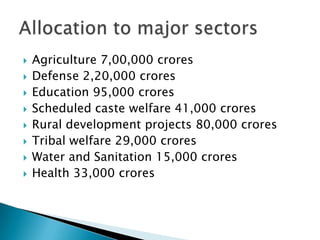

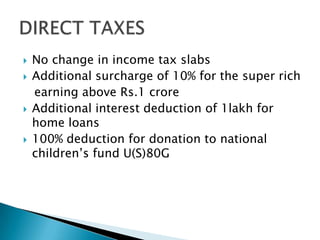

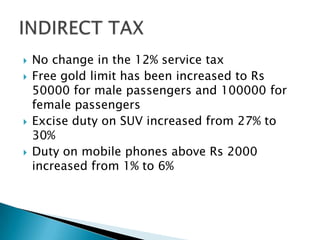

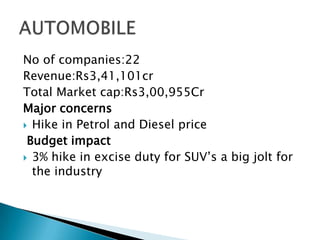

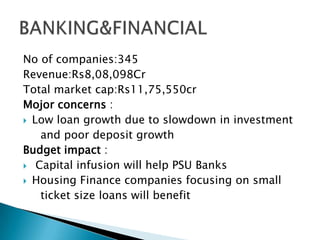

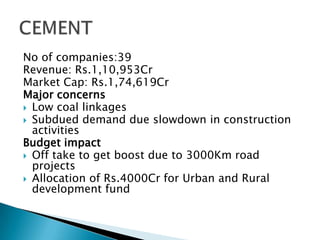

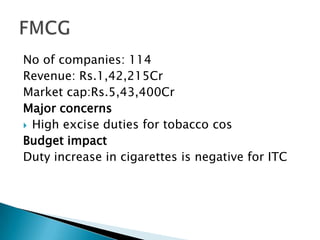

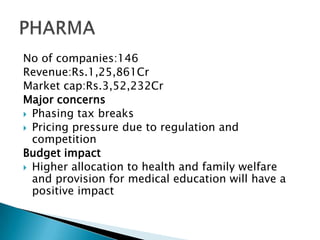

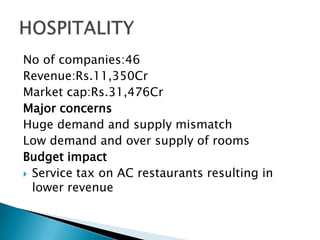

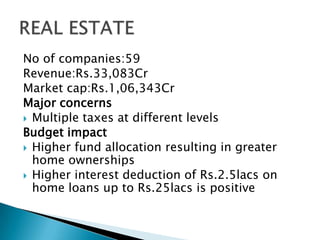

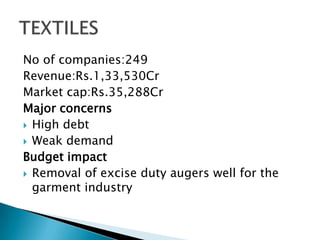

This document provides budget allocation figures for various sectors in India such as agriculture, defense, education, etc. It also summarizes the budget's impact on various industries including automobiles, banks, cement, healthcare, hotels, housing, and textiles. Key points from the budget include no change to income tax slabs but a 10% surcharge on income over 1 crore, an interest deduction increase for home loans, and duty increases on SUVs, cigarettes, and mobile phones priced over 2000. The budget aims to boost sectors like infrastructure, rural development, and affordable housing.