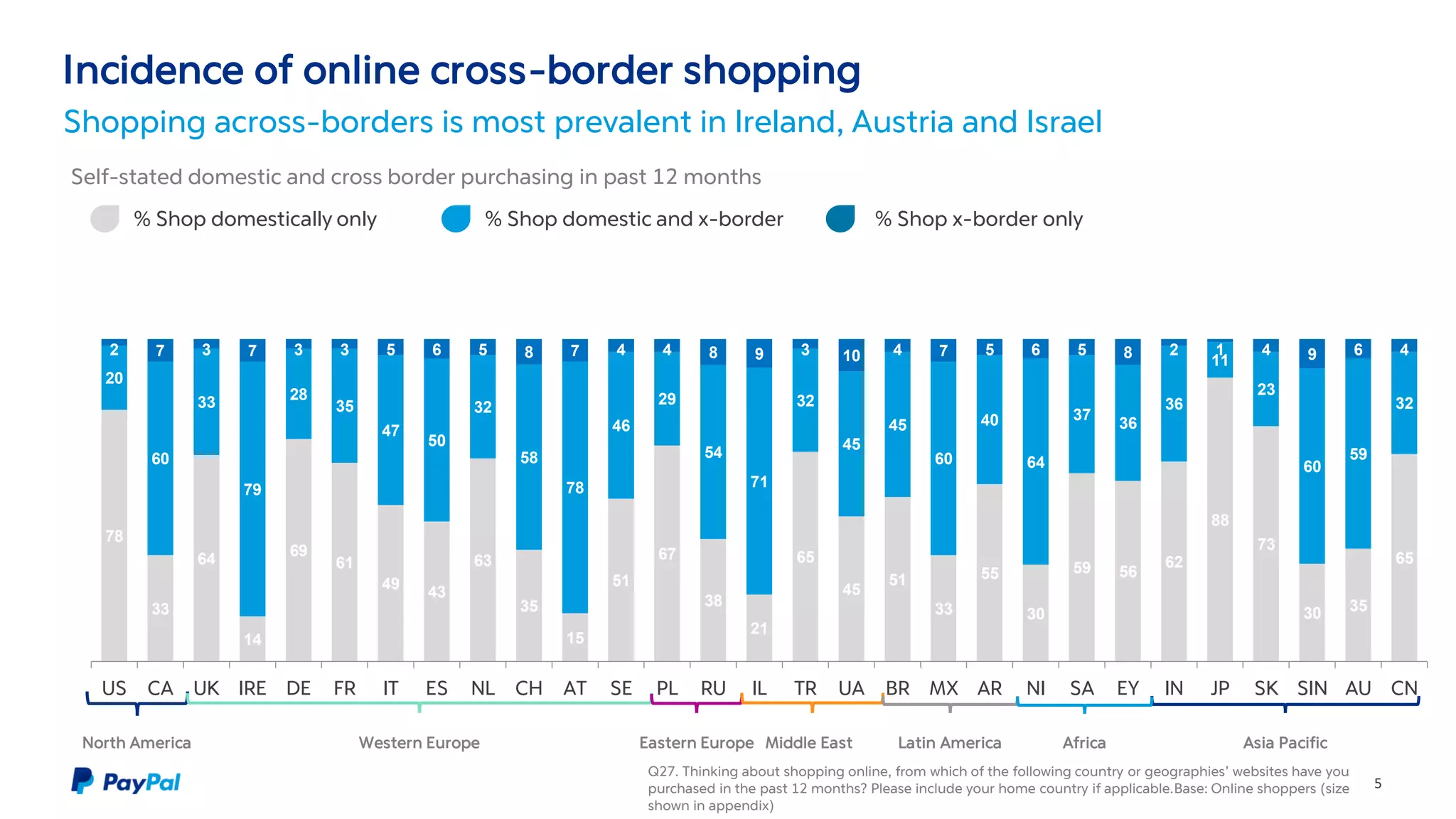

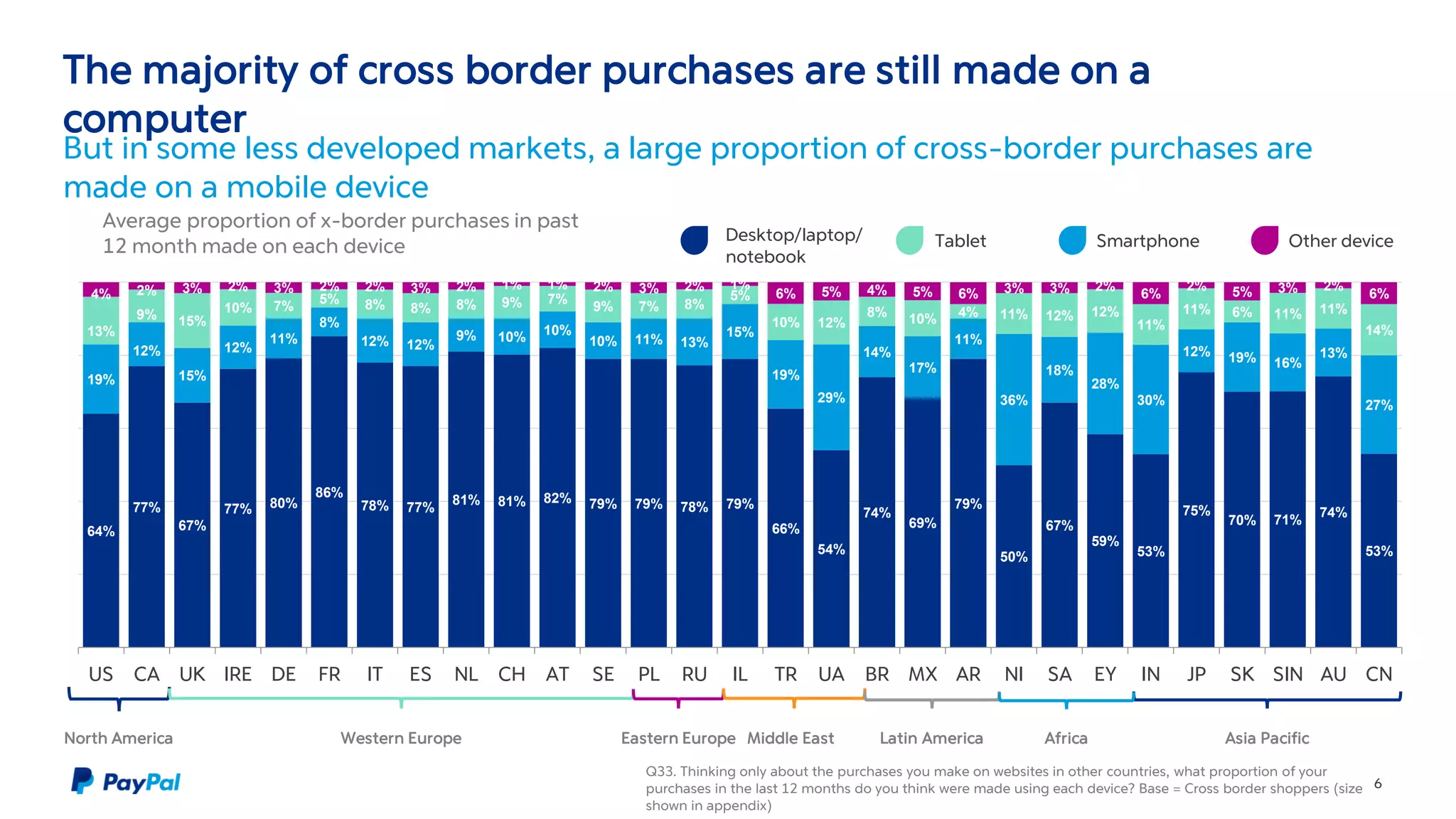

This document provides a summary of PayPal's 2015 global survey on cross-border e-commerce. Some key findings include:

- Clothing and apparel was the most popular category for cross-border purchases across most regions.

