Portfolio perspectives avoiding_loss_0714

•

0 likes•184 views

If you understand the difference between a temporary decline and a permanent loss, then you have a leg up on many investors. Unlike temporary declines, permanent losses have a real impact on your portfolio. Permanent losses are losses that cannot be recovered ... when you get out at the low point and the markets recover afterwards.

Report

Share

Report

Share

Download to read offline

Recommended

Portfolio perspectives _volatility_0415

Volatility — One of The Biggest Threats to Your Savings and for your Retirement

Investing for a lifetime

some of the most common problems unsuccessful investors make, how to avoid mistakes and how to increase wealth through out your lifetime.

Winter of our discontent - Financial Post Magazine April 2019

Be like the ant and make preparations for a downturn when times are good, to avoid ending up like the grasshopper

Recommended

Portfolio perspectives _volatility_0415

Volatility — One of The Biggest Threats to Your Savings and for your Retirement

Investing for a lifetime

some of the most common problems unsuccessful investors make, how to avoid mistakes and how to increase wealth through out your lifetime.

Winter of our discontent - Financial Post Magazine April 2019

Be like the ant and make preparations for a downturn when times are good, to avoid ending up like the grasshopper

Income Matching Using Individual Bonds

Asset Dedication slide presentation from FPA NorCal Conference 2011

11 eaton vance volatility - the black widow returns

11 eaton vance volatility - the black widow returns

Index reconstitution the price of tracking

There is a cost to indexing that most investors are unaware of. It is called “reconstitution.”

A blog post is scheduled for 8 Feb 2017 discussing this article.

http://wp.me/p2Oizj-Hh

An Abundant Retirement

Learn how to invest successfully, minimize taxes, and enjoy a worry-free retirement.

Developing an Asset Allocation Strategy and the Military Family

This webinar discusses asset allocation, diversification and strategies to implement an individualized investment plan https://learn.extension.org/events/1715

What is Fixed Income Investing?

Banking executive Colin Robertson, who has operated in Chicago for most of his career, began his long association with Northern Trust in 1999, when he joined the firm as a senior vice president. Prior to that, he worked for other financial services firms, including Mellon Financial Corporation and Continental Bank. Now an executive vice president for Northern Trust Asset Management, Colin Robertson is Managing Director of Fixed Income for the Chicago-based firm.

[EN] Fixed Income Case Study Phase 3 January 2016![[EN] Fixed Income Case Study Phase 3 January 2016](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![[EN] Fixed Income Case Study Phase 3 January 2016](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

We build partnerships based on sharing intelligence, not keeping it to ourselves. Our partners make our experience and expertise work for them.

Standpoint: Diversifying Into Property by Malcom Homes

How does property fit into an investor’s overall portfolio?

Hurricane gonzalo; we need to get better at weathering storms

Hurricane gonzalo; we need to get better at weathering storms

Five asset classes to ensure proper asset allocation

In this presentation, Matthew Lekushoff covers the five major asset classes investors should consider when putting together their portfolios. Ensuring investments in each asset class will guarantee proper asset allocation.

Matthew is a financial advisor with Raymond James Ltd.'s head office in Toronto.

INEC | OUTUBRO | 31/10/2013

O Índice Nacional de Expectativa do Consumidor (INEC) aumentou 0,5% em outubro na comparação com setembro e alcançou 107,7 pontos. "Mesmo assim, o INEC permanece abaixo da média de 113,7 pontos registrada nos primeiros cinco meses de 2013", informa a pesquisa divulgada nesta quinta-feira, 31 de outubro, pela Confederação Nacional da Indústria (CNI).

More Related Content

What's hot

Income Matching Using Individual Bonds

Asset Dedication slide presentation from FPA NorCal Conference 2011

11 eaton vance volatility - the black widow returns

11 eaton vance volatility - the black widow returns

Index reconstitution the price of tracking

There is a cost to indexing that most investors are unaware of. It is called “reconstitution.”

A blog post is scheduled for 8 Feb 2017 discussing this article.

http://wp.me/p2Oizj-Hh

An Abundant Retirement

Learn how to invest successfully, minimize taxes, and enjoy a worry-free retirement.

Developing an Asset Allocation Strategy and the Military Family

This webinar discusses asset allocation, diversification and strategies to implement an individualized investment plan https://learn.extension.org/events/1715

What is Fixed Income Investing?

Banking executive Colin Robertson, who has operated in Chicago for most of his career, began his long association with Northern Trust in 1999, when he joined the firm as a senior vice president. Prior to that, he worked for other financial services firms, including Mellon Financial Corporation and Continental Bank. Now an executive vice president for Northern Trust Asset Management, Colin Robertson is Managing Director of Fixed Income for the Chicago-based firm.

[EN] Fixed Income Case Study Phase 3 January 2016![[EN] Fixed Income Case Study Phase 3 January 2016](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![[EN] Fixed Income Case Study Phase 3 January 2016](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

We build partnerships based on sharing intelligence, not keeping it to ourselves. Our partners make our experience and expertise work for them.

Standpoint: Diversifying Into Property by Malcom Homes

How does property fit into an investor’s overall portfolio?

Hurricane gonzalo; we need to get better at weathering storms

Hurricane gonzalo; we need to get better at weathering storms

Five asset classes to ensure proper asset allocation

In this presentation, Matthew Lekushoff covers the five major asset classes investors should consider when putting together their portfolios. Ensuring investments in each asset class will guarantee proper asset allocation.

