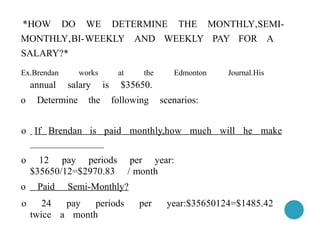

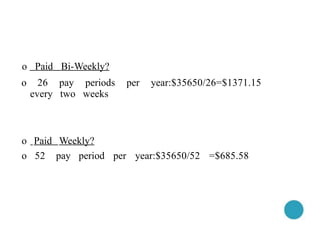

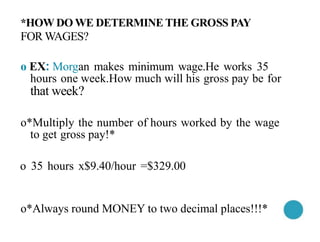

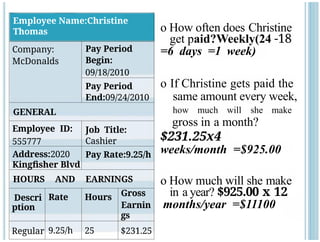

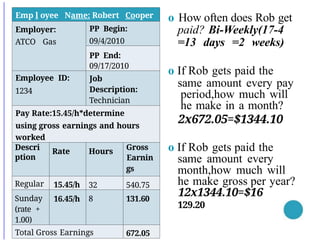

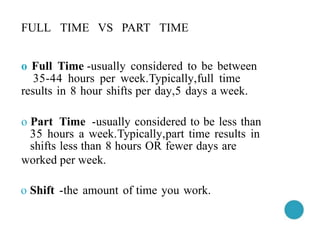

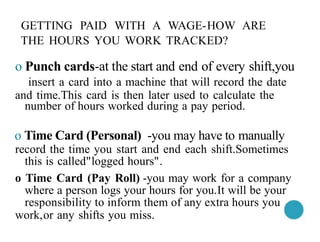

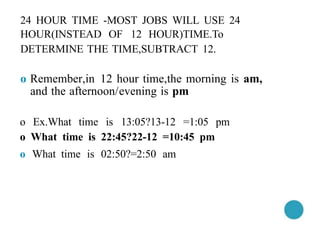

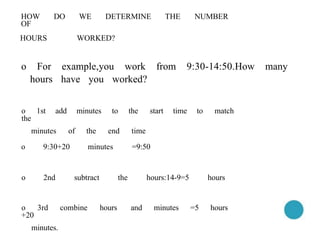

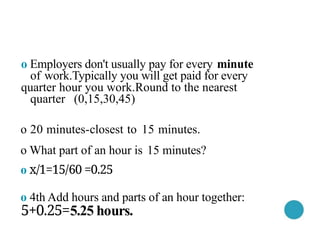

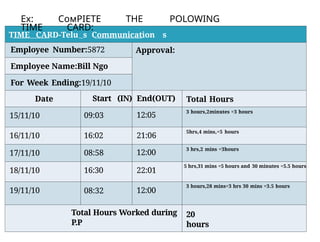

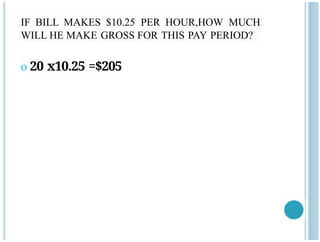

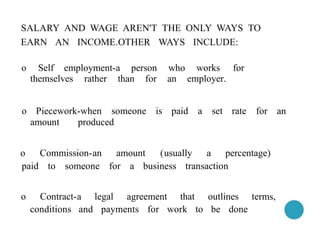

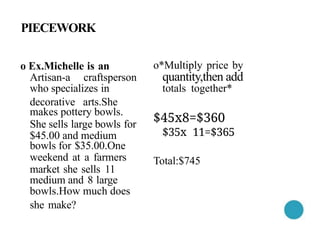

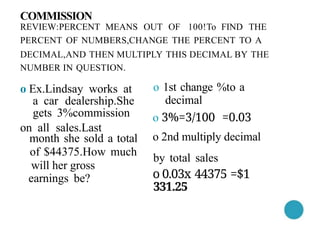

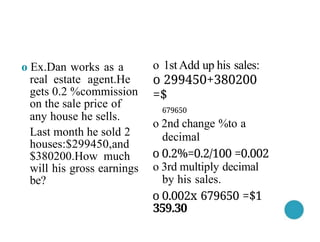

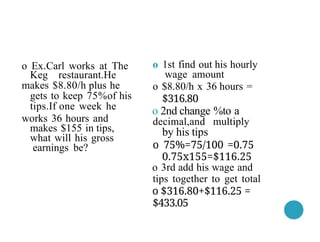

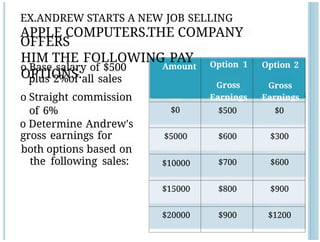