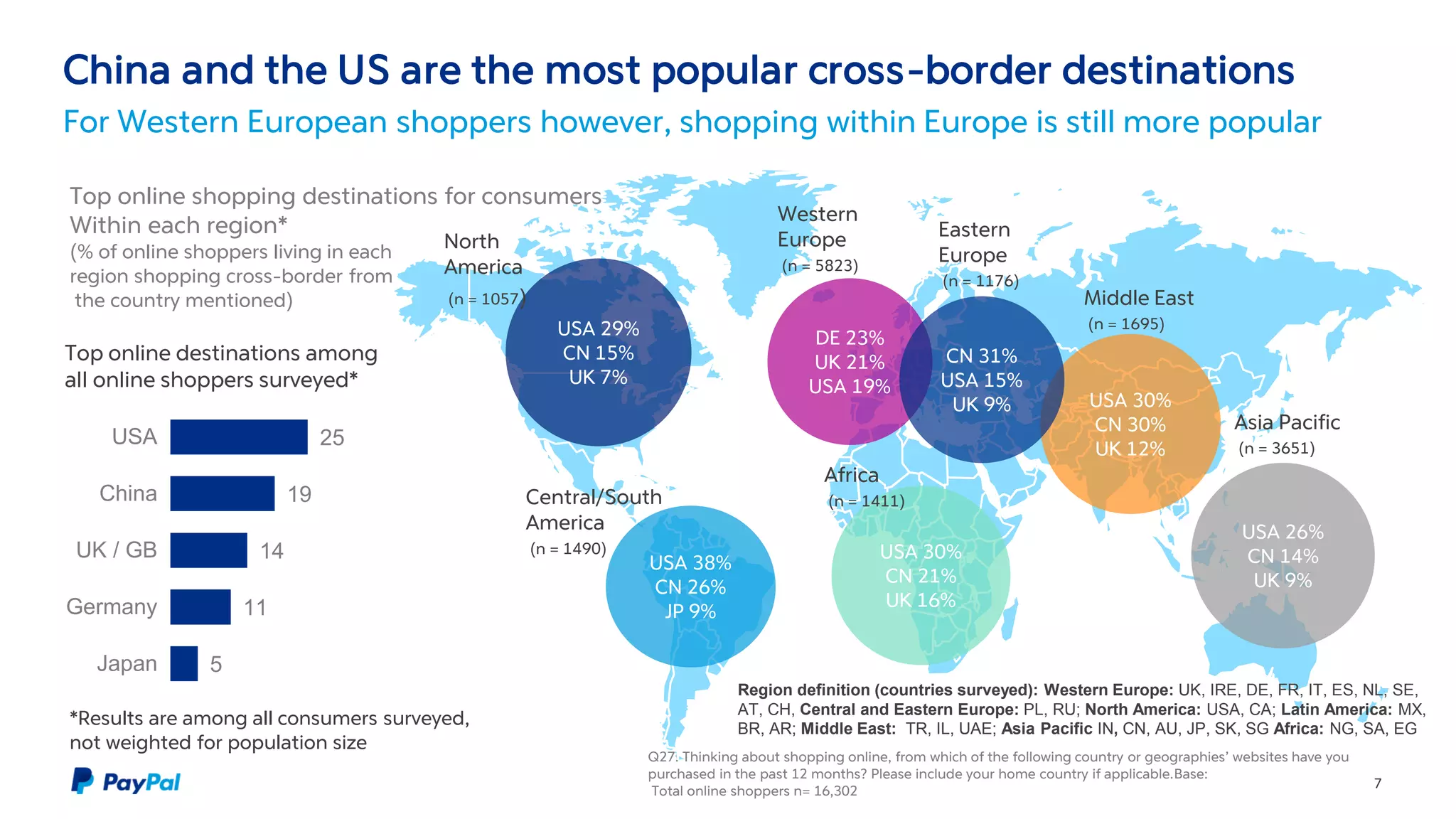

- China and the US were the most popular cross-border shopping destinations overall, while within Europe shopping within the region was more common.

