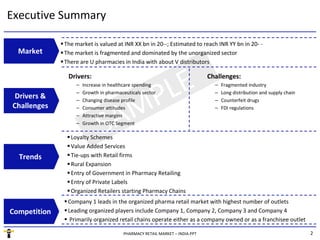

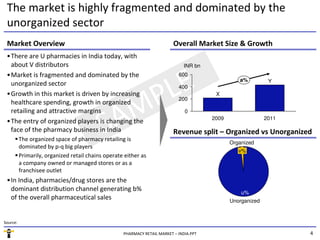

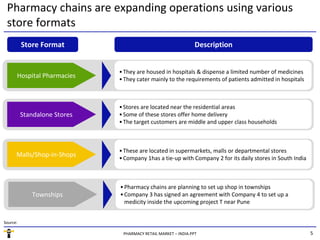

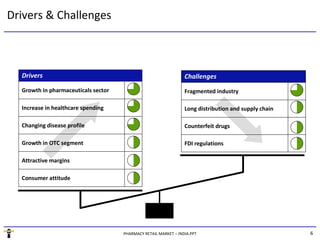

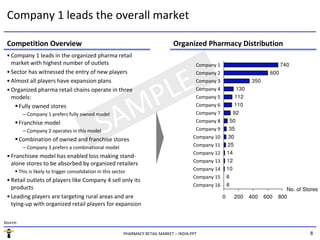

The pharmacy retail market in India is valued at INR xx billion and is expected to grow due to increasing healthcare spending and the entry of organized players. The market is highly fragmented, dominated by the unorganized sector, with major competition among several organized chains. Key trends include the growth of OTC segments, loyalty schemes, and rural expansions, alongside challenges from counterfeit drugs and a lengthy distribution chain.