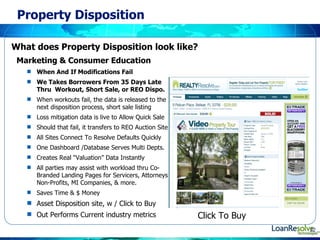

The document summarizes a presentation about LoanResolve Technologies, a real estate mortgage loss mitigation system. It discusses how the system provides a single dashboard for loan processing, foreclosure prevention, and connecting all relevant parties. It also outlines how the system handles the entire loan process from early delinquency to REO asset disposition, with a focus on loss mitigation, short sales, and online auctions. Security of customer data is handled through partnerships with Peak 10 data centers.