The document discusses the Tax-Free Savings Account (TFSA) introduced by the Canadian government in 2008. Key points:

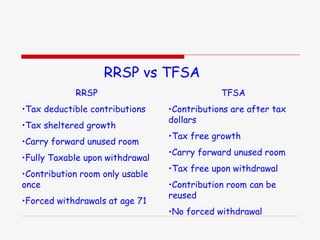

- Canadians over 18 can contribute up to $5,000 annually to a TFSA, with unused contribution room carried forward and annual increases for inflation.

- Earnings and withdrawals from a TFSA are completely tax-free and contributions can be reused after withdrawals.

- TFSAs allow for effective savings of short and medium term goals and can supplement retirement incomes.

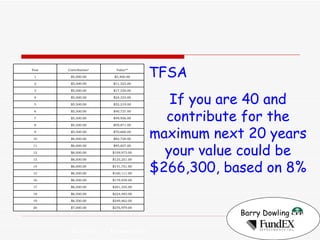

- Contributing the maximum annually from age 40 for 20 years could result in around $266,300 in savings based on 8% annual growth.