Matthew is a financial advisor with Raymond James Ltd.'s head office in Toronto.

What's hot (20)

11 eaton vance volatility - the black widow returns

11 eaton vance volatility - the black widow returns

Developing an Asset Allocation Strategy and the Military Family

Developing an Asset Allocation Strategy and the Military Family

Standpoint: Diversifying Into Property by Malcom Homes

Standpoint: Diversifying Into Property by Malcom Homes

Hurricane gonzalo; we need to get better at weathering storms

Hurricane gonzalo; we need to get better at weathering storms

Five asset classes to ensure proper asset allocation

Five asset classes to ensure proper asset allocation

Viewers also liked

INEC | OUTUBRO | 31/10/2013

O Índice Nacional de Expectativa do Consumidor (INEC) aumentou 0,5% em outubro na comparação com setembro e alcançou 107,7 pontos. "Mesmo assim, o INEC permanece abaixo da média de 113,7 pontos registrada nos primeiros cinco meses de 2013", informa a pesquisa divulgada nesta quinta-feira, 31 de outubro, pela Confederação Nacional da Indústria (CNI).

Real Estate in India

Leading Space Pvt. Ltd. has grown from strength to strength in making our clients dreams into a reality Our services include: Real Estate Consultants.

Advice iq frank 1 30 14

After settling on a career (Part 1), identifying college and costs becomes easier.

How To Become a PR Technologist

It's no secret consumer behavior has changed drastically in the past decade with the advances of technology. They are making purchase decisions in new ways involving social networks, search engines, forums, and content to name a few.

Our role as a communications professional has become more complex as we need to evolve to meet the new challenges this presents to the brands with whom we work.

This presentation illustrates the changes, talks about what it means to be a technologist, outlines eight areas where our jobs have changed, and provides four steps to become a technologist.

Viewers also liked (19)

Денис Марголин, как Apple превращается в мобильную компанию

Денис Марголин, как Apple превращается в мобильную компанию

Similar to Portfolio perspectives avoiding_loss_0714

Return On Investment - Spring 2016

In This Issue:

1. Low Interest Rates

2. Words of Wisdom

3. Retirement Planning: Milestones

4. When to Take CPP Benefits

Portfolio perspective volatility_0315

Most investors chase returns, unaware that volatility of those returns is as, or more, important.

Ninja trading system

If you have watched the stock market for long period of time, you realize that it can be very unpredictable. One day bubbles flourish, things could get any better and then the next day it seem like the sky is falling.

Investment diversification b 2013/14

the choice of financial professionals

Print

Digital

Websites

Creative

Marketing

Personalised Client Marketing Factsheets

You may also be interested in

Financial adviser newsletters

Financial adviser client magazines

Personalised marketing factsheets

Financial adviser Corporate brochures

Personalised 2014/15 Tax Data card

Bespoke publishing services

Financial adviser client marketing factsheets

Goldmine Media's professional financial adviser factsheets will enable your business to extend client communication, raise brand awareness, improve marketing efficiency, enhance client retention and increase sales.

Generate further repeat business opportunities

This service has been designed to generate further repeat business opportunities and referrals from your clients. Besides educating and informing clients, you're also achieving greater brand and name recognition, which is a very beneficial way to build lasting relationships.

Nurture relationships as part of your ongoing service proposition

In a post-RDR environment, there has never been a more important time to communicate with your clients on a regular basis, and each factsheet will ensure that you're able to nurture relationships as part of your ongoing client service proposition.

Each factsheet used as part of a direct mail campaign provides an unrivalled way of maintaining client contact and providing information that your clients know to be impartial, relevant and timely.

Portfolio perspectives greatest_lesson_part3_0913

Part 3 of a 3 part series that discusses 6 lessons from the Great Recession.

Dato Yau

Dato’ Yau is a chartered accountant and has more than 30 years experience in auditing, corporate finance and general management. Prior to joining Tropicana as the Group Chief Executive Officer, he was with Hong Leong Industries Bhd where he served as group managing director since September 2011 and prior to that, he was Sunway Holdings Bhd managing director since April 2001. He has also served well in various Sunway Group Berhad.

Investment diversification a 2013/14

the choice of financial professionals

Print

Digital

Websites

Creative

Marketing

Personalised Client Marketing Factsheets

You may also be interested in

Financial adviser newsletters

Financial adviser client magazines

Personalised marketing factsheets

Financial adviser Corporate brochures

Personalised 2014/15 Tax Data card

Bespoke publishing services

Financial adviser client marketing factsheets

Goldmine Media's professional financial adviser factsheets will enable your business to extend client communication, raise brand awareness, improve marketing efficiency, enhance client retention and increase sales.

Generate further repeat business opportunities

This service has been designed to generate further repeat business opportunities and referrals from your clients. Besides educating and informing clients, you're also achieving greater brand and name recognition, which is a very beneficial way to build lasting relationships.

Nurture relationships as part of your ongoing service proposition

In a post-RDR environment, there has never been a more important time to communicate with your clients on a regular basis, and each factsheet will ensure that you're able to nurture relationships as part of your ongoing client service proposition.

Each factsheet used as part of a direct mail campaign provides an unrivalled way of maintaining client contact and providing information that your clients know to be impartial, relevant and timely.

Guide to Investing

For beginner investors, the thought of investments falling in value can be far more worrying than it is for experienced investors - usually because beginners have not fully analysed their attitude to risk. Learning about financial products and understanding the risk and rewards on offer can help even the most inexperienced investor to make informed investment decisions.

