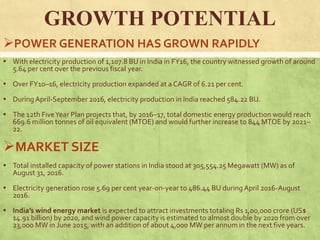

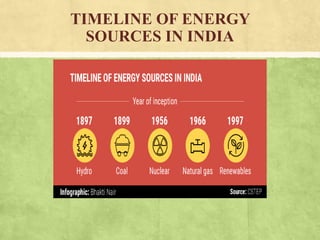

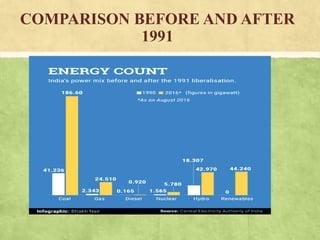

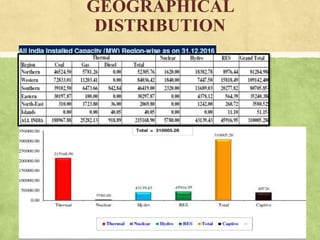

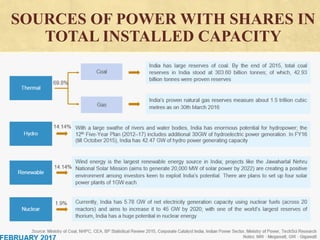

The document details the historical growth and current state of power generation in India, highlighting the transition from hydropower to coal dominance and the rise of renewable energy sources. With projections for substantial growth in energy production and investments in the sector, it also emphasizes the government's targets for renewable energy and electricity generation by 2022. Additionally, the report outlines career opportunities in both the public and private sectors for graduates specializing in power management.

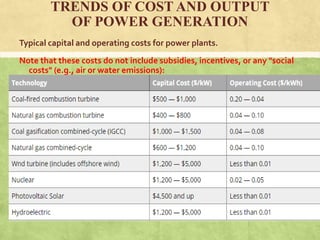

![▪ Operating costs for power plants include fuel, labour and maintenance costs.The fixed costs of

power generation are essentially capital costs and land. The capital cost of building central station

generators vary from region to region, largely as a function of labour costs and "regulatory costs," which

include things like obtaining siting permits, environmental approvals, and so on.

Irrespective of technology, all generators share the following characteristics

which influence the plant's operations:

▪ Ramp rate

This variable influences how quickly the plant can increase or decrease power output, in [MW/h] or in [%

of capacity per unit time]

▪ Ramp time

The amount of time it takes from the moment a generator is turned on to the moment it can start

providing energy to the grid at its lower operating limit (see below), in [h]

▪ Capacity

The maximum output of a plant, in [MW]

▪ Lower Operating Limit (LOL)

The minimum amount of power a plant can generate once it is turned on, in [MW]

▪ Minimum RunTime

The shortest amount of time a plant can operate once it is turned on, in [h].

▪ No-Load Cost

The cost of turning the plant on, but keeping it "spinning," ready to increase power output, in [Rs/MWh].

Another way of looking at the no-load cost is the fixed cost of operation; i.e., the cost incurred by the

generator that is independent of the amount of energy generated.

▪ Start-up and Shut-down Costs

These are the costs involved in turning the plant on and off, in [Rs/MWh].](https://image.slidesharecdn.com/powerenergygenerationreport-170409102501/85/Power-energy-generation-report-20-320.jpg)