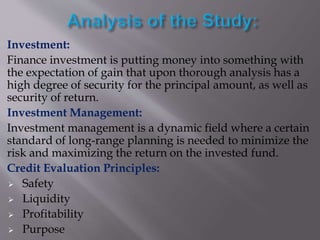

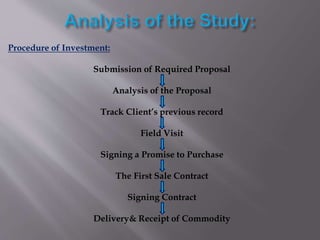

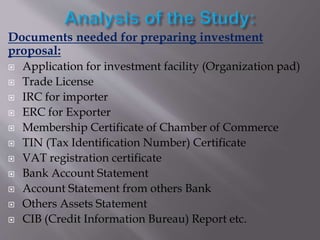

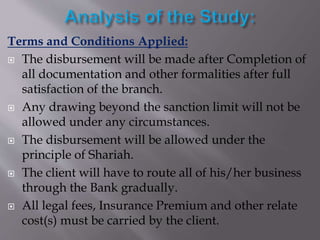

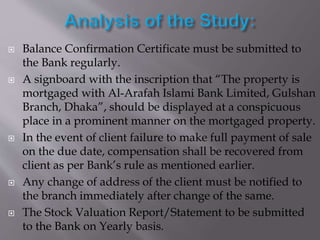

This document summarizes a study on the investment management practices of Al-Arafah Islami Bank Limited's Gulshan branch in Bangladesh. The study aimed to analyze the bank's investment approval process, risk assessment system, existing investment risks, and ways to improve performance. Primary data collection methods included employee interviews, observation, and customer conversations. Key findings were that the bank follows regulatory procedures, officers are knowledgeable about client screening, and decisions are made at the branch level to speed up the approval process. Recommendations included decentralizing decision-making further, expanding the employee base, and increasing training on Islamic banking.