Similar to Portfolio perspectives avoiding_loss_0714 (20)

More from Better Financial Education

The Dynamic Implications of Sequence Risk on a Distribution Portfolio Journal...

The Dynamic Implications of Sequence Risk on a Distribution Portfolio Journal...Better Financial Education

A practical method for advisers to measure exposure to sequence risk is through evaluation of the current probability of failure rate (which I've later renames as iteration failure rate to reflect measurement of the Monte Carlo simulation rather than the plan itself - two different things). This paper lead to a deeper investigation of failure rates thus leading to two subsequent papers discovering the three-dimensional nature of simulations over various time periods and allocations, as well as application of longevity to the simulation modeling.Skittles_Quilt Chart 2022.pdf

Can You Pick The Next Winner?

Asset Class Performance 2002‐2021 of various global markets.

Pick any color in any earlier year and see what

happened in any later year. Bottom go up and top go down randomly.

*Note the 20 year results also

change asset class positions

over the years (don't predict

the future).

the-rewarding-distribution-of-us-stock-market-returns.pdf

Annual stock market returns are unpredictable, but “up” years have occurred much more frequently than “down” years in the US. That may be reassuring to investors, especially if they find market downturns unsettling.

The US stock market posted positive returns in 75% of thecalendar years from 1926 through 2021.

• The market gained an annualized average of 10.2% during this period. Yet nearly two-thirds of yearly observations were at least 10 percentage points above or below the average.

• Another noteworthy trend: More than two-thirds of the down years were followed by up years. The most recent example: a 5.0% loss in 2018 followed by a 30.4% gain in 2019.

Prototype software example of aging model incorporating both portfolio and lo...

Prototype software example of aging model incorporating both portfolio and lo...Better Financial Education

This first appeared in blog post that describes the graphs in more details

https://blog.betterfinancialeducation.com/sustainable-retirement/what-are-the-three-paradigms-of-retirement-planning/

Prototype software example of aging model incorporating both portfolio and longevity percentile statistics along with consumer spending trend line of “Real People” (which is not based here on spending percentile statistics, but on research averages). Starting balance $500,000 with $36,000 Social Security. Two simple graphs by age answer many retiree questions about potential future spending and balances. Creates a whole different discussion. Also illustrates why age 95 is a poor reference for planning since it doesn’t plan or consider aging into future ages from the beginning of retirement.Bio napfa article june 2021

Finding the parallels between flying a jet and helping people

develop financial plans may be difficult for the average person, but for Larry R. Frank Sr., the similarities between these two activities are crystal clear.

A question of equilibrium - can there be more buyers than sellers? Or more se...

A question of equilibrium - can there be more buyers than sellers? Or more se...Better Financial Education

Have you ever wondered who is buying if so many people are selling?

The notion that sellers can outnumber buyers on

down days doesn’t make sense. What the newscasters should say, of course, is that prices adjusted lower because would-be buyers weren’t prepared to pay

the former price.

What happens in such a case is either the would-be sellers sit on their shares or prices quickly adjust to the point where supply and demand come into balance and transactions occur at a price that both buyers

and sellers find mutually beneficial. Economists refer

to this as equilibrium. The happiness equation

The Happiness Equation as it relates to investing is an interrelationship between your perceptions and expectations of investing and events. How do you manage happiness when you can't manage the markets?

Sailing with the tides and investing metaphor

A mistake many inexperienced sailors make is not having a plan at all. They embark without a clear sense of their destination. And once they do decide, they often find themselves lost at sea in the wrong boat

with inadequate provisions.

Destination, contingencies when trouble comes up, course corrections, bad weather and more can happen on the journey. How do you properly prepare for sailing is much the same as investing.

Key questions for the long term investor

9 key questions every investor asks themselves eventually. Here are some short answers with academic foundations.

The uncommon average

When setting expectations,

it’s helpful to see the range of outcomes experienced

by investors historically. For example, how often have

the stock market’s annual returns actually aligned with

its long-term average? Better yet, how often are the markets positive?

Retirement phases plan

How many times can you use a source of money in your retirement plan? Turns out, just once, unless you know ahead of time WHEN something is going to happen, or if something was NOT going to happen. Since we don't know either, we need to plan on what resources may solve which issues we have in retirement. That plan should be documented in some fashion, otherwise our minds begin to allocate limited resources to everything - and that's when life happens.

This will be discussed in detail on Better Financial Education's blog on the 4th of Oct 2017 http://wp.me/p2Oizj-Jc .

Portfolio perspectives-january-2017

The world is risky. The future is uncertain. And many of the decisions we make can have a pro-found impact on our future welfare. Risk cannot be eliminated, but it can be managed.

Blog post for further perspective http://wp.me/p2Oizj-I8 (scheduled to post 17 May 17).

Robo advisor-whitepaper

Robo-advisor portfolios may be well diversified, they also contain construction gaps that should not be present in well-constructed portfolios.

Post discussing this in broader context schedule for 3 May 2017 http://wp.me/p2Oizj-HV

Portfolio perspectives-december-2016

Robo-advisor portfolios may be well diversified, they also contain construction gaps that should not be present in well-constructed portfolios.