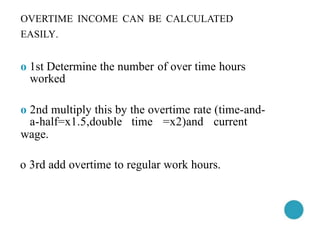

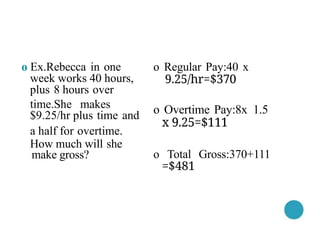

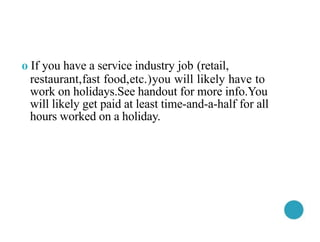

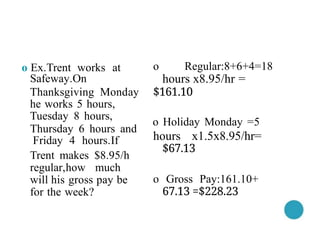

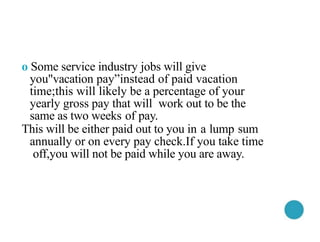

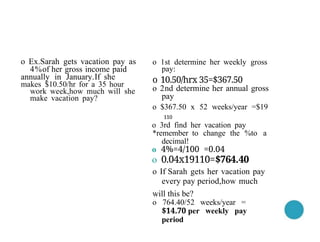

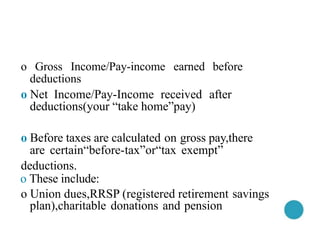

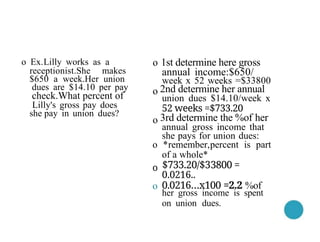

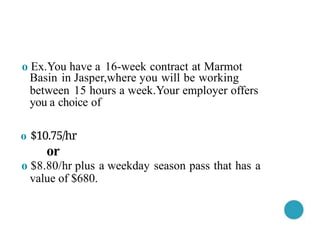

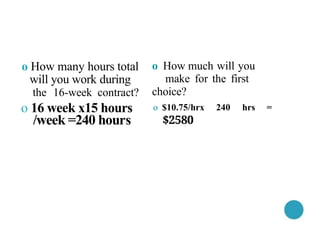

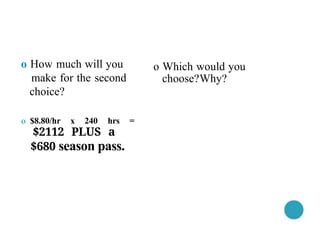

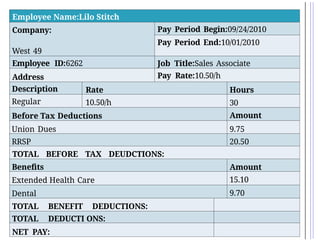

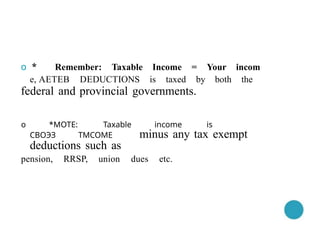

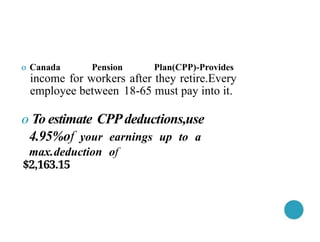

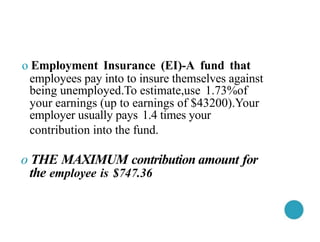

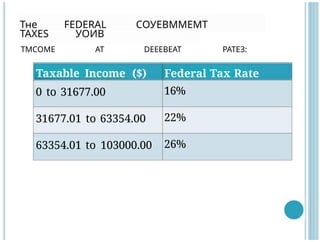

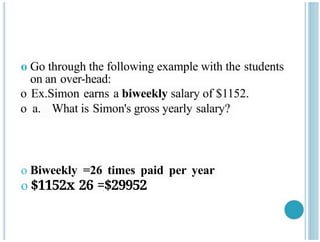

