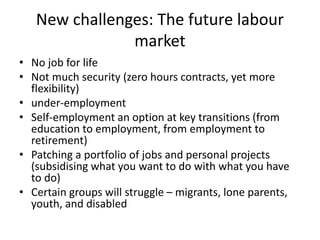

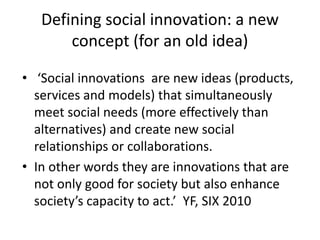

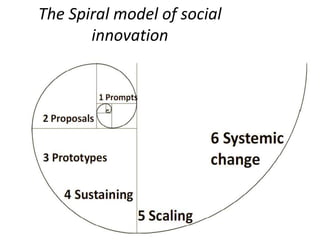

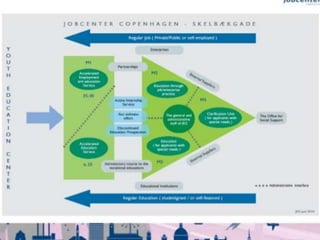

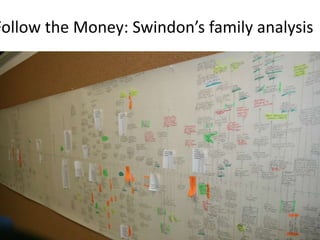

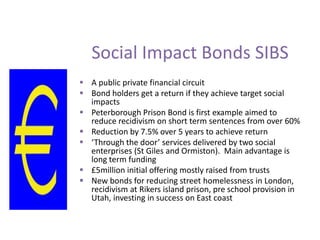

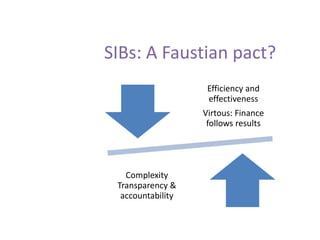

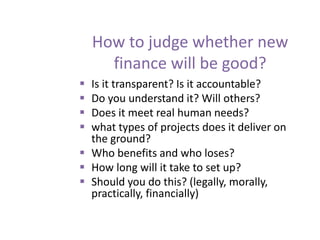

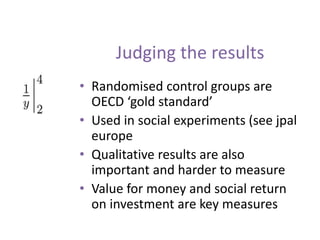

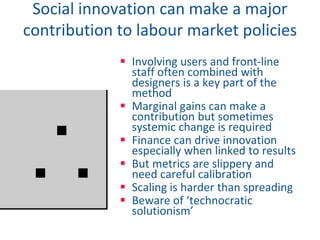

The document discusses social innovation in the labor market, highlighting the transition from traditional employment to a more flexible, portfolio-based approach. It emphasizes the role of public sector in fostering innovation through methods like co-creation and tailored solutions, while also addressing the challenges faced by vulnerable groups. Additionally, it explores new financing models such as microfinance and social impact bonds that aim to support innovative projects and improve outcomes in the labor market.