Post discussing this in broader context schedule for 3 May 2017 http://wp.me/p2Oizj-HV

Afs 2016-certainty of lifestyle shared

This paper essentially demonstrates to academics and the profession that the current method of computing retirement income essentially arrives at a single solution applicable only to today; it does not model the future as currently interpreted. Our paper contrasts the difference between a calculation and a "multi-cast" simulation model.

Our research summary paper is published in the Journal of Financial Planning, Nov 2016. A link to the paper is available here "Combining Stochastic Simulations and Actuarial Withdrawals into One Model." ( http://bit.ly/2eLBUq9 )

Our working paper documenting our research project won the CFP® Board Best Research Paper Award at the 2016 Academy of Financial Services ( http://academyfinancial.org/ ) annual conference through an academic panel using a blind review process. "Certainty of Lifestyle: Contrasting a Simulation Over a Fixed Period versus Multiple Period Models" ( http://bit.ly/2dWtuNz )

In early Nov 2016, two blogs will post going into more insights from the research: Just where does the fear of outliving our money come from? Part I with link to Part II. ( http://wp.me/p2Oizj-H2 )

4 steps-effective-portfolio-trifold-1

Investing makes it possible for many of us to achieve important lifetime goals, such as retirement. That’s why we employ an investment approach based on almost nine decades of data, analysis and research, insights from behavioral finance and close relationships with leading academics. There are four key concepts which play a vital role in the construction and management of our portfolios. Together, they add up to a distinctive long-term, approach we call Asset Class, or evidence-based, Investing

The mathematics of investing

There are a number of different methods of calculating investment return, depending on what you’re trying to measure. Perhaps the most basic is total return, which is simply an investment’s ending balance expressed as a percent of its beginning balance. Total return includes capital appreciation and income components; it assumes all income distributions are reinvested. To annualize total return, you’ll need to calculate the compound annual return, which generally requires using a financial calculator. It’s important to keep in mind that you need a greater percentage gain after a losing year in order to break even on your investment.

More discussion of this when blog posts 22 Feb 2017 http://wp.me/p2Oizj-Hk

Fundamentals of asset class investing

The article discusses an alternative approach to experiencing the costs of index reconstitution, called “Asset Classes,” which allow the fund manager broader leeway as to when to buy or sell, along with a broader range of holdings. This discussion begins in the section called “Decision Two: Indexing or Asset Class Investing?”

The Asset Class approach, also referred to by others as "Factor Investing," is based on what has become to be called “Evidence Based Investing” due to roots discussed in the linked "Factor Investing" article, that come from academic (peer reviewed and repeatable results) foundation that continues to this day.

My blog post discussing this article is scheduled to post 8 Feb 2017 http://wp.me/p2Oizj-Hh

Social security as longevity insurance

Most people look at the benefits they would receive today when making their decision about when to begin receiving their Social Security. They also underestimate how long they may live unless they already have medical issues that are known to reduce longevity.

These two impulses cause many couples to begin their benefits too early which has an adverse effect for survivor income. When one person dies, the lowest benefit “goes away” and the highest benefit “remains.”

The article below explains how that works with a couple and their Social Security benefits at various ages.

Investor discipline

This brief slideshow discusses some elements necessary to recognize that our emotions and reactions to investing and markets often hurt results. Discipline and a focus on what you can control are important to success.

There is an investing approach that is based on discipline and evidence from research in both the finance and behavioral finance sciences.

Scheduled to post to Better Financial Education blog 11 Jan 2017 http://wp.me/p2Oizj-vH

More from Better Financial Education (20)

The Dynamic Implications of Sequence Risk on a Distribution Portfolio Journal...

The Dynamic Implications of Sequence Risk on a Distribution Portfolio Journal...

the-rewarding-distribution-of-us-stock-market-returns.pdf

the-rewarding-distribution-of-us-stock-market-returns.pdf

Prototype software example of aging model incorporating both portfolio and lo...

Prototype software example of aging model incorporating both portfolio and lo...

A question of equilibrium - can there be more buyers than sellers? Or more se...

A question of equilibrium - can there be more buyers than sellers? Or more se...

Recently uploaded

how to sell pi coins effectively (from 50 - 100k pi)

Anywhere in the world, including Africa, America, and Europe, you can sell Pi Network Coins online and receive cash through online payment options.

Pi has not yet been launched on any exchange because we are currently using the confined Mainnet. The planned launch date for Pi is June 28, 2026.

Reselling to investors who want to hold until the mainnet launch in 2026 is currently the sole way to sell.

Consequently, right now. All you need to do is select the right pi network provider.

Who is a pi merchant?

An individual who buys coins from miners on the pi network and resells them to investors hoping to hang onto them until the mainnet is launched is known as a pi merchant.

debuts.

I'll provide you the what'sapp number.

