This document provides information on various services offered by an accounting firm, including:

- Auditing services in accordance with auditing standards.

- Tax agent and consultant services such as tax return preparation and tax planning advice.

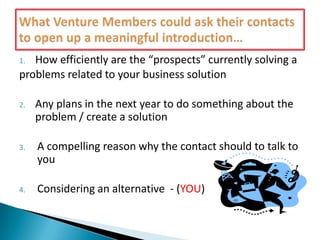

- Business finance services like cash flow analysis, cost control, and budget planning.

- Corporate secretarial services like maintaining statutory company records and filing annual returns.

It also provides details on tax-related topics like corporation tax, income tax, PAYE, and tax planning strategies. The document aims to promote the firm's services and solutions to business challenges related to compliance, cash flow management, and profitability.