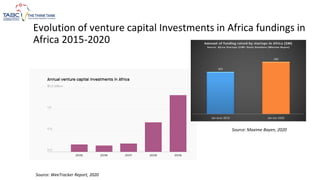

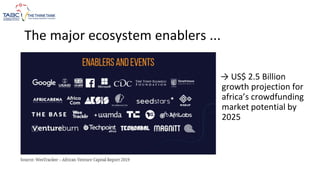

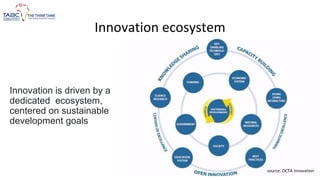

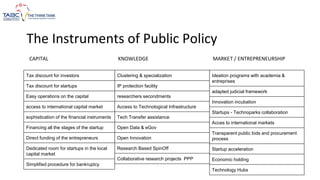

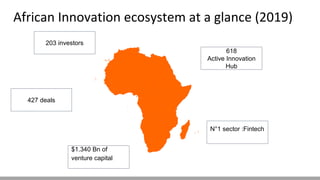

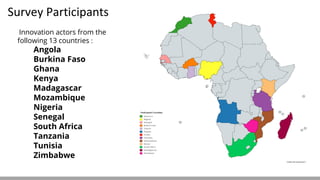

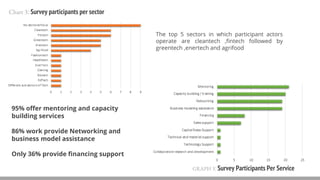

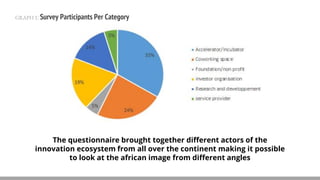

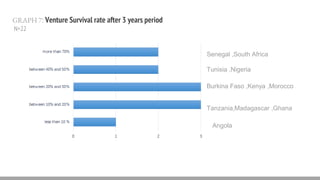

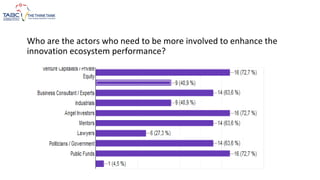

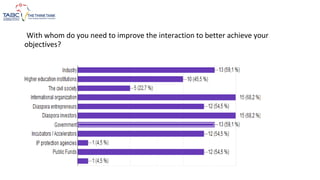

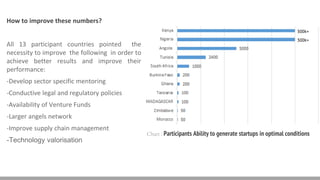

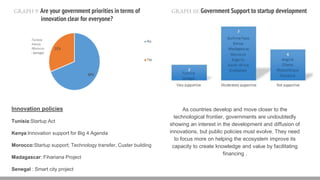

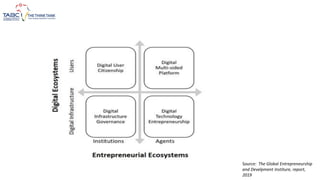

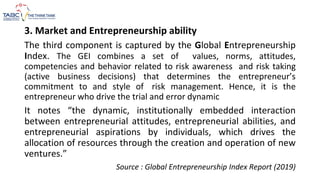

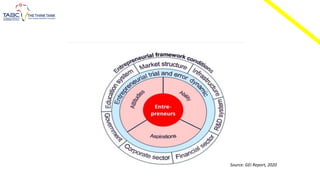

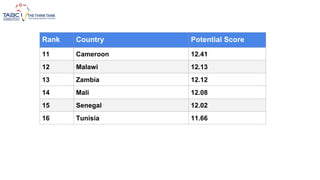

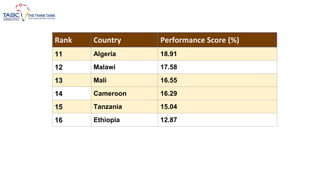

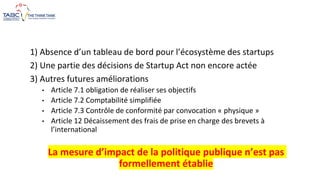

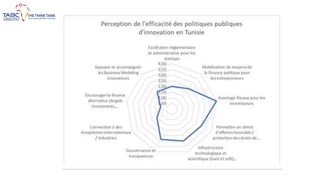

The document discusses the innovation ecosystem landscape in Africa, highlighting major enablers, venture capital investments, and the impacts of the COVID-19 pandemic on startups. It emphasizes the growth of startup hubs across various cities and presents a case study on Tunisia, pointing out barriers to innovation and the need for public policy reform. Additionally, it outlines the performance metrics of startups across several African countries and suggests improvements in mentoring, funding, and regulatory policies to enhance the innovation ecosystem.