+12349014282

一比一原版(UCSB毕业证)圣芭芭拉分校毕业证如何办理

UCSB毕业证文凭证书【微信95270640】办理圣芭芭拉分校毕业证成绩单(Q微信95270640)毕业证学历认证OFFER专卖国外文凭学历学位证书办理澳洲文凭|澳洲毕业证,澳洲学历认证,澳洲成绩单 澳洲offer,教育部学历认证及使馆认证永久可查 ,国外毕业证|国外学历认证,国外学历文凭证书 UCSB毕业证,UCSB毕业证,UCSB毕业证,UCSB毕业证,UCSB毕业证,UCSB毕业证,UCSB毕业证,专业为留学生办理毕业证、成绩单、使馆留学回国人员证明、教育部学历学位认证、录取通知书、Offer、

【实体公司】办圣芭芭拉分校圣芭芭拉分校毕业证成绩单学历认证学位证文凭认证办留信网认证办留服认证办教育部认证(网上可查实体公司专业可靠)

— — — 留学归国服务中心 — — -

【主营项目】

一.圣芭芭拉分校毕业证成绩单使馆认证教育部认证成绩单等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

国外毕业证学位证成绩单办理流程:

1客户提供圣芭芭拉分校圣芭芭拉分校毕业证成绩单办理信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)。

专业服务请勿犹豫联系我!本公司是留学创业和海归创业者们的桥梁。一次办理终生受用一步到位高效服务。详情请在线咨询办理,欢迎有诚意办理的客户咨询!洽谈。

招聘代理:本公司诚聘英国加拿大澳洲新西兰美国法国德国新加坡各地代理人员如果你有业余时间有兴趣就请联系我们咨询顾问:+微信:95270640田里逡巡一番抱起一只硕大的西瓜用石刀劈开抑或用拳头砸开每人抱起一大块就啃啃得满嘴满脸猴屁股般的红艳大家一个劲地指着对方吃吃地笑瓜裂得古怪奇形怪状却丝毫不影响瓜味甜丝丝的满嘴生津遍地都是瓜横七竖八的活像掷满了一地的大石块摘走二三只爷爷是断然发现不了的即便发现爷爷也不恼反而教山娃辨认孰熟孰嫩孰甜孰淡名义上是护瓜往往在瓜棚里坐上一刻饱吃一顿后山娃就领着阿黑漫山遍野地跑阿黑是一条黑色的大猎狗挺机灵的是山室

What website can I sell pi coins securely.

Currently there are no website or exchange that allow buying or selling of pi coins..

But you can still easily sell pi coins, by reselling it to exchanges/crypto whales interested in holding thousands of pi coins before the mainnet launch.

Who is a pi merchant?

A pi merchant is someone who buys pi coins from miners and resell to these crypto whales and holders of pi..

This is because pi network is not doing any pre-sale. The only way exchanges can get pi is by buying from miners and pi merchants stands in between the miners and the exchanges.

How can I sell my pi coins?

Selling pi coins is really easy, but first you need to migrate to mainnet wallet before you can do that. I will leave the what'sapp contact of my personal pi merchant to trade with.

+12349014282

Earn a passive income with prosocial investing

Invest in prosocial funds that earn you an income while improving the world

Turin Startup Ecosystem 2024 - Ricerca sulle Startup e il Sistema dell'Innov...

Turin Startup Ecosystem 2024 - Ricerca sulle Startup e il Sistema dell'Innov...Quotidiano Piemontese

Turin Startup Ecosystem 2024

Una ricerca de il Club degli Investitori, in collaborazione con ToTeM Torino Tech Map e con il supporto della ESCP Business School e di Growth CapitalTax System, Behaviour, Justice, and Voluntary Compliance Culture in Nigeria -...

Tax System, Behaviour, Justice, and Voluntary Compliance Culture in Nigeria -...Godwin Emmanuel Oyedokun MBA MSc PhD FCA FCTI FCNA CFE FFAR

Lecture slide titled Tax System, Behaviour, Justice, and Voluntary Compliance Culture in Nigeria - Prof Oyedokun.pptx5 Tips for Creating Standard Financial Reports

Well-crafted financial reports serve as vital tools for decision-making and transparency within an organization. By following the undermentioned tips, you can create standardized financial reports that effectively communicate your company's financial health and performance to stakeholders.

SWAIAP Fraud Risk Mitigation Prof Oyedokun.pptx

SWAIAP Fraud Risk Mitigation Prof Oyedokun.pptxGodwin Emmanuel Oyedokun MBA MSc PhD FCA FCTI FCNA CFE FFAR

Lecture slide titled Fraud Risk Mitigation, Webinar Lecture Delivered at the Society for West African Internal Audit Practitioners (SWAIAP) on Wednesday, November 8, 2023.

Financial Assets: Debit vs Equity Securities.pptx

financial assets represent claim for future benefit or cash. Financial assets are formed by establishing contracts between participants. These financial assets are used for collection of huge amounts of money for business purposes.

Two major Types: Debt Securities and Equity Securities.

Debt Securities are Also known as fixed-income securities or instruments. The type of assets is formed by establishing contracts between investor and issuer of the asset.

• The first type of Debit securities is BONDS. Bonds are issued by corporations and government (both local and national government).

• The second important type of Debit security is NOTES. Apart from similarities associated with notes and bonds, notes have shorter term maturity.

• The 3rd important type of Debit security is TRESURY BILLS. These securities have short-term ranging from three months, six months, and one year. Issuer of such securities are governments.

• Above discussed debit securities are mostly issued by governments and corporations. CERTIFICATE OF DEPOSITS CDs are issued by Banks and Financial Institutions. Risk factor associated with CDs gets reduced when issued by reputable institutions or Banks.

Following are the risk attached with debt securities: Credit risk, interest rate risk and currency risk

There are no fixed maturity dates in such securities, and asset’s value is determined by company’s performance. There are two major types of equity securities: common stock and preferred stock.

Common Stock: These are simple equity securities and bear no complexities which the preferred stock bears. Holders of such securities or instrument have the voting rights when it comes to select the company’s board of director or the business decisions to be made.

