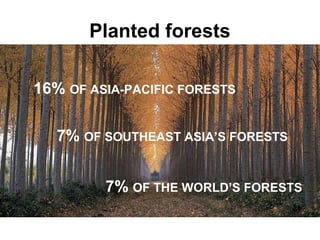

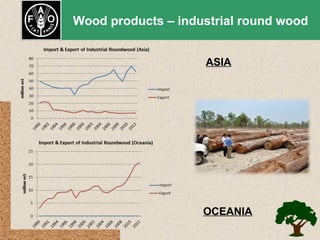

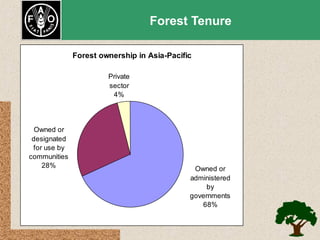

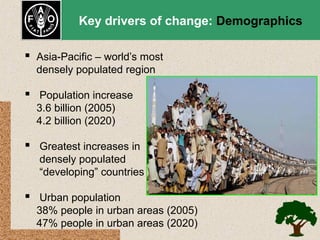

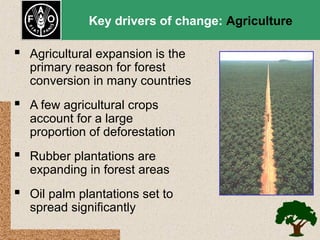

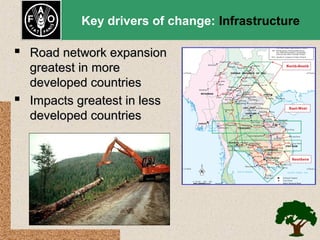

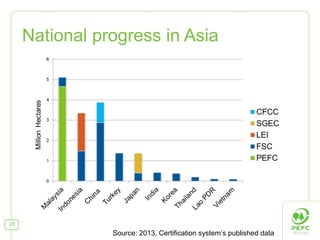

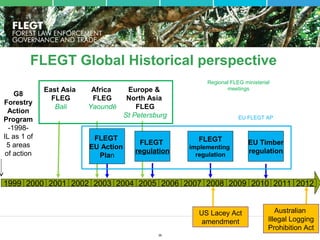

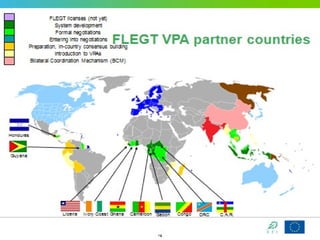

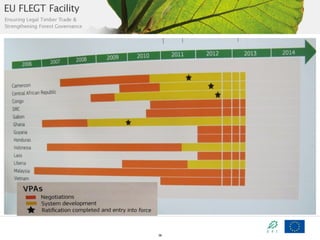

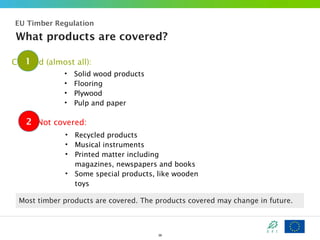

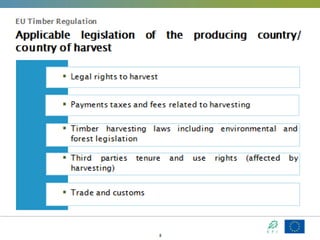

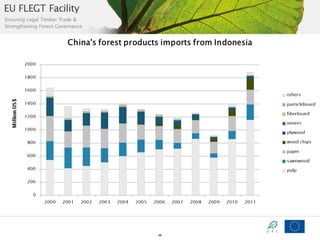

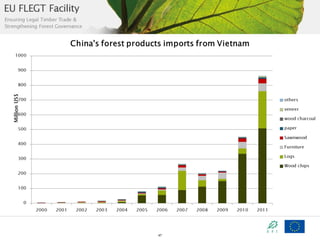

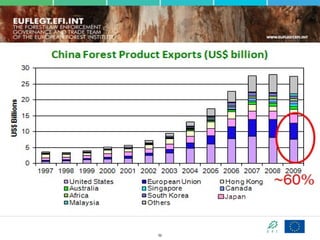

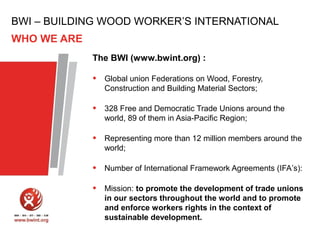

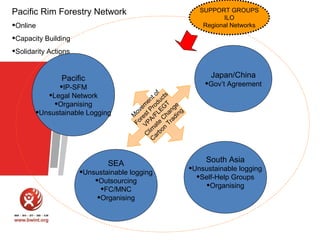

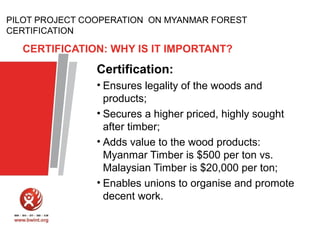

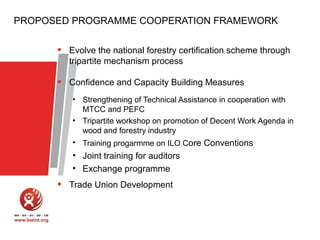

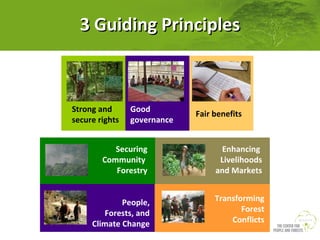

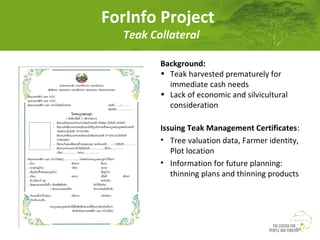

