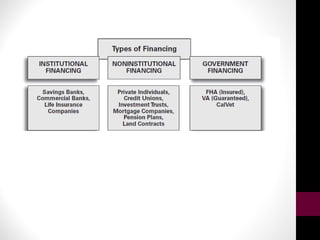

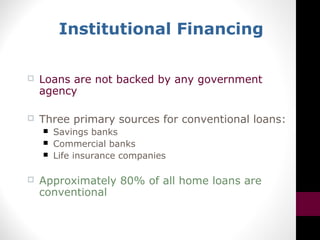

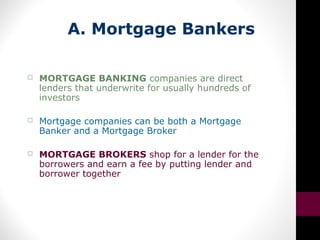

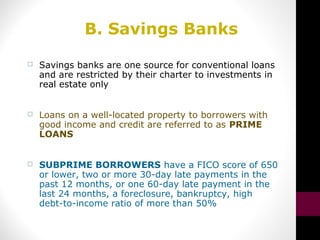

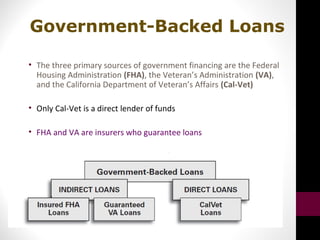

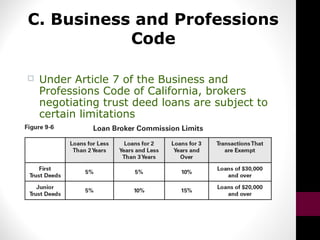

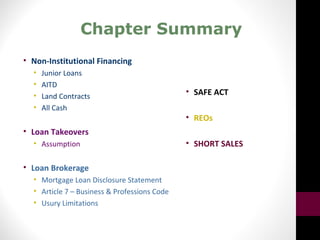

This chapter discusses various aspects of the real estate finance process. It covers conventional institutional financing sources like mortgage bankers, savings banks, and commercial banks. It also describes government financing options through FHA, VA, and Cal-Vet programs. The chapter explains how borrowers are qualified, including credit scoring and applicable laws. Non-institutional financing such as junior loans and land contracts are explained. The chapter concludes with discussions of loan defaults, real estate owned properties, and short sales.