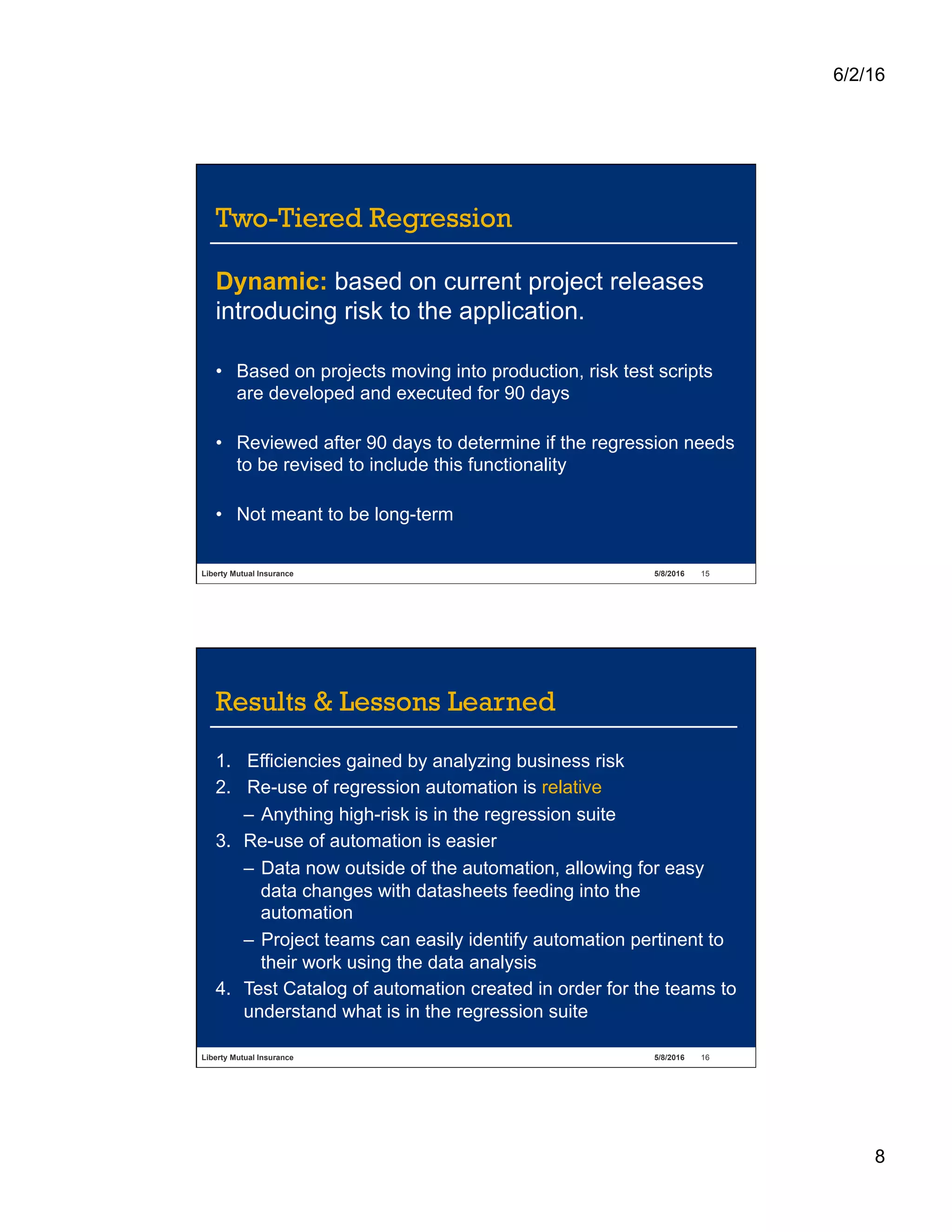

Penny McVay from Liberty Mutual presented a session on predictive test planning aimed at improving system quality through various methodologies like combinatorial analysis, automation, and risk-based testing. The project focused on optimizing and rewriting an automated regression suite to enhance performance and maintainability, reducing regression test scripts significantly while ensuring quality assurance. Key outcomes included business data analysis, defect ranking, and the implementation of a two-tiered regression approach to address testing efficiency based on risks and historical data.