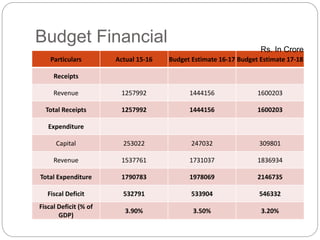

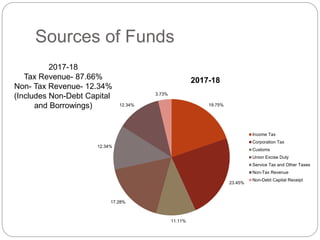

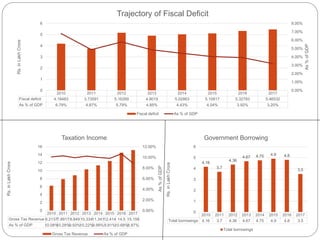

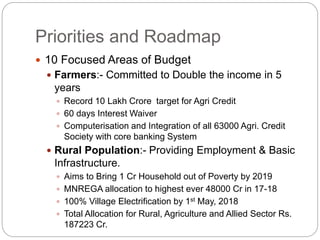

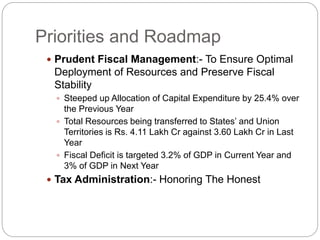

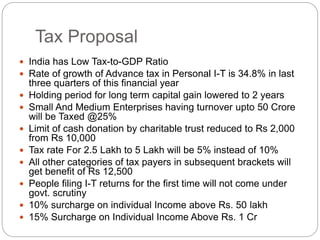

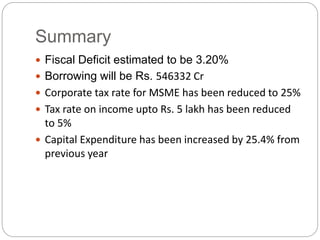

The budget document outlines key details of the 2017-18 Indian union budget. Some highlights include a fiscal deficit target of 3.2% of GDP, total borrowing estimated at Rs. 546332 crore, a reduction of the corporate tax rate for MSMEs to 25%, and a reduction of the tax rate on income up to Rs. 5 lakh to 5%. It also notes a 25.4% increase in capital expenditure from the previous year.