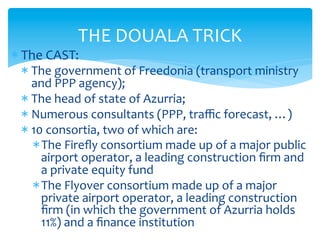

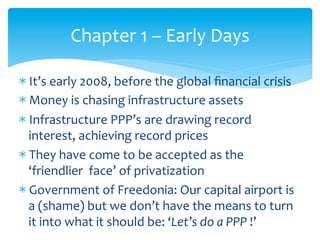

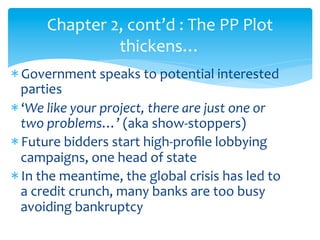

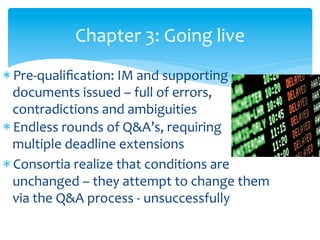

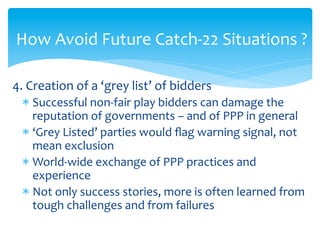

The document narrates a fictional account of a public-private partnership (PPP) for an airport in Freedonia, highlighting the challenges faced during the planning and execution phases amid a global recession. It discusses the optimistic initial forecasts, subsequent failures to attract bids, and the eventual signing of a PPP agreement that leads to inaction due to financing issues. Recommendations are provided to avoid future pitfalls, including improving government PPP capacity and managing public expectations effectively.