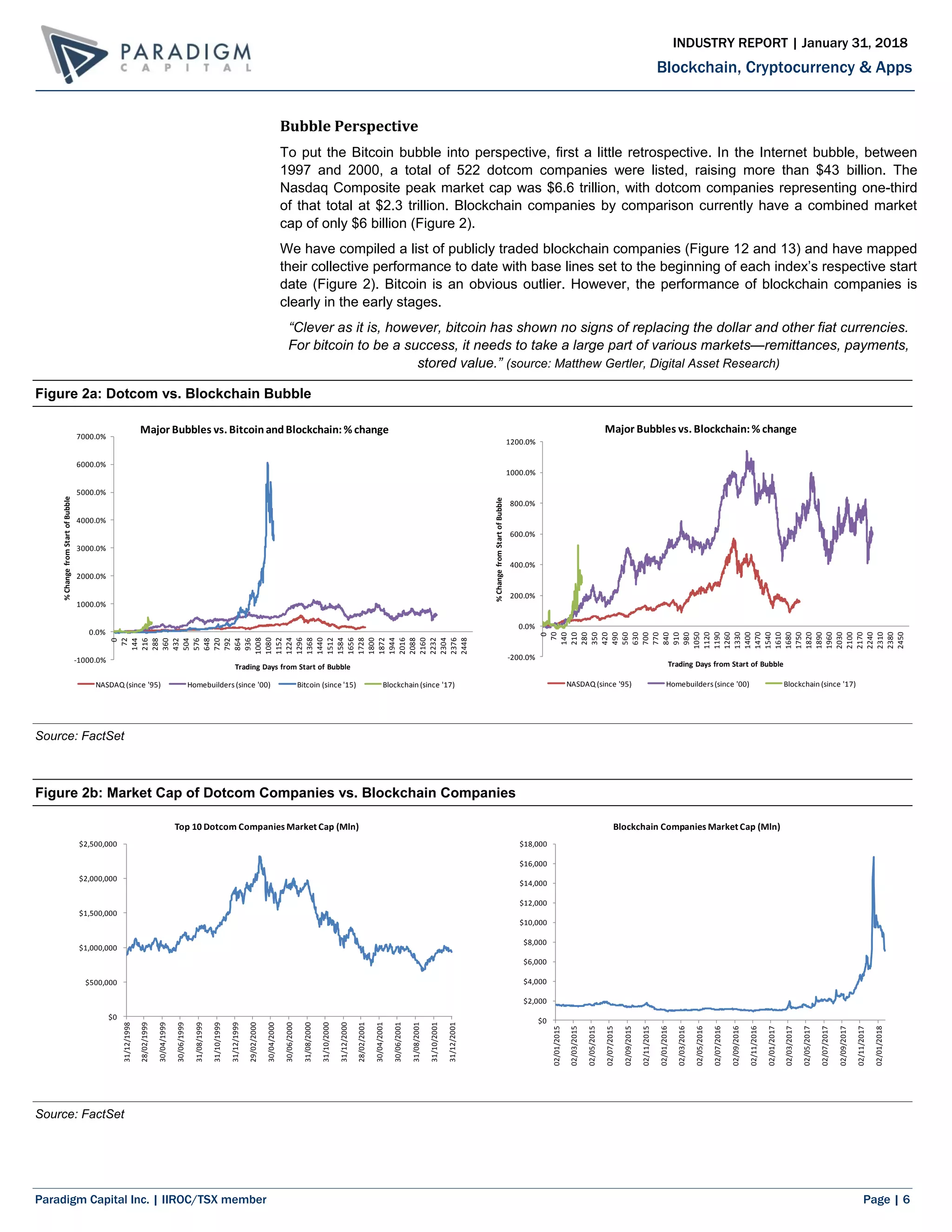

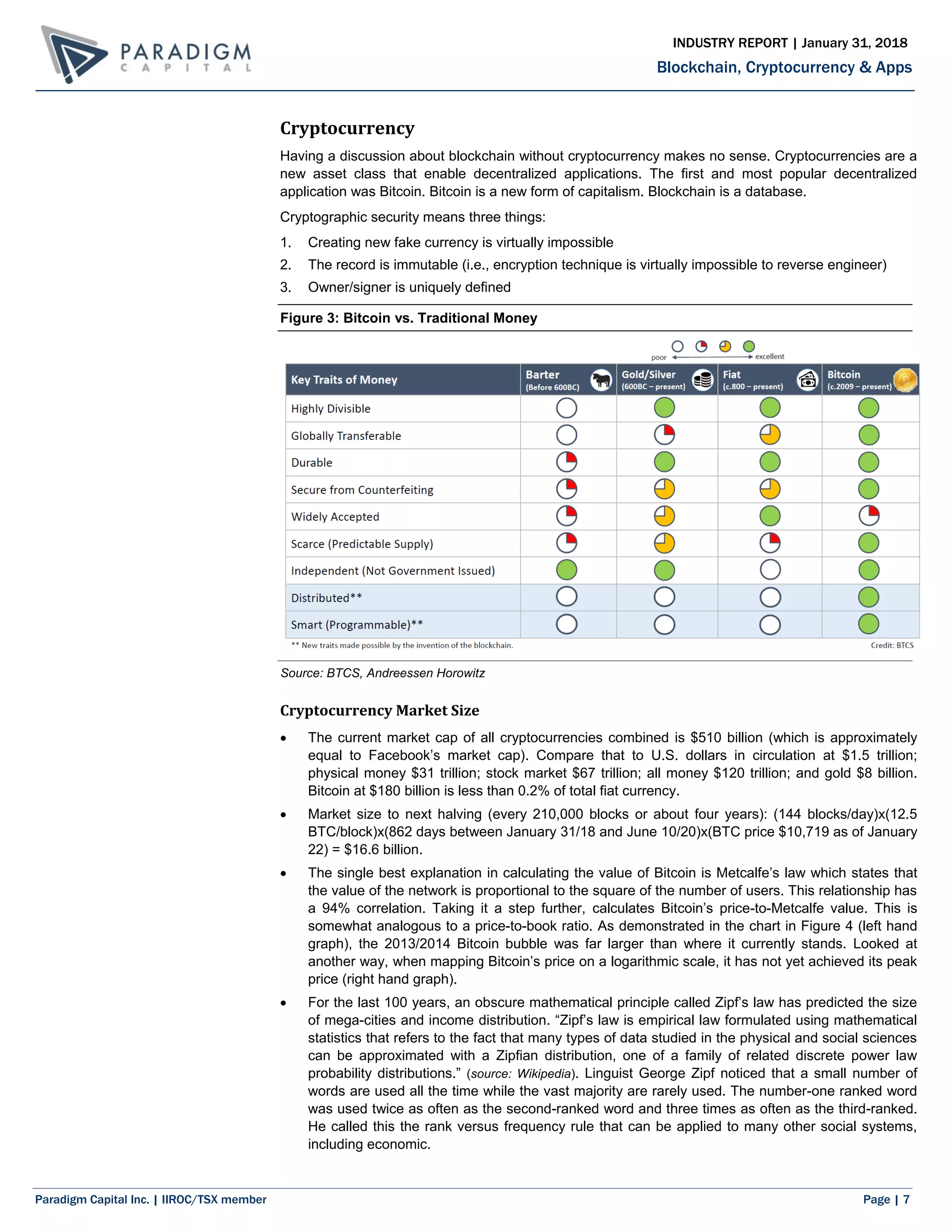

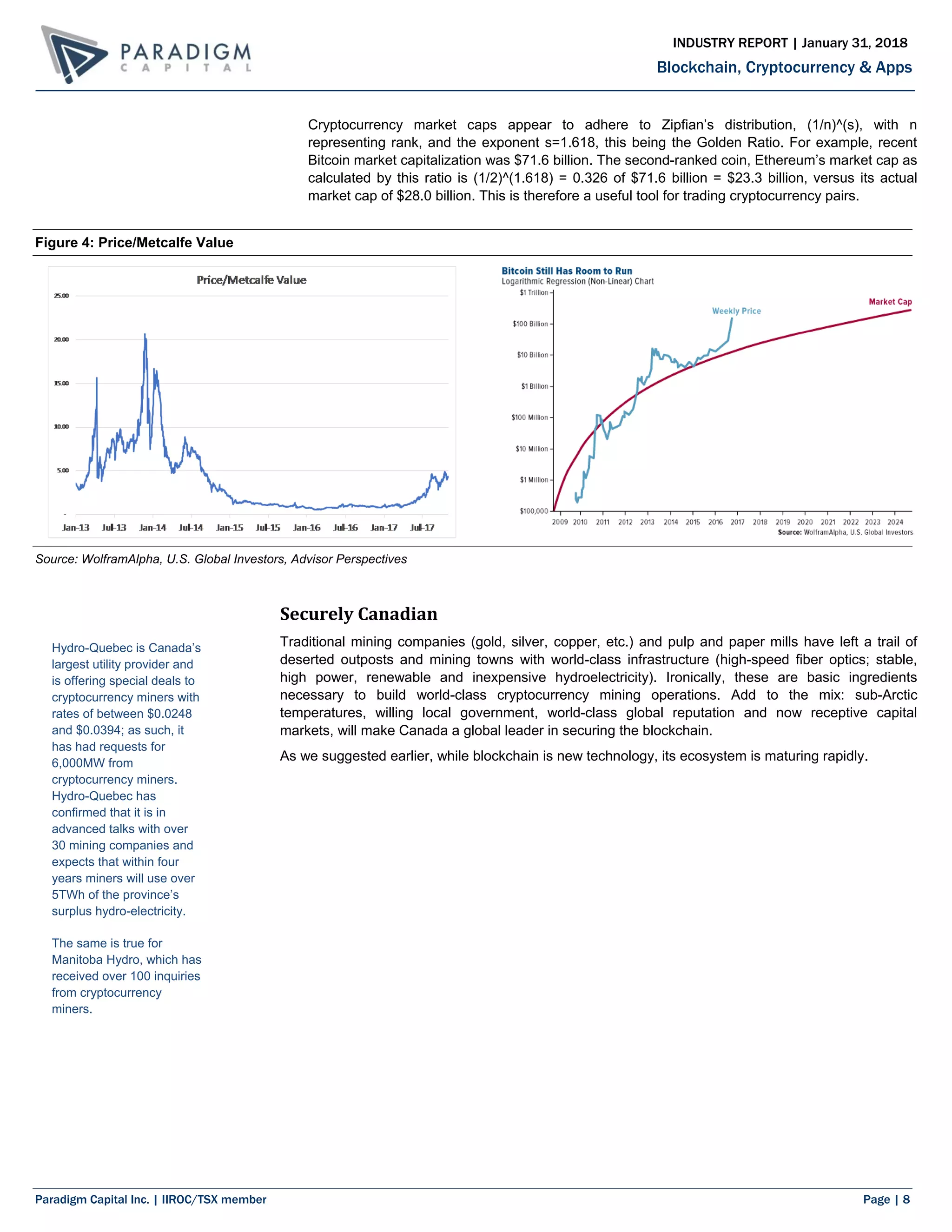

