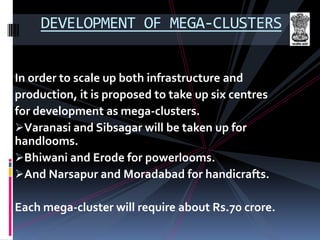

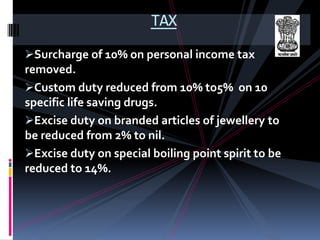

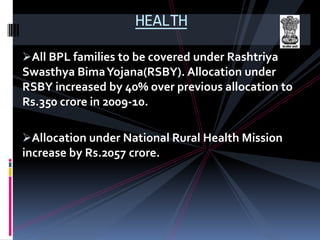

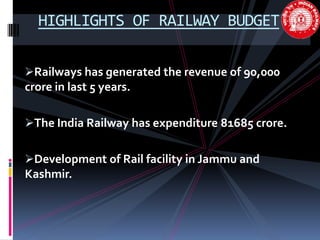

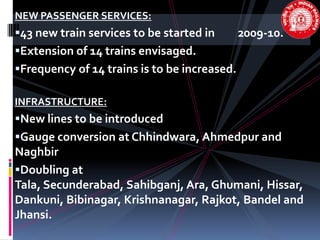

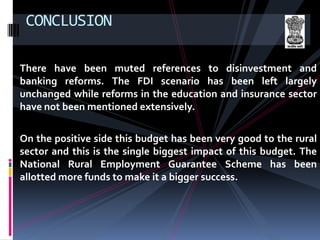

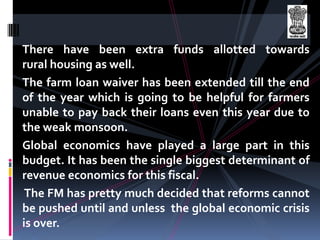

The document provides details about the Union Budget of India for 2009-2010. It summarizes the key aspects of the budget including total estimated expenditures of Rs. 10.2 trillion and estimated revenues of Rs. 6.1 trillion. It outlines spending increases for sectors like rural development, education, health, and infrastructure development. The economic survey highlights India's GDP growth target of 7.5% for 2009-2010 with challenges from the global slowdown and inflation addressed through fiscal policy changes.