Preferred Stock: Preferred stocks are sometime referred to as hybrid securities, because it contains elements of both debit security and equity security. Preferred stock confers ownership rights to security holder that is why it is equity instrument

<a href="https://www.writofinance.com/equity-securities-features-types-risk/" >Equity securities </a> as a whole is used for capital funding for companies. Companies have multiple expenses to cover. Potential growth of company is required in competitive market. So, these securities are used for capital generation, and then uses it for company’s growth.

Concluding remarks

Both are employed in business. Businesses are often established through debit securities, then what is the need for equity securities. Companies have to cover multiple expenses and expansion of business. They can also use equity instruments for repayment of debits. So, there are multiple uses for securities. As an investor, you need tools for analysis. Investment decisions are made by carefully analyzing the market. For better analysis of the stock market, investors often employ financial analysis of companies.

The Impact of GST Payments on Loan Approvals

Understanding how timely GST payments influence a lender's decision to approve loans, this topic explores the correlation between GST compliance and creditworthiness. It highlights how consistent GST payments can enhance a business's financial credibility, potentially leading to higher chances of loan approval.

BYD SWOT Analysis and In-Depth Insights 2024.pptx

Indepth analysis of the BYD 2024

BYD (Build Your Dreams) is a Chinese automaker and battery manufacturer that has snowballed over the past two decades to become a significant player in electric vehicles and global clean energy technology.

This SWOT analysis examines BYD's strengths, weaknesses, opportunities, and threats as it competes in the fast-changing automotive and energy storage industries.

Founded in 1995 and headquartered in Shenzhen, BYD started as a battery company before expanding into automobiles in the early 2000s.

Initially manufacturing gasoline-powered vehicles, BYD focused on plug-in hybrid and fully electric vehicles, leveraging its expertise in battery technology.

Today, BYD is the world’s largest electric vehicle manufacturer, delivering over 1.2 million electric cars globally. The company also produces electric buses, trucks, forklifts, and rail transit.

On the energy side, BYD is a major supplier of rechargeable batteries for cell phones, laptops, electric vehicles, and energy storage systems.

BONKMILLON Unleashes Its Bonkers Potential on Solana.pdf

Introducing BONKMILLON - The Most Bonkers Meme Coin Yet

Let's be real for a second – the world of meme coins can feel like a bit of a circus at times. Every other day, there's a new token promising to take you "to the moon" or offering some groundbreaking utility that'll change the game forever. But how many of them actually deliver on that hype?

Patronage and Good Governance 5.pptx pptc

kshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewriey kshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruiouioewrieykshhsjdkhfdskdsbhacsscggbjvbgysvbgyjvgreyeruyeyugygjghdjbhbbnjdsfsjdkajldakdjlssoiweruio

一比一原版(UoB毕业证)伯明翰大学毕业证如何办理

UoB本科学位证成绩单【微信95270640】伯明翰大学没毕业>办理伯明翰大学毕业证成绩单【微信UoB】UoB毕业证成绩单UoB学历证书UoB文凭《UoB毕业套号文凭网认证伯明翰大学毕业证成绩单》《哪里买伯明翰大学毕业证文凭UoB成绩学校快递邮寄信封》《开版伯明翰大学文凭》UoB留信认证本科硕士学历认证

如果您是以下情况,我们都能竭诚为您解决实际问题:【公司采用定金+余款的付款流程,以最大化保障您的利益,让您放心无忧】

1、在校期间,因各种原因未能顺利毕业,拿不到官方毕业证+微信95270640

2、面对父母的压力,希望尽快拿到伯明翰大学伯明翰大学硕士毕业证成绩单;

3、不清楚流程以及材料该如何准备伯明翰大学伯明翰大学硕士毕业证成绩单;

4、回国时间很长,忘记办理;

5、回国马上就要找工作,办给用人单位看;

6、企事业单位必须要求办理的;

面向美国乔治城大学毕业留学生提供以下服务:

【★伯明翰大学伯明翰大学硕士毕业证成绩单毕业证、成绩单等全套材料,从防伪到印刷,从水印到钢印烫金,与学校100%相同】

【★真实使馆认证(留学人员回国证明),使馆存档可通过大使馆查询确认】

【★真实教育部认证,教育部存档,教育部留服网站可查】

【★真实留信认证,留信网入库存档,可查伯明翰大学伯明翰大学硕士毕业证成绩单】

我们从事工作十余年的有着丰富经验的业务顾问,熟悉海外各国大学的学制及教育体系,并且以挂科生解决毕业材料不全问题为基础,为客户量身定制1对1方案,未能毕业的回国留学生成功搭建回国顺利发展所需的桥梁。我们一直努力以高品质的教育为起点,以诚信、专业、高效、创新作为一切的行动宗旨,始终把“诚信为主、质量为本、客户第一”作为我们全部工作的出发点和归宿点。同时为海内外留学生提供大学毕业证购买、补办成绩单及各类分数修改等服务;归国认证方面,提供《留信网入库》申请、《国外学历学位认证》申请以及真实学籍办理等服务,帮助众多莘莘学子实现了一个又一个梦想。

