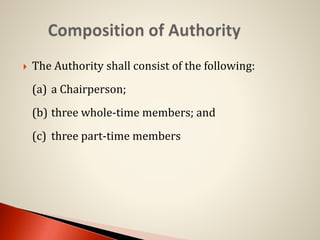

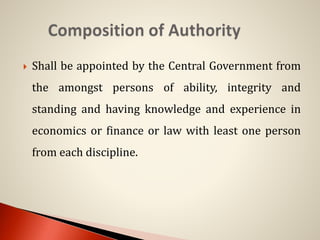

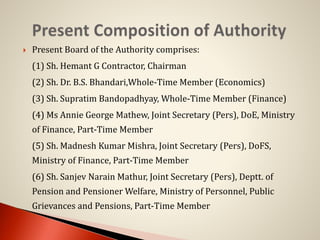

The Pension Fund Regulatory and Development Authority (PFRDA) was established by the Government of India in 2014 to regulate and develop pension funds and protect the interests of subscribers. PFRDA regulates the National Pension System and is headed by a chairman and includes whole-time and part-time members. As the regulator for NPS, PFRDA oversees intermediaries like the Central Record Keeping Agency and pension funds, monitors their performance, and safeguards subscribers' interests.