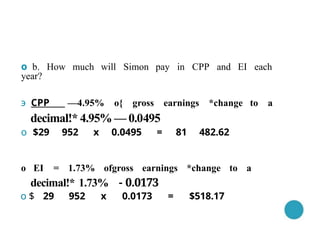

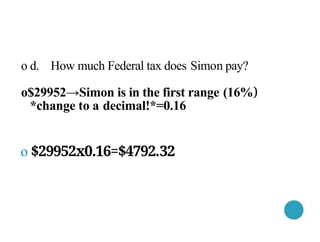

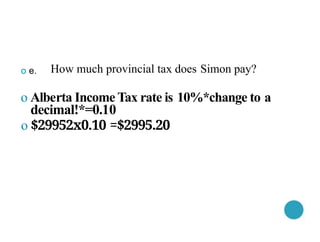

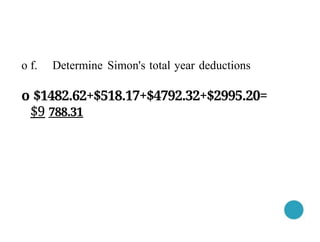

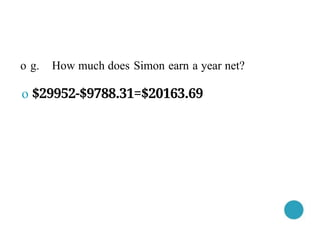

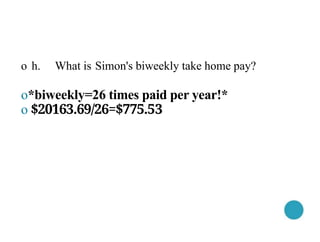

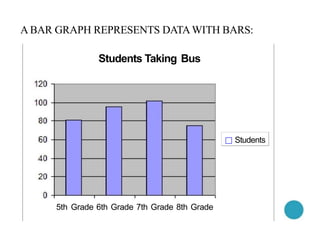

Chapter 2 discusses earning an income, focusing on wages and salaries with examples from various provinces in Canada. It explains the differences between salary and wage, pay periods, and how to calculate gross pay, while also covering aspects like overtime, deductions, and alternative income sources such as commission and piecework. Additionally, it includes scenarios and calculations to illustrate these concepts using real-life examples.