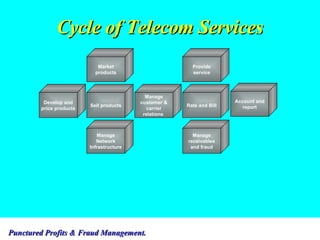

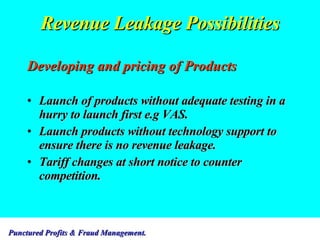

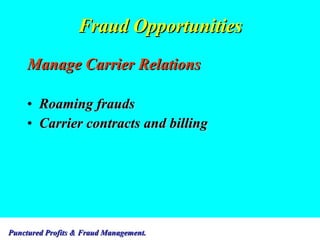

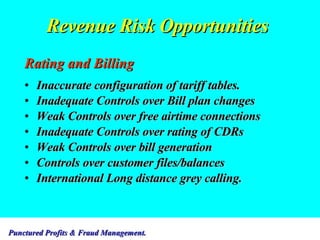

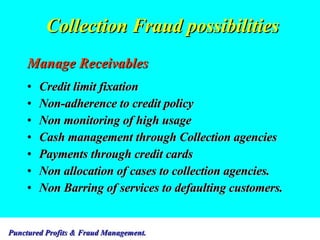

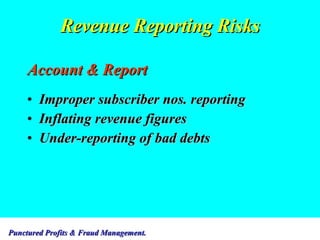

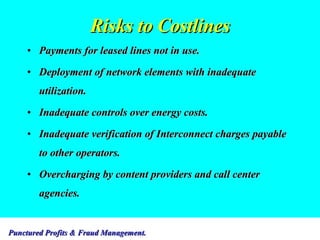

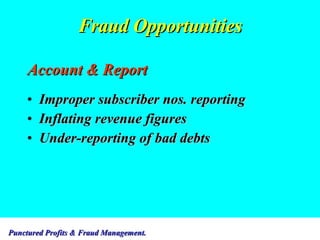

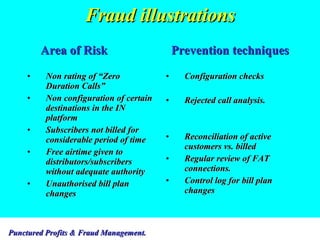

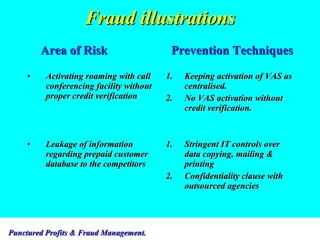

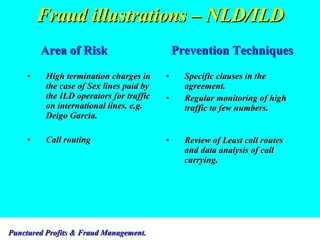

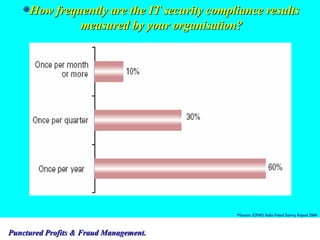

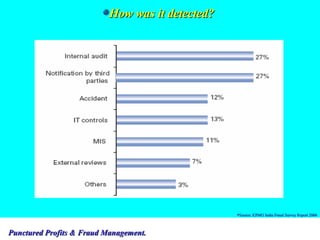

The document discusses revenue assurance and fraud management in the telecom industry. It outlines various points in the service cycle where revenue leakage and fraud opportunities can occur, including developing and pricing products, network infrastructure, service provisioning, rating and billing, collections, and revenue reporting. Examples of past corporate frauds like Enron and Worldcom are provided as warnings. Prevention techniques for common frauds are also suggested.