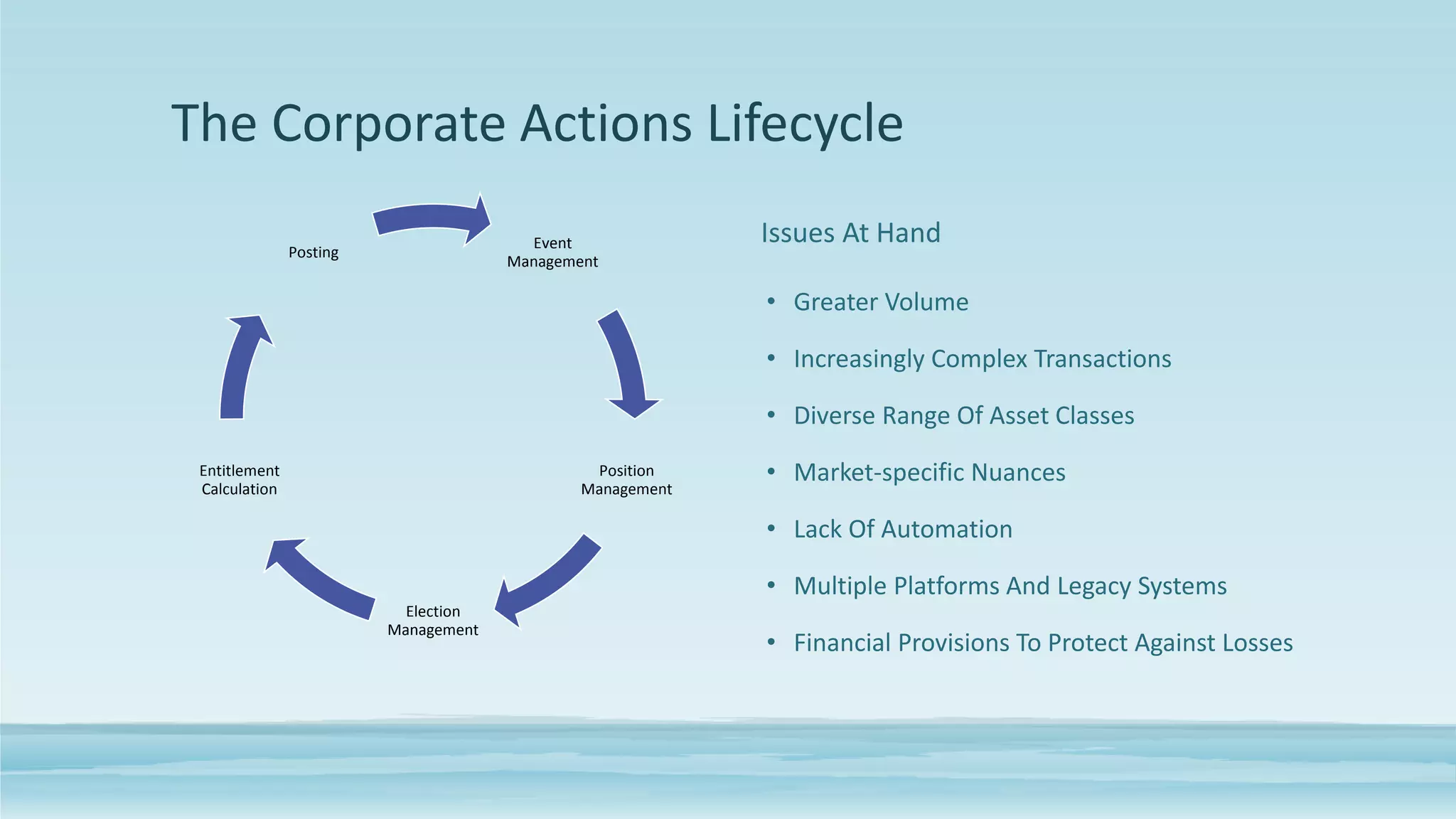

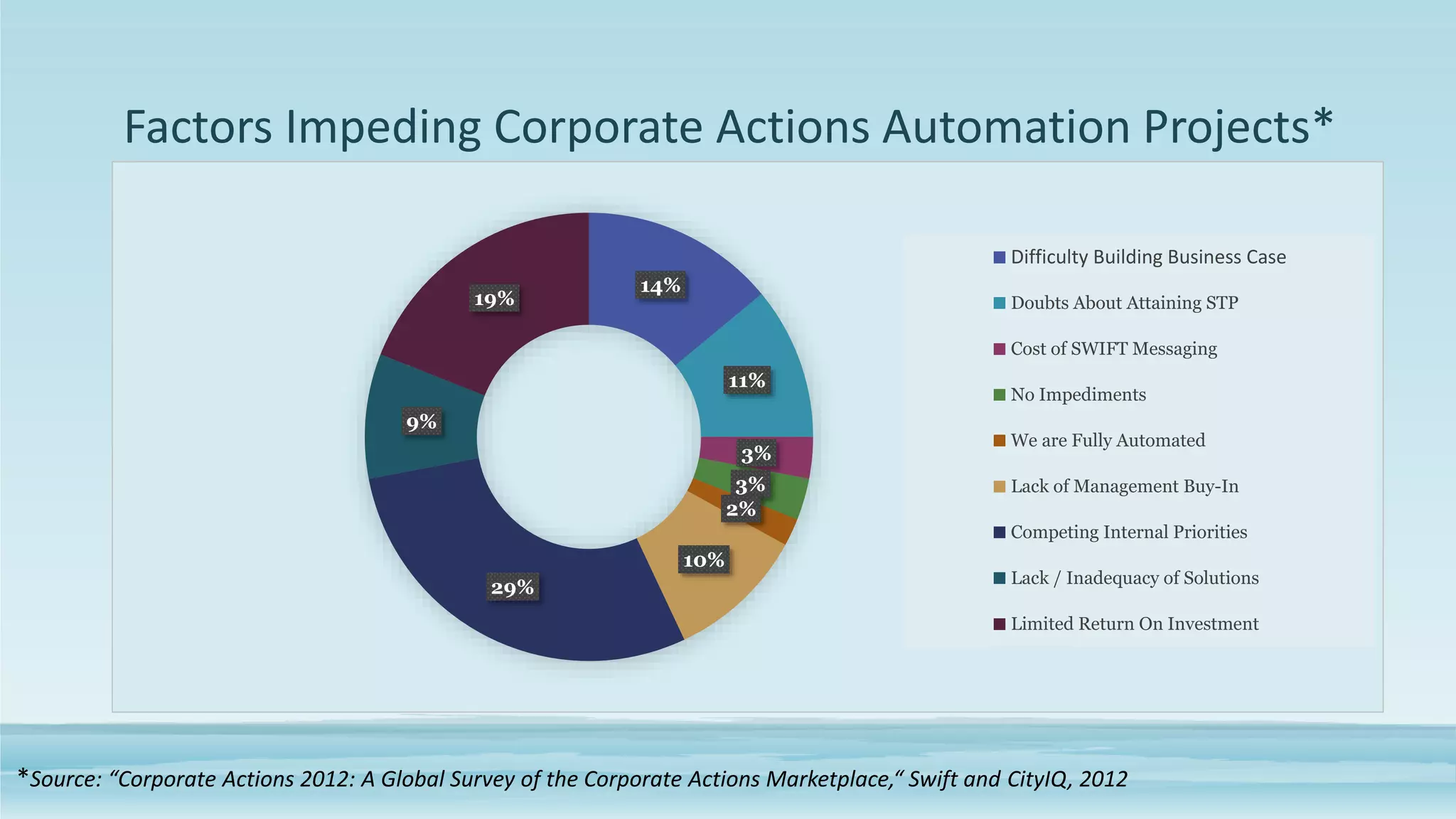

This document summarizes challenges in the corporate actions lifecycle and opportunities for improvement. It outlines the key stages in the lifecycle and issues like increasing volume, complexity, and lack of automation. The top impediments to automation projects are difficulties building a business case and competing priorities. Without addressing these issues, firms may face losses, increased costs, and sub-optimal investment decisions. Regulatory changes are also creating new operational impacts. Overall, adopting standards and automation could streamline processing and improve data quality and timeliness, benefiting industry players.