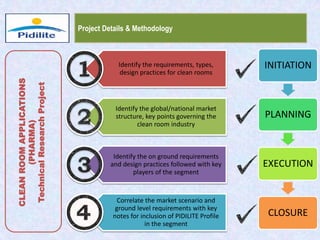

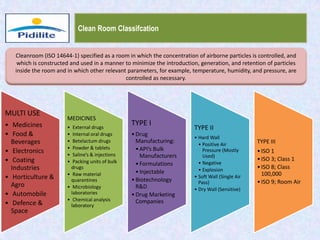

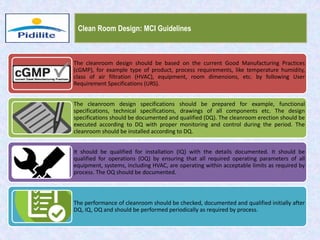

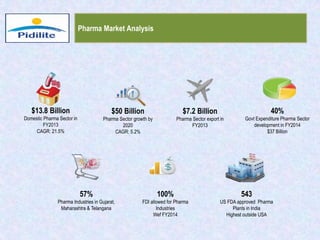

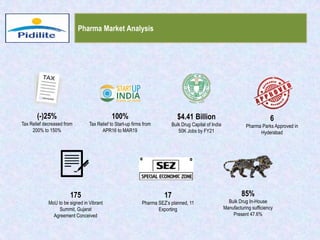

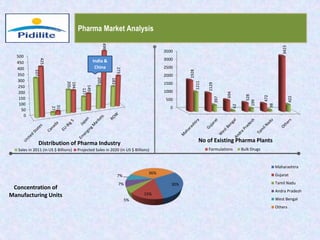

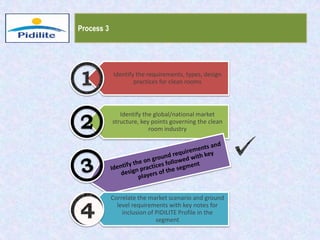

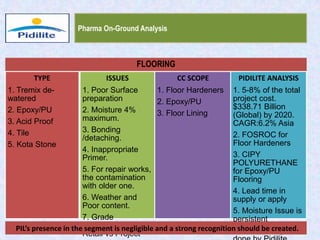

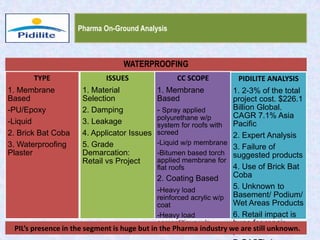

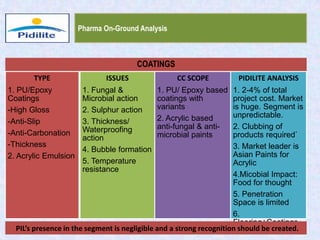

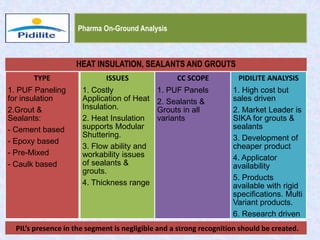

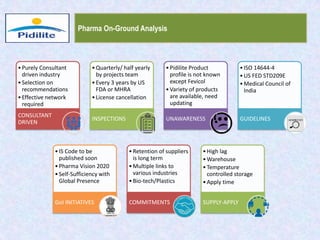

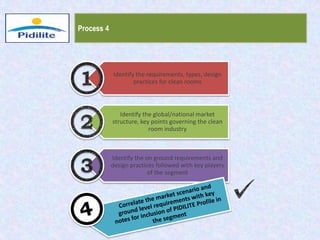

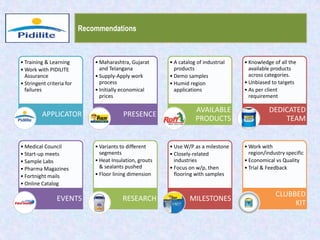

This document summarizes a market analysis report on the Indian pharmaceutical industry. It identifies key requirements for clean rooms including classifications, design practices, and issues in flooring, waterproofing, and coatings. It analyzes the market size and growth rates. On-ground requirements are identified for various segments. Recommendations are provided to increase PIDILITE's presence including dedicated teams, product varieties, applicator training, and attending industry events. A SWOT analysis identifies strengths in product development and weaknesses in awareness and approvals. Opportunities exist in market growth and threats include consultant-driven buying and high failure costs.