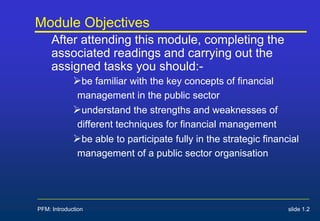

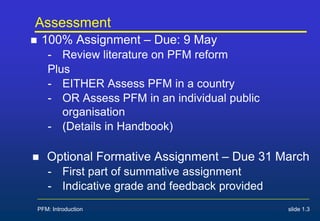

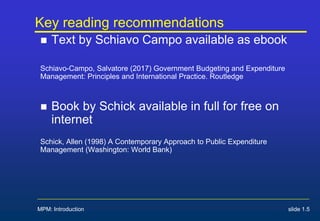

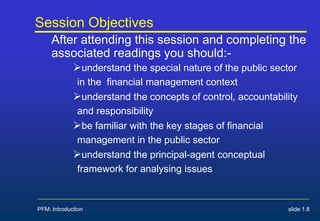

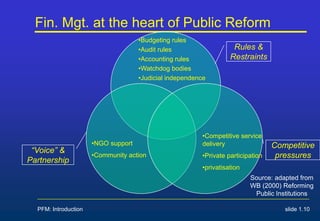

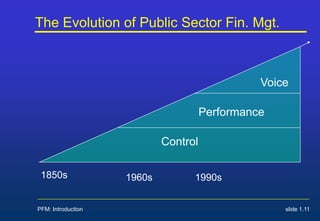

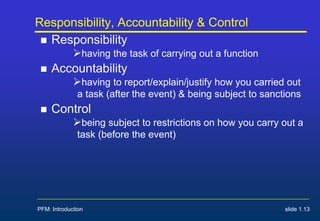

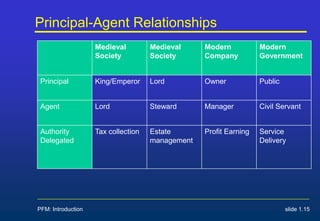

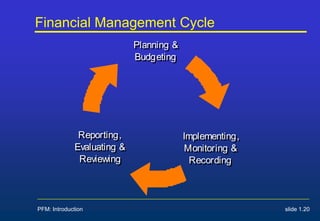

This document provides an introduction to a module on Public Financial Management (PFM). The module objectives are to familiarize students with key PFM concepts, understand different financial management techniques, and participate in strategic financial management. Assessments include a literature review and country or organization case study. Key readings are recommended and issues are addressed. The document covers concepts like responsibility, accountability, and control in PFM. It discusses principal-agent relationships and how financial management applies the planning, budgeting, implementation, reporting cycle in the public sector context.