- The document is the year-end 2016 conference call for Silver Standard Resources Inc. discussing financial and operational results.

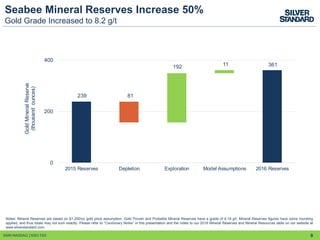

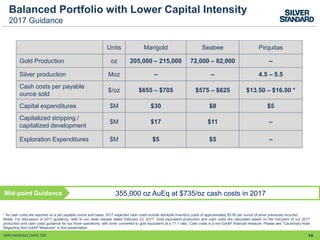

- Key highlights include record annual gold equivalent production of 393,325 ounces at lower cash costs of $653/oz. Exploration success extended reserve life at Marigold and Seabee mines.

- Financial results were strong with $115 million in cash generated and adjusted net income of $100.3 million.