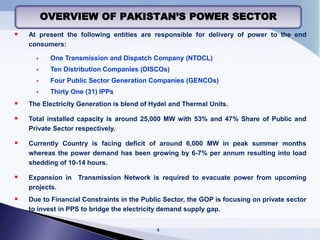

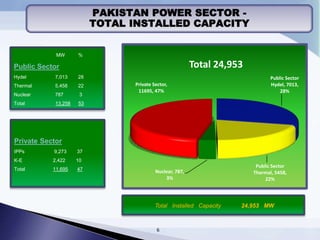

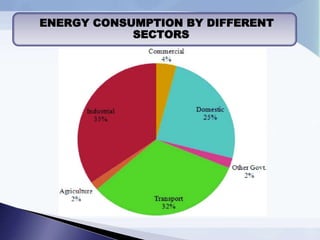

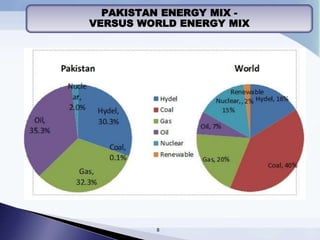

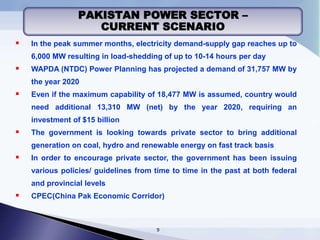

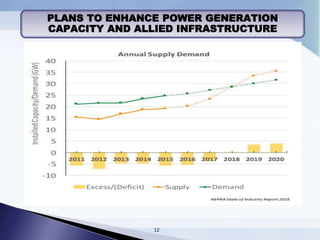

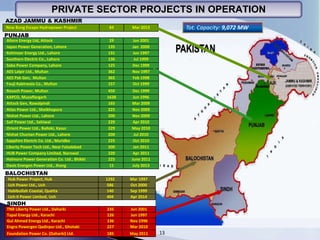

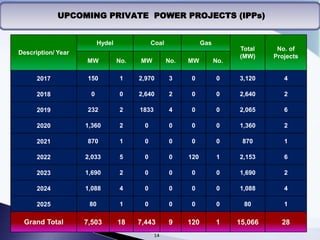

This document provides an overview of Pakistan's current electricity demand and supply scenario. It discusses that Pakistan is facing a 6000 MW deficit in peak summer months, with demand growing at 6-7% annually. It attributes the crisis to bad governance, financial issues, and theft. Plans are outlined to enhance generation capacity through coal, hydel, and renewable projects to bridge the gap and attract private investment. Charts show current installed capacity by source, consumption by sector, and Pakistan's energy mix compared to global averages. Upcoming private projects through 2025 are projected to add over 15,000 MW of capacity.