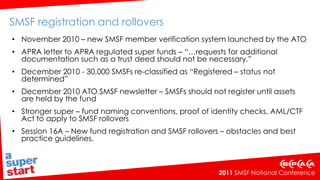

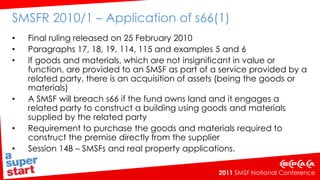

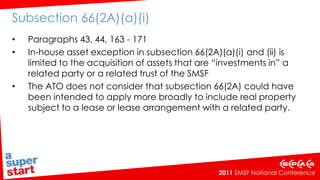

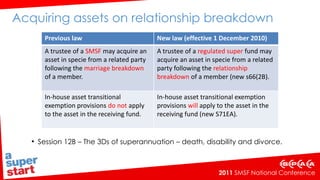

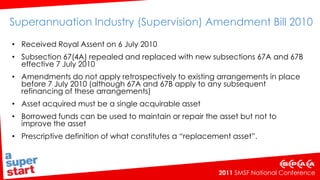

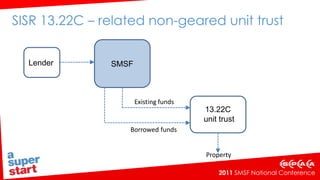

This document provides an overview of an SMSF session covering topics like SMSF registration and rollovers, acquisition of related party assets, payment of benefits, contributions, limited recourse borrowing arrangements, in-house assets, and the government's response to the Cooper Review. Key points include new SMSF registration requirements under Stronger Super, rules around acquiring assets from related parties, determining when a benefit has been "cashed," updates to limited recourse borrowing arrangements, and potential changes to in-house asset and collectibles rules.