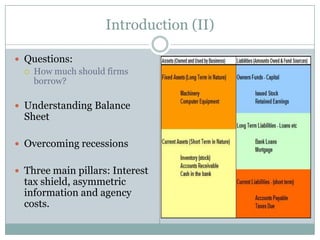

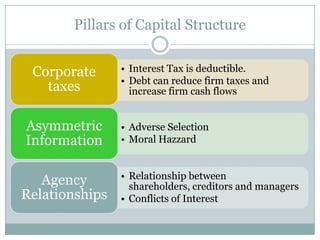

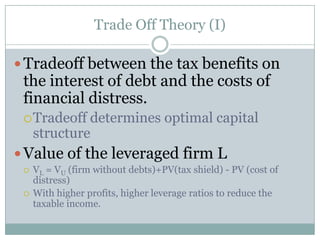

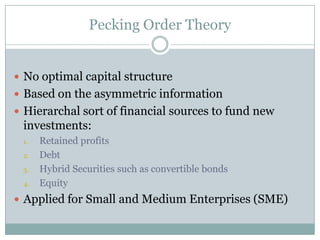

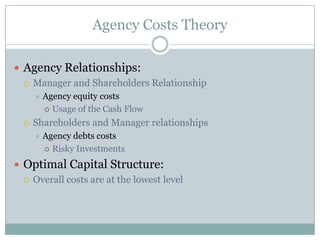

This document discusses capital structure and the different theories around the optimal leverage level for firms. It covers the trade-off theory, which balances the tax benefits of debt against the costs of financial distress, and the pecking order theory, which states firms fund investments first through retained earnings, then debt, and finally equity. It also discusses agency costs theory and how the relationships between shareholders, creditors, and managers influence capital structure. The conclusion is that no single theory can fully explain capital structure choices and the optimal leverage level depends on firm-specific characteristics.