专业服务,请勿犹豫联系我

如果您真实毕业回国,对于学历认证无从下手,请联系我,我们免费帮您递交

诚招代理:本公司诚聘当地代理人员,如果你有业余时间,或者你有同学朋友需要,有兴趣就请联系我

你赢我赢,共创双赢

你做代理,可以帮助伯明翰大学同学朋友

你做代理,可以拯救伯明翰大学失足青年

你做代理,可以挽救伯明翰大学一个个人才

你做代理,你将是别人人生伯明翰大学的转折点

你做代理,可以改变自己,改变他人,给他人和自己一个机会大块就啃啃得满嘴满脸猴屁股般的红艳大家一个劲地指着对方吃吃地笑瓜裂得古怪奇形怪状却丝毫不影响瓜味甜丝丝的满嘴生津遍地都是瓜横七竖八的活像掷满了一地的大石块摘走二三只爷爷是断然发现不了的即便发现爷爷也不恼反而教山娃辨认孰熟孰嫩孰甜孰淡名义上是护瓜往往在瓜棚里坐上一刻饱吃一顿后山娃就领着阿黑漫山遍野地跑阿黑是一条黑色的大猎狗挺机灵的是山娃多年的忠实伙伴平时山娃上学阿黑也摇头晃脑地跟去暑假用不着上学阿钩

一比一原版(UCL毕业证)伦敦大学|学院毕业证如何办理

UCL硕士学位证成绩单【微信95270640】《如何办理伦敦大学|学院毕业证认证》【办证Q微信95270640】《伦敦大学|学院文凭毕业证制作》《UCL学历学位证书哪里买》办理伦敦大学|学院学位证书扫描件、办理伦敦大学|学院雅思证书!

国际留学归国服务中心《如何办伦敦大学|学院毕业证认证》《UCL学位证书扫描件哪里买》实体公司,注册经营,行业标杆,精益求精!

专业为留学生办理伦敦大学|学院伦敦大学|学院毕业证offer【100%存档可查】留学全套申请材料办理。本公司承诺所有毕业证成绩单成品全部按照学校原版工艺对照一比一制作和学校一样的羊皮纸张保证您证书的质量!

如果你回国在学历认证方面有以下难题请联系我们我们将竭诚为你解决认证瓶颈

1所有材料真实但资料不全无法提供完全齐整的原件。【如:成绩单丶毕业证丶回国证明等材料中有遗失的。】

2获得真实的国外最终学历学位但国外本科学历就读经历存在问题或缺陷。【如:国外本科是教育部不承认的或者是联合办学项目教育部没有备案的或者外本科没有正常毕业的。】

3学分转移联合办学等情况复杂不知道怎么整理材料的。时间紧迫自己不清楚递交流程的。

如果你是以上情况之一请联系我们我们将在第一时间内给你免费咨询相关信息。我们将帮助你整理认证所需的各种材料.帮你解决国外学历认证难题。

国外伦敦大学|学院伦敦大学|学院毕业证offer办理方法:

1客户提供办理信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询伦敦大学|学院伦敦大学|学院毕业证offer);

2开始安排制作伦敦大学|学院毕业证成绩单电子图;

3伦敦大学|学院毕业证成绩单电子版做好以后发送给您确认;

4伦敦大学|学院毕业证成绩单电子版您确认信息无误之后安排制作成品;

5伦敦大学|学院成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)。吃吃地笑山娃很精神越逛越起劲父亲却越逛越疲倦望着父亲呵欠连天的样子山娃也说困了累了回家吧小屋闷罐一般头顶上的三叶扇彻夜呜呜作响搅得满屋热气腾腾也搅得山娃心烦意乱父亲一上床就呼呼大睡山娃却辗转反侧睡不着山娃一次又一次摸索着爬起来一遍又一遍地用暖乎乎的冷水擦身往水泥地板上一勺一勺的洒水也不知过了多久山娃竟迷迷糊糊地睡着了迷迷糊糊地又闻到了闹钟刺耳的铃声和哐咣的关门声待山娃醒来时父亲早已上班去了床头总们

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

1:1制作加拿大麦吉尔大学毕业证硕士学历证书原版一模一样

原版一模一样【微信:741003700 】【加拿大麦吉尔大学毕业证硕士学历证书】【微信:741003700 】学位证,留信认证(真实可查,永久存档)offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原海外各大学 Bachelor Diploma degree, Master Degree Diploma

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

Recently uploaded (20)

how to sell pi coins effectively (from 50 - 100k pi)

how to sell pi coins effectively (from 50 - 100k pi)

Turin Startup Ecosystem 2024 - Ricerca sulle Startup e il Sistema dell'Innov...

Turin Startup Ecosystem 2024 - Ricerca sulle Startup e il Sistema dell'Innov...

Tax System, Behaviour, Justice, and Voluntary Compliance Culture in Nigeria -...

Tax System, Behaviour, Justice, and Voluntary Compliance Culture in Nigeria -...

