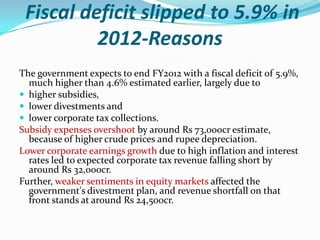

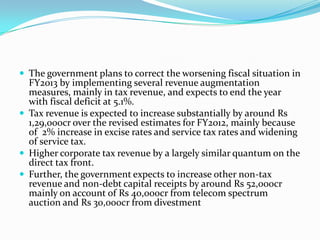

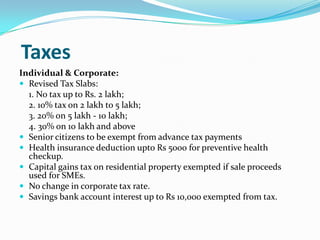

This document summarizes key aspects of the Indian government's budget for 2012-2013. It notes that GDP growth for 2011-2012 is estimated to be 6.9%, lower than the previous two years due to global economic issues. The fiscal deficit for 2012-2013 is projected to be 5.1% of GDP, an improvement from 5.9% the previous year. Taxes are adjusted with new income tax slabs and exemptions for senior citizens, health insurance, and capital gains from property sale. Disinvestment targets are set at 30,000 crore rupees. Efforts to reform taxation include a direct tax code and goods and services tax.