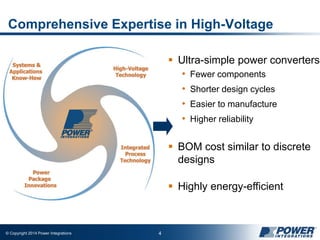

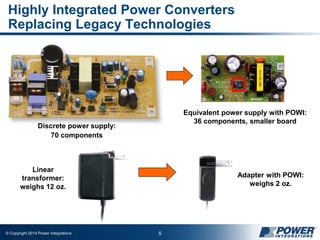

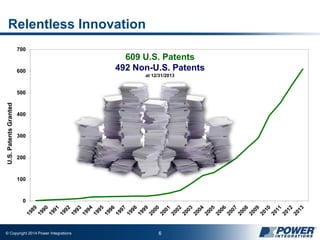

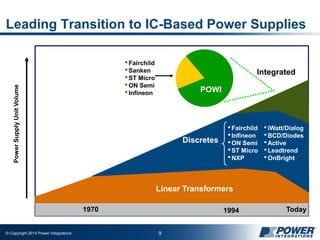

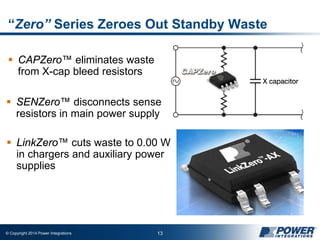

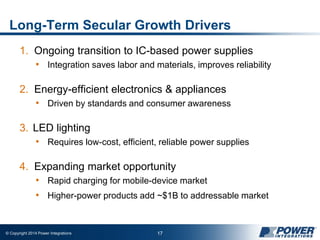

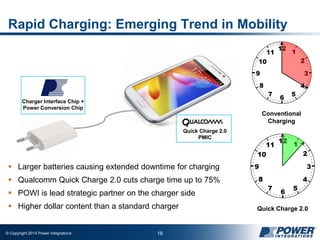

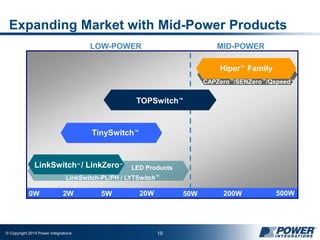

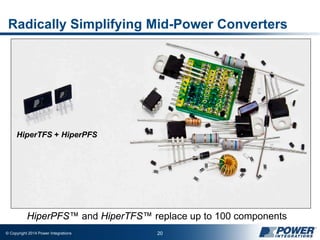

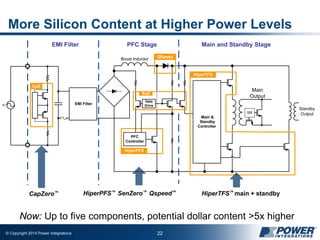

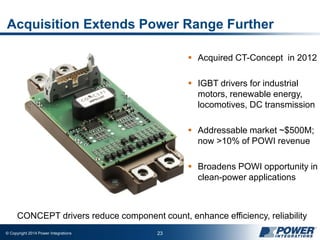

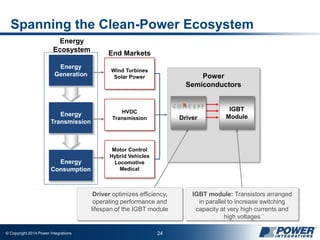

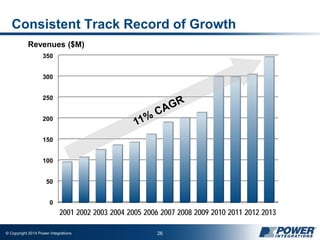

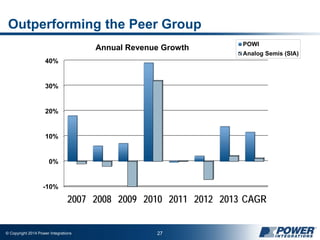

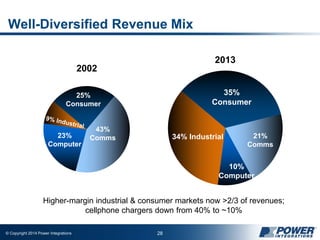

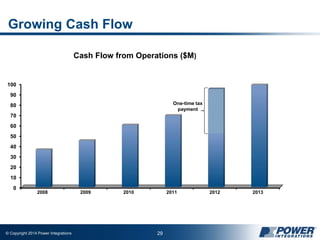

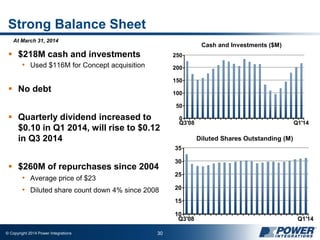

This document provides an overview of Power Integrations, Inc. It discusses the company's position as a leader in energy-efficient power conversion technology, its long-term growth drivers including the transition to integrated circuit-based power supplies and increasing demand for energy efficiency. The company has expanded its addressable market with new higher-power products and an acquisition of a company providing motor control technology. Power Integrations has achieved consistent revenue growth and a strong balance sheet to support further innovation and growth opportunities.