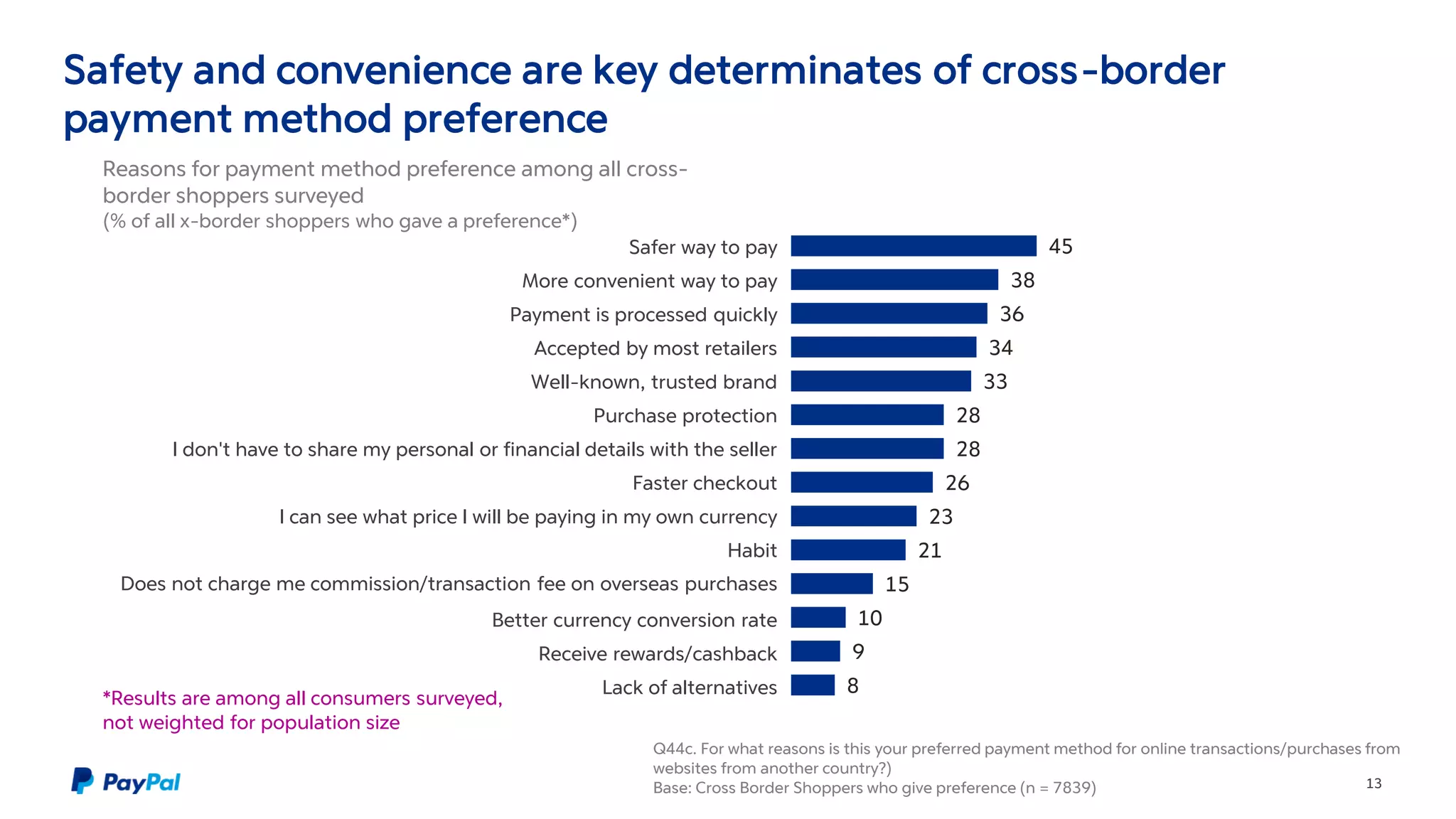

- Concerns about shipping costs and product safety/authenticity were the top barriers to cross-border shopping. Free shipping and safe payment methods were the biggest drivers.

