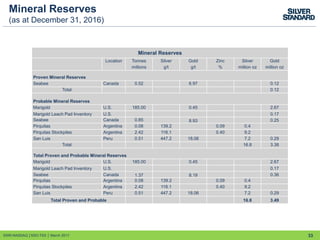

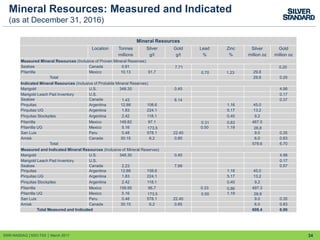

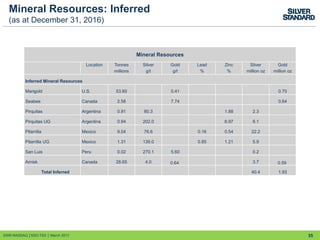

This document is a March 2017 corporate presentation that provides cautionary notes about forward-looking statements in the presentation. It discusses risks and uncertainties that could cause actual results to differ from expectations. It also notes that qualified persons reviewed and approved the scientific and technical information about the company's Marigold, Seabee, and Pirquitas mines. Finally, it provides cautionary notes about how mineral resource and reserve classifications differ between Canadian and U.S. standards.