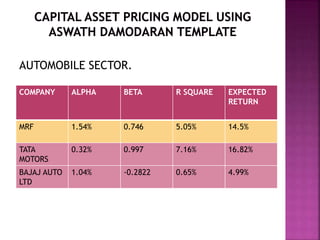

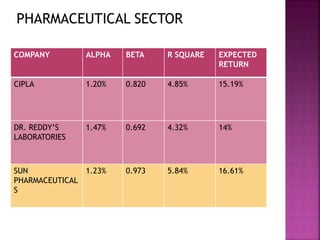

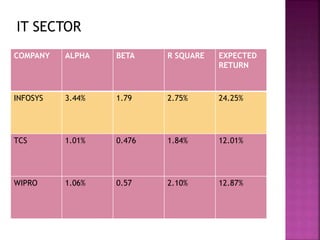

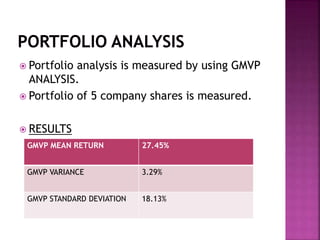

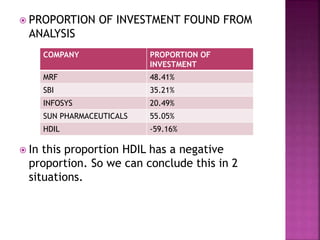

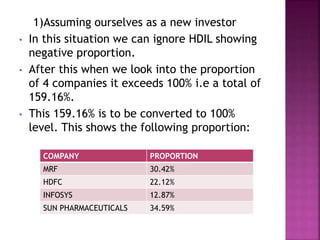

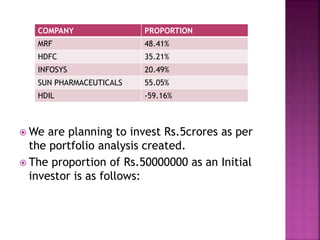

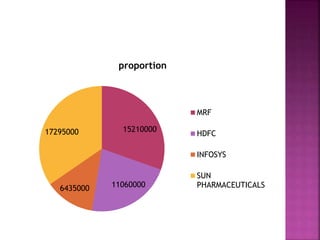

The document discusses selecting companies to create a portfolio with minimum risk and maximum return. 15 companies across 5 sectors were analyzed using CAPM. This identified the best performing company from each sector: MRF from automobiles, HDFC from banking, Sun Pharmaceuticals from pharmaceuticals, Infosys from IT, and HDIL from real estate. Portfolio analysis using GMVP found an expected return of 27.45% and variance of 3.29%. The optimal investment proportions across the companies were calculated except for HDIL which showed a negative proportion.