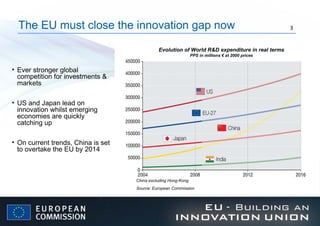

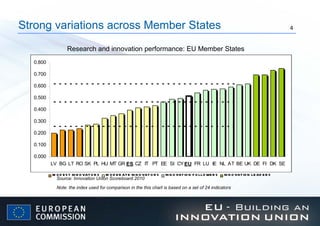

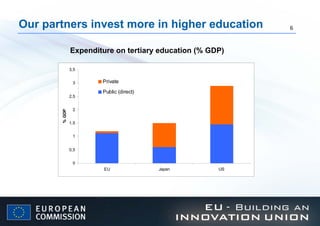

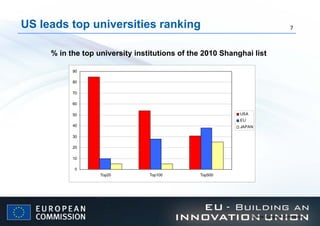

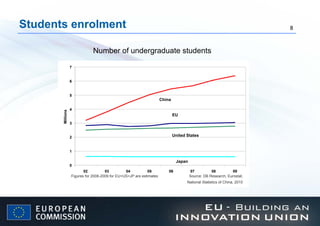

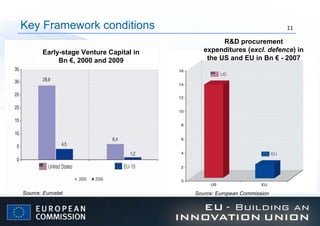

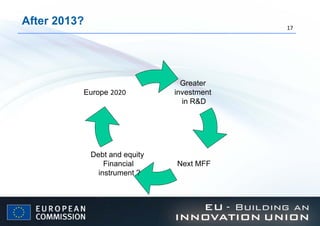

The document discusses the European Union's efforts to close its innovation gap with competitors like the United States and emerging economies such as China. It outlines the EU's strategic approach through the Innovation Union initiative to improve framework conditions for start-ups and early-stage innovation through measures like the Risk Sharing Finance Facility and proposals to improve access to venture capital across borders. The EU aims to better leverage public and private funding to boost investment in skills, education, research and innovation.