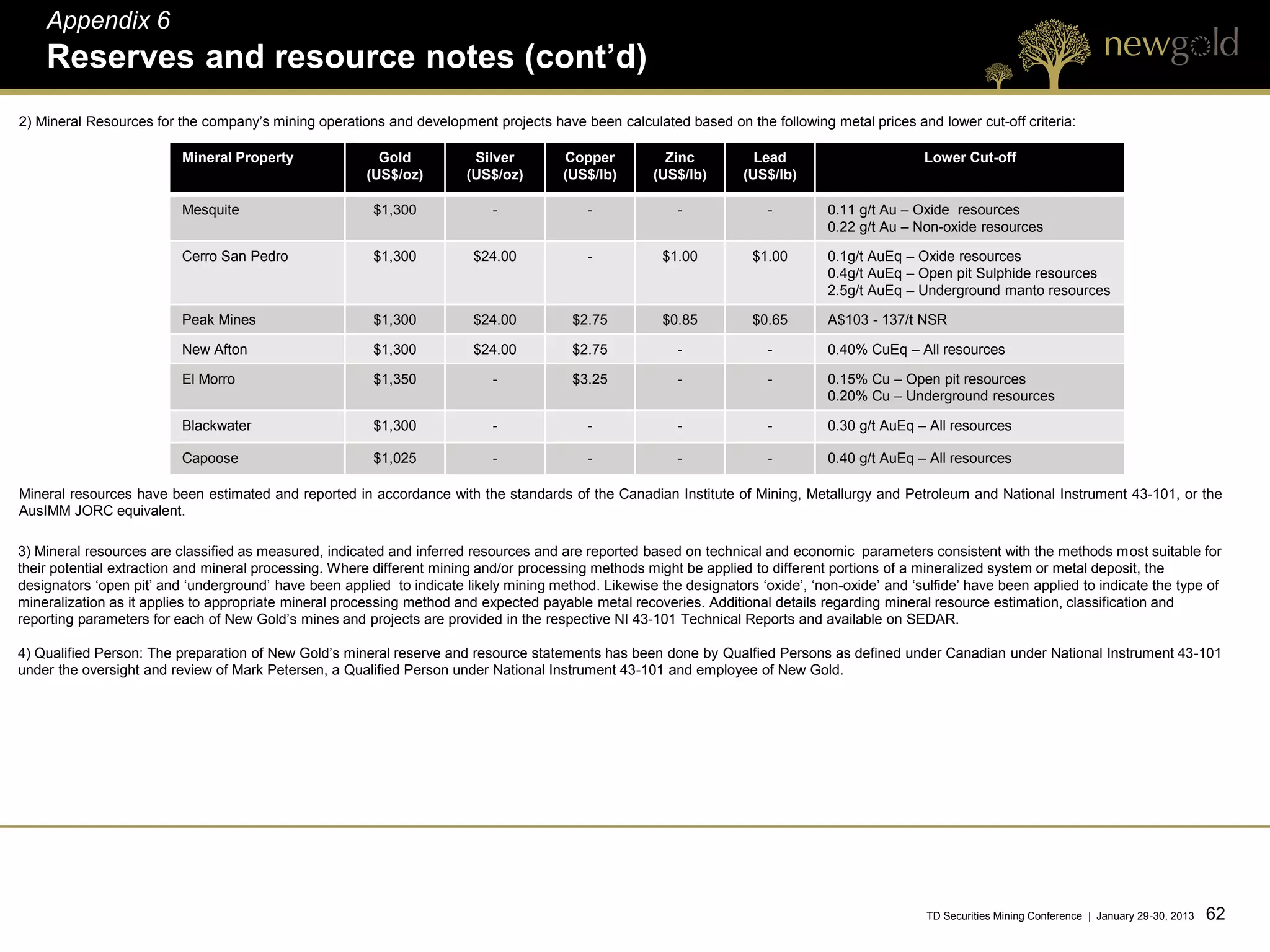

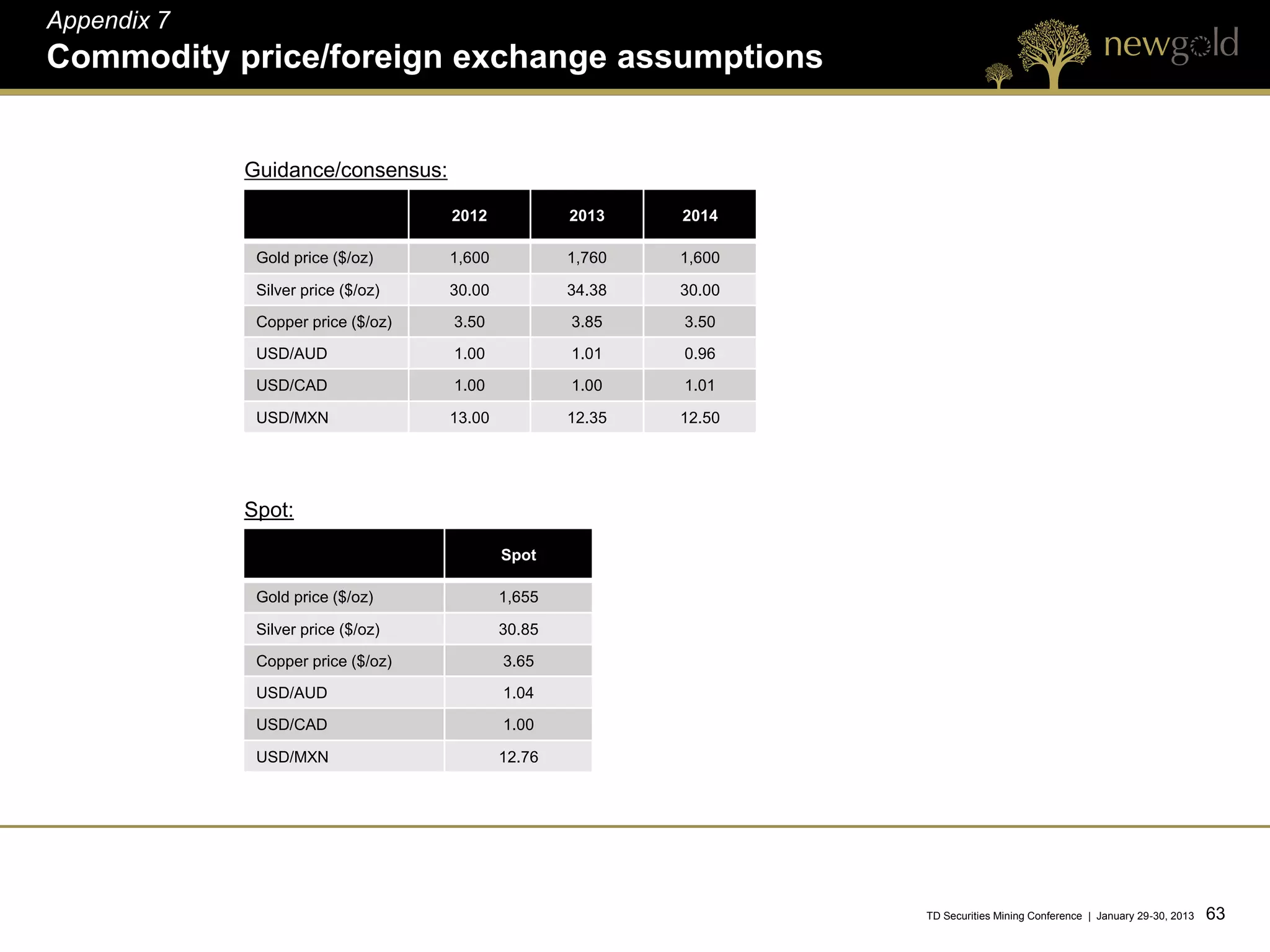

This document provides cautionary statements and details regarding New Gold's presentation at the TD Securities Mining Conference on January 29-30, 2013. It outlines the risks associated with forward-looking statements and non-IFRS measures. It also provides an overview of New Gold's history of growth through acquisitions, track record of delivering on production targets, lowering costs and expanding resources. Key assets discussed include New Afton, Cerro San Pedro, Mesquite, and New Gold's 30% interest in the El Morro project in Chile.