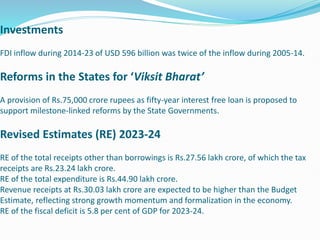

The Interim Union Budget 2024-25, presented by Finance Minister Nirmala Sitharaman, emphasizes social justice and welfare, particularly for women, youth, farmers, and the poor, with significant allocations for various support schemes. Key highlights include increased capital expenditure for infrastructure, continued focus on poverty alleviation, and reforms aimed at enhancing the tax system and improving taxpayer services. The budget outlines ambitious targets for agriculture, health, tourism, and sustainable energy, alongside robust fiscal measures to maintain economic stability.