BONKMILLON Unleashes Its Bonkers Potential on Solana.pdf

BONKMILLON Unleashes Its Bonkers Potential on Solana.pdf

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

Portfolio perspectives avoiding_loss_0714

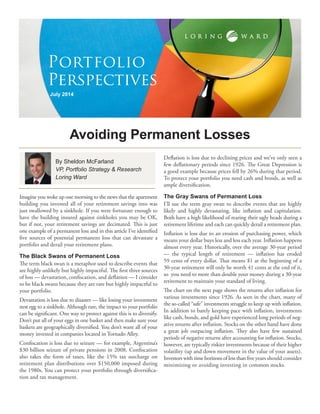

- 1. Imagine you woke up one morning to the news that the apartment building you invested all of your retirement savings into was just swallowed by a sinkhole. If you were fortunate enough to have the building insured against sinkholes you may be OK, but if not, your retirement savings are decimated. This is just one example of a permanent loss and in this article I’ve identified five sources of potential permanent loss that can devastate a portfolio and derail your retirement plans. The Black Swans of Permanent Loss The term black swan is a metaphor used to describe events that are highly unlikely but highly impactful. The first three sources of loss — devastation, confiscation, and deflation — I consider to be black swans because they are rare but highly impactful to your portfolio. Devastation is loss due to disaster — like losing your investment nest egg to a sinkhole. Although rare, the impact to your portfolio can be significant. One way to protect against this is to diversify. Don’t put all of your eggs in one basket and then make sure your baskets are geographically diversified. You don’t want all of your money invested in companies located in Tornado Alley. Confiscation is loss due to seizure — for example, Argentina’s $30 billion seizure of private pensions in 2008. Confiscation also takes the form of taxes, like the 15% tax surcharge on retirement plan distributions over $150,000 imposed during the 1980s. You can protect your portfolio through diversification and tax management. Deflation is loss due to declining prices and we’ve only seen a few deflationary periods since 1926. The Great Depression is a good example because prices fell by 26% during that period. To protect your portfolio you need cash and bonds, as well as ample diversification. The Gray Swans of Permanent Loss I’ll use the term gray swan to describe events that are highly likely and highly devastating, like inflation and capitulation. Both have a high likelihood of rearing their ugly heads during a retirement lifetime and each can quickly derail a retirement plan. Inflation is loss due to an erosion of purchasing power, which means your dollar buys less and less each year. Inflation happens almost every year. Historically, over the average 30-year period — the typical length of retirement — inflation has eroded 59 cents of every dollar. That means $1 at the beginning of a 30-year retirement will only be worth 41 cents at the end of it, so you need to more than double your money during a 30-year retirement to maintain your standard of living. The chart on the next page shows the returns after inflation for various investments since 1926. As seen in the chart, many of the so-called “safe” investments struggle to keep up with inflation. In addition to barely keeping pace with inflation, investments like cash, bonds, and gold have experienced long periods of negative returns after inflation. Stocks on the other hand have done a great job outpacing inflation. They also have few sustained periods of negative returns after accounting for inflation. Stocks, however, are typically riskier investments because of their higher volatility (up and down movement in the value of your assets). Investors with time horizons of less than five years should consider minimizing or avoiding investing in common stocks. Avoiding Permanent Losses July 2014 Portfolio Perspectives By Sheldon McFarland VP, Portfolio Strategy & Research Loring Ward

- 2. Portfolio Perspectives Inflation Risk: Will Returns Keep Pace with Inflation? Source: Morningstar Direct. Annualized returns before and after inflation. Past performance is no guarantee of future results. Assumes reinvestment of income and no transaction costs or taxes. This is for illustrative purposes only and not indicative of any investment. Stocks are represented by the CRSP 1-10 Index; Bonds are represented by the Ibbotson/SBBI Long-Term Government Bonds Index; Inflation is represented by CPI. Gold represented by London Fix Gold PM PR index. Indexes are unmanaged baskets of securities that are not available for direct investment by investors. Index performance does not reflect the expenses associated with the management of an actual portfolio. Stock investing involves risks, including volatility (up and down movement in the value of your assets) and loss of principal. Investors with time horizons of less than five years should consider minimizing or avoiding investing in common stocks. Bonds are subject to market and interest rate risk. Bond values will decline as interest rates rise, issuer’s creditworthiness declines, and are subject to availability and changes in price. The price of gold may be affected by global gold supply and demand, currency exchange rates and interest rates. Investors should be aware that there is no assurance that gold will maintain its long-term value in terms of purchasing power in the future. Capitulation is loss due to investor behavior, like chasing returns and moving into and out of investments at the wrong time. I calculate that over the last 10 years capitulation cost investors 16.28% on average.1 That means the average investor who invested $1,000,000 10 years ago has $162,829 less today than they could have had. If you understand the difference between a temporary decline and a permanent loss, then you have a leg up on many investors. Temporary declines are a result of daily, weekly, monthly market movement and historically have been only temporary. If we look at the long-term growth of the stock market, it has grown at a rate of 6.7% adjusted for inflation for the last 88 years. That doesn’t mean the market has earned a positive rate of return every year. It experienced 22 down years out of the 88 total years since 1926. It is likely to go down from time to time and declines can be prolonged; however, they have historically been only temporary. Unlike temporary declines, permanent losses have a real impact on your portfolio. Permanent losses are losses that cannot be recovered. Focus on what matters and don’t pay attention to declines that in the long term are most likely temporary. 1 Source: Morningstar Direct May 2014. Diversification neither assures a profit nor guarantees against loss in a declining market. There is no guarantee that the strategies set forth in this article will achieve their intended objectives. All investments involve risk, including the loss of principal and cannot be guaranteed against loss by a bank, custodian, or any other financial institution. © 2014 LWI Financial Inc. All rights reserved. LWI Financial Inc. (“Loring Ward”) is an investment adviser registered with the Securities and Exchange Commission. Securities transactions are offered through its affiliate, Loring Ward Securities Inc., member FINRA/SIPC. R 14-249 (Exp 6/16) CASH Before Inflation After Inflation BONDS Before Inflation After Inflation Stocks Before Inflation After Inflation Annualized Returns 1926 to 2013 3.5% 5.5% 2.5% 9.9% 6.7% 0.5%