This document discusses poverty and potential policy solutions to address it. The key points are:

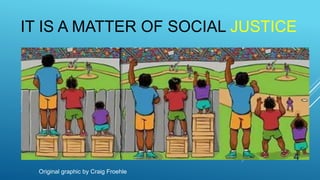

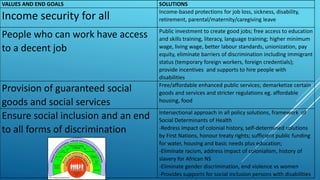

1) Poverty is a political issue that requires transforming the welfare state based on principles of equity and equality.

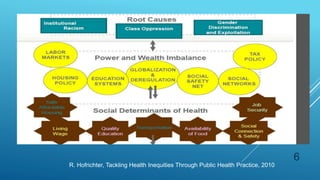

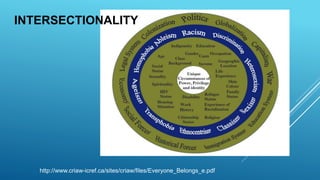

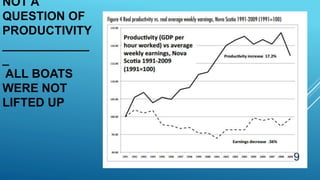

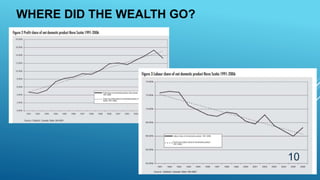

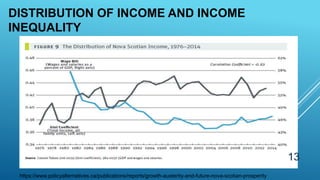

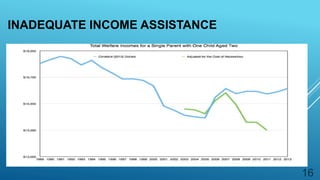

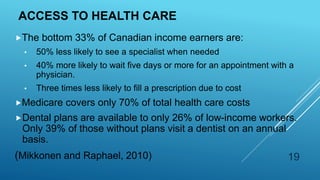

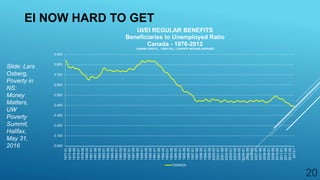

2) Effective policy solutions require addressing the root causes of poverty, including a lack of good jobs, affordable housing and services, as well as discrimination and inequality.

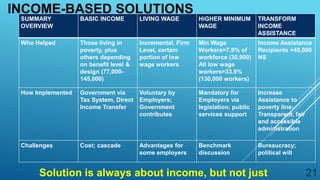

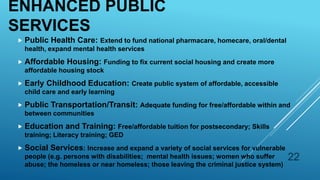

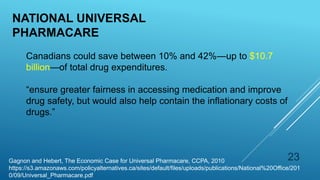

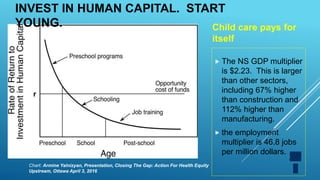

3) Solutions proposed include implementing a basic income, increasing the minimum wage, improving income assistance, enhancing public services like healthcare and childcare, and undertaking tax reforms to ensure wealthy individuals and corporations pay their fair share.