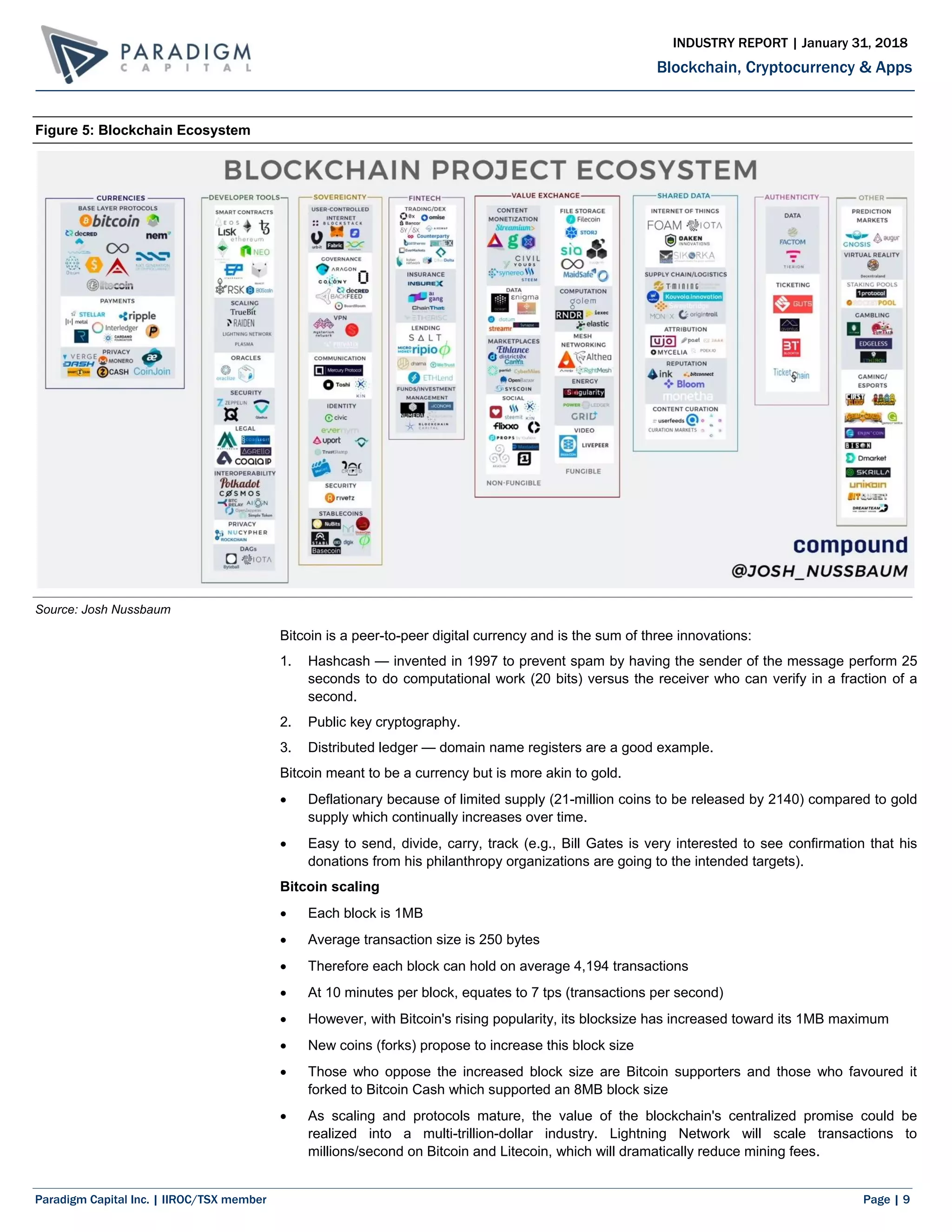

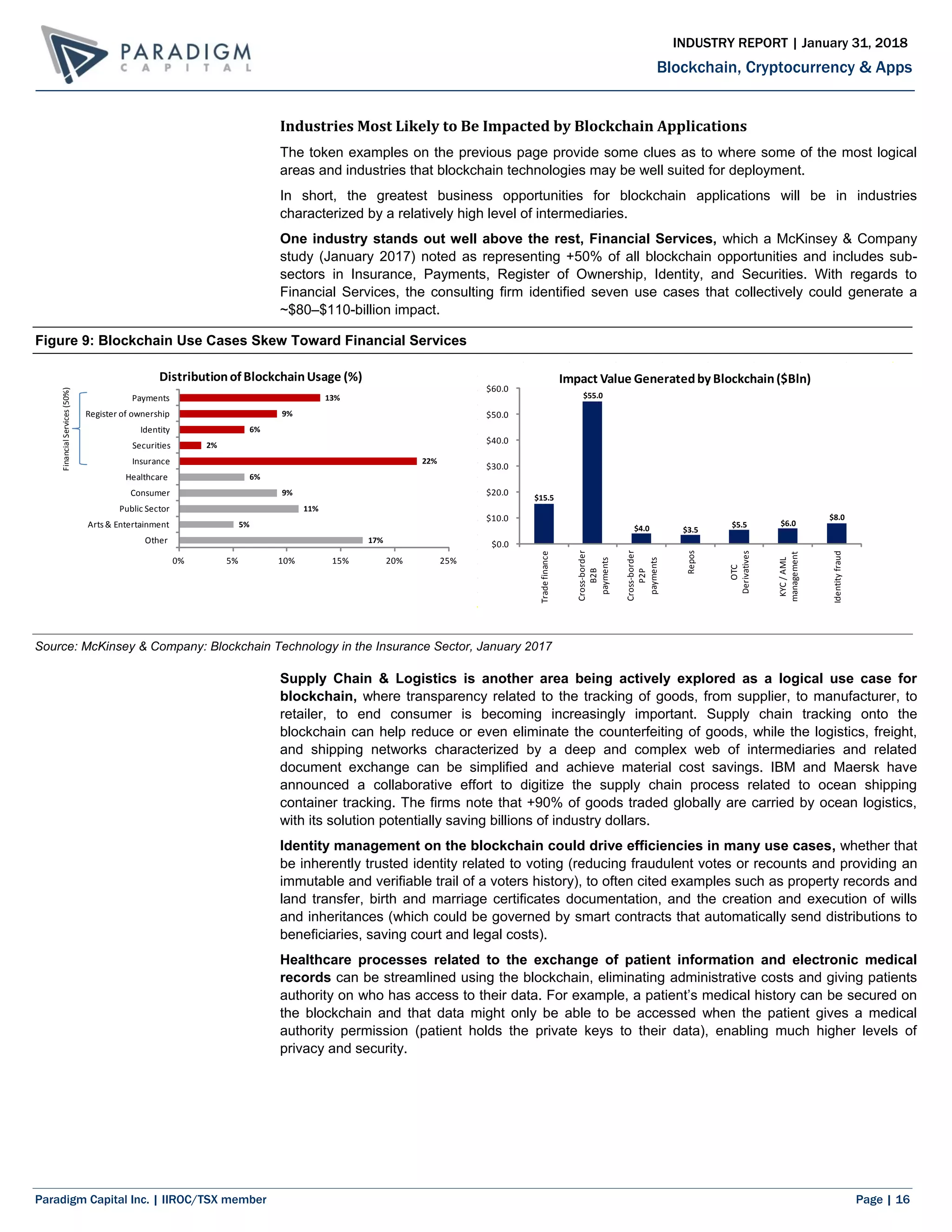

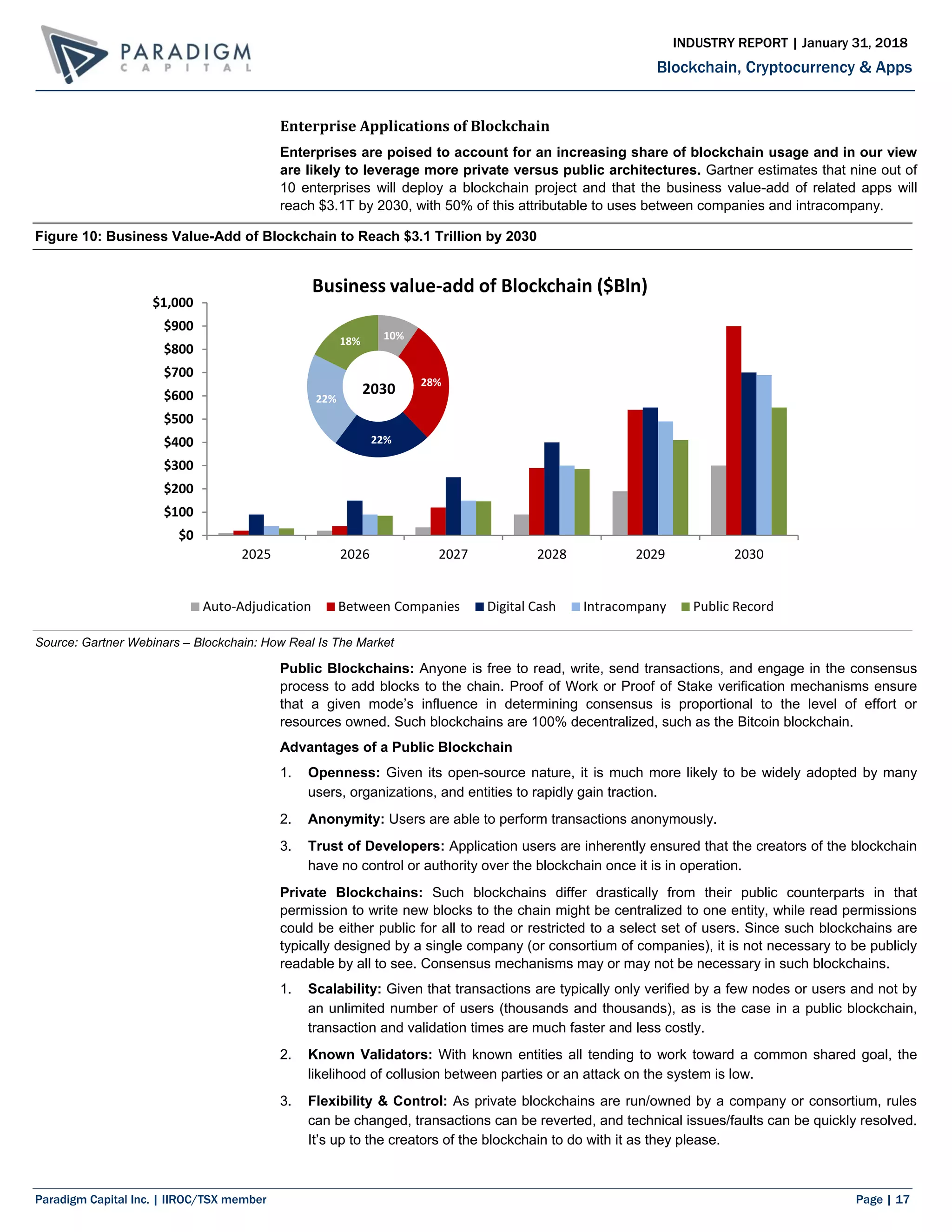

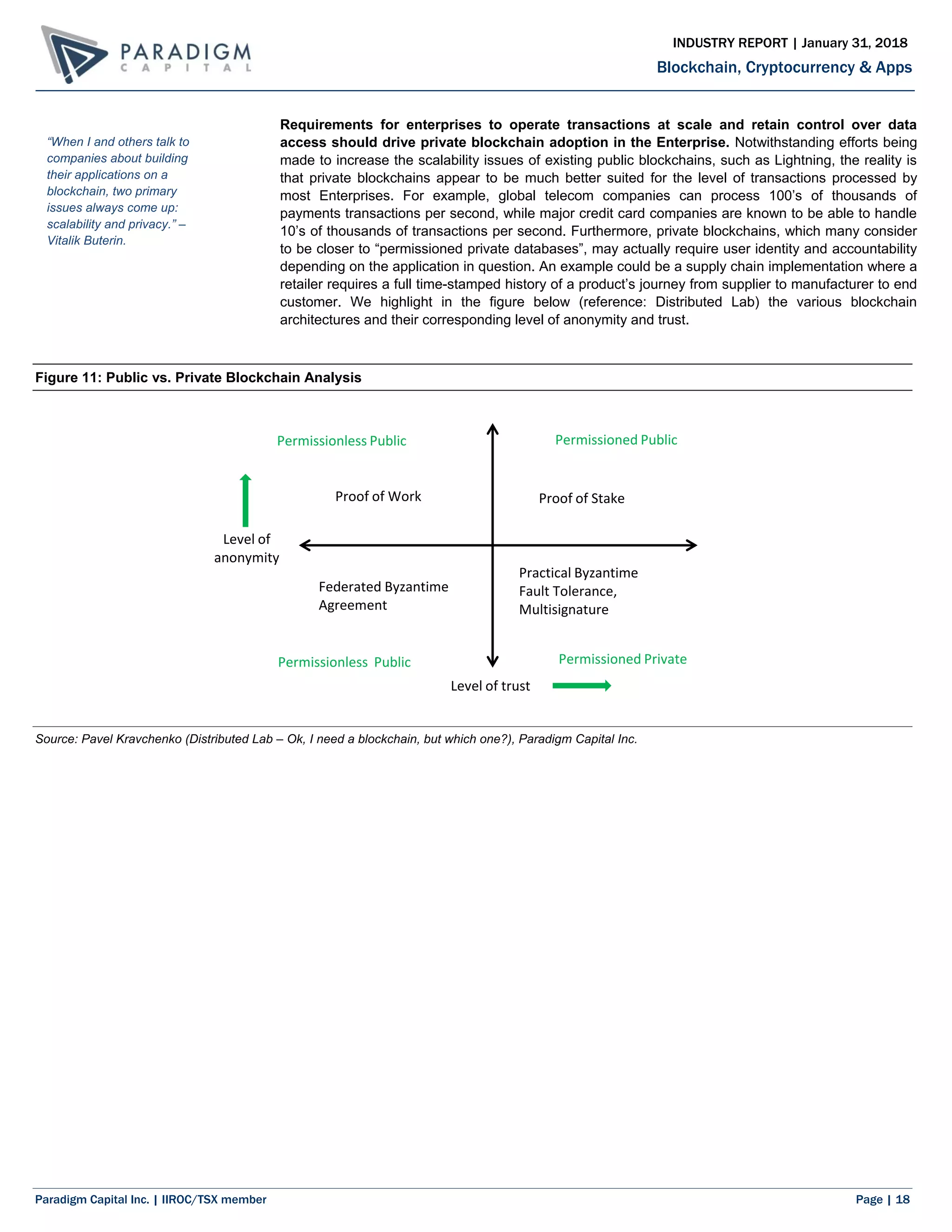

