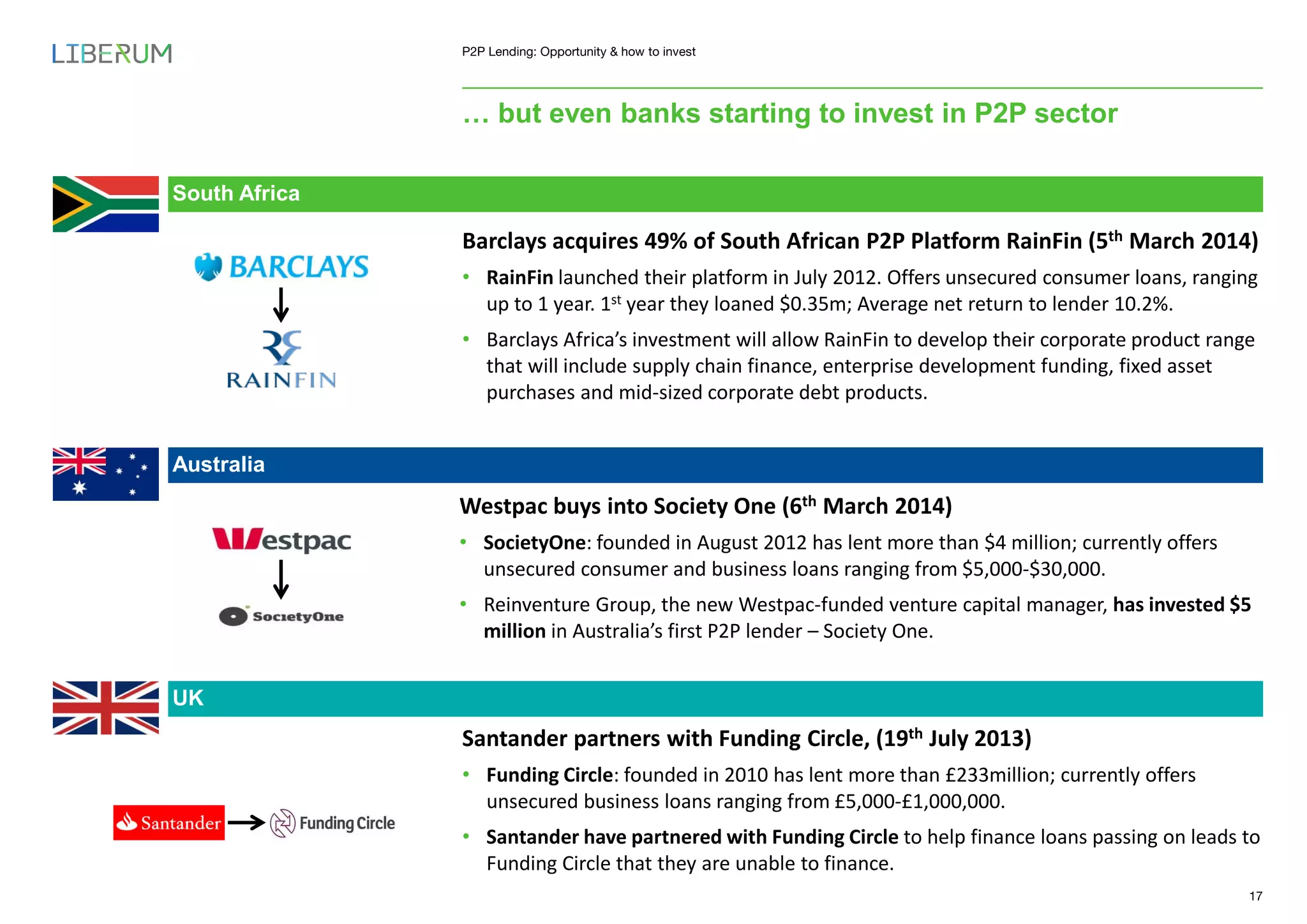

This document discusses peer-to-peer (P2P) lending and opportunities for investing in the sector. It notes that P2P lending volumes have grown 136% annually since 2009 and reached £5 billion across the top 5 platforms in 2014. P2P lending offers borrowers lower rates and investors higher returns compared to traditional banks due to much lower operating costs for platforms. While regulation of P2P is still developing, the sector is seen as having significant long-term potential for disrupting traditional banking through greater efficiency. The document examines performance data from several P2P platforms and notes some risks and criticisms of the industry but overall presents an optimistic view of investment opportunities.