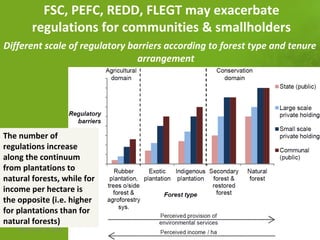

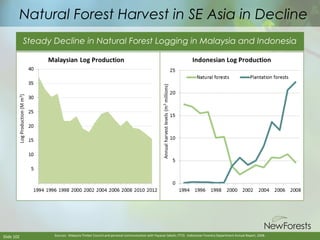

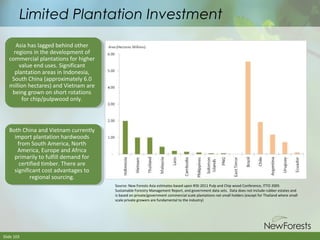

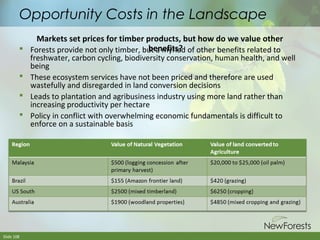

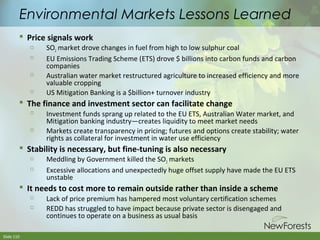

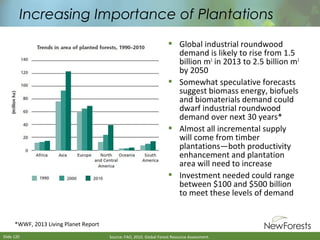

The document discusses the state of forestry in the Asia-Pacific region, focusing on timber certification, forest cover changes, and the links between sustainable forest management and various socio-economic factors. It highlights critical drivers of change, including demographics, economics, agriculture, infrastructure, politics, and societal concerns, emphasizing the need for improved governance and stakeholder participation. Additionally, it outlines initiatives like the EU FLEGT action plan and various certification efforts aimed at promoting sustainable forest practices in the region.