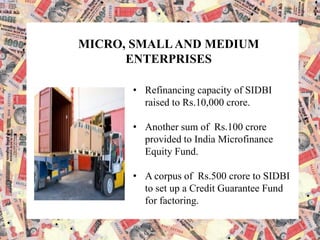

The document outlines the key areas and allocations of the 2013 Indian budget. It allocates funds to agriculture, infrastructure, education, environment, micro/small/medium enterprises, textiles, taxes, and defense. For agriculture, it sets a credit target of Rs. 7 lakh crore and creates a credit guarantee fund. It allocates Rs. 5,284 crore for scholarships and Rs. 13,215 crore for school meals. The defense budget is increased to Rs. 2,03,672 crore, including Rs. 86,741 crore for capital expenditure. It outlines various tax proposals and incentives for manufacturing, renewable energy, rural housing, and small businesses.