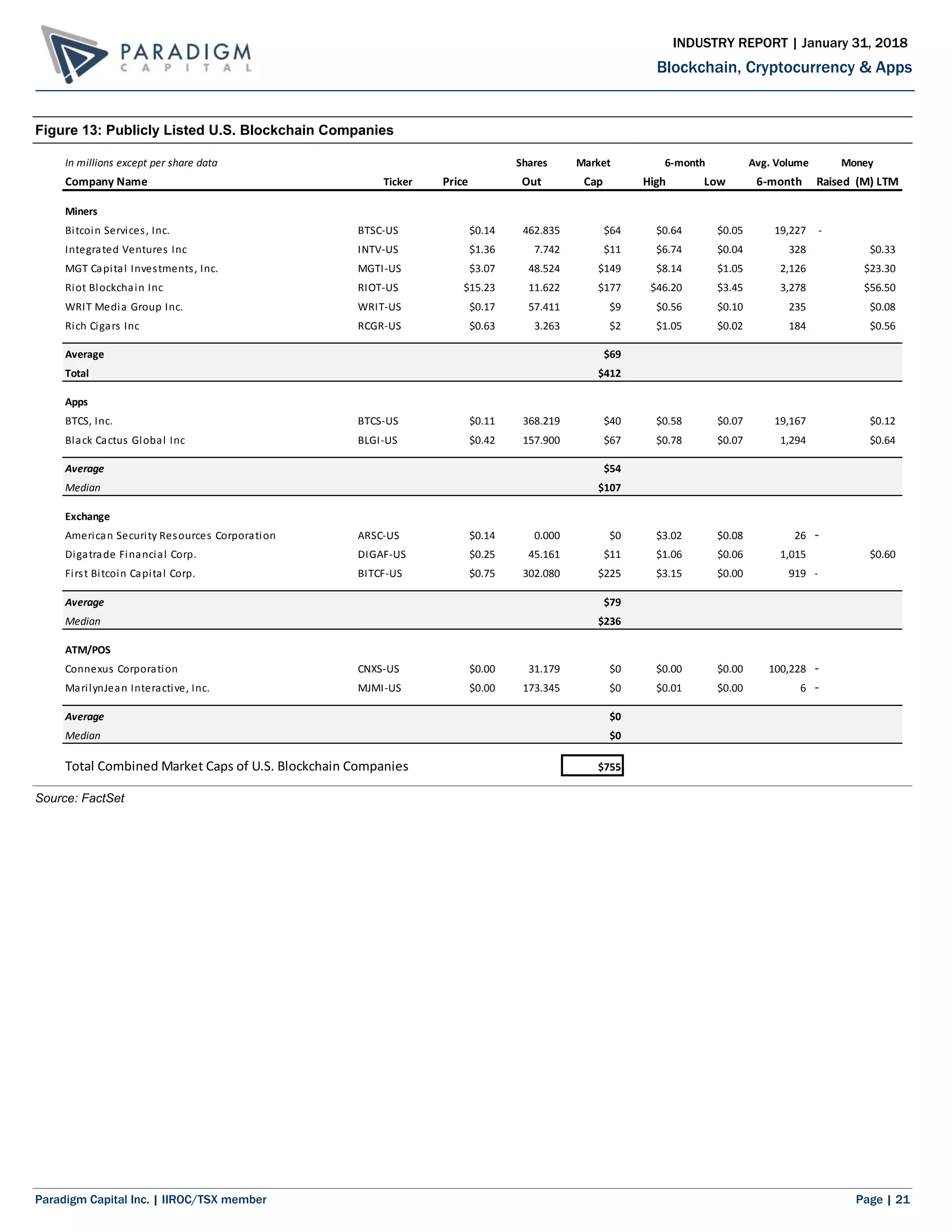

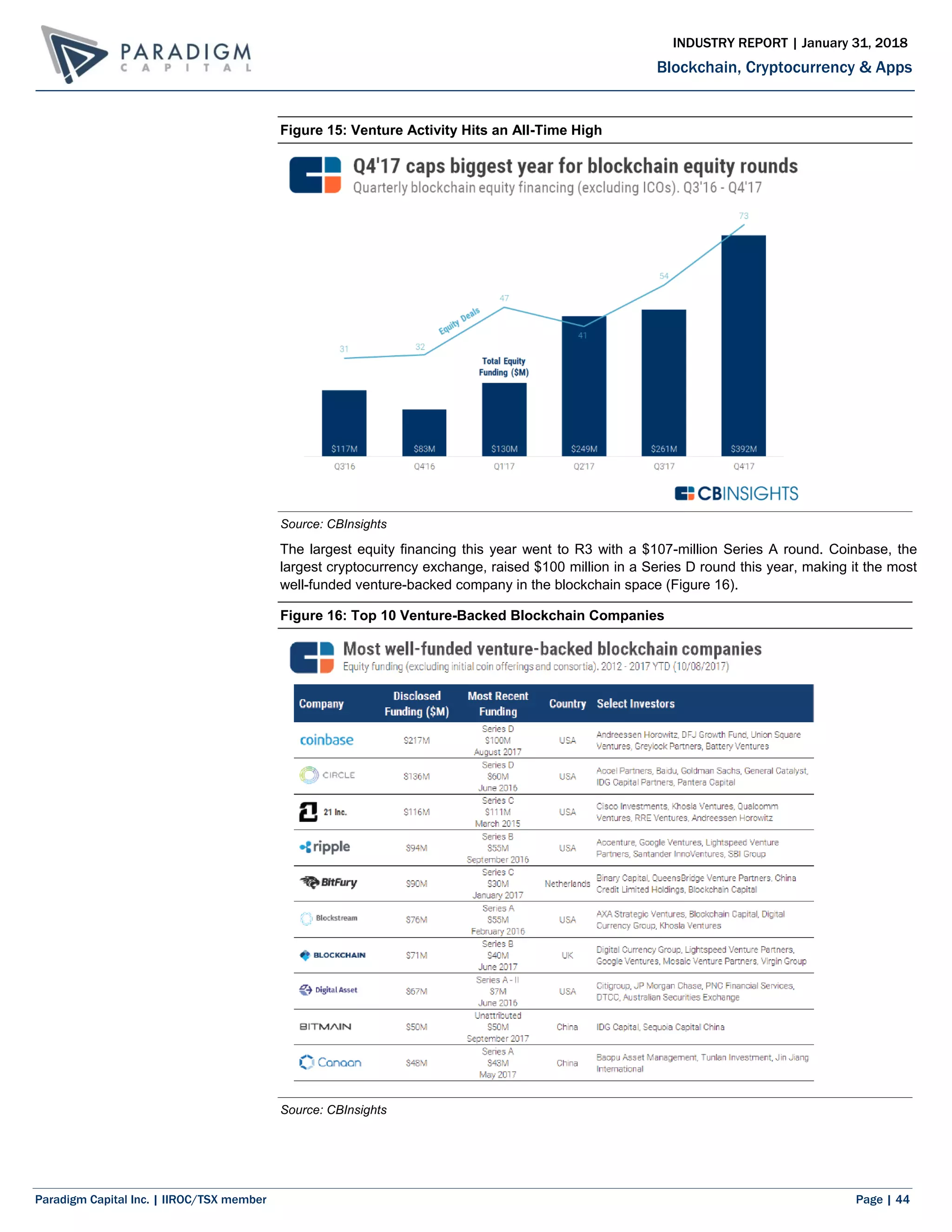

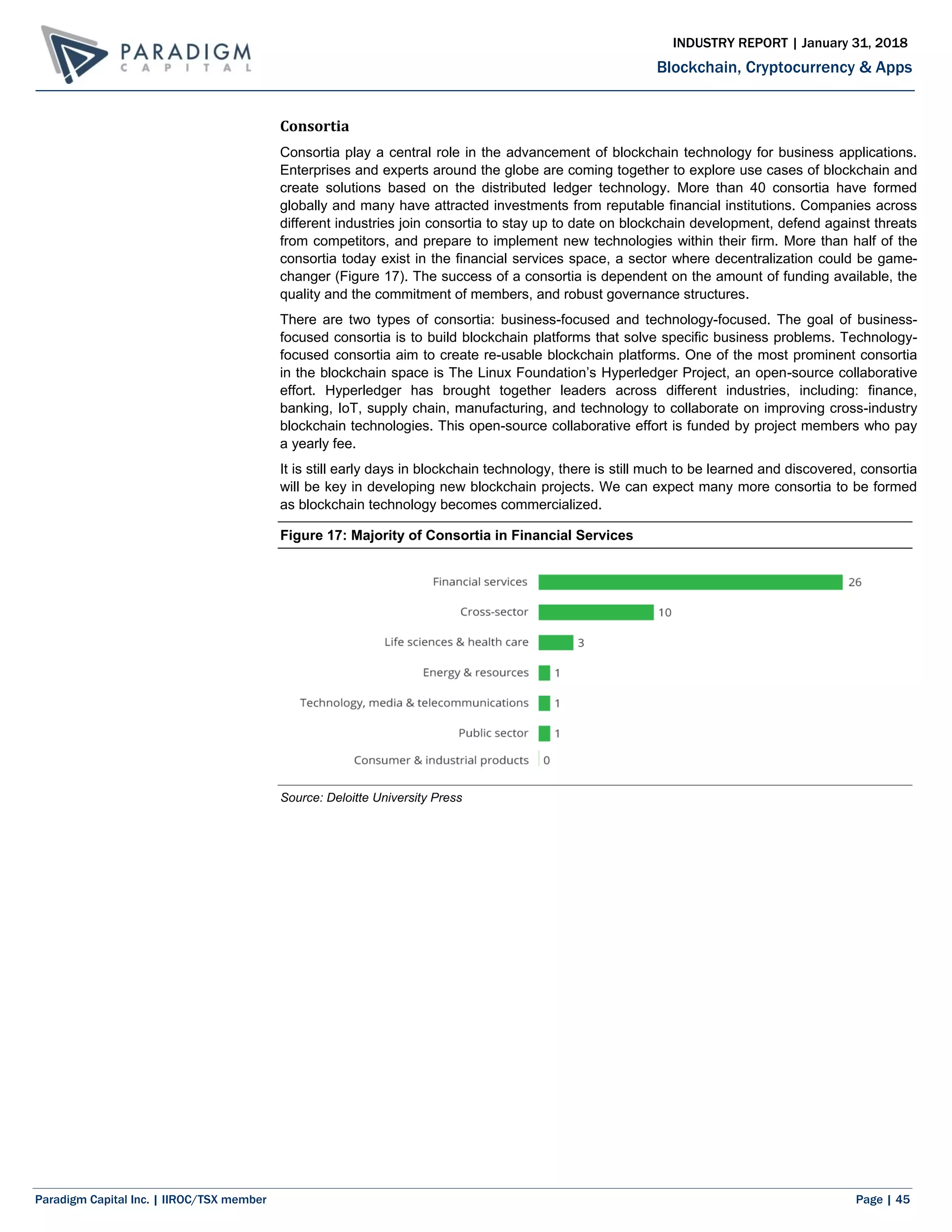

The document discusses the opportunities in blockchain technology and cryptocurrency. It notes that blockchain has the potential to massively change business processes and industries, as well as unlock new business opportunities, similar to how the internet impacted markets. Blockchain also has the potential to help distribute wealth more widely by banking the unbanked global population. The document provides an overview of the blockchain and cryptocurrency markets, Canadian companies involved, popular blockchain applications like Bitcoin and Ethereum, and concludes that we are still in the early stages of blockchain's impact and the opportunity for high returns has just begun.