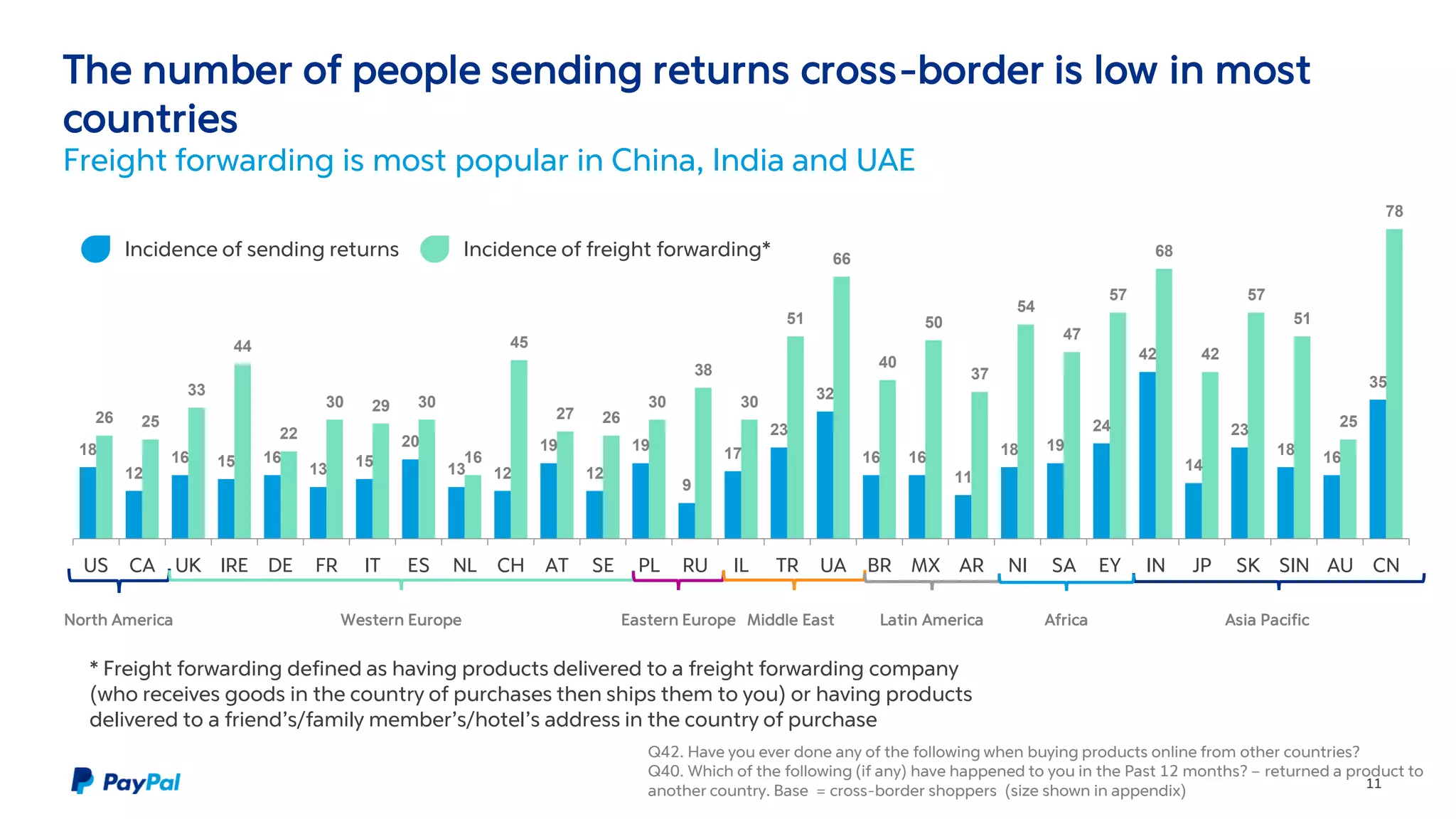

- The use of returns and freight forwarding for cross-border purchases was generally low except in China, India, and the UAE.

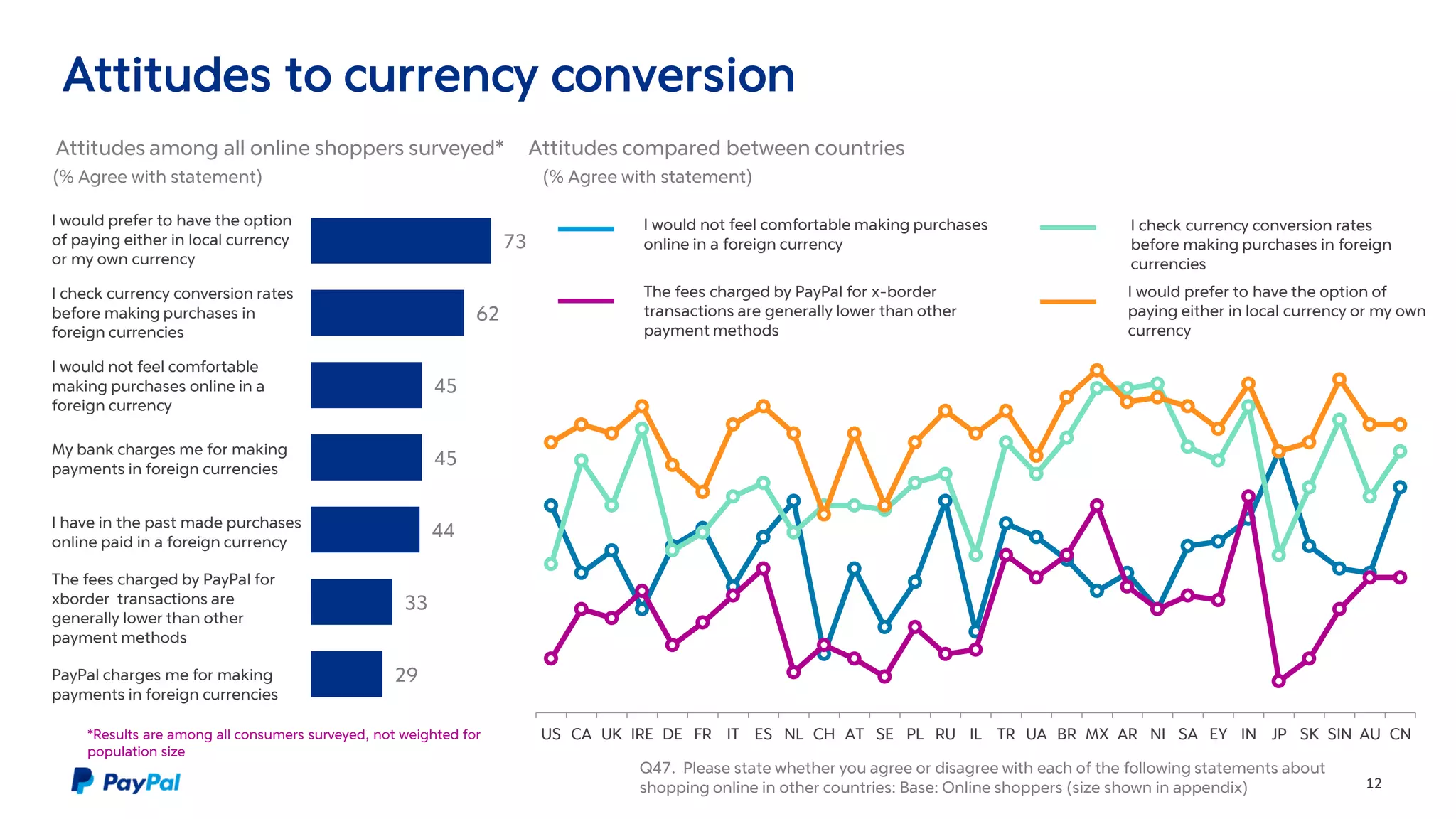

- Payment preferences were driven most