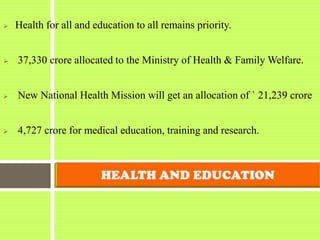

The budget proposes a Rs 2,000 tax credit for those with taxable income up to Rs 5 lakh, increasing their exemption limit from Rs 2 lakh to Rs 2.2 lakh. It does not change tax rates for seniors or the 3% education cess. A 10% surcharge is introduced for taxable income over Rs 1 crore. Agriculture is allocated Rs 27,049 crore, a 22% increase, and health remains a priority with Rs